Common carrier cargo insurance coverage is a type of insurance that protects shippers from financial loss due to damage or loss of their goods during transportation. This type of insurance is usually purchased by the shipper and is a separate coverage from the carrier's liability insurance.

There are three main types of common carrier cargo insurance coverage: basic, excess, and declared value. Basic coverage is the most basic type and covers goods up to a certain value, while excess coverage provides additional protection for goods worth more than the basic coverage limit. Declared value coverage is the most comprehensive type and requires the shipper to declare the exact value of their goods.

The cost of common carrier cargo insurance coverage varies depending on the type of coverage and the value of the goods being shipped. On average, basic coverage can cost between 0.5% to 1% of the declared value of the goods, while excess coverage can cost between 1% to 3% of the declared value.

Expand your knowledge: Does Insurance Cover Cgm for Type 2 Diabetes

What is Common Carrier Cargo Insurance?

Common Carrier Cargo Insurance is a type of policy that safeguards your goods against loss, damage, or theft while they're in transit.

Carrier liability is limited and may not cover the full value of your goods, which is why you need additional protection.

You can't rely on the carrier's liability insurance alone, as it's often insufficient to fully cover the value of your goods.

Freight insurance, on the other hand, can be tailored to your specific needs and provides much higher levels of coverage than carrier liability.

It's like adding a safety net to your cargo's protection, giving you peace of mind and ultimate protection against unforeseen events.

Independent freight insurance gives you the full-value shield your precious shipments deserve, no matter what happens during transit.

For more insights, see: What Types of Litigation Does Umbrella Insurance Protect against

Types of Insurance

Types of insurance are available to cover various risks associated with shipping goods. There are several types of freight insurance to choose from, depending on your specific needs.

Worth a look: Types of Cargo Insurance

Cargo Insurance is the most common type, covering physical damage or loss of goods during shipping. It can be arranged by the seller, buyer, or a third party and is often used in international trade.

Liability Insurance protects against third-party claims of bodily injury or property damage. This is particularly important for freight forwarders and logistics providers.

All-Risk Coverage is the most comprehensive option, covering a wide range of risks. This type of policy provides the broadest protection but also tends to be the most expensive.

Within cargo insurance, there are three main levels of cover: Basic Cover, Broad Cover, and All-Risk Cover.

The level of cover you choose will depend on the value and sensitivity of your goods. For example, Basic Cover is not recommended for high-value or sensitive goods.

Expand your knowledge: Progressive Total Loss Coverage vs Actual Cash Value

Choosing the Right Insurance

Choosing the right insurance is crucial to protect your cargo. Assess your risks by evaluating the types of goods you typically ship, your usual transport modes, routes, and destinations. This will help you identify any unique risks associated with your cargo or shipping processes.

To determine the right level of cover, consider your specific needs and budget constraints. You can choose from basic, broad, or all-risk cover. For example, if you ship high-value or fragile goods, all-risk cover may be the best option.

It's essential to check carrier liability and identify any gaps in protection. This will help you understand what risks and liabilities are covered by your carrier's insurance. Don't be afraid to shop around and compare providers with deep industry expertise, competitive rates, and strong customer support.

Here are some key factors to consider when choosing a provider:

- Reputability

- Industry expertise

- Competitive rates

- Strong customer support

Review your insurance coverage regularly to ensure it still meets your needs. As your business evolves, your insurance requirements may change. Update your coverage as required to maintain adequate protection for your cargo.

Cost and Options

Freight insurance premiums can cost around 0.3% to 0.5% of the commercial invoice value of the goods, but this can vary based on several factors.

To keep your freight insurance costs down, consider properly packing and labeling your cargo, providing accurate declarations and documentation, choosing reputable carriers, and opting for appropriate levels of cover.

The type and value of goods being shipped, mode of transport, destination country, and shipping route all play a role in determining your freight insurance costs.

