EMV technology credit cards have revolutionized the way we make transactions, and it's essential to understand what they are and how they work.

EMV stands for Europay, Mastercard, and Visa, which are the three companies that developed this technology.

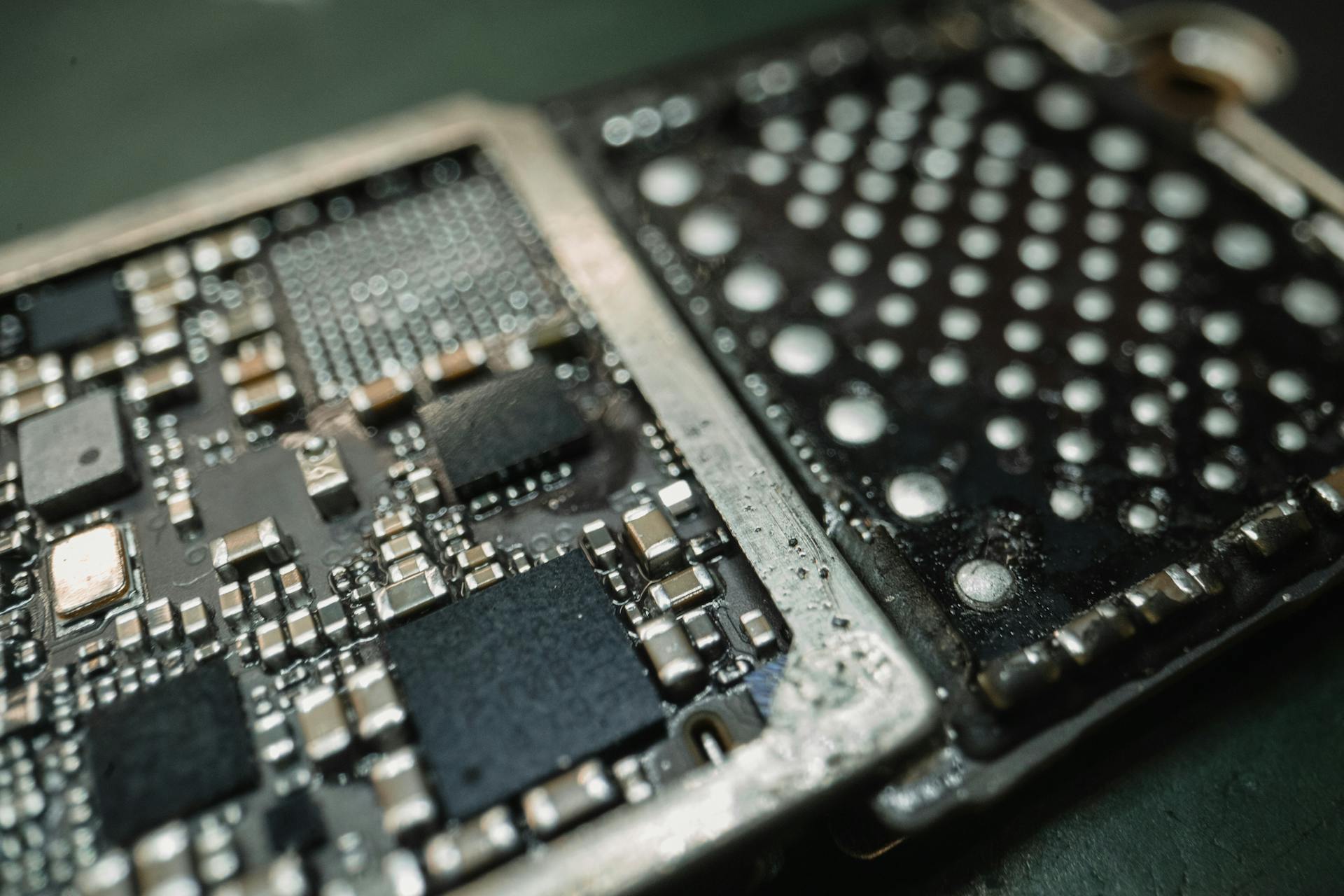

These credit cards use a small computer chip embedded in the card to store and process transaction data, providing a secure and convenient way to make purchases.

The chip technology is designed to prevent counterfeiting and reduce the risk of credit card fraud.

In addition to the chip, EMV credit cards also have a magnetic stripe, which is used for transactions that are not supported by the chip.

As of 2015, the majority of credit cards issued in the US were EMV-enabled, marking a significant shift away from traditional magnetic stripe cards.

Recommended read: Technology behind Credit Cards

What Is EMV Technology?

EMV technology is a safer card standard compared to traditional magnetic strips. It was developed by Europay, MasterCard, and Visa in 1995.

