Chip credit cards are a type of payment card that uses a microchip to secure transactions, replacing the traditional magnetic stripe.

These cards are designed to be more secure than their magnetic stripe counterparts, as the chip creates a unique code for each transaction, making it harder for thieves to steal your information.

The chip credit card technology was first introduced in the 1990s and has since become the standard in many countries.

The use of chip credit cards has significantly reduced credit card fraud, with some countries reporting a decrease of up to 80% in card-present fraud.

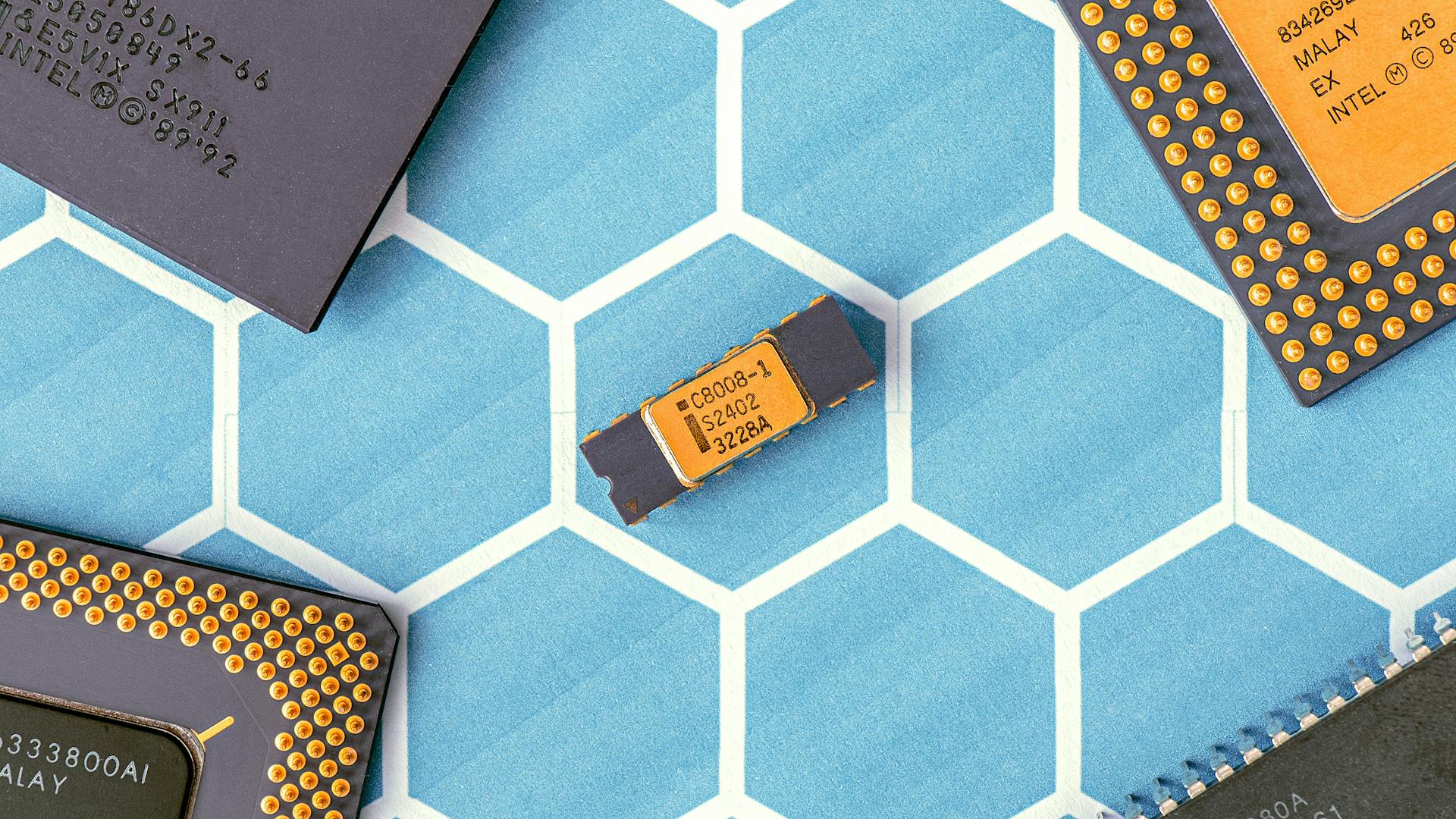

History of Chip Credit Cards

The history of chip credit cards is a fascinating story that spans several decades. Until the introduction of chip & PIN, all face-to-face credit or debit card transactions involved the use of a magnetic stripe or mechanical imprint to read and record account data, and a signature for purposes of identity verification.

