Cargo cover insurance provides financial protection against losses or damages to goods in transit, and it's a must-have for businesses that rely on transportation to move their products.

The cost of cargo cover insurance varies depending on the type of goods being transported, their value, and the route they're being taken.

Businesses can expect to pay between 1-3% of the total value of the goods being transported for cargo cover insurance premiums.

This cost is a small price to pay for the peace of mind that comes with knowing your goods are protected against loss or damage.

In the event of a loss or damage, the insurance policy will cover the cost of replacing or repairing the goods, minimizing the financial impact on the business.

Cargo cover insurance also provides protection against other risks such as theft, fire, and natural disasters.

You might like: Types of Cargo Insurance

Coverage Types

Cargo insurance comes in various forms, each designed to protect different types of cargo. Motor truck cargo insurance is a popular choice for for-hire truckers who transport goods for others.

This type of insurance covers losses to property owned by others due to situations like collisions, fires, stolen cargo, or accidents that harm the cargo. It's a must-have for truckers who want to minimize financial risk associated with unforeseen events.

Motor truck cargo insurance with refrigeration breakdown is another specialized coverage that helps protect goods that require temperature control, such as fresh or frozen food, live plants, and certain electronics. This coverage is essential for truckers who transport temperature-sensitive cargo.

The all-risk coverage type is the most popular choice, offering broad protection against virtually all physical losses to cargo, except for those explicitly excluded in the policy. It's a great option for truckers who want peace of mind and maximum protection for their cargo.

Here are some examples of vehicles that may require cargo insurance:

- Dump trucks

- Most trailers

- Cement mixers

- Dually pickups

Understanding the Cost

The cost of cargo insurance can vary greatly depending on several factors. In most cases, the insurance cost is around 0.5% of the total value of your cargo.

This cost will vary based on the type of goods, the origin and destination, and whether you’re using closed or open containers. For example, a shipment with a value of $500,000 could cost around 0.5% to 2% or more in insurance, which is a significant expense.

Several key factors influence the pricing of your cargo insurance premium, including cargo type, coverage limits, and loss history. If you're transporting riskier cargo, you can expect to pay more in premiums.

Here are some factors that affect the cost of cargo insurance:

- Cargo type: Insurance prices are affected by the type of cargo being transported. Riskier cargo can increase premiums.

- Coverage limits: You can choose more coverage, which changes the cost.

- Loss history: Your past claims and losses can affect your premium.

Cost of Ocean Coverage

The cost of ocean coverage is a crucial aspect to consider when shipping goods internationally. In most cases, the insurance cost is around 0.5% of the total value of your cargo.

This cost can vary based on the type of goods, the origin and destination, and whether you’re using closed or open containers. The cost can range to 2% or more.

For a shipment valued at $500,000, the insurance cost would be $2,500, but it can be more or less depending on the specifics of your cargo.

What's the Cost?

The cost of cargo insurance can vary, but in most cases, it's around 0.5% of the total value of your cargo.

This percentage can range to 2% or more, depending on the type of goods, origin and destination, and container type.

If you're transporting high-risk cargo, you can expect to pay a higher premium.

The cost of cargo insurance is influenced by several key factors.

Here are some of the key factors that affect the pricing of your cargo insurance premium:

- Cargo type: Riskier cargo can increase premiums, while stable cargo is cheaper to insure.

- Coverage limits: Choosing more coverage increases the cost.

- Loss history: Past claims and losses can affect your premium.

Why You Need It

Cargo cover insurance is a must-have for any business that transports goods. It protects your shipments from physical loss or damage to goods in transit, regardless of the mode of transportation.

Estimates of cargo theft in the United States range from $25-$50 billion annually, making it a significant financial risk for businesses. This is why cargo insurance is essential to save you from the financial burden of cargo damage, loss, or harm during transport.

Cargo insurance is not just limited to cargo damage, it also extends its protective reach beyond cargo, covering unexpected costs such as cleanup expenses if a truck gets into an accident on the highway.

