Cargo liability coverage is a type of insurance that safeguards your goods during transit, providing financial protection against losses or damages.

This coverage is usually included in the freight contract, but it's essential to understand its terms and conditions to ensure you're adequately protected.

The coverage amount is typically calculated based on the value of the goods being transported, with the maximum coverage limit ranging from $50,000 to $500,000, depending on the type of cargo and the carrier's policies.

As a freight owner, it's crucial to understand that cargo liability coverage does not cover damages caused by the shipper's own negligence or errors.

Additional reading: Defender Cargo Rack

Choosing the Right Coverage

Choosing the right coverage for your cargo liability needs can be a daunting task. There are several types of freight insurance to choose from, depending on your specific needs. Cargo insurance, liability insurance, and all-risk coverage are the most common types of freight insurance.

To select the ideal freight insurance for your business, consider the following key steps: Assess your risks, check carrier liability, get the right level of cover, compare providers, and review regularly. This will help you choose the right policy for your business.

A different take: Choose Life Insurance Beneficiaries

Here are the main differences between freight insurance and cargo insurance:

By understanding these differences, you can make an informed decision about which type of insurance is right for your business.

How to Choose

Choosing the right freight insurance can be a daunting task, but with the right approach, you can ensure your valuable cargo is protected. Start by assessing your risks, evaluating the types of goods you typically ship, your usual transport modes, routes, and destinations.

Identify any unique risks associated with your cargo or shipping processes. According to Example 6, freight shipping insurance is often requested for businesses that handle interstate or interdecadal trucking, especially in regions with varying weather conditions and operational challenges.

Check carrier liability to see what risks and liabilities are covered by your carrier's insurance and identify any gaps in protection. As mentioned in Example 5, freight forwarders have limited control over the policy, but they can still be liable for damages due to errors or negligence.

For your interest: Cargo Space

Get the right level of cover by choosing from basic, broad, or all-risk cover based on your specific needs and budget constraints. For instance, all-risk coverage (Example 3) provides the widest scope of freight insurance coverage, covering all risks except those excluded in the policy.

Compare providers to find reputable insurers with deep industry expertise, competitive rates, and strong customer support. Don't be afraid to shop around, as Example 7 suggests reviewing and updating your insurance coverage periodically as your business evolves.

Here's a quick reference guide to help you choose the right level of cover:

Remember, the right freight insurance can give you peace of mind knowing your goods are covered, no matter what the journey brings.

Protection and Cost

Freight insurance premiums can range from 0.3% to 0.5% of the commercial invoice value of the goods, depending on factors like the type and value of goods, mode of transport, destination country, and shipping route.

Worth a look: Goods in Transit and Public Liability Insurance

To keep costs down, consider proper packing and labeling of cargo, accurate declarations and documentation, and choosing reputable carriers with good safety records.

Costs can vary significantly based on the mode of transport, with air cargo insurance being more expensive than sea cargo insurance.

The cost of freight insurance can be affected by the value of cargo, with higher values requiring more comprehensive coverage and higher premiums.

A deductible is typically included in freight insurance policies, which is the amount the insured party must pay when a claim is made.

Deductibles can range from $0 to $1,000 for shipments valued at less than $10,000 to $100,000, and 2% of the shipment value for cargo valued at more than $100,000.

Exclusions are also a crucial aspect of freight insurance, which can include losses due to wear and tear, poor packing, war and civil unrest, and delays.

It's essential to review and understand the exclusions in your policy to avoid surprises when filing a claim.

Here's a summary of the common exclusions in freight insurance:

- Wear and tear or gradual deterioration

- Improper packing or labeling of goods

- Employee dishonesty or intentional damage

- Delay-related losses, unless specifically included

- War, strikes, or civil unrest, unless specifically included

By understanding the costs and exclusions of freight insurance, you can make informed decisions and choose the right coverage for your business.

Air Cargo Liability

Air cargo liability is a crucial aspect of cargo liability coverage. Most air carriers are required to have a certain level of liability insurance, but this minimum coverage is unlikely to meet the needs of most cargo shippers.

For instance, full-risk air cargo insurance typically protects against almost all types of damage or loss, but this coverage is more expensive and may exclude older goods or ones vulnerable to breakage, spoilage, or loss.

Liability insurance, on the other hand, protects against third-party claims of bodily injury or property damage. This is particularly important for freight forwarders and logistics providers.

Here are the three main levels of cover in cargo insurance:

This table highlights the different levels of protection available in cargo insurance, from basic to all-risk cover. The choice of level depends on the specific needs and risks of the cargo shipment.

A fresh viewpoint: Types of Cargo Insurance

What is Air?