Here are some common freight insurance coverages available:

- All Risks: Covers unexpected property damage, but has limitations and exclusions.

- Annual: Perfect for frequent shippers, provides coverage for a year and involves sharing detailed information about shipments.

- Named Perils: Covers damages caused by perils specifically listed in the policy.

- Open Cover: Covers all shipments, no matter the value, and has no expiration date.

- Single Shipment: Covers a single shipment from origin to destination.

Cost

Freight insurance premiums typically range from 0.3% to 0.5% of the commercial invoice value of the goods.

Factors like the type and value of goods, mode of transport, destination country, and shipping route can greatly impact insurance costs.

Costs can vary based on the level of cover selected, so it's essential to choose the right amount of coverage for your needs.

To minimize costs, consider properly packing and labeling your cargo to minimize risks.

Providing accurate declarations and documentation can also help avoid disputes that might drive up costs.

Choosing reputable carriers with good safety records can also help keep costs down.

Opting for the right level of cover is key to finding a balance between protection and cost.

Here's a rough idea of the factors that can influence freight insurance costs:

By understanding these factors and taking steps to minimize costs, you can find the right balance of protection and cost for your unique needs.

Available Options

There are several freight insurance options to consider, each with its own unique features.

All Risks freight insurance covers unexpected property damage, but it's essential to familiarize yourself with the limitations and exclusions of your policy.

Annual policies stay on the records for a year and are perfect for frequent shippers, requiring in-depth information about shipments and annual turnover.

Named Perils insurance specifically covers damages caused by perils listed in the policy.

Open Cover policies cover all shipments, no matter the value, from beginning to end and have no expiration date.

Single Shipment policies apply to a single shipment, covering it from origin to destination and taking the least amount of time.

Total loss insurance protects your goods during catastrophic events or total loss, but it doesn't cover partial losses.

Shipping Methods

Freight forwarders often arrange insurance for their clients' shipments, acting as an intermediary between the client and the insurance provider.

Freight forwarders may offer cargo insurance as an additional service to their clients.

For high-value, time-sensitive shipments, air cargo insurance is critical for protecting these valuable goods.

Air

Air freight is a fast and efficient way to transport goods, but it comes with its own set of risks like airport handling and potential delays.

Air freight insurance can protect against these risks and may also cover the costs of the air freight itself and associated charges.

Fast air transport is often used for high-value, time-sensitive shipments, making air cargo insurance critical for protecting these valuable goods.

Air cargo insurance provides coverage for goods transported by air, which is a significant investment for many businesses.

Companies shipping perishable goods like pharmaceuticals or fresh produce should ensure they have coverage for delays or damage due to extended time in transit.

Delays caused by adverse weather or mechanical issues can severely impact a business's supply chain, making air cargo insurance a vital consideration.

