Credit cards have revolutionized the way we shop and pay for things, but have you ever wondered how they work? Essentially, a credit card is a small plastic card that contains a microchip or magnetic stripe, which stores your account information.

This information is linked to a network of computers that verify transactions and keep track of your balance. The microchip or magnetic stripe is a secure way to store sensitive data, and it's used to authenticate transactions when you make a purchase.

When you swipe or insert your credit card, the merchant's terminal communicates with the bank's system to verify the transaction. This process happens in a matter of seconds, and it's what allows you to make purchases online or in person.

Related reading: Stripe Credit Cards

How They Work

Credit cards have come a long way since their introduction, and understanding the technology behind them can make a big difference in how we use them. The process of credit card transaction processing is complex, but it's broken down into several key steps.

The first step is initiation, where the cardholder provides their credit card information to the business. This can be done by swiping, inserting, or tapping their card in-person, or by entering the card details manually online.

Data transmission is the next step, where the business's POS system or payment gateway securely transmits the transaction details to the credit card processor. This is done to ensure the information is protected and can't be accessed by unauthorized parties.

Contactless credit cards, which have a small embedded chip emitting electromagnetic waves, work in a similar way but without the need for physical contact. To initiate payment, the cardholder simply needs to place their card within a few inches of a contactless-enabled payment terminal.

Chip cards, also known as EMV cards, have a little silver or gold microchip embedded on the front of the card. To use a chip card, the cardholder inserts the card into a chip-enabled terminal, such as an ATM or a POS terminal, and the terminal submits the cardholder's information to the merchant or card provider's site.

Here's a breakdown of the EMV transaction process:

- Application selection

- Initiate application processing

- Read application data

- Processing restrictions

- Offline data authentication

- Certificates

- Cardholder verification

- Terminal risk management

- Terminal action analysis

- First card action analysis

- Online transaction authorization (only carried out if required by the result of the previous steps; mandatory in ATMs)

- Second card action analysis

- Issuer script processing

Overall, the technology behind credit cards is designed to make transactions quick, easy, and secure. By understanding how it works, we can appreciate the complexity and security measures that are in place to protect our financial information.

Credit Card Components

Account data is the information presented or embedded in a physical card, providing necessary details to route and verify payment information.

Account data breaks down into two subsets: Cardholder Data (CHD) and Sensitive Authentication Data (SAD).

Cardholder Data (CHD) is a subset of account data, but the article doesn't specify what it entails.

Suggestion: Credit Card Numbers and Information

Account Identifiers

Account Identifiers are a crucial part of credit card components, and understanding how they work can help you navigate the world of payments. An Account Identifier is a unique account number used by an issuing bank to identify a cardholder's account.

Think of it like a home's unit number and street address - it tells the bank which ledger account it should debit or credit. This is similar to how a mailing address helps deliver mail to the right person.

The Account Identifier is often embedded in the card itself, along with other important information. In fact, it's a key part of the Primary Account Number (PAN) that we discussed earlier.

A different take: E S a Payments

Here's a breakdown of the PAN and how the Account Identifier fits into it:

The Account Identifier is a vital piece of the PAN puzzle, and understanding how it works can help you make sense of the complex world of credit card payments.

Service Code

A service code is a three-digit or four-digit value in the magnetic stripe that follows the expiration date of the payment card.

It's used for various things, such as defining service attributes, differentiating between international and national interchange, or identifying usage restrictions.

For example, a service code tells a merchant and processor whether to process the card as a debit or credit card.

Curious to learn more? Check out: One - Mobile Banking

American Express

American Express has adopted contactless technology in most of its products, so you can expect to see the contactless symbol on the back or front of your card. If you don't already have a contactless card, it's likely that your next renewal card or replacement card will have this feature.

Not all American Express products have yet adopted contactless technology, so it's worth checking your card to see if it has this feature.

Check this out: Emv Technology Credit Cards

Less Wear-and-Tear

Magnetic strips can wear out from repeated contact with payment terminals, which can lead to declined transactions.

This is a common issue with traditional credit cards that use magnetic strips, and it can be frustrating to deal with.

A contactless card chip, on the other hand, is designed to last for years without suffering from wear and tear.

This is because contactless chips don't require the same level of physical contact as magnetic strips or EMV chips.

In fact, contactless chips can withstand thousands of transactions without showing any signs of degradation.

