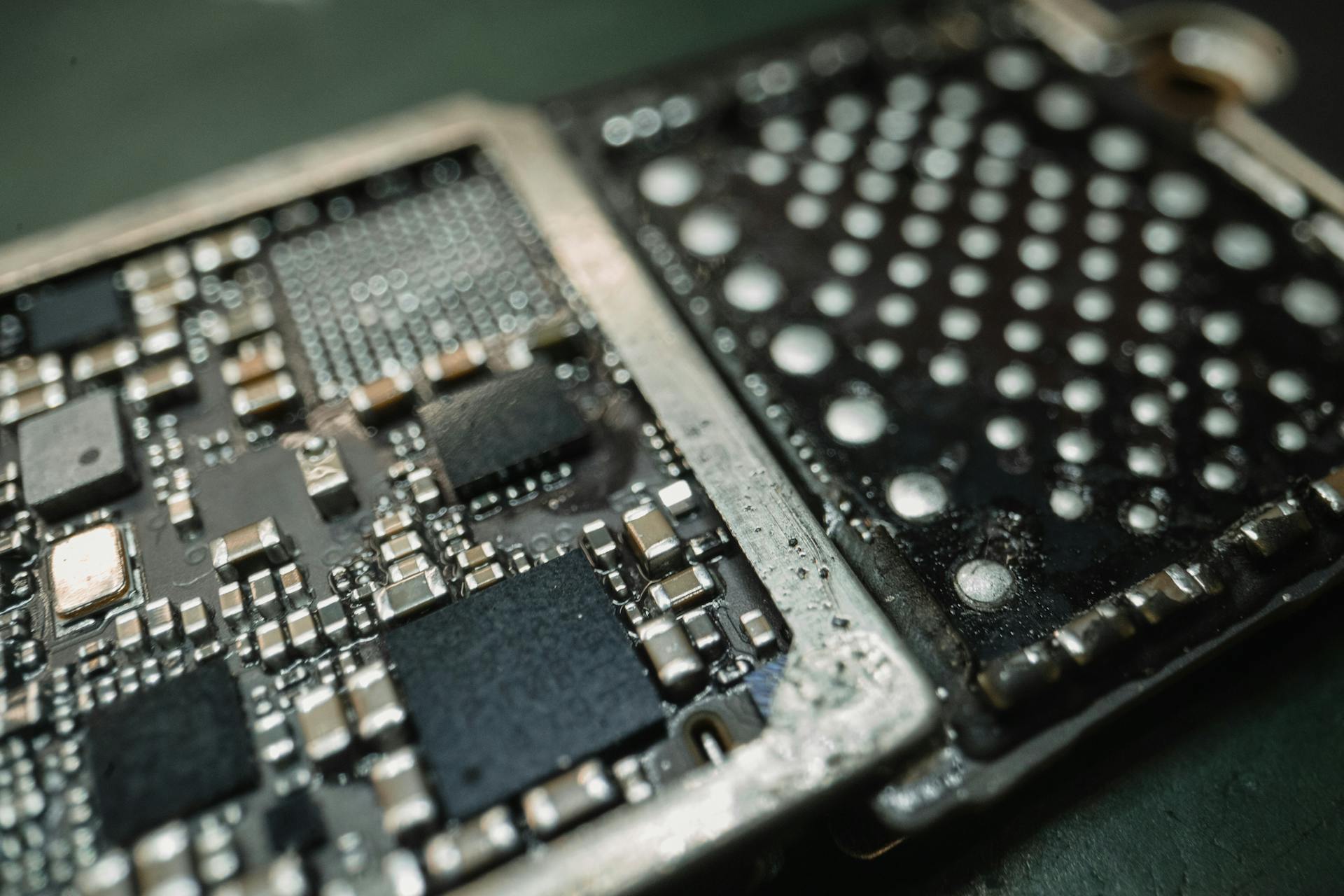

Chip readers in credit cards have revolutionized the way we make transactions, offering convenience and security like never before.

Chip readers, also known as EMV readers, use a small chip in the credit card to authenticate the transaction, making it more secure than traditional magnetic stripe cards.

