Cargo insurance is a vital protection for businesses that ship goods. It helps cover financial losses in case of damage, theft, or loss during transit.

There are several types of cargo insurance to choose from, including all-risk, named-peril, and open-peril policies. All-risk policies cover a wide range of risks, while named-peril policies only cover specific risks listed in the policy.

Named-peril policies are often more affordable than all-risk policies but offer less comprehensive coverage. For example, if a policy only covers loss or damage due to fire, theft, or collision, it won't cover losses due to other causes like natural disasters or equipment failure.

Businesses can also opt for open-peril policies, which cover all risks except those specifically excluded in the policy. This type of policy provides the most comprehensive coverage but can be more expensive.

Take a look at this: Comprehensive Renters Insurance

Types of Cargo Insurance

There are several types of cargo insurance, each offering varying levels of protection. All Risk Coverage is one of the most common types, providing comprehensive coverage for a wide range of risks.

Total Loss Only coverage, on the other hand, only pays out if the entire shipment is lost or damaged beyond repair.

Named/Specific Perils coverage is another option, which only covers losses caused by specific perils such as fire, theft, or water damage.

Contingent insurance policies offer coverage when the primary policy doesn't respond or is not in place, acting as a safety net in situations where coverage gaps might occur.

International shipping, unreliable carriers, high-risk cargo, and complex supply chains are situations where contingent coverage could be an ideal choice.

Here are the four most common cargo insurance policies:

Motor truck cargo insurance is another type of coverage, which helps protect goods being transported by for-hire truckers, covering losses due to collisions, fires, stolen cargo, or accidents that harm the cargo.

Motor truck cargo insurance with refrigeration breakdown is a specialized type of coverage that helps cover losses to items caused by spoilage or change in temperature due to sudden and accidental breakdown of refrigeration or heating units on the covered auto.

A fresh viewpoint: Copay Due at Time of Service Sign

Coverage Options

There are four main types of cargo insurance policies: All Risk Coverage, Total Loss Only, Named/Specific Perils, and Contingent. Each offers a different level of protection.

All Risk Coverage provides the most comprehensive protection, covering losses due to a wide range of risks. This type of coverage is ideal for high-value or sensitive cargo.

Total Loss Only coverage, on the other hand, only pays out if the entire shipment is lost. This type of coverage is often less expensive, but it may not provide the level of protection you need.

Named/Specific Perils coverage covers losses due to specific risks, such as theft or fire. This type of coverage is often used for cargo that is particularly vulnerable to certain risks.

Contingent coverage is typically used in conjunction with other types of coverage, such as motor truck cargo insurance.

Here are the four main types of cargo insurance policies:

- All Risk Coverage

- Total Loss Only

- Named/Specific Perils

- Contingent

Insurance Policies

Insurance Policies play a crucial role in protecting your cargo from unforeseen events.

All-risk cargo insurance policies cover a wide range of risks, including damage, theft, and loss, making them a popular choice for many shippers.

This type of policy is often more expensive than others, but provides comprehensive protection for your cargo.

For example, a shipper who transports valuable electronics may opt for an all-risk policy to safeguard against damage or loss during transit.

Other types of insurance policies, such as named-perils policies, cover specific risks, such as fire, storm, or collision, but may not provide the same level of protection as an all-risk policy.

Named-perils policies can be a more cost-effective option for shippers who only transport cargo that is susceptible to a few specific risks.

A different take: Proof of Loss Form for Insurance Claim

Total Loss Only Policies

Total Loss Only policies are a type of cargo insurance that protects you from situations where you might lose the entire shipment, but not from minor damages. This policy type is often more cost-effective than other forms of cargo insurance.

Additional reading: What Type of Business Insurance Do I Need

If your cargo is of relatively low value, a Total Loss Only policy might be the right choice. This is because covering the total loss would be more sensible than insuring against minor damages.

Some goods are hardy and unlikely to suffer from minor damage during transit, making them good candidates for a Total Loss Only policy. These include metal parts, certain machinery, or raw materials.

If your budget is tight, a Total Loss Only policy offers a balance between cost and coverage. It ensures you won't face a catastrophic loss, even if it doesn't cover every issue.

