Accounting principles are the foundation of financial reporting, and understanding them is essential for making informed decisions.

GAAP, or Generally Accepted Accounting Principles, is the standard framework for accounting in the United States.

Accounting principles guide the preparation of financial statements, ensuring consistency and comparability across companies.

The matching principle, one of the fundamental accounting principles, requires expenses to be matched with the revenues they help generate.

Revenue recognition is another key principle, which dictates that revenue should be recorded when it is earned, regardless of when cash is received.

Intriguing read: Deferred Income Accounting Entry

Accounting Basics

Accounting is the process of recording financial transactions, which is broken down into several components.

At its most basic level, accounting records and reveals cash flows and operations. It divides all business transactions into credits and debits, which are somewhat counterintuitive in financial accounting.

Debits increase asset or expense accounts and decrease liability or equity accounts, while credits increase liability or equity accounts and decrease asset or expense accounts.

Readers also liked: A Deferred Revenue Liability Appears on the Balance Sheet For:

The accounting equation is a fundamental concept to understand: Assets = Liabilities + Equity. This equation is used as a guide when recording transactions and balancing credit and debit accounts.

Accountants track expenses as well as profits and losses, ensuring transactions are balanced. This basic accounting information is then used by managers to make business decisions.

To fully understand the accounting cycle, it's essential to have a solid grasp of basic accounting principles, such as revenue recognition, the matching principle, and the accrual principle.

Here's a quick rundown of the basic accounting concepts to get you started:

Financial Statements

Financial statements are a crucial part of accounting, providing a snapshot of a company's financial health. They help stakeholders understand the company's performance and make informed decisions.

The three main financial statements are the balance sheet, income statement, and cash flow statement. These statements are prepared using the correct balances, such as assets, liabilities, and equity.

Explore further: How to Reconcile Bank Statements in Quickbooks

A balance sheet is a summary of a company's financial balances, including assets, liabilities, and ownership equity, as of a specific date. It's like taking a photo of the company's financial situation at a particular moment.

The income statement shows how revenue is transformed into net income, also known as the "bottom line." It's a key indicator of a company's profitability.

Here are the three main financial statements:

The cash flow statement is a crucial tool for understanding a company's liquidity and ability to meet its financial obligations. It shows whether a company is generating more cash than it's spending or vice versa.

Accounting Process

The accounting process is a crucial part of understanding accounting fundamentals. It's a holistic process that records and processes all financial transactions of a company.

The accounting cycle is the process of recording and processing all financial transactions, from when the transaction occurs to its representation on the financial statements. It repeats itself every fiscal year as long as a company remains in business.

Discover more: Prior to the Adjusting Process Accrued Revenue Has

To handle basic accounting transactions, accountants must record all transactions in the accounts, including purchases, sales, receipts, and compensation. These transactions include the purchase of inventory, materials, and services, as well as payments made to employees for their hours worked.

Here are some examples of typical transactions:

- Purchases: Includes the purchase of inventory, materials, and services

- Sales: Includes the sale of goods and services to customers

- Receipts: Includes the receipt of payment for any sales made

- Compensation: Includes payments made to employees for their hours worked

The accounting cycle incorporates all the accounts, journal entries, T accounts, debits, and credits, adjusting entries over a full cycle.

Additional reading: Stock Based Compensation Journal Entries

Steps in the Cycle

The accounting process is a series of steps that help you understand and record a company's financial transactions. It's a repetitive cycle that happens every fiscal year.

First, financial transactions start the process. These transactions can include debt payoffs, purchases, sales revenue, or expenses incurred (Example 5). Transactions are the foundation of the accounting process.

The next step is to record these transactions in the accounts. Accountants must record all transactions, including purchases, sales, receipts, and compensation (Example 4). This involves tracking debits and credits.

Recommended read: How to Record Sales Tax Payments in Quickbooks Online

The transactions are then posted to the journal, which is a record of all the transactions. The journal entries are then posted to the general ledger (Example 6).

To ensure the debits and credits on the trial balance match, the bookkeeper must look for errors and make corrective adjustments on a worksheet (Example 3). This is a crucial step in the accounting process.

Finally, adjusting entries must be posted to accounts for accruals and deferrals at the end of the company's accounting period (Example 7). This ensures the financial statements accurately reflect the company's financial position.

Consider reading: Convertible Bonds Accounting Journal Entries

4 Trial Balance

The trial balance is a crucial step in the accounting process. It's calculated at the end of the accounting period, which can be quarterly, monthly, or yearly, depending on the company.

A total balance is calculated for the accounts, ensuring that all financial transactions are accounted for. This helps prevent errors and discrepancies in the financial records.

A unique perspective: Can Someone Check My Bank Account Balance with Account Number

The trial balance is a snapshot of the company's financial position at a specific point in time. It's a summary of all the accounts and their balances, providing a clear picture of the company's financial health.