The use of signatures as a verification method had several security flaws, including the relative ease with which cards may go missing before their legitimate owners can sign them. The invention of the silicon-integrated circuit chip in 1959 led to the idea of incorporating it onto a plastic smart card in the late 1960s by two German engineers, Helmut Gröttrup and Jürgen Dethloff.

The first standard for smart payment cards was the Carte Bancaire B0M4 from Bull-CP8 deployed in France in 1986. This was followed by the B4B0' standard deployed in 1989, which was compatible with the M4 standard.

The EMV standard was designed to allow cards and terminals to be backwardly compatible with these standards. EMV stands for Europay, Mastercard, and Visa, the three companies that created the standard.

The EMV standard is now managed by EMVCo, a consortium with control split equally among Visa, Mastercard, JCB, American Express, China UnionPay, and Discover. JCB joined the consortium in February 2009, China UnionPay in May 2013, and Discover in September 2013.

The top vendors of EMV cards and chips are: ABnote (American Bank Corp), CPI Card Group, IDEMIA (from the merger of Oberthur Technologies and Safran Identity & Security (Morpho) in 2017), Gemalto (acquired by the Thales Group in 2019), Giesecke & Devrient and Versatile Card Technology.

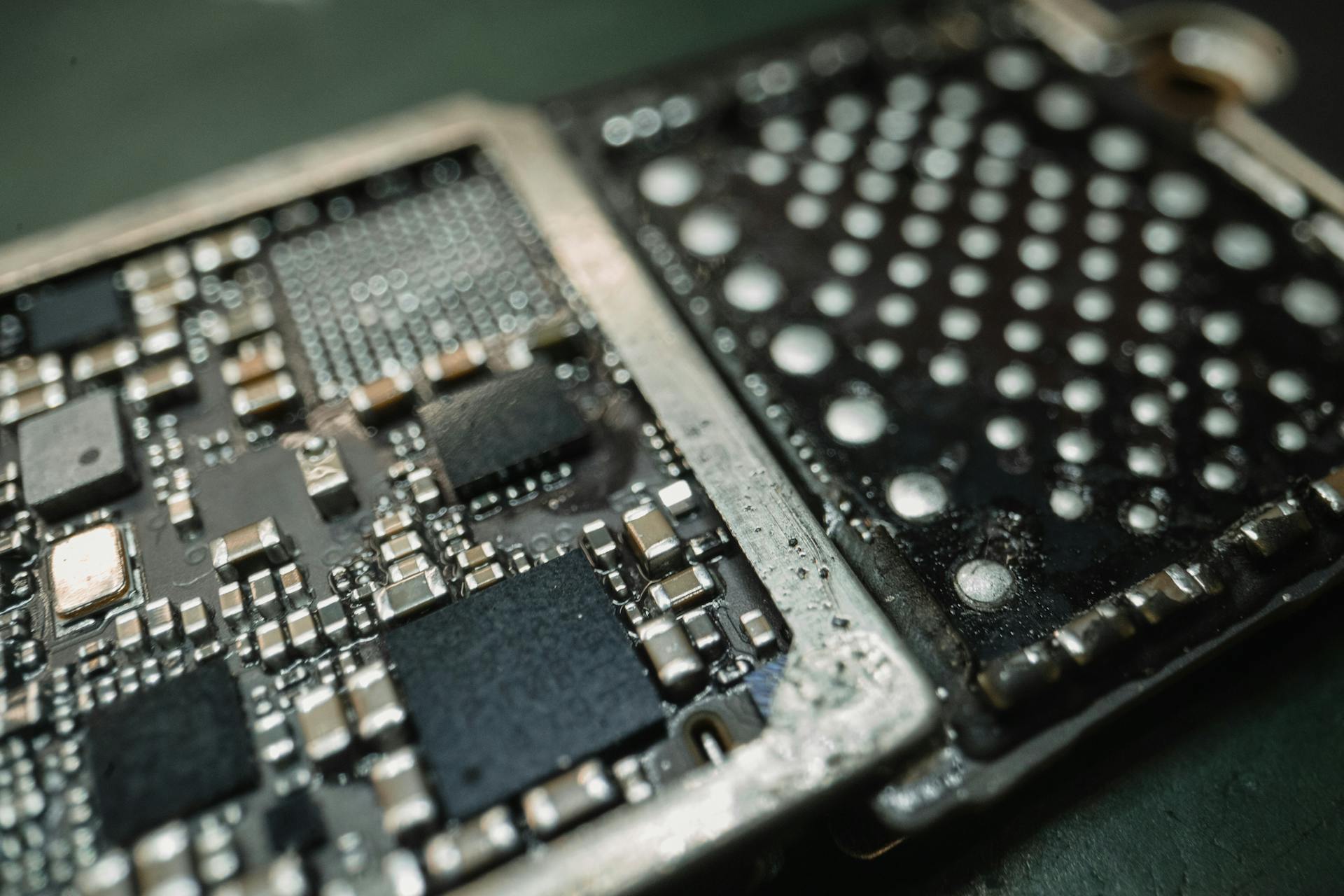

How Chip Credit Cards Work

Chip credit cards are a type of payment card that uses a small metallic chip on the front to hold your payment data. This chip is designed to reduce fraud by providing a unique code for each purchase.

The chip card technology was first introduced in Europe in 1993 and is still more popular there than in the U.S. Today, all U.S. merchants are mandated to accept EMV cards or face potential liability for any credit card fraud originating at their establishment.

To make a payment with a chip card, you'll need a payment acceptance device that's certified with PIN and chip standards. This device will exchange information with the chip card to authenticate the transaction and either approve or decline it.

The chip card generates a unique code called an ARQC (Authorization Request Cryptogram) for each transaction. This code is a digital signature of the transaction details and provides a strong cryptographic check that the card is genuine.

Here's a simplified overview of the chip card authorization process:

Benefits and Security

Chip credit cards offer an added layer of security with chip-enabled terminals, making purchases more difficult to skim. This encryption security is in addition to the fraud prevention monitoring offered by card providers.

Purchases made with chip credit cards often have coverage for fraudulent usage, limiting a customer's liability in the event of theft. Embedded chips help merchants avoid card-present fraud, but other lines of protection must come from other methods to prevent card-not-present-fraud.

The chip makes transactions more secure by encrypting information when used at a chip-enabled terminal. The chip is limited to supporting authentication of card data during purchases, and is not yet a locator system, so you can't find your card using a locator service if you lose it.