Here are some common types of vehicles that commonly need cargo coverage:

- Box trucks

- Cargo vans

- Flatbeds

- Car haulers

- Tractor-trailers

Why You Need It

You need cargo insurance because shipments in transit are subject to numerous risks that are beyond our control. Goods may be damaged in a storm or fire, stolen, involved in a collision or just mishandled. Estimates of cargo theft in the United States range from $25-$50 billion annually.

Regulatory changes are happening, and with that, the carrier's liability is changing and their tariff will be upheld in the court system. This means that trucking companies need cargo insurance to protect themselves from financial burdens.

Cargo insurance provides a cost-effective way of covering your freight for physical loss or damage to goods in transit. It protects your shipments against all risks of physical loss or damage to freight from any external cause during shipping.

Many risk managers now require cargo insurance from truckers. If you're a for-hire trucking operation, you likely need cargo coverage. Here are some types of vehicles that commonly require cargo coverage:

- Box trucks

- Cargo vans

- Flatbeds

- Car haulers

- Tractor-trailers

Cargo insurance serves as a vital safety net for trucking companies, saving them from the financial burden of cargo damage, loss, or harm during transport, loading, and unloading. It also extends its protective reach beyond cargo, covering unexpected costs like cleanup expenses after an accident.

Core Benefits of Removing Insurance

Removing cargo insurance can provide a cost savings, but it also comes with some significant drawbacks.

You'll have to bear the financial burden of any unexpected losses or damages to your cargo.

Regulatory changes can reduce the carrier's liability, making them less accountable for losses.

This shift in liability can leave you with little to no recourse if something goes wrong.

At Gallagher Transport, they believe cargo insurance is an integral part of the importation process, implying that it's not optional.

A fresh viewpoint: What Does Liability Car Insurance Cover

Coverage Details

Comprehensive coverage is available through "All-Risk" cargo insurance, which covers goods for loss or damage without the need to prove liability.

"All-Risk" coverage typically excludes improper packing, inherent vice, or rejection of goods by Customs. Other exclusions may apply, so it's essential to review the policy details.

The coverage includes damages from bad weather, seawater or freshwater flooding, improper stowage by the shipping company, mud and grease damage, and fumigation services.

Some eligible risks to cargo include:

- Damages from bad weather

- Seawater or freshwater flooding

- Improper stowage by the shipping company

- Mud and grease damage

- Fumigation services

Total loss of the entire shipment would be covered if due to a collision, explosion, or burning involving the ocean vessel. This includes non-delivery of an entire shipment, including theft.