A fresh viewpoint: Wave Free Version Auto Bank Transactions

Overseas Travel

Going abroad? Make sure your credit card is equipped with chip and PIN technology, which is now the norm overseas, especially in Europe and Australia.

Many self-serve ticket machines require a chip and PIN-enabled card or contactless payment, so it's essential to have one of these options.

If you don't have a chip and PIN-enabled card, using a contactless credit card may be your only way to pay some vendors, making life much easier.

Additional reading: Apple Cash Pin

Restrictions

Restrictions are a crucial part of the credit card processing flow. They help determine whether a card should be used for a transaction.

The purpose of processing restrictions is to check the card's validity. This involves examining three key data elements: Application version number, Application usage control, and Application effective/expiration dates.

If any of these checks fail, the terminal sets an appropriate bit in the terminal verification results. This bit is used later in the transaction flow to make an accept or decline decision.

Card issuers can use this feature to permit cardholders to continue using expired cards for specific transactions. However, all transactions with an expired card must be performed online.

Worth a look: Bbva Bank Application

Emv Specification

The EMV specification is a crucial part of the credit card ecosystem, and it's interesting to note that the first version of the EMV standard was published in 1995.

The EMV standard is now defined and managed by the privately owned corporation EMVCo LLC, which is owned equally by six major payment brands: American Express, Discover Financial, JCB International, Mastercard, China UnionPay, and Visa Inc.

Readers also liked: Standard Bank Payment

EMVCo issues recognition of compliance with the EMV standard after submission of results of testing performed by an accredited testing house, which is a vital step in ensuring the security and integrity of credit card transactions.

The EMV standard has two levels of compliance testing: EMV Level 1, which covers physical, electrical, and transport level interfaces, and EMV Level 2, which covers payment application selection and credit financial transaction processing.

Here are the four "books" that define the official EMV standard documents, as of 2011:

- Book 1: Application Independent ICC to Terminal Interface Requirements

- Book 2: Security and Key Management

- Book 3: Application Specification

- Book 4: Cardholder, Attendant, and Acquirer Interface Requirements

Issuer Script

Issuer scripts are a powerful tool for card issuers to update card information post-issuance.

Issuer scripts are essentially commands sent to the card to make changes, such as blocking the card or modifying its parameters. These scripts are meaningless to the terminal and can be encrypted for added security.

Issuer script processing is not available in certain types of transactions, including contact transactions processed with Visa Quick Chip for EMV and Mastercard M/Chip Fast, as well as contactless transactions across schemes.

Recommended read: Venmo Business Transaction

Credit Card Security

Credit card security is a top priority for both cardholders and issuers. The security code, also known as the Card Verification Code (CVC) or Value (CVV), is a 3-digit code printed on the back of a payment card or a 4-digit code printed on the front (i.e., American Express), and it cannot be stored on the magnetic stripe or EMV chip of the card.

The CVC/CVV helps verify that your card is in your possession, making it more difficult for attackers to use your card without your knowledge. In fact, it's incredibly difficult for a hacker to recreate the one-time code that contactless credit cards create for each transaction, making them much more secure than magnetic strips.

Contactless credit cards are designed to generate a unique code for each transaction, making it harder for fraudsters to capture and use cardholder data in a fraudulent transaction. This is in contrast to magnetic strips, which store cardholder data and some verification logic as static data.

For your interest: What Is a Cvv Number on a Bank Card

The Validator Digit

The Validator Digit is a crucial security measure in payment card processing. It's used to ensure the accuracy of the PAN, or Primary Account Number, which is the unique number assigned to each credit card.

A small mistake, like entering a '2' instead of a '3', can throw off the entire number and make it invalid. This is where the Validator Digit comes in – it's a check digit that catches small inconsistencies upfront.

In the context of payment card processing, the Validator Digit is used to verify the accuracy of the number. If the Validator Digit is incorrect, it indicates that the number is invalid, preventing it from being processed.

This is a great way to catch errors before they reach the networks, reducing the strain on the systems that support them. It's a simple yet effective security measure that helps keep your credit card information safe.

You might enjoy: Recurring Credit Card Payments

Security Codes

Security Codes are a crucial part of credit card security. They're designed to verify that your card is in your possession.