Here are some key benefits of chip credit cards:

- Additional layer of security with chip-enabled terminals

- Coverage for fraudulent usage, limiting customer liability

- Embedded chips help merchants avoid card-present fraud

What Is a Pin?

A credit card PIN is a four-digit code you can use to verify you are the person making a purchase with your chip and PIN credit card.

You can pick your own PIN when you sign up for a chip and PIN credit card, and you can also change your PIN at any time. This adds an extra layer of security to your transactions.

Your unique PIN should be known by nobody but you, making it even less susceptible to fraud. Hackers and thieves will have a more difficult time guessing a four-digit code.

Note that your chip credit card might not automatically come with a PIN, so be sure to check with your issuer if you're unsure.

Best with Security

EMV chip cards are designed to provide an additional layer of security when used at a chip-enabled terminal, making purchases more difficult to skim.

The chip encrypts information during transactions, adding an extra layer of protection against fraud. This encryption security is in addition to the fraud prevention monitoring already offered by card providers.

In the event of theft, purchases are usually covered for fraudulent usage, limiting a customer's liability. Embedded chips help merchants avoid card-present fraud, but other lines of protection must come from other methods to prevent card-not-present-fraud.

Chip cards are not a locator system, so if you lose your card, you'll have to request a replacement from your provider. The chip is limited to supporting authentication of card data during purchases, making it easily replaceable in the event of loss or damage.

Banks monitor chip card activity by location, purchase amount, and merchant, detecting deceptive activity and attempting to contact the customer. If fraudulent charges are verified, the bank will issue a credit to the chip-card account.

Here are some benefits of chip card technology:

- Additional layer of security against skimming

- Encryption security in addition to fraud prevention monitoring

- Coverage for fraudulent usage in most cases, limiting customer liability

- Embedded chips help merchants avoid card-present fraud

- Replacement cards are easily obtainable in the event of loss or damage

Chip and PIN credit cards are significantly safer to use than magnetic stripe cards, thanks to the unique, encrypted code generated each time you initiate a transaction. This code keeps your actual credit card number concealed, making any data derived from thieves during a transaction useless.

Certificates

Certificates play a crucial role in verifying the authenticity of payment cards. EMV certificates are used for this purpose, issued by the EMV Certificate Authority to payment card issuers.

The EMV Certificate Authority issues digital certificates to payment card issuers. The digital certificates contain the card issuer's public key.

