EMV chip and pin credit cards have become the new standard for secure transactions. This technology replaces the traditional magnetic stripe with a microchip that stores sensitive information.

The chip is designed to be difficult to counterfeit, making it a more secure option than magnetic stripe cards. It's also harder to skim or hack.

To use an EMV chip and pin credit card, you'll need to insert the card into a reader and enter your pin number. This process is typically faster than signing a receipt.

The EMV chip and pin system uses a dynamic authentication process to verify transactions, making it more secure than traditional credit card systems.

For another approach, see: Emv Technology Credit Cards

What Are EMV Chip and Pin Credit Cards?

EMV chip and pin credit cards are a type of payment card that uses a microchip to store and process transaction information.

These cards have a small chip embedded in the card, which holds sensitive information such as your name, card number, and expiration date.

See what others are reading: Do Credit Bureaus Sell Your Information

The chip is designed to be more secure than traditional magnetic stripe cards, as it requires the cardholder to enter a personal identification number (PIN) to complete a transaction.

The EMV chip and pin system is widely used around the world, with over 100 countries adopting the technology.

In the United States, EMV chip and pin credit cards have become the new standard, with many merchants now requiring cardholders to insert their card and enter their PIN to complete a purchase.

This shift away from traditional magnetic stripe cards has been driven by the need for greater security and fraud protection.

The EMV chip and pin system has been shown to reduce the risk of card skimming and other types of card-not-present (CNP) fraud.

You might enjoy: Stripe for Credit Cards

Benefits and Security

EMV chip and PIN credit cards offer a higher level of security compared to traditional magnetic stripe cards.

One of the primary benefits of EMV chip cards is their use of advanced encryption technology, which generates a unique encrypted transaction code that cannot be easily cloned or copied by fraudsters.

For another approach, see: Emv Atm Machines

This encryption makes it significantly more challenging for criminals to create counterfeit cards, reducing the risk of card-present fraud.

EMV technology has been instrumental in reducing fraud, especially in card-present transactions, with countries that have widely adopted EMV technology seeing a dramatic decrease in face-to-face credit card fraud.

The security chip on credit cards protects your personal and financial information by encrypting data directly on the chip, making sensitive information not easily accessible during the transaction process.

EMV cards are accepted worldwide, making them a convenient option for international travelers, with a global standard that ensures the same level of security and acceptance as at home.

Here are some key statistics on the adoption of chip and PIN technology:

In the United States, the adoption rate of chip and PIN cards has been slower, but this is changing as more merchants and financial institutions require transactions with EMV cards.

The use of a four-digit PIN for authorization is the biggest reason chip and PIN cards are more secure than magnetic stripe cards, making it easier to know that the cardholder is the real owner of the card.

If this caught your attention, see: Capital One Bank Credit Card Pin

In the event of a lost or stolen card, the chip and PIN technology ensures that sensitive information is not easily accessible, making it more difficult for thieves to use your card for fraudulent purchases.

The Fair Credit Billing Act (FCBA) sets a limit of $50 in total liability for fraudulent credit card transactions made with your card, and liability is set at $0 for fraudulent transactions made with your card number.

Curious to learn more? Check out: Fair and Accurate Credit Transactions Act

How They Work

Chip-and-PIN cards have an embedded microchip that generates a unique transaction code for every purchase, making it nearly impossible for fraudsters to replicate the card's information.

The chip communicates with the terminal, proving the card is genuine, and then generates a dynamic transaction code unique to each purchase.

Cardholders insert their card into the merchant's point of sale (POS) terminal and enter their PIN to authorize and complete the transaction.

The use of a PIN also bypasses the need for employees to verify that the signature matches the one shown on the card, a process that can slow down transactions and annoy customers.

The EMV chip card never transmits the card number when inserted into a merchant's EMV reader, and the dynamic encryption makes it nearly impossible for fraudsters to replicate the card's information to conduct counterfeit transactions.

Broaden your view: What Is Purchase Apr on Credit Cards

What Is a Card?

A card is essentially a standard-size plastic debit or credit card that contains an embedded microchip. This microchip encrypts information to increase data security when making transactions.

Chip cards, also known as smart cards, are a type of card that uses this technology. They are less susceptible to fraud than previous generations of credit cards.

A chip-and-PIN card is a type of credit card that requires the cardholder to authorize the transaction by entering their personal identification number (PIN). This makes it even harder for fraudsters to use the card without the cardholder's permission.

Chip cards contain both a microchip and a traditional magnetic stripe, which is still used by some merchants.