The EMV chip is embedded in the card and is read by inserting the card at the payment terminal, unlike swiping a magnetic strip. This chip scrambles the transaction information when you make a purchase.

Even if someone steals the transaction information, it would be extremely difficult to use it to commit fraud, usually in the form of unauthorized purchases.

A different take: Chip Technology Credit Cards

How EMV Technology Works

EMV technology is a game-changer when it comes to in-store payment security. This technology stores a vast amount of information, including encrypted data that helps protect against in-store payment fraud.

The EMV chip can hold dynamic information that changes over time, making it even more secure. This is a major improvement over magnetic stripe credit cards, which can be easily compromised.

Whenever you use an EMV chip for an in-store payment, you'll need to dip your card into a chip reader at the point-of-sale terminal. This is a simple process that's become standard in many countries.

Consider reading: Emv Chip and Pin Credit Cards

The EMV chip generates a unique transaction code for each purchase, which can never be used again. This ensures that even if your card falls into the wrong hands, it can't be used for fraudulent transactions.

Here's a quick breakdown of the EMV chip process:

- The customer dips their card into a chip reader

- The EMV chip generates a unique transaction code

- The code is used for the transaction and can never be reused

Using EMV cards can also help you avoid difficulties when shopping abroad. Many countries have already adopted EMV chip technology, and using EMV cards can remove restrictions when buying in-person from merchants around the globe.

A fresh viewpoint: How to Make Money Using Your Mobile Phone

Payment Security

EMV chip technology provides a high level of security for in-store transactions, as the embedded security chips are very difficult to clone.

Most of the world had already adopted EMV chip technology by the time it arrived in the US in 2011, but the US introduced new liability rules in 2015 to speed the transition to this more secure payment standard.

As of 2019, over 1 billion chip cards have been issued to US consumers, making it easier for merchants and consumers to have peace of mind when making transactions.

Related reading: Chip Readers in Credit Cards

EMV chip cards offer greater security and enhanced fraud protection, reducing the risk of fraudulent losses, penalties, and litigation.

A unique, encrypted code is generated for each credit card transaction, making it extremely difficult for criminals to duplicate without expensive equipment.

In fact, EMV chip cards are said to be more secure than credit cards without a chip, and can reduce counterfeit fraud by up to 87%.

However, it's worth noting that chip-and-signature cards are considered less secure than chip-and-PIN cards, as they rely on merchants to verify the signature on the back of the card.

Here are some key benefits of EMV chip technology:

- Greater security and enhanced fraud protection

- Reduced risk of fraudulent losses, penalties, and litigation

- Peace of mind for patrons that their data will stay secure

Benefits and Advantages

Chip and PIN credit cards have a unique code for each purchase, making it difficult for thieves to use stolen information. This added security feature helps protect you from financial loss.

These cards are generally considered safer than magnetic stripe cards and have added fraud protection. The chip technology embedded in the card makes it harder for hackers to access your information.

Take a look at this: What Is Shareholder Value Added

With some research, consumers can find a chip and PIN credit card that offers both security and rewards. This way, you can enjoy the benefits of a secure card without sacrificing rewards.

Here are some benefits of using chip and PIN credit cards:

- Unique code for each purchase

- Added fraud protection

- Security features make it harder for hackers to access your information

Payment Processing and Equipment

To get started with EMV technology, all you need is a credit card embedded with an EMV security chip, which is now the norm due to new liability rules.

Most card-issuing banks have already shipped EMV plastic, so the majority of customers carry chip cards in their wallets. As a brick-and-mortar merchant, you only need a credit card machine that can read EMV chip technology, which is often included in modern terminals.

Most EMV terminals come with a magnetic stripe slot for legacy plastic payments and NFC technology for contactless payments. You can even turn your existing smartphone or tablet into a portable credit card reader with Clover Go, allowing you to securely process payments made via contactless or EMV chip technology.

Here are some EMV-enabled equipment options to consider:

- Clover Go: a portable credit card reader that accepts EMV chip cards, contactless EMV cards, Apple Pay, Samsung Pay, and Google Pay

- Clover Station Solo: a POS system that allows businesses to run their entire business from one device, including EMV-enabled credit card processing

In-Store Payment Equipment

To accept EMV chip cards for in-store payments, you'll need a credit card machine that can correctly read EMV chip technology. This doesn't mean investing in multiple terminals, as most EMV readers come with a magnetic stripe slot for payments made via legacy plastic.

You can also use NFC technology for contactless payments, which allows merchants to securely accept wireless payments made using EMV plastic or mobile wallets with stored credit card data. This is a convenient option that's becoming increasingly popular.

If you're a brick-and-mortar merchant, you have a few options for accepting EMV payments. You can invest in a dedicated POS terminal, but this isn't necessary. Clover Go, for example, allows merchants to turn their existing smartphones and tablets into portable credit card readers that can securely process payments made via contactless or EMV chip technology.