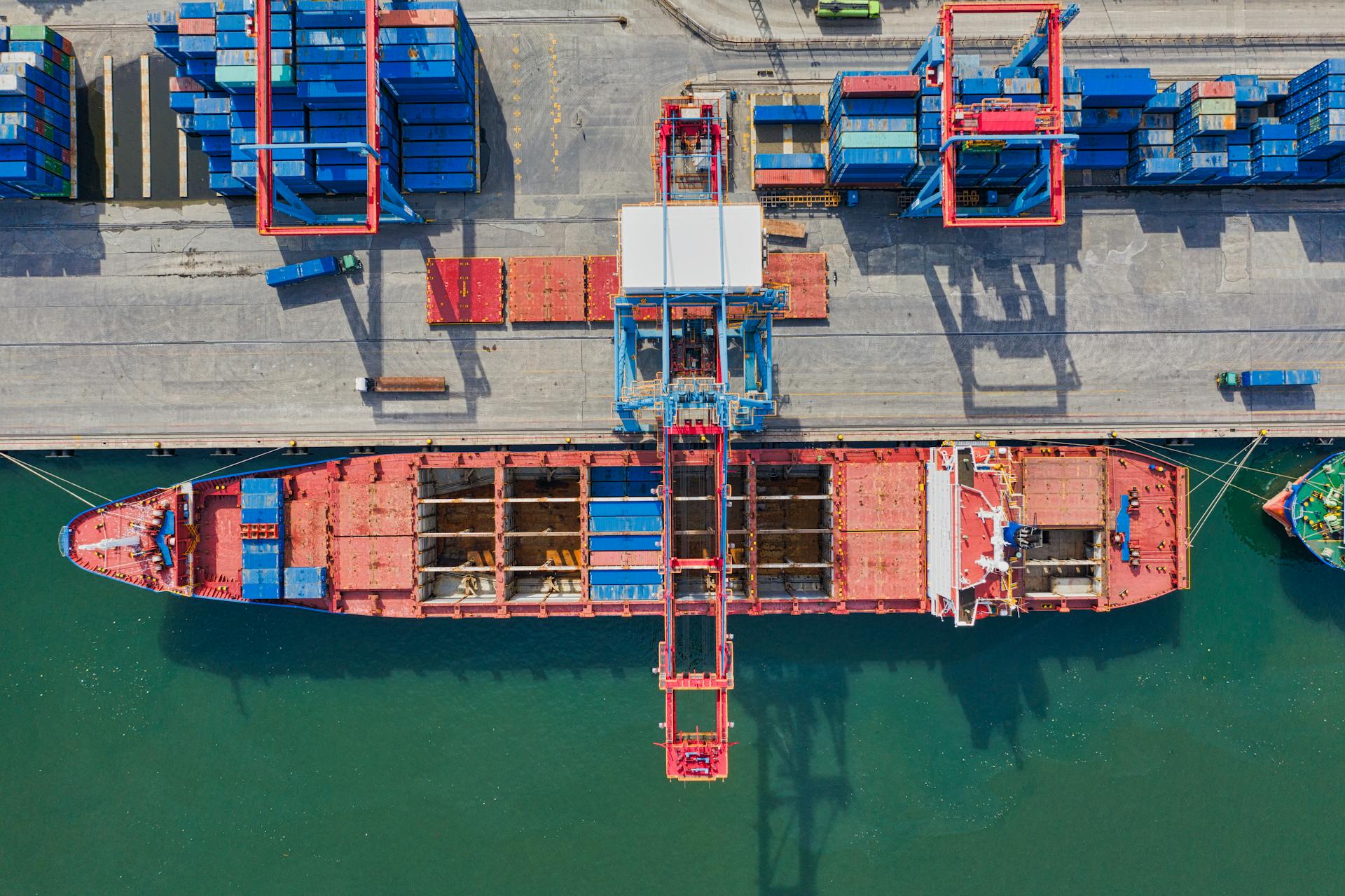

Container Shipping

Container shipping is a complex process that requires careful planning and consideration of potential risks.

Sea voyages are subject to risks like rough sea conditions, port congestion, and delays, which can cause significant losses if not properly insured.

A good container shipping insurance policy will protect you against these marine-specific risks, giving you peace of mind during the shipping process.

Freight forwarders often play a key role in arranging insurance for their clients' shipments, acting as an intermediary between the client and the insurance provider.

Freight forwarders can also take out their own insurance to cover their liabilities in the event of an incident, providing an added layer of protection for both parties involved.

Land/Haulier

Land/Haulier cargo insurance is designed to protect goods transported via road or rail. It's particularly relevant for companies that rely on trucking services to move their cargo within a country or across borders.

This type of insurance often includes provisions for vehicle accidents, theft, and mishandling. Companies should always assess whether the haulier's liability coverage will be enough to meet their needs.

There are different coverage categories for Land/Haulier cargo insurance. Here are some of the most common types:

- All-Risks Coverage: This is the most comprehensive form of coverage, providing protection against all types of risks except for those explicitly excluded in the policy.

- Named Perils Coverage: This type of coverage only protects against specific risks listed in the policy.