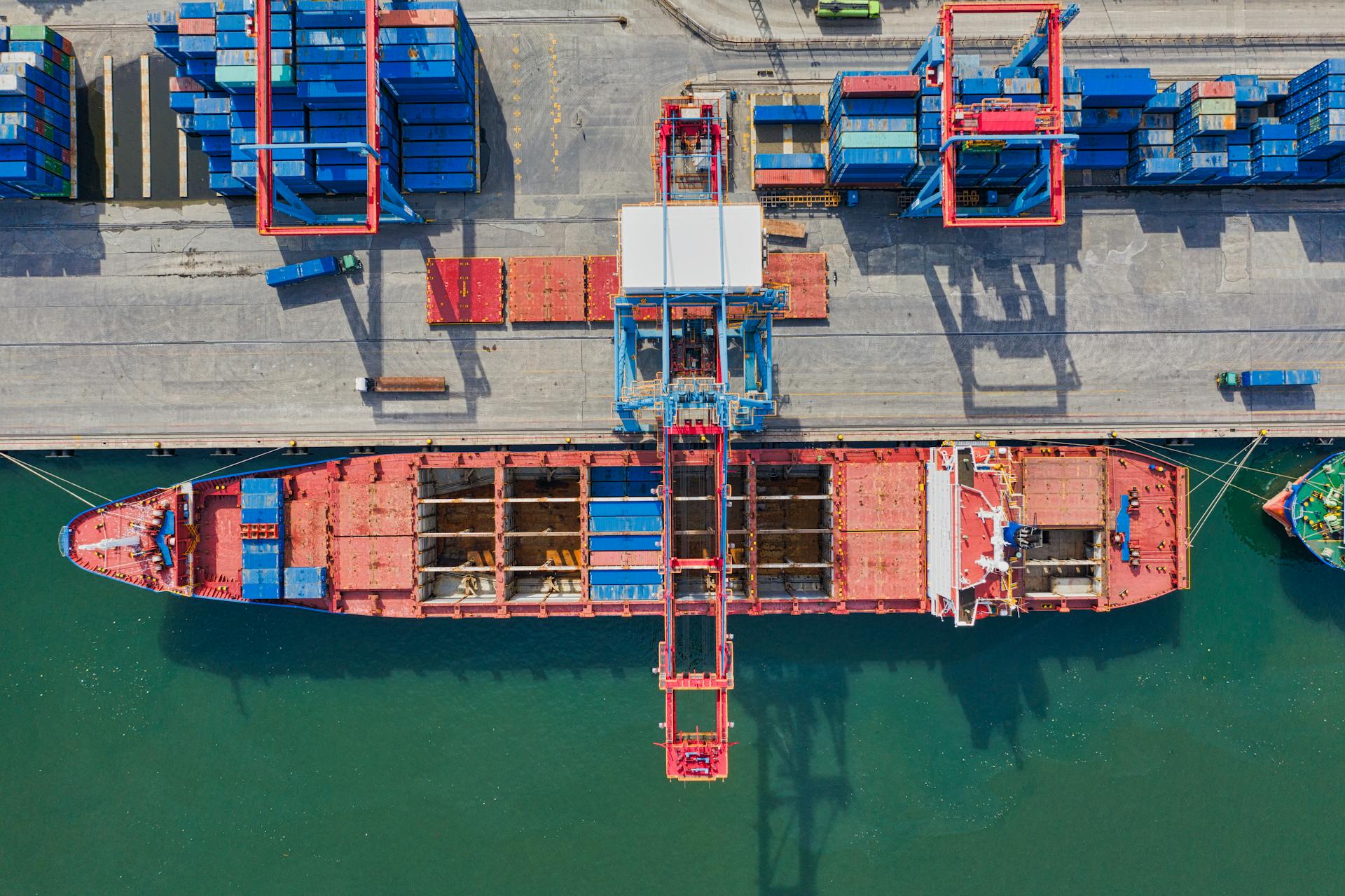

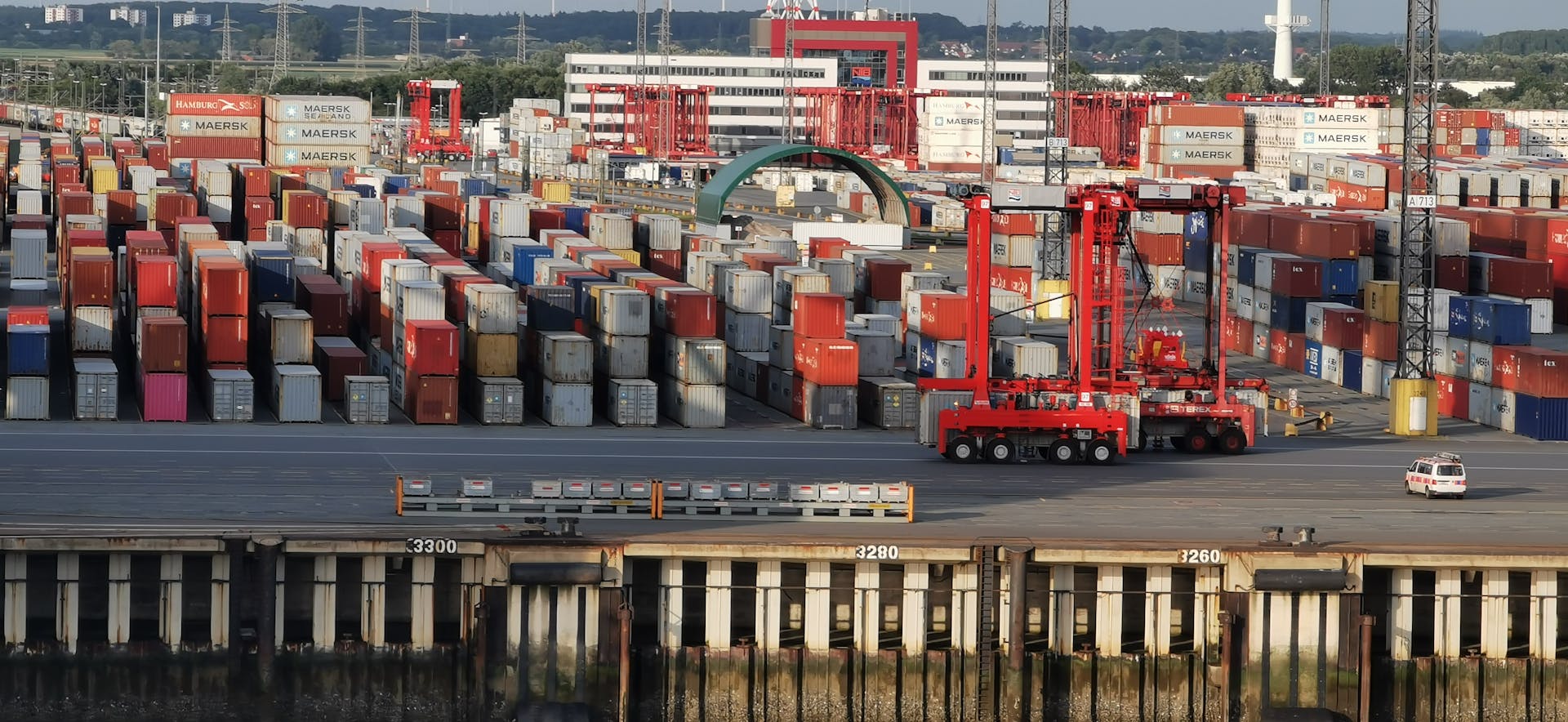

Industry and Insurance

The Logistics industry is in a period of rapid change, driven by client demands, digital technology, and intense global competition.

Client demands are dictating how Logistics and Transportation companies engage with clients, requiring a more convenient and cost-effective approach.

Thousands of Freight Forwarders, Third Party Logistics Providers, Common Carriers, and Load Brokers rely on CargoCover for their customer's cargo insurance needs.

CargoCover is the industry's leading online cargo insurance platform, offering secure and real-time insurance certificates from anywhere in the world.

The Marsh Specialty Marine, Logistics and Transportation Specialty Group has the necessary resources and industry-specific expertise to help organizations manage their risk.

This expertise is provided by Marsh, the world's leading risk and insurance services firm with a long history of providing transportation insurance and risk management consulting services to the logistics industry.

Choosing an Insurance Provider

When selecting a cargo cover insurance provider, it's essential to consider their experience and knowledge of the shipping industry.

Look for a provider with a good track record of handling claims efficiently, such as Allianz, which has a 95% claims acceptance rate.

Research the provider's financial stability to ensure they can meet their obligations, as seen in the case of Chubb, which has a strong A- rating from A.M. Best.

Check if the provider offers a wide range of coverage options to suit your specific needs, such as cargo insurance for high-value items or specialized equipment.

Consider the provider's reputation for customer service, as evidenced by the positive reviews of AXA, which has a customer satisfaction rating of 92%.

Risk and Policy

The specific coverage of ocean cargo insurance can vary depending on the policy, but typically includes protection for loss or damage due to theft, accidents, and weather events.

All-risk coverage provides the broadest protection for your cargo, covering any loss or damage except for specific exclusions listed in the policy. This type of coverage is ideal for high-value cargo or shipping to areas with higher risks.