If your cargo travels along well-established, safe routes, this coverage might be all you need. Risks of total loss are significantly lower when your cargo isn't traveling through high-risk areas or extreme weather conditions.

Here are some situations where a Total Loss Only policy is a good choice:

- Low-Value Goods

- Resilient Commodities

- Budget Constraints

- Low-Risk Routes

Contingent Policies

Contingent Policies provide coverage when the primary policy isn't in place, acting as a safety net for situations where coverage gaps might occur.

International shipping can be a high-risk venture, especially when dealing with varying laws and regulations from one country to another. A contingent policy can offer extra protection in these situations.

For businesses involved in global shipping, contingent coverage can be a valuable addition to their insurance portfolio. It's not a one-size-fits-all solution, but rather a specialized policy designed for higher-risk or complex shipments.

If you're dealing with new or unreliable carriers, a contingent policy can safeguard you against unforeseen losses. This is especially important if you're unsure about the adequacy of their insurance coverage.

Unreliable carriers can be a major concern, and having a contingent policy can give you peace of mind. It's a way to ensure that you're protected, even if the primary policy doesn't respond.

Here are some situations where contingent coverage might be an ideal choice:

- International Shipping

- Unreliable Carriers

- High-Risk Cargo

- Complex Supply Chains

Calculating Insured Value

Calculating the insured value of a shipment is a crucial step in getting the right insurance coverage. To estimate the insured value, you can simply add the invoice value of the shipment to the cost of freight.

Adding an extra ten percent to account for any additional costs is a common practice. This ensures that you're covered for any unforeseen expenses that might arise during transit.

The exact method for determining valuation should be clearly stated in your insurance policy. Make sure to review your policy carefully to understand how the insured value is calculated.