Here are some EMV-enabled equipment options to consider:

- Clover Station Solo: A POS system that allows business owners to run their entire business from one device

- Clover Go: A portable credit card reader that can securely process payments made via contactless or EMV chip technology

These devices are EMV-enabled and can also accept standard credit cards, debit cards, and contactless payment solutions. They're great options for businesses that want to accept EMV chip cards for in-store payments.

Recommended read: Does Walmart Accept American Express Credit Cards

Payment Processing Costs

Payment processing costs can be a significant expense for businesses, with most processors charging an average of 2.4% of the transaction value.

This fee can be broken down into monthly fees, flat per-transaction fees, and percentage-based commissions, or a mix of these.

Processors may also apply a small fee based on industry, processing volume, average ticket size, and processing history.

It's essential to explore your options and compare quotes to find the best fit for your business needs.

Don't forget to review the contract carefully, looking for binding language, automatic-renewal clauses, early-termination fees, and any hidden charges.

Fill out the application only when you're ready to commit to the company's services, as it may be included in the contract.

Worth a look: Electronic Transaction for Payment Explanation

History and Adoption

In 2015, the U.S. credit card issuers, including Mastercard, Visa, Discover, and American Express, altered the fraud liability rules to facilitate the adoption of EMV chip technology.

These changes shifted the liability for in-store counterfeit fraud to whichever side of a transaction wasn’t EMV-ready – either the merchant or the card-issuing bank. As a result, non-compliance with EMV chip technology became more expensive than upgrading one’s payment environment.

Since these liability rules went into effect, in-store payment fraud has dropped significantly, with U.S. merchants seeing a 87 percent decrease in counterfeit fraud between September 2015 and March 2019.

The adoption of EMV chip technology has been so successful that, starting in April 2018, Visa, Mastercard, American Express, and Discover decided they would no longer require signatures to verify card-based purchases. Retailers can still optionally require signatures to verify a cardholder’s identity, but this is at their discretion.

You might enjoy: Do S Corps Pay Corporate Taxes

Why Continues to Rise

As of 2019, over 3.7 million merchants now accept chip cards, making EMV chip technology a dominant force in the payment industry.

Many businesses are making the switch to EMV chip technology due to its enhanced security features. EMV chip technology is inherently more secure than legacy credit cards, making it harder for thieves to copy magnetic stripes.

In-person purchases benefit greatly from this increased security, with EMV cards requiring a dip or wave to be read by a dedicated chip reader. This makes it much harder for counterfeiters to create fake cards.

A different take: Secured Credit Card Bad Credit with No Security Deposit

Liability rules are also driving the adoption of EMV technology, with card-issuing banks and merchants both facing fines if payment fraud occurs. This means that businesses are incentivized to make the switch to avoid these costly penalties.

Most new EMV cards and chip-based readers come with near field communication (NFC) technology, allowing for contactless payments that are faster and more secure than traditional swiping methods.

A History of U.S. Adoption

In the United States, the adoption of EMV chip technology was a significant shift from magstripe plastic. The move to EMV proved to be expensive for small businesses that couldn't afford the necessary hardware upgrades to their POS systems.

Fraud liability rules were altered in 2015 by major credit card issuers, including Mastercard, Visa, Discover, and American Express. These changes made non-compliance with EMV chip technology more expensive than upgrading one's payment environment.

Between September 2015 and March 2019, U.S. merchants that made the switch to EMV saw counterfeit fraud plummet 87 percent. This significant drop in in-store payment fraud demonstrates the effectiveness of EMV chip technology.

In April 2018, Visa, Mastercard, American Express, and Discover decided to no longer require signatures to verify card-based purchases. This change helps streamline the checkout process without compromising credit card security.

U.S. Standard

The U.S. Standard is finally catching up with the rest of the world. As of 2019, over 3.7 million merchants now accept chip cards, which is a significant increase from previous years.

In fact, EMV chip technology is already the standard card technology for many foreign countries, especially Europe, where card fraud got out of control. The U.S. is just playing catch-up.

The U.S. hasn't found a big enough reason to ditch the traditional magnetic strip on payment cards, until recently. Data breaches surely played a role in emphasizing the need for a more secure card payments.

The four big U.S. card processing networks - American Express, Discover, Mastercard, and Visa - will make card issuers and/or merchants absorb the losses that come from fraudulent purchases if they don’t offer EMV-chip credit cards (card issuers) or don’t accept them (merchants).

The rules will apply at a later date for gas stations. This policy change will incentivize card issuers and merchants to make the transition to more secure EMV technology.

You might like: Does Paying Credit Cards off Raise Your Score

Here are the upcoming policy changes for each of these card payment networks:

With the U.S. standard finally catching up, we can expect to see many more credit cards with EMV chips in the future.