By reconciling the trial balance, accountants can identify any discrepancies or errors in the financial records. This helps maintain the accuracy and reliability of the financial statements.

Accounting Concepts

Accounting concepts are the foundation of accounting, and understanding them is crucial for anyone looking to learn about accounting. Accounting concepts include assets, liabilities, and capital, which are the three fundamental concepts of accounting.

Assets describe an individual or company's holdings of financial value, such as cash, inventory, and property. These can be tangible, like a piece of equipment, or intangible, like a patent.

Liabilities are debts and unpaid expenses that a company owes to others. This can include loans, accounts payable, and taxes owed.

Revenue recognition is a key accounting concept that determines when a company can record sales revenue. This is typically when the sale is made, not when the payment is received.

Consider reading: What Are Current Asset Accounts

The matching principle is another important concept that matches expenses to revenues. This ensures that the costs of producing a product or service are matched with the revenues earned from selling it.

The accrual principle is also a fundamental concept that requires companies to record revenues and expenses when they are earned or incurred, regardless of when they are paid. This is in contrast to the cash basis, which records revenues and expenses when they are received or paid.

Some other important accounting concepts include the accounting period, which is the time frame used to prepare financial statements, and the chart of accounts, which is a list of the accounts used by a business entity to define each class of items for which money or the equivalent is spent or received.

Here are some key accounting concepts summarized in a table:

Frequently Asked Questions

What are the 7 functions of accounting?

The 7 key functions of accounting include managing accounts, payroll, inventory, and finances, as well as ensuring compliance and control. These essential tasks help accounting departments optimize time and resources.