- Carrier Liability: This type of coverage protects against the haulier's negligence, but it typically covers only a fraction of the cargo's total value.

Carrier liability coverage is often not enough to meet the needs of companies. They may need to invest in a more robust cargo insurance policy to ensure their goods are fully protected.

Liability and Coverage

Carrier liability is the basic level of protection offered by most carriers, but it's limited in scope. It's generally limited to a specific amount per pound of freight, which may be far below the actual value of your goods.

Carrier liability is subject to various conditions and exclusions, often depending on the cause of the damage. For example, if a natural disaster affects the shipment, the carrier may not be liable. This can leave you with a significant financial loss.

Freight insurance, on the other hand, provides complete coverage for your goods, reimbursing you for the total declared value of the shipment in case of loss or damage.

Intriguing read: Will Insurance Cover Covid Tests after May 11

What's Covered?

Carrier liability is limited in scope and only covers a portion of any damage or loss, generally limited to a specific amount per pound of freight.

The amount covered by carrier liability may be far below the actual value of your goods, especially for high-value items, leaving you with a significant financial loss if an incident occurs.

Carrier liability is subject to various conditions and exclusions, often depending on the cause of the damage, such as natural disasters like hurricanes or floods, which may not be covered.

Freight insurance, on the other hand, provides complete coverage for your goods, reimbursing you for the total declared value of the shipment in case of loss or damage.

This comprehensive coverage extends to a broader range of risks, including natural disasters, theft, accidents, and mishandling during transit, giving you a far more reliable safety net.

Freight insurance also covers high-value items and sensitive shipments, making it ideal for valuable or high-stakes shipments that require extra protection.

Expand your knowledge: Does Car Insurance Cover Natural Disasters

Liability

Carrier liability is the basic level of protection offered by most carriers, but it's limited in scope. It covers up to a certain dollar amount per pound of freight, which may be far below the actual value of your goods.

This limited coverage is determined by the carrier and varies depending on the commodity type or freight class of the goods being shipped. The included liability coverage is often less than the actual value of the goods, especially for used items not directly from the manufacturer.

Carrier liability has limitations in certain instances, such as when the damage is due to an act of God or an act of the shipper. In these cases, the carrier cannot be held responsible.

For example, if a shipment is damaged due to weather-related issues, the carrier may not be liable. Similarly, if the damage is caused by improper packaging or loading by the shipper, the carrier cannot be held responsible.

Recommended read: Motor Carrier Act of 1980 Minimum Insurance Requirements

The claims process for carrier liability can be complex and time-consuming. You must file the freight claim within 9 months of delivery, and provide proof of value and proof of loss. Some carriers require immediate notification if the delivery receipt isn’t noted as damaged.

Here's a summary of the claims process for carrier liability:

- The freight claim must be filed within 9 months of delivery

- If the delivery receipt isn’t noted as damaged, some carriers require immediate notification

- Proof of value and proof of loss must be provided

- The carrier has 30 days to acknowledge the claim and must respond within 120 days

- You must prove carrier negligence

Frequently Asked Questions

What is not covered in cargo insurance?

Cargo insurance typically excludes losses caused by intentional misconduct, wear and tear, and ordinary leakage or loss. This means you may not be covered for certain types of damage or loss, so it's essential to review your policy carefully.

What is MTC coverage?

MTC coverage provides liability protection for truckers transporting property of others. It helps ensure they're financially responsible for cargo damage or loss.

Sources

- https://www.freightos.com/freight-resources/freight-insurance/

- https://www.freightcenter.com/freight-insurance/

- https://www.cargolineme.com/blog/cargo-insurance-types-and-coverage/

- https://usaspecialtyinsurance.com/insurance-blog/understanding-motor-truck-cargo-insurance-basics-coverage/

- https://www.logisticsplus.com/carrier-liability-versus-cargo-insurance-whats-difference/

Featured Images: pexels.com