Consider reading: I M B Bank Share Price Today

The Card Verification Code (CVC) or Value (CVV) is a 3-digit code printed on the back of a payment card, or a 4-digit code printed on the front for American Express. This code can't be stored on the magnetic stripe or EMV chip of the card.

Requiring the CVC or CVV for card-not-present transactions helps verify that your card is in your possession. If your card ever gets compromised with your CVV, attackers would have free rein to use your card anywhere.

Sensitive Authentication Data (SAD) contains information used to verify transactions and prevent abuse. It includes the security code, EMV chip, and a subset of information found in the magnetic strip.

The security code, or Card Verification Code or Value, is a key component of SAD. It's not stored on the magnetic stripe or EMV chip of the card, and must be immediately deleted after authorization.

Here are some key facts about Security Codes:

- The CVC or CVV is a 3-digit code for most cards, or a 4-digit code for American Express.

- The security code can't be stored on the magnetic stripe or EMV chip of the card.

- Requiring the security code for card-not-present transactions helps verify that your card is in your possession.

- SAD includes the security code, EMV chip, and a subset of information found in the magnetic strip.

No matter how secure your card is, it's still possible for someone to steal it and use it for contactless payments. However, the one-time code generated by the card chip for each transaction makes it incredibly difficult for a hacker to recreate the code.

2010: PIN Checking Disabled

In 2010, credit card companies made a significant change to their security measures by disabling PIN checking for online transactions.

This change allowed cardholders to make online purchases without having to enter their PIN.

However, it's worth noting that this change still required cardholders to enter their card details, including the card number and expiration date.

This shift in security measures was likely a response to the growing use of online shopping, which was becoming increasingly popular at the time.

Broaden your view: Bofa Change of Address

Offline Data Authentication (ODA)

Offline data authentication (ODA) is a crucial aspect of credit card security. It's a cryptographic check that validates the card using public-key cryptography.

There are three different processes that can be undertaken depending on the card: Static data authentication (SDA), Dynamic data authentication (DDA), and Combined DDA/generate application cryptogram (CDA).

Static data authentication (SDA) ensures that data read from the card has been signed by the card issuer, preventing modification of data but not cloning.

Dynamic data authentication (DDA) provides protection against modification of data and cloning, offering a higher level of security.

Combined DDA/generate application cryptogram (CDA) combines DDA with the generation of a card's application cryptogram to assure card validity.

Here are the three processes in a nutshell:

- SDA: Prevents modification of data, but not cloning.

- DDA: Protects against modification of data and cloning.

- CDA: Combines DDA with application cryptogram generation for added security.

CDA is not mandatory in terminals and can only be carried out where both card and terminal support it.

EMV Documents and Standards

EMV Documents and Standards are crucial for ensuring the security of credit card transactions. The official EMV standard documents are published as four "books" and some additional documents, as of 2011.

Book 1: Application Independent ICC to Terminal Interface Requirements, Book 2: Security and Key Management, Book 3: Application Specification, and Book 4: Cardholder, Attendant, and Acquirer Interface Requirements are the core documents that define all the components in an EMV payment system.

The EMV standard is defined and managed by EMVCo LLC, a privately owned corporation owned by major payment brands like American Express, Discover Financial, JCB International, Mastercard, China UnionPay, and Visa Inc.

For another approach, see: Cheque Book Number

These organizations have representatives in the EMVCo organization and working groups, ensuring that the standard is regularly updated and maintained.

EMVCo issues recognition of compliance with the EMV standard, also known as device certification, after submission of results of testing performed by an accredited testing house.

EMV Compliance testing has two levels: EMV Level 1, which covers physical, electrical and transport level interfaces, and EMV Level 2, which covers payment application selection and credit financial transaction processing.

Here are the main EMV documents and standards:

- Book 1: Application Independent ICC to Terminal Interface Requirements

- Book 2: Security and Key Management

- Book 3: Application Specification

- Book 4: Cardholder, Attendant, and Acquirer Interface Requirements

- Common Payment Application Specification

- EMV Card Personalisation Specification

Credit Card Types and Issuers

There are over 400 million contactless Visa credit cards in circulation in the U.S.

Most major American credit card issuers are now sending contactless cards by default.

Capital One is one of the prominent issuers of contactless credit cards, with many of their popular cards featuring contactless card chips.

Bank of America

Bank of America offers contactless credit cards to its cardholders.