A fresh viewpoint: Credit Cards with Chip and Pin

How It Works

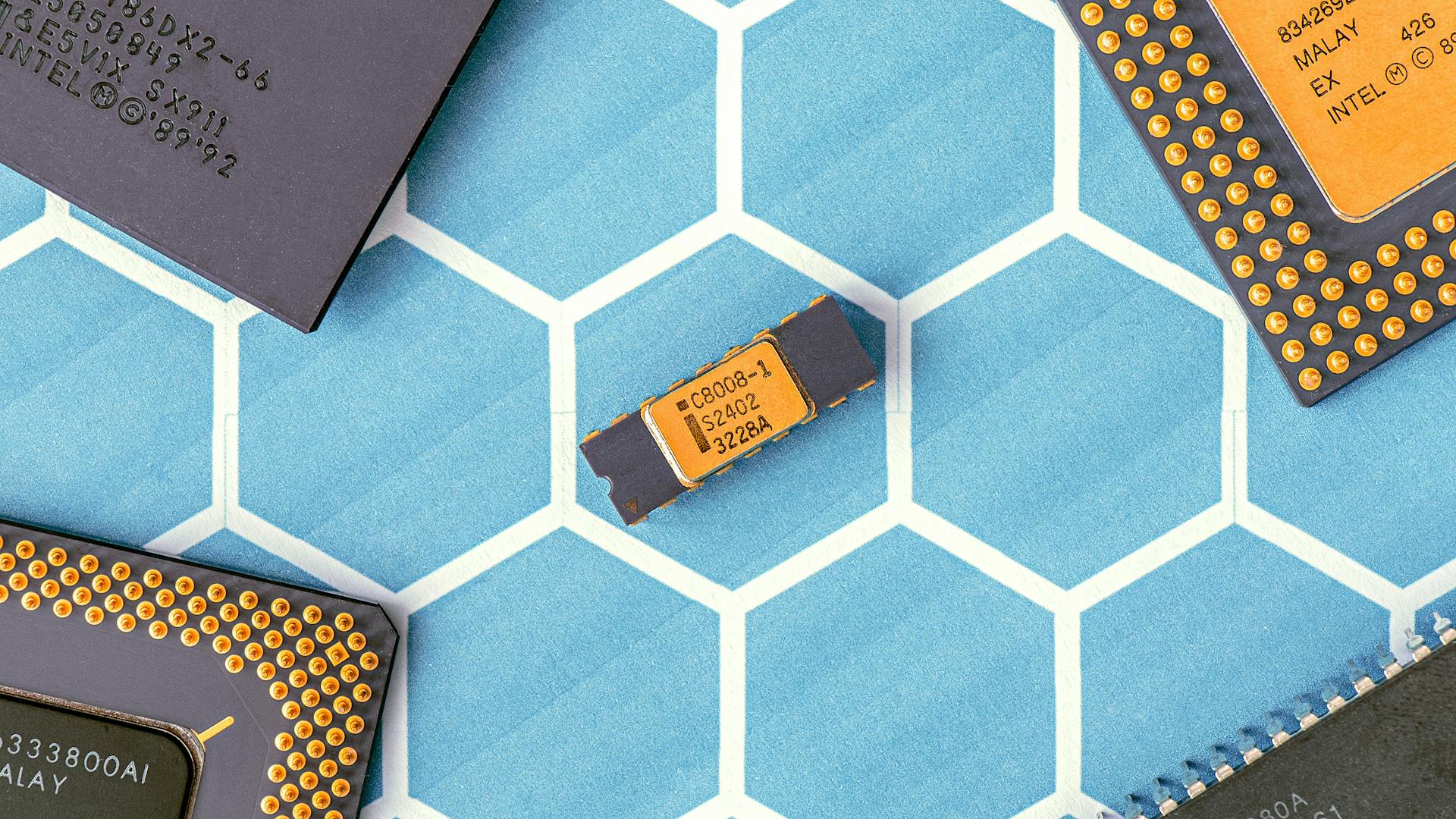

Chip cards, also known as EMV cards, have a little silver or gold microchip embedded on the front that contains information about the account(s) associated with the card.

This technology was first used in Europe before becoming a standard around the world, and it was officially adopted in the United States in October 2015.

To use a chip card, you insert the card into a chip-enabled terminal, such as an ATM or a point-of-sale terminal, and the terminal submits your information to the merchant or card provider's site.

If your account balance supports the transaction, it is then approved, but if not, the terminal rejects the transaction and it doesn't go through.

Chip technology helps reduce certain types of fraud resulting from data breaches, although it doesn't actually prevent a data breach from occurring.

The enhanced security of the chip itself contains counterfeiting preventive measures.

Chip-and-PIN cards have an embedded, square-shaped microchip that not only carries information about the card and cardholder but also generates a unique code for each transaction.

This code is useless once the transaction is complete, making it difficult for thieves to replicate the card's information.

Chip-and-PIN cards require you to enter your PIN to authorize and complete the transaction.

Unlike magnetic stripe technology, chip-and-PIN cards don't require merchants to retain large amounts of paper records, and the use of a PIN bypasses the need for employees to verify that the signature matches the one shown on the card.

Broaden your view: Medical Debt Doesn't Affect Credit

Chip cards are far more difficult to counterfeit than magnetic stripe cards, and thieves can't use techniques like skimming to steal the information on the card.

Inserting your card into a merchant's EMV reader never transmits your card number, and the transaction process with an EMV chip card involves several steps that significantly reduce the risk of fraud.

The EMV chip generates a unique transaction code for every purchase that cannot be used again, making it nearly impossible for fraudsters to replicate the card's information.

Card authentication, transaction authorization, and cardholder verification are the key steps that make EMV chip technology so secure.