Sources

- https://en.wikipedia.org/wiki/Outline_of_accounting

- https://www.accounting.com/resources/basic-accounting-terms/

- https://zoetalentsolutions.com/course/fundamentals-of-accounting-course/

- https://gocardless.com/guides/posts/the-basics-of-accounting/

- https://corporatefinanceinstitute.com/resources/accounting/accounting-cycle/

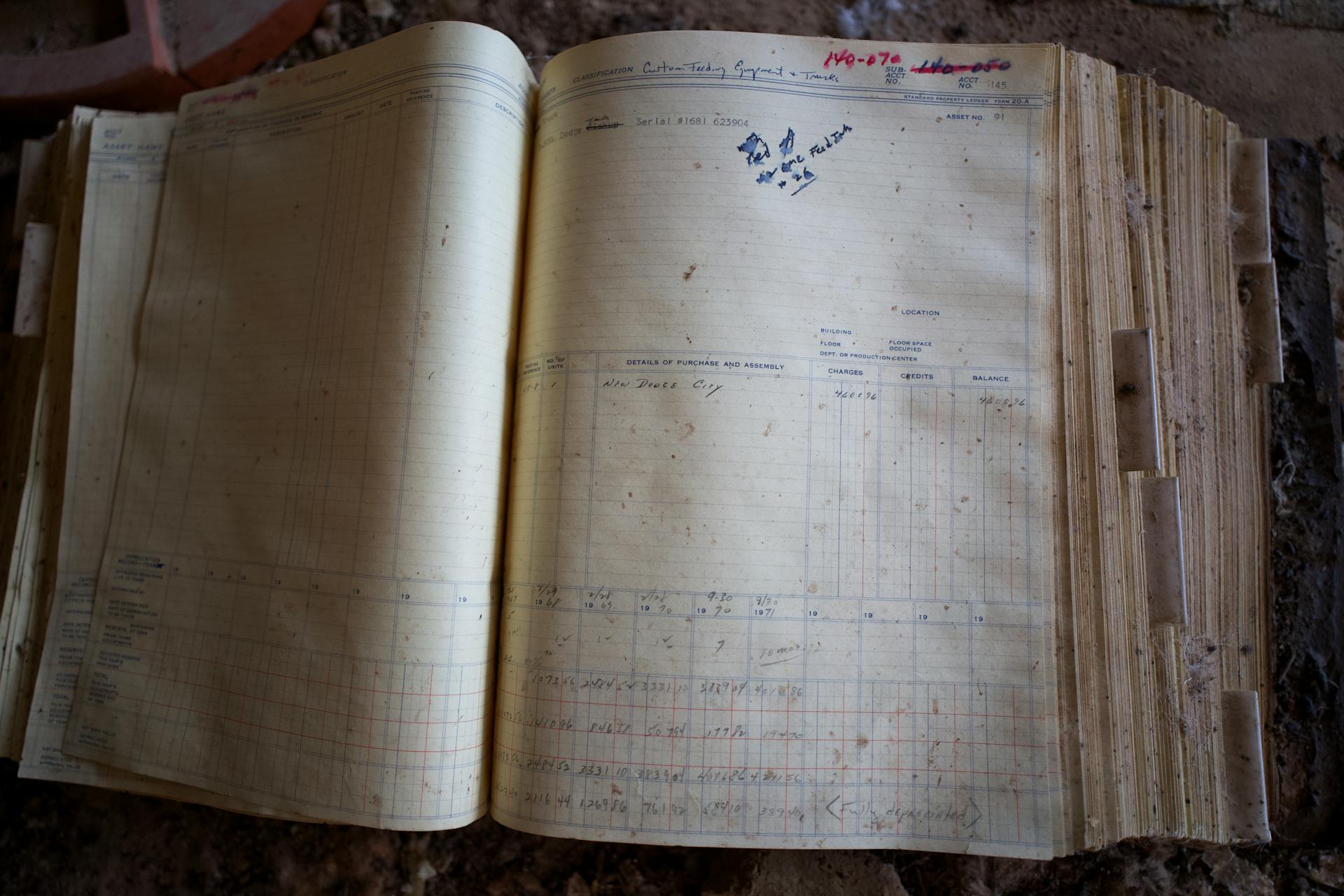

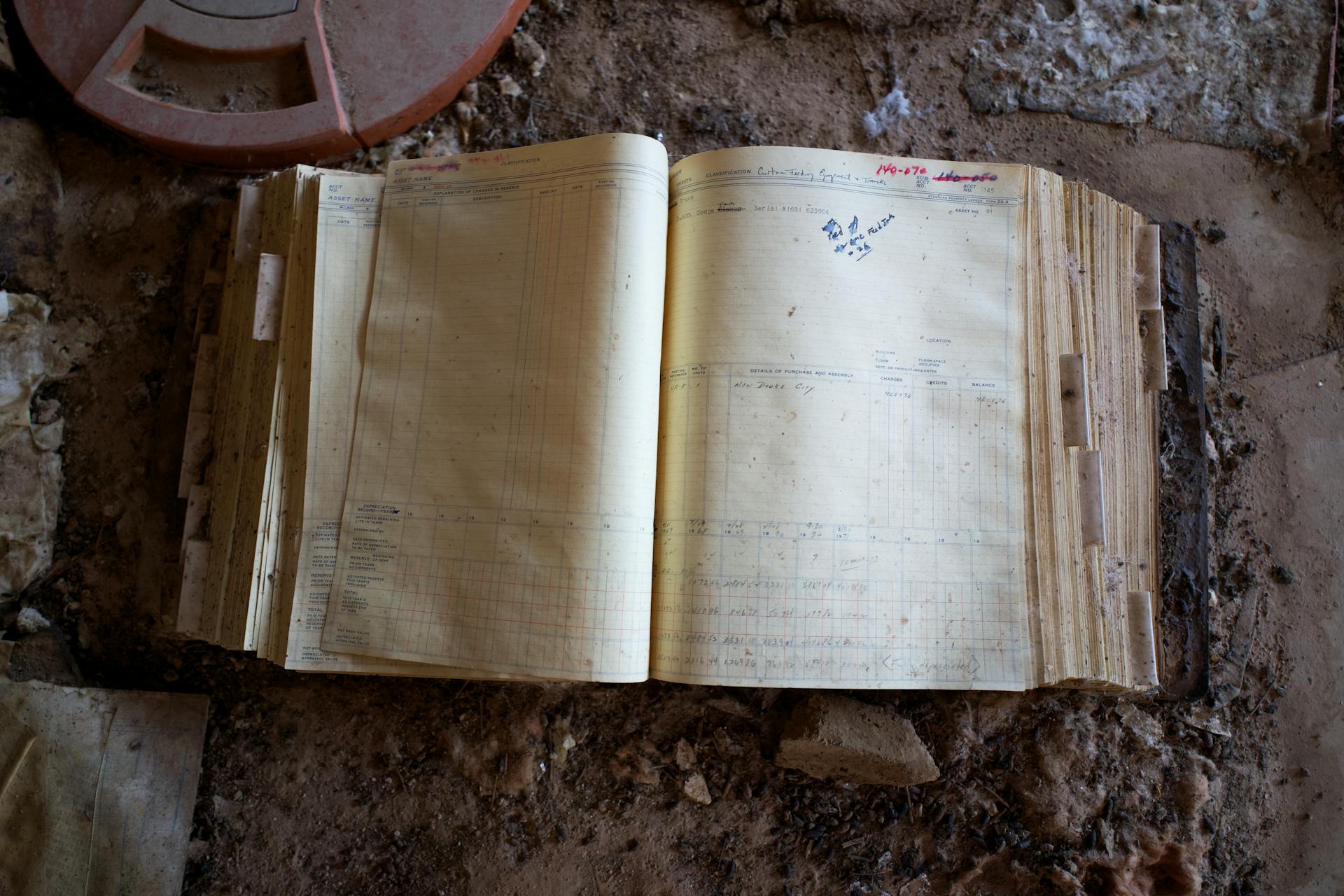

Featured Images: pexels.com