Named perils coverage provides protection against specific risks listed in the policy, such as theft, fire, or sinking of the vessel. This type of coverage may be a more cost-effective option for lower-value cargo or shipping to areas with lower risks.

Total loss coverage will protect against total loss of your cargo due to a covered event, such as the sinking of the vessel. This type of coverage is best for cargo with a high value and a desire for protection against total loss due to a specific risk.

Exceptions and Restrictions

Exceptions and restrictions are an essential part of motor truck cargo insurance, and it's crucial to understand what's not covered.

Some states may not offer motor truck cargo insurance, so it's best to check with your insurance provider for specific information about your area.

Certain vehicle types are excluded from coverage, including limousines, buses, and ice cream trucks.

Exclusions for specific cargo types include valuables like precious and semi-precious metals and stones, art, jewelry, money, or valuable papers or documents.

Restricted substances, such as marijuana, contraband, pharmaceuticals, tobacco, and alcohol, are also not covered.

Live animals are another excluded cargo type.

Mobile and modular homes are not covered under motor truck cargo insurance.

Here are some additional exclusions to be aware of:

- Cargo under another carrier's custody

- Property or goods owned by the insured

- Cargo not listed in the bill of lading

- Storage exceeding 72 hours

- Shipping containers

- Explosive or radioactive materials

- Property carried without a charge

Risk Factors

Shipping high-value items, such as electronics or luxury goods, requires ocean cargo insurance coverage to avoid the potential cost of replacing or repairing lost or damaged goods.

The cost of insurance premiums is typically much lower than the potential cost of replacing or repairing lost or damaged goods.

If you're shipping fragile or susceptible items, like heavy machinery or oversized freight, insurance coverage is a good idea, especially without the help of a specialized freight forwarder.

Shipping across a long or risky route, such as through areas known for piracy or extreme weather events, increases the likelihood of damage or theft, and insurance coverage can help mitigate these risks.

Goods that are particularly susceptible to damage or theft may require additional insurance coverage to protect against losses.

FPA:

FPA, or Free of Particular Average, is a limited coverage option that only covers specific perils listed in the policy in case of a partial loss.

It's commonly used for bulk goods and shipments with on-deck ocean bills of lading, providing reduced protection for common partial losses like pilferage, breakage, and rough handling.

Here are some key differences between All Risk and FPA coverage:

As you can see, FPA coverage has some significant limitations compared to All Risk coverage, so it's essential to carefully consider your options when choosing a policy.

Ocean Policies

Ocean cargo insurance policies vary, but typically cover loss or damage due to theft, accidents, and weather events.

There are three main types of ocean cargo insurance policies: all-risk coverage, named perils coverage, and total loss coverage.

All-risk coverage provides the broadest protection, covering any loss or damage except for specific exclusions listed in the policy.

Named perils coverage provides protection against specific risks listed in the policy, such as theft, fire, or sinking of the vessel.

Total loss coverage protects against total loss of your cargo due to a covered event, such as the sinking of the vessel.

Not all ocean cargo insurance coverage is created equal, so it's essential to carefully review the terms and conditions of any policy you're considering.

Your policy can also cover the entire journey, door to door, including damage that occurs on a truck moving to or from the port.

Frequently Asked Questions

What is not covered in cargo insurance?

Cargo insurance typically excludes losses caused by intentional misconduct, wear and tear, and certain types of leakage or loss. This means you may not be covered for damages resulting from these common issues.

Sources

- https://www.roanokegroup.com/faqs/whats-covered-and-excluded-in-a-cargo-insurance-policy/

- https://www.icetransport.com/blog/do-you-need-ocean-cargo-insurance-coverage

- https://gallaghertransport.com/customs-broker/cargo-insurance/

- https://www.cargocover.com/en/about-us/cargocover-overview.html

- https://www.geico.com/commercial-auto-insurance/truck-insurance/cargo-insurance/

Featured Images: pexels.com