EMV technology supports two methods of verifying that the person using the card is the legitimate cardholder: signature or PIN.

A unique perspective: Does S Corp Pay Corporate Taxes

Signature

Signature plays a crucial role in chip-and-signature cards, which are the most common type in the U.S.

These cards require customers to sign as part of a transaction, adding an extra layer of verification beyond the EMV chip.

However, this method is considered more vulnerable to fraud, as a thief might be able to fake a signature.

Merchants often don't even request a signature to speed up transactions, making chip-and-signature cards all the more vulnerable.

In contrast, chip-and-PIN cards are in wide use elsewhere in the world, where security is taken more seriously.

Special Considerations

Some merchants may not have chip-enabled technology, which can make transactions a bit more complicated. This is because high costs, equipment availability, and other factors can prevent merchants from implementing chip-enabled technology.

Cardholders may be required to swipe their cards using the magnetic stripe if the merchant's terminal can't read the chip. This is still a secure way to make a transaction, but it's a more traditional method.

Users may need to enter their PINs or sign to authorize the transaction and complete the purchase, even if they're using a chip-enabled card.

For your interest: Make Money from Mobile Phone

Special Considerations

Some merchants still don't have chip-enabled technology, so cardholders may need to swipe their cards using the magnetic stripe.

High costs and limited equipment availability can make it difficult for merchants to upgrade to chip-enabled terminals.

Not all sales terminals in the US have been updated to read chip cards, which is why some credit cards have both magnetic stripes and microchips.

It's only a matter of time before magnetic stripes disappear on most types of cards, with Mastercard announcing that no new cards will be issued with magnetic stripes by 2029.

Cardholders may be required to enter their PINs or sign to authorize transactions when using magnetic stripe cards.

See what others are reading: Do Magnetic Wallets Ruin Credit Cards

Return

Returning a purchase can be a hassle, but it's a necessary part of shopping online.

Chip-and-PIN cards offer the most security for consumers, requiring a PIN to complete a transaction.

If you're using a debit or credit card to make an ATM withdrawal, you'll need to enter your PIN in the United States.

Consumers in Canada and other countries are required to use their PINs for all card transactions, even if it's a credit card.

Here's an interesting read: Consumers Credit Union Mortgage Rates

Travel and Contactless Payments

Traveling abroad can be a breeze with the right credit card. Some credit cards come with no transaction fees, making it a great option for international travel.

You can also use your EMV chip and pin credit card for contactless payments, which can make shopping and dining experiences more convenient. This technology is widely accepted in many countries.

With the right credit card, you can travel without worries, knowing that your transactions are secure and fee-free.

Curious to learn more? Check out: Discover Right Card

Travel Without Worries

Traveling without worries is a great feeling, and it's easier than ever with the right credit card. Choose a credit card with no transaction fees, and you'll save money on foreign transaction fees when you travel abroad.

Having the right credit card can unlock exclusive benefits, including travel perks. Credit cards with no transaction fees can save you money on foreign transactions, making your travel budget go further.

Some credit cards even offer rewards programs that can be redeemed for travel expenses, making your trip even more affordable. Consider a credit card that offers travel rewards to make your next adventure even more enjoyable.

For your interest: Hdfc Bank Credit Card Foreign Transaction Fee

Contactless Payment Basics

Contactless payment is a convenient way to pay for purchases without the need for a physical signature or PIN. You can use your contactless card or mobile device to make payments.

A contactless credit card is a chip card that has been enabled for contactless transactions. It will be indicated on the card by a symbol of four concentric lines much like a wireless symbol.

You can tap your card on a sales terminal or wave it nearby to make a contactless payment. At sales terminals that are not equipped to handle contactless payments, you can use your card in the usual way, by inserting it in the terminal.

It's worth noting that some sales terminals may require you to sign or supply a PIN on your first use of contactless payment.

Suggestion: Master Card Symbol

American Express Blue Cash Everyday Card

The American Express Blue Cash Everyday Card is a no-annual-fee credit card that lets you earn cash back on grocery purchases and other bills. It earns cash back in the form of "Rewards Dollars", which can be redeemed as statement credits.

This card comes with a welcome bonus of $200 in statement credits after you spend $2,000 in purchases on your new card within the first six months of card membership.

To earn the welcome bonus, you need to spend $2,000 in purchases on your new card within six months.

You can request a PIN for this card by calling the customer service phone number on the back of your credit card.

If this caught your attention, see: Penfed Bonus

Frequently Asked Questions

How do I know if my credit card has an EMV chip?

Your credit card has an EMV chip if it has a small, metallic square embedded into the card that you can see and feel. Look for this chip on the front or back of your card to confirm its presence.

Sources

- https://www.investopedia.com/terms/c/chip-card.asp

- https://www.bankrate.com/credit-cards/advice/chip-and-pin-credit-cards/

- https://www.investopedia.com/terms/c/chipandpin-card.asp

- https://www.ent.com/education-center/security-center/what-is-an-emv-card/

- https://money.howstuffworks.com/personal-finance/debt-management/chip-and-pin-credit-cards.htm

Featured Images: pexels.com