Payment Solutions and Options

As a consumer, you're likely already familiar with EMV chip cards, but did you know that there are various payment solutions that tie to EMV chip technology? These include contactless EMV cards, mobile EMV technology, and wearable EMV technology.

You can use your existing smartphone or tablet as a portable credit card reader that can securely process payments made via contactless or EMV chip technology with Clover Go. This device is perfect for anywhere your business goes, allowing customers to pay via Apple Pay, Samsung Pay, Google Pay, contact EMV chip cards, or contactless EMV cards.

If you're looking for a more permanent solution, consider the Clover Station Solo, which is a POS system that allows business owners to run their entire business from one convenient device. This EMV-enabled device can also accept standard credit cards, debit cards, and contactless payment solutions, making it a great option for businesses that need to process multiple types of payments.

Curious to learn more? Check out: Electronic Billing & Payment Solutions

Payment Solutions

More than 3.7 million merchants now accept EMV chip technology, a significant increase from previous years. This shift in acceptance is largely due to the benefits of EMV technology, including reduced fraud and increased security.

EMV chip technology comes in various forms, including contactless EMV cards, mobile EMV technology, and wearable EMV technology. These options provide consumers with flexibility and convenience when making payments.

Contactless EMV cards, for example, allow users to make payments by simply tapping their card on a terminal. Mobile EMV technology enables users to make payments using their smartphones, while wearable EMV technology allows for payments to be made using devices such as smartwatches.

As a merchant, you can accept EMV chip payments using a credit card machine that can correctly read EMV chip technology. Most EMV terminals now come with NFC technology for contactless payments, making it easy to securely accept wireless payments.

To get started with EMV technology, you'll need a credit card machine that can read EMV chip technology. You can also consider using a portable credit card reader, such as Clover Go, which allows merchants to turn their existing smartphones and tablets into secure payment devices.

Here are some common payment options that accept EMV chip technology:

- Apple Pay

- Samsung Pay

- Google Pay

- Contact EMV chip cards

- Contactless EMV cards

These options provide consumers with a range of choices when making payments, and merchants with a secure and convenient way to accept payments.

What Gas Stations Mean

Gas stations are slowly adopting EMV technology, but it's a costly process. Replacing card readers alone is estimated to cost $6 billion.

The transition requires gas stations to replace their pumps, hardware, and software, making it a significant undertaking.

Visa and Mastercard are requiring gas stations to make the switch from magnetic stripe card readers to EMV readers by April 17, 2021.

Readers also liked: Gas Station Tap to Pay

Security and Protection

EMV technology credit cards offer a higher level of security compared to traditional magnetic stripe cards. The embedded security chips in EMV cards are extremely difficult to clone, making it hard for thieves to create counterfeit cards.

More than one billion chip cards have been issued to U.S. consumers as of 2019. This shift to EMV technology has been driven by the need for greater security and enhanced fraud protection.

By using a unique code for each transaction, EMV chip cards reduce the risk of fraudulent losses, penalties, and litigation. This randomized one-time code is encrypted and nearly impossible to duplicate without expensive equipment.

See what others are reading: Four Corners Model for Payment Security

The benefits of EMV chip technology far outweigh the costs of implementation. In fact, the reduced risk of fraudulent losses alone can save businesses a significant amount of money.

Here are some key benefits of EMV chip technology:

- Greater security and enhanced fraud protection

- Reduced risk of fraudulent losses, penalties, and litigation

- Peace of mind for patrons that their data will stay secure

EMV chip technology is one of the most effective ways to prevent in-person fraud, giving cardholders and merchants peace of mind.

Frequently Asked Questions

How do I know if my credit card has an EMV chip?

Your credit card has an EMV chip if it has a small, metallic square embedded into the card that you can see and feel. Look for this chip on the front or back of your card to confirm its presence.

What are the disadvantages of EMV chip cards?

EMV chip cards are vulnerable to online transactions, leaving them susceptible to certain types of fraud. Despite their security benefits, EMV chip cards have limitations when it comes to protecting against online threats

What is the difference between an EMV and a chip card?

EMV and chip card are terms that refer to the same technology, which uses a small computer chip to process credit card transactions securely. In essence, all EMV cards are chip cards, but not all chip cards are EMV-enabled.

Sources

- https://www.carat.fiserv.com/en-us/resources/emv-chip-card-technology/

- https://www.mybanktracker.com/news/credit-cards-us-emv-chip-technology

- https://www.bankrate.com/credit-cards/advice/chip-and-pin-credit-cards/

- https://www.shopify.com/retail/chip-credit-cards

- https://www.creditkarma.com/credit-cards/i/how-emv-credit-card-chip-works

Featured Images: pexels.com