Air cargo insurance is a type of policy that protects buyers and sellers of goods being transported through the air.

This type of insurance reimburses the insured for items that are damaged, destroyed, or lost.

In some cases, air cargo insurance may even offer compensation for shipment delays.

Air cargo insurance covers items that are damaged, destroyed, or lost during transportation, providing financial protection to buyers and sellers.

This protection is especially important for businesses that rely on timely and secure delivery of goods to stay competitive.

Air cargo insurance can offer reimbursement for items that are damaged or destroyed, helping businesses avoid financial losses.

Broaden your view: State Farm Offer Travel Insurance

Types of Air

Air cargo insurance can be a lifesaver for businesses that rely on timely and secure delivery of goods. There are different types of air cargo insurance, and understanding them can help you make informed decisions about your shipping needs.

Air carriers are required to have a certain level of liability insurance, but this minimum coverage is unlikely to meet the needs of most cargo shippers.

Full-risk air cargo insurance typically protects against almost all types of damage or loss, but it's more expensive and may exclude older goods or ones vulnerable to breakage, spoilage, or loss.

Expand your knowledge: Who Needs an Umbrella Policy

There are also more affordable options like Institute Cargo Clauses, which offer different levels of coverage. Type A provides all-risk insurance, Type B provides average insurance, and Type C coverage is also called free of particular average insurance.

Type C coverage is the most inexpensive form of insurance, but it only covers total losses, not partial damages.

A different take: Immediate Cash Value Life Insurance

Container Shipping and Liability

Container shipping by sea comes with its own set of risks, including rough sea conditions and the potential for containers to be lost overboard or damaged in transit.

A good container shipping insurance policy will protect you against these marine-specific risks, such as port congestion and delays.

Sea voyages can be unpredictable, and having the right insurance coverage can give you peace of mind and financial protection against unexpected losses.

Check this out: Bad Faith Claims against Insurance Companies

Container Shipping

Container shipping can be a complex and high-risk process, especially when it comes to marine-specific risks like rough sea conditions and port congestion. Sea voyages are subject to these risks, which can cause delays and damage to containers.

A good container shipping insurance policy can protect you against these risks. This type of insurance is a must for shipping goods by sea.

Containers can be lost overboard or damaged in transit, resulting in significant losses for shippers. A container shipping insurance policy will cover these types of losses.

Rough sea conditions can cause containers to be damaged or lost, while port congestion can lead to delays and further damage.

If this caught your attention, see: How Does Shipping Insurance Work

Carrier Liability Differences

Carrier liability can be a complex issue in container shipping, but understanding the basics can help you navigate potential risks.

Freight insurance specifically covers losses resulting from negligent acts or errors made by freight forwarders or carriers.

Liabilities don't matter when it comes to cargo insurance, as claims are usually paid regardless of who's at fault.

Not all entities use the same type of insurance; freight insurance can be used by freight forwarders, brokers, logistics companies, and transport entities.

Cargo insurance covers damage, loss, and theft that occur during transit, providing protection for shippers and carriers alike.

The key difference between freight and cargo insurance lies in their coverage and liability requirements.

Expand your knowledge: Florida Workers Compensation Insurance Carriers

Who Is Responsible?

In a supply chain, anyone whose service or job description involves significant risk should buy the best insurance coverage they can afford. This includes freight forwarders and importers.

Air carriers are required to provide a minimum level of liability insurance, so shippers don't have to worry about that aspect. However, the responsibility of insuring air cargo still falls on the shipper.

Essentially, everyone from the freight forwarder to the importer is responsible for purchasing insurance in a supply chain.

Additional reading: Risk Pooling in Supply Chain Management

Marine and Cargo Liability

Marine and Cargo Liability is a crucial aspect of cargo liability coverage. Marine insurance is an extremely broad insurance coverage that applies to every entity in the ocean shipping universe.

Protection and Indemnity (P&I) or liability insurance is a type of insurance that's often included under marine insurance. It covers damage and loss of shipping carriers, terminals, and special transportation vessels.

All-risk cargo insurance is another type of insurance that's subsumed under marine insurance. It provides comprehensive coverage for cargo damage or loss.

On a similar theme: Home Damage Claims

War-risk insurance is a specialized type of marine insurance that covers damage or loss due to war or other hostile actions. It's essential for shipping carriers that operate in high-risk areas.

Freight insurance and Hull insurance are also types of marine insurance that cover specific risks, such as damage to cargo or the ship itself.

Marine insurance policies can be categorized into three types: open, voyage, and time coverages. These can be valid for one-time or multiple trips over an indefinite period.

Discover more: Florida Insurance Claim Time Limit

Frequently Asked Questions

What does cargo legal liability cover?