They started issuing these cards in mid-2019, initially only to those living in New York City, Boston, and San Francisco.

All newly issued Bank of America credit cards now come with contactless technology.

This means cardholders can make payments quickly and securely without having to insert their card or sign a receipt.

Capital One

Capital One is a well-known issuer of credit cards with contactless technology. Many of their U.S.-issued cards feature contactless card chips.

The Capital One Venture X Rewards Credit Card and Capital One Venture Rewards Credit Card are two popular examples that come with this feature.

These cards are designed for travelers and offer rewards on purchases.

Citi

Citi is a well-known credit card issuer that offers a range of cards with contactless technology.

The feature is included with Select Citi Cards, but the exact cards that have contactless chips are not explicitly listed on the Citi website.

However, you can check the card detail page to see if a particular card is contactless or not.

For example, the Citi Double Cash Card and Citi Rewards+ Card are currently being issued as contactless cards.

Here are some Citi credit cards that are known to have contactless technology:

- Citi Double Cash

- Citi Rewards+ Card

It's worth noting that Citi's website does not provide a comprehensive list of contactless credit cards, so you may need to check the card detail page or contact Citi directly to confirm.

Credit Card History and Evolution

The history of credit cards is a fascinating one. Until the introduction of chip & PIN, all face-to-face credit or debit card transactions involved a magnetic stripe or mechanical imprint to read and record account data, and a signature for identity verification.

The signature on the card was used as a verification method, but it had its security flaws, including the ease with which cards could go missing before their legitimate owners could sign them. Another issue was the forgery of the correct signature.