The payment card chip provides the card issuer's public key certificate and Secure Signature Application Data (SSAD) to the terminal. The terminal retrieves the Certificate Authority's public key from local storage.

The terminal uses the card issuer's public key to verify the card's SSAD was signed by the card issuer.

Types and Examples

Chip credit cards come in two main types: EMV and contactless.

EMV chips store more data than traditional magnetic stripes, allowing for greater security. They use a cryptogram to verify transactions, making them harder to counterfeit.

Some chip credit cards also offer contactless payments, which use near-field communication (NFC) technology to enable transactions with a tap of the card.

Citi Double Cash

The Citi Double Cash card is a great option for those who want to earn cash back on every purchase. This card offers 2% cash back on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases.

To earn cash back, you must pay at least the minimum due on time. If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

The Citi Double Cash card also offers a $200 cash back bonus after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou points, which can be redeemed for $200 cash back.

Here are the details of the Citi Double Cash card's cash back offer:

- Earn 2% on every purchase

- Unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases

- $200 cash back bonus after spending $1,500 in the first 6 months

Bank of America Premium Rewards Credit Card

The Bank of America Premium Rewards Credit Card is a great option for those who want to earn rewards and enjoy travel perks. It charges a $95 annual fee, but the benefits you receive can make it a good investment.

You can earn 60,000 online bonus points, worth $600, when you spend $4,000 on your card within the first 90 days of account opening. This is a significant bonus that can help you get started with your rewards.

Additional benefits include up to a $100 airline incidental credit each year, up to $100 in Global Entry or TSA Precheck credits every four years, and no foreign transaction fees. These perks can save you money and make your travels more convenient.

To request a PIN for this card, you can log in to your Bank of America online account, use the Mobile Banking app, or call the customer service phone number.

Versions

The EMV standard has a rich history, with the first version, EMV 2.0, appearing in 1995.

EMV 3.0 was introduced in 1996 and is sometimes referred to as EMV '96, marking a significant upgrade to the original standard.

Later amendments led to EMV 3.1.1 in 1998, which built upon the improvements made in the previous version.

In December 2000, EMV 4.0 was released, also known as EMV 2000, and it became effective in June 2004.

Version 4.1 became effective in June 2007, and it's worth noting that each new version brought important updates and enhancements to the standard.

Version 4.2 took effect in June 2008, and it's interesting to see how the standard continued to evolve over the years.

Finally, Version 4.3 became effective in November 2011, marking another significant milestone in the EMV standard's development.

Transaction Process

The transaction process with a chip credit card is quite fascinating. An EMV transaction has several steps, including application selection, initiate application processing, and online transaction authorization.

The process begins with application selection, where the terminal sends a command to the card and receives a list of functions to perform in processing the transaction. The card provides the application interchange profile (AIP) and application file locator (AFL) to the terminal.

During initiate application processing, the terminal sends the get processing options command to the card, which responds with the AIP and AFL. This step is crucial in determining the functions to be performed in processing the transaction.

In the case of online transaction authorization, the card generates an authorization request cryptogram (ARQC), which is a digital signature of the transaction details. This ARQC is sent to the issuer for verification.

Here are the steps involved in an EMV transaction:

- Application selection

- Initiate application processing

- Read application data

- Processing restrictions

- Offline data authentication

- Certificates

- Cardholder verification

- Terminal risk management

- Terminal action analysis

- First card action analysis

- Online transaction authorization (only carried out if required by the result of the previous steps; mandatory in ATMs)

- Second card action analysis

- Issuer script processing

Contactless transactions, which involve chip cards, have become increasingly popular due to their efficiency and need for a contactless way to complete payments.

Application and Processing

The application and processing of chip credit cards involves several key steps.

The terminal sends a command to the card to initiate application processing, supplying any requested data elements in the process. This command is known as the "get processing options" command.

The card responds with an application interchange profile (AIP), which is a list of functions to perform in processing the transaction. It also provides the application file locator (AFL), which contains the files and records that the terminal needs to read from the card.

The terminal then checks the card's processing restrictions, which include the application version number, application usage control, and application effective/expiration dates. If any of these checks fail, the terminal sets the appropriate bit in the terminal verification results (TVR), which affects the accept/decline decision later in the transaction flow.