Cargo legal liability covers damage or loss due to accidents, theft, vandalism, and other unforeseen circumstances during cargo handling, transportation, and storage. This protection safeguards against financial losses resulting from cargo-related perils.

What is included in cargo insurance?

Cargo insurance covers loss, damage, or theft of shipments while in transit, reimbursing the designated value of goods in case of a covered event. This protection goes beyond basic claims insurance, providing added peace of mind for shippers and receivers.

What is the cargo liability limit?

The cargo liability limit is the maximum amount of insurance coverage for goods being transported, provided by an insurer in case of loss or damage. It's the cap on the financial protection for your cargo during transit.

Sources

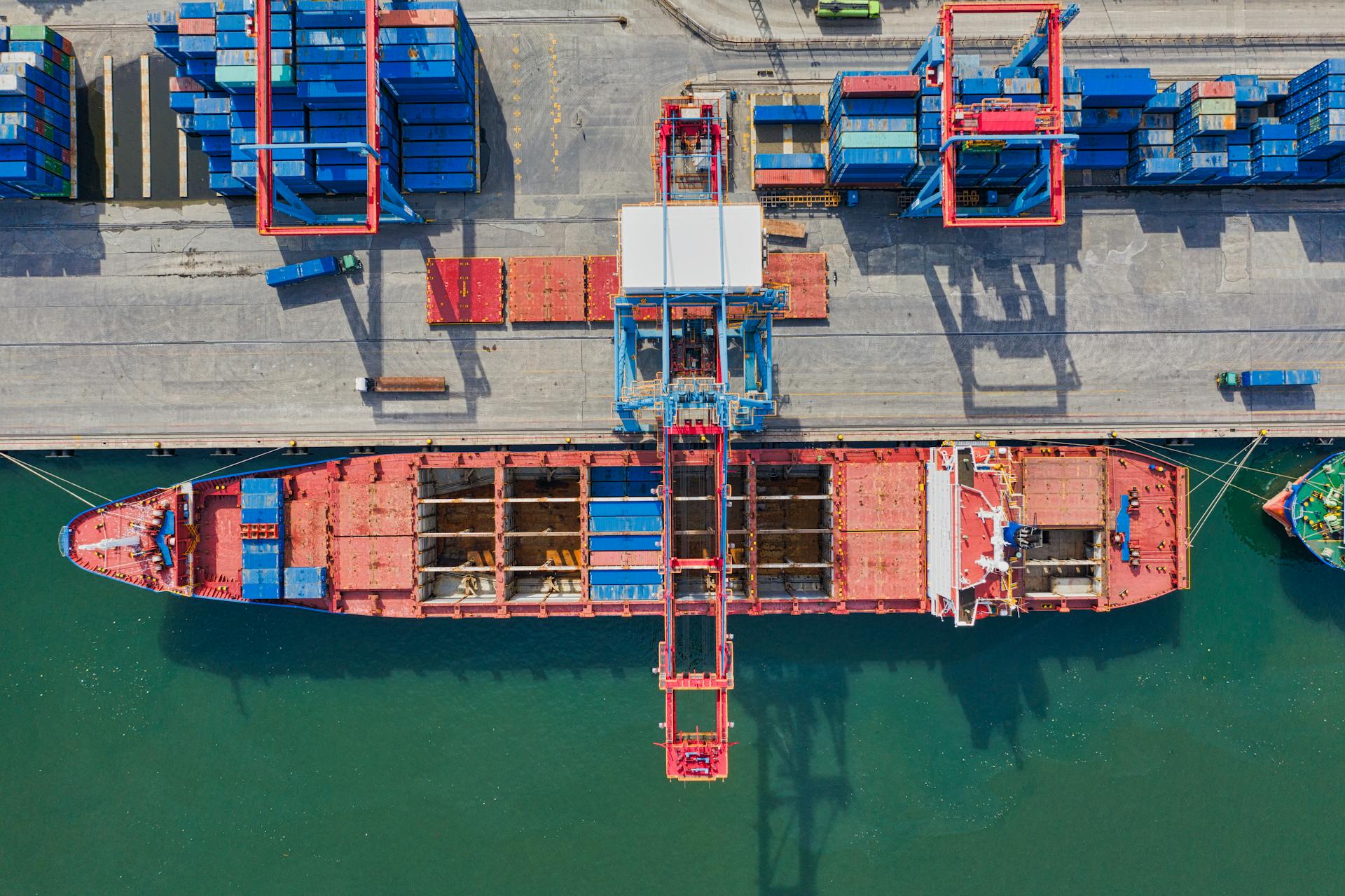

Featured Images: pexels.com