Shipping and Transportation

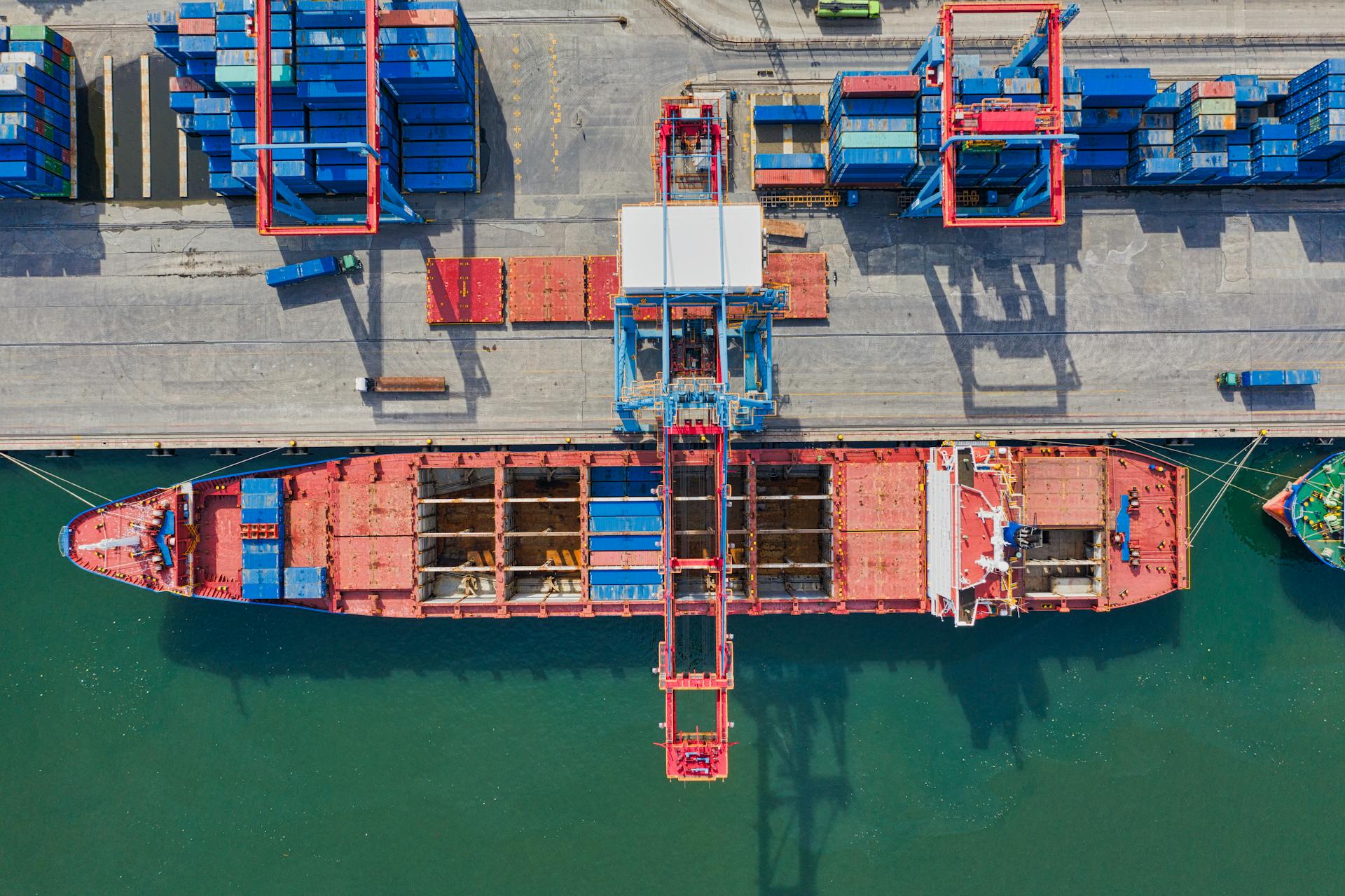

Shipping and transportation play a crucial role in cargo insurance, with different modes of transportation posing unique risks.

The three standard methods of cargo transportation are air, ocean/marine, and truck and trailer. Your choice of transportation mode will significantly impact the type of insurance you should choose.

To ensure adequate coverage, consider the perils associated with each mode: air cargo is susceptible to risks like extreme weather conditions and mechanical failures, while ocean/marine cargo faces risks like rough sea conditions and port congestion.

Here are the three main levels of cover within cargo insurance:

- Basic Cover: Minimal protection against major disasters like accidents and natural disasters.

- Broad Cover: Expands on basic to include theft, non-delivery, and more.

- All-Risk Cover: The highest level of protection, covering all risks unless specifically excluded.

Whether shipping by air, land, or sea, it's essential to choose the right type of cargo insurance to protect your goods against various risks and perils.

Mode of Transportation

Choosing the right mode of transportation for your shipment is a crucial decision that can impact the type of insurance you need. The three standard methods of cargo transportation are air, ocean/marine, and truck and trailer.

Each mode of transportation has its unique characteristics and risks. For example, air transportation is often faster but more expensive, while ocean/marine transportation is more cost-effective but slower and more susceptible to weather-related risks.

Here's a breakdown of the three standard methods of cargo transportation:

The choice of transportation mode will have a significant impact on the type of insurance you need. For instance, if you're shipping goods by sea, container shipping insurance is a must to protect against marine-specific risks.

Land

When shipping goods, land transportation is a common option. It's a cost-effective way to move items over short to medium distances.

Land cargo insurance is available to protect your goods from theft, collision damage, fires, and more. This type of insurance is only applicable when shipping within a country, so international moves are often exempt.

Shipping via utility truck, semi, or train can be a convenient option for moving heavy or bulky items.

Explore further: How to Value Items for Insurance Claim

Frequently Asked Questions

How much is $100,000 in cargo insurance?

Annual cargo insurance for $100,000 in coverage typically costs between $400 and $1,200. Learn more about cargo insurance rates and how to get a quote.

Sources

- https://freightinsurancecoverage.com/process/types-of-cargo-insurance/

- https://www.freightos.com/freight-resources/freight-insurance/

- https://www.investopedia.com/terms/a/air-cargo-insurance.asp

- https://www.ecabrella.com/blog-posts/types-of-cargo-insurance

- https://www.geico.com/commercial-auto-insurance/truck-insurance/cargo-insurance/

Featured Images: pexels.com