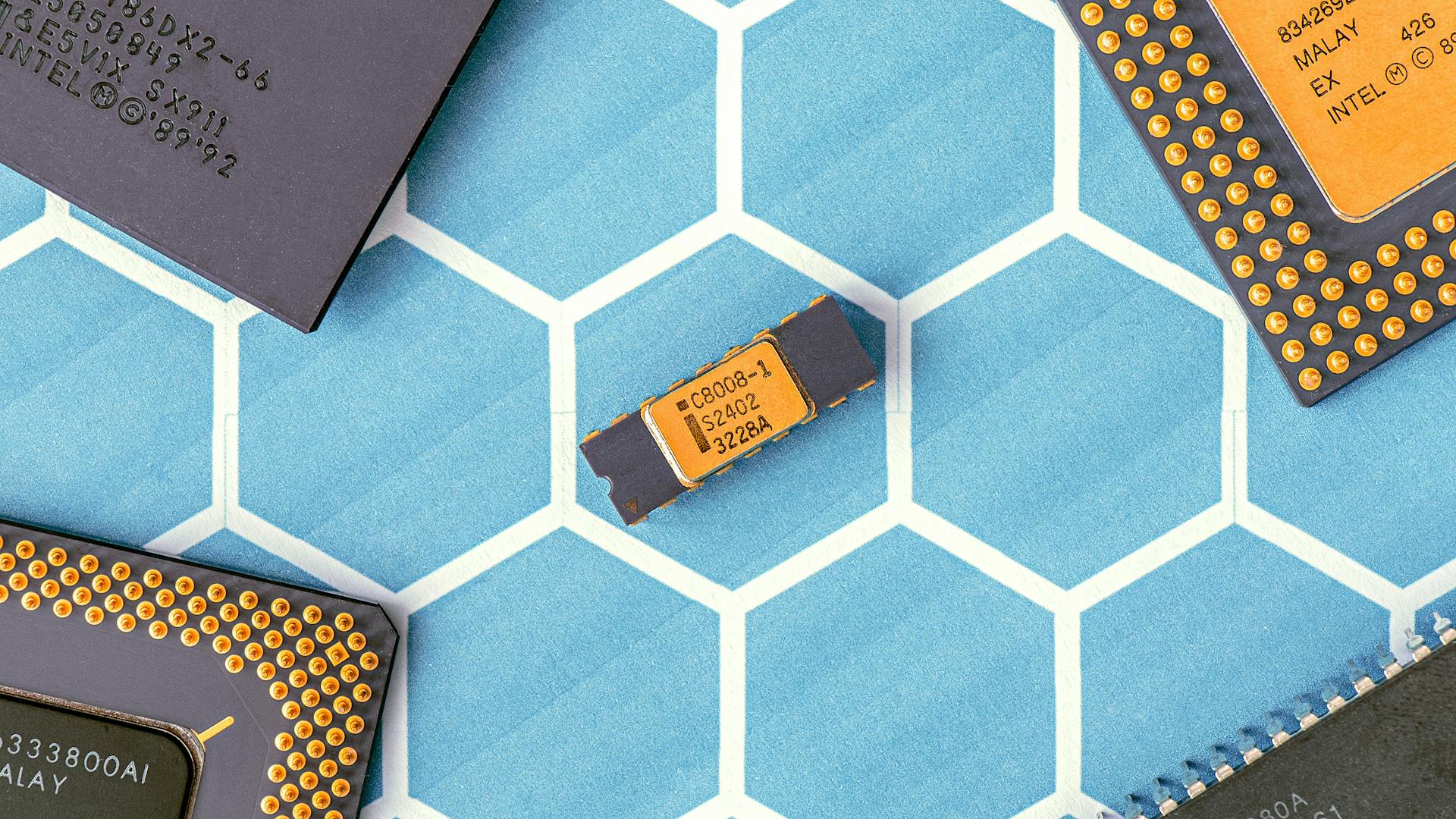

The invention of the silicon-integrated circuit chip in 1959 led to the idea of incorporating it onto a plastic smart card in the late 1960s by two German engineers, Helmut Gröttrup and Jürgen Dethloff.

Worth a look: Do Credit Card Skimmers Work on Chip Cards

History

Until the introduction of chip & PIN, all face-to-face credit or debit card transactions involved the use of a magnetic stripe or mechanical imprint to read and record account data, and a signature for purposes of identity verification.

The invention of the silicon-integrated circuit chip in 1959 led to the idea of incorporating it onto a plastic smart card in the late 1960s by two German engineers, Helmut Gröttrup and Jürgen Dethloff.

The earliest smart cards were introduced as calling cards in the 1970s, before later being adapted for use as payment cards.

The first standard for smart payment cards was the Carte Bancaire B0M4 from Bull-CP8 deployed in France in 1986, followed by the B4B0' (compatible with the M4) deployed in 1989.

Geldkarte in Germany also predates EMV, and France has since migrated all its card and terminal infrastructure to EMV.

EMV was designed to allow cards and terminals to be backwardly compatible with these standards.

The standard is now managed by EMVCo, a consortium with control split equally among Visa, Mastercard, JCB, American Express, China UnionPay, and Discover.

For your interest: Pay Standard Chartered Bank Credit Card

Versions

The EMV standard has undergone significant changes over the years, with the first version emerging in 1995 as EMV 2.0.

A fresh viewpoint: Emv Chip and Pin Credit Cards

The EMV standard was upgraded to EMV 3.0 in 1996, and later amendments were made to EMV 3.1.1 in 1998.

In December 2000, the EMV standard was further amended to version 4.0, also known as EMV 2000.

Version 4.0 became effective in June 2004, marking a significant milestone in the evolution of the EMV standard.

Version 4.1 became effective in June 2007, and version 4.2 took effect in June 2008.

Version 4.3, the latest version at the time of writing, is in effect since November 2011.

Additional reading: Big 4 Investment Banks

Asian Pacific Countries

Asian Pacific Countries have undergone significant changes in credit card liability. Mastercard's liability shift took place on 1 January 2006, but it wasn't until 1 October 2010 that a liability shift occurred for all point of sale transactions, except for domestic transactions in China and Japan.

The region's credit card landscape is complex, with different countries having different liability shift dates. For example, domestic ATM transactions in China are not currently subject to a liability shift deadline.

Suggestion: Money Transfer from India to China

Mastercard required all point of sale terminals to be EMV capable by April 2013. This change aimed to improve security and reduce the risk of credit card fraud.

Here's a summary of liability shift dates for Asian Pacific countries:

Visa's liability shift for points of sale took place on 1 October 2010, but it wasn't until 1 October 2015 that a liability shift occurred for all ATM transactions, except in China, India, Japan, and Thailand.

You might like: Basel 1 vs Basel 2

Frequently Asked Questions

Do credit cards use RFID or NFC?

Credit cards use both RFID and NFC technologies for contactless payment, with RFID powering the chip and NFC enabling communication with card readers. This technology allows for secure and convenient transactions with just a tap of the card.

Featured Images: pexels.com