Here are the steps involved in the transaction flow of an EMV transaction:

- Application selection

- Initiate application processing

- Read application data

- Processing restrictions

- Offline data authentication

- Certificates

- Cardholder verification

- Terminal risk management

- Terminal action analysis

- First card action analysis

- Online transaction authorization (only carried out if required)

- Second card action analysis

- Issuer script processing

Online, Phone, and Mail Transactions

Online, phone, and mail transactions have become a significant concern in the credit card industry. At least 50% of all credit card fraud is attributed to card-not-present (CNP) transactions, which include online, phone, and mail order transactions.

To address this issue, alternative security measures have been devised. Software approaches such as Verified by Visa and Mastercard SecureCode are being implemented to provide an extra layer of security for online transactions.

Creating a one-time virtual card linked to a physical card with a given maximum amount is another approach. This method allows for a limited amount of spending, reducing the potential for large-scale fraudulent activity.

Additional hardware, like keypads and screens, can produce one-time passwords for added security. These devices can be integrated into complex cards or used as standalone units.

The Emue card, a pilot project by Visa, generates a one-time number that replaces the code printed on the back of standard cards.

Application Selection

Application selection is a crucial process in the world of EMV cards. An application identifier (AID) is used to address an application in the card or Host Card Emulation (HCE) if delivered without a card.

An AID consists of a registered application provider identifier (RID) of five bytes, which is issued by the ISO/IEC 7816-5 registration authority. This is followed by a proprietary application identifier extension (PIX), which enables the application provider to differentiate among the different applications offered.

The AID is printed on all EMV cardholder receipts. Card issuers can alter the application name from the name of the card network.

Here's a breakdown of the RID, Product, PIX, and AID for some common card schemes:

As you can see, each card scheme has its own unique RID, Product, and AID. This is why application selection is so important in the world of EMV cards. It allows card issuers to differentiate their applications and provide a unique experience for their customers.

Initiate Application Processing

Initiating application processing is a crucial step in the EMV transaction flow. The terminal sends the get processing options command to the card, which includes any data elements requested by the card.

The card responds with the application interchange profile (AIP), a list of functions to perform in processing the transaction. The AIP is a critical component of the application processing stage.

The card also provides the application file locator (AFL), a list of files and records that the terminal needs to read from the card. This information is essential for the terminal to access the necessary data for the transaction.

The AFL is a list of files and records that the terminal needs to read from the card, which includes:

- Files

- Records

This information is used to determine the specific application to be used for the transaction. The application interchange profile (AIP) specifies the functions to be performed in processing the transaction.

The AIP is a list of functions to perform in processing the transaction, which includes:

- Reading data from the card

- Authenticating the card

- Verifying the cardholder

- Processing the transaction

The AIP is a critical component of the application processing stage, as it determines the specific functions to be performed in processing the transaction.

Read Application Data

Reading application data is a crucial step in the EMV transaction process. This involves retrieving data from the files stored on the smart card.

Smart cards store data in files, and the Application File Locator (AFL) contains the files that contain EMV data. To read this data, the read record command must be used. EMV doesn't specify which files data is stored in, so all files must be read.

Data in these files is stored in BERTLV (Basic Encoding Rules, Tag-Length-Value) format. This is a standard format for storing data in EMV cards.

Here's a list of the EMV commands used for reading application data:

- read record (7816-4)

Evaluate Payment Costs

Payment costs can be a significant expense for businesses, especially if you're not aware of the fees associated with processing transactions. Most payment processors charge an average of 2.4% of the transaction value.

To get a clear picture of the costs, you'll need to explore the pricing models and fee structures of different processors. This will help you understand how much you'll be charged for each transaction type.

Some processors apply a small fee based on the industry, processing volume, average ticket size, and processing history. This can vary greatly depending on the processor and your business's specific needs.

It's essential to compare quotes from different processors to find the best option for your business. Be sure to review the contract carefully, looking for binding language, automatic-renewal clauses, early-termination fees, and any hidden charges.

Frequently Asked Questions

Are all credit cards chip cards now?

No, not all credit cards are chip cards yet, but over 70% of issued cards worldwide use EMV chip technology. While chip card technology is widely adopted, there are still some cards without chips, and we can help you understand the benefits and differences.

Which is safer tap or chip?

Tap payments are generally safer than chip payments because the card itself doesn't touch the terminal, reducing the risk of physical tampering

How do I know if my credit card has a chip?

Your credit card likely has a chip if it displays the NFC logo prominently on the front, which resembles WiFi turned on its side. This logo indicates that the card supports Near Field Communication technology.

Is the chip on a credit card read by a PIN reader?

No, the chip on a credit card is not read by a PIN reader. Instead, the chip is read by the POS terminal, which then prompts the cardholder to enter their PIN for authorization.

Featured Images: pexels.com