This increased security comes at the cost of a slightly slower transaction time, but it's a small price to pay for the added protection against card skimming and identity theft.

As a result, chip readers have become the norm in many countries, with over 80% of transactions now using chip technology.

A different take: Secured Credit Card Bad Credit with No Security Deposit

What Is Contactless?

It’s up to 10 times faster than swiping, inserting or using cash. Plus, it keeps your info secure and your hands off the card reader.

Many credit cards and debit cards now feature contactless technology, making payments more convenient.

What Is Contactless?

Contactless cards work a lot like mobile wallets, where the transaction is completed by holding or tapping the card on a contactless-enabled card reader.

It's up to 10 times faster than swiping, inserting, or using cash, which can be a big time-saver. Many of Capital One's U.S.-issued credit cards and debit cards now feature contactless technology.

You can also make payments by tapping your smartphone, smartwatch, or other connected device if your credit card is attached to a digital wallet like Apple Pay or Google Pay.

This technology keeps your info secure and your hands off the card reader, which can be a relief. Contactless payments are becoming increasingly popular and convenient.

Take a look at this: How to Make Credit Card Payments to Increase Credit Score

Convenience

Contactless payments offer a level of convenience that's hard to beat. With credit card swipers, customers can make seamless payments through their credit or debit cards, resulting in heightened satisfaction and loyalty.

The convenience of credit card readers is undeniable, especially with mobile point-of-sale (POS) systems that are uncomplicated and highly portable. This makes it easy for businesses to accept payments on-the-go.

NFC technology takes convenience to the next level, enabling businesses to adopt a cashless operational approach. Customers can simply tap their cards or devices to complete transactions swiftly, making the checkout process a breeze.

Contactless Credit Capabilities

To check whether your credit card is contactless, just look for the contactless symbol on the front or back of your card. The contactless symbol is four vertical, curved lines that get bigger from left to right—like the Wi-Fi symbol turned on its side.

EMV and NFC support are key features to consider when it comes to contactless payments. EMV technology utilizes EMV-chipped credit cards to encrypt cardholder data, while NFC support lets customers wave phones, tap Apple Watches, or use contactless cards.

The Helcim Card Reader is a hassle-free credit and debit card payment solution that includes features like Tap & Pay, Chip & PIN, PIN Debit, and Debit Tap. It's equipped with easy setup, a colored countertop stand, and quick delivery in 2-3 business days.

Worth a look: Are Credit Cards Safer than Debit Cards

Contactless Credit Capabilities

To determine if your credit card is contactless, simply look for the contactless symbol on the front or back of your card - it's four vertical, curved lines that get bigger from left to right.

The contactless symbol indicates that your card is equipped with Near Field Communication (NFC) technology, which allows for fast and secure transactions.

You can also check if your card reader supports contactless payments. Modern card readers often come with EMV and NFC support, which utilizes EMV-chipped credit cards to encrypt cardholder data and lets customers wave phones, tap Apple Watches, or use contactless cards.

The Helcim Card Reader is a great example of a card reader that supports contactless payments, with features like Tap & Pay and Debit Tap.

This reader also includes extra features like email receipts and inventory tracking, making it a convenient option for businesses.

The Helcim Card Reader connects to any device without additional equipment, making it easy to set up and use.

The Helcim Card Reader costs $99, which is a relatively affordable option compared to other card readers on the market.

The Zettle Card Reader 2 by PayPal is another popular option for contactless payments, with a transaction fee of 2.29% + $0.09 and reliable wireless connectivity.

Chip-and-signature cards provide an additional layer of security over traditional magnetic stripe cards, requiring a signature after the transaction is approved.

Broaden your view: Nfc Tap to Pay

Benefits of

Contactless credit cards have revolutionized the way we make transactions, and one of the key benefits is the added layer of security they provide.

Chip card technology is more difficult to skim than traditional magnetic stripe cards, making it harder for thieves to steal your information. This encryption security is in addition to the fraud prevention monitoring already offered by card providers.

In most cases, purchases have coverage for fraudulent usage, limiting a customer's liability in the event of theft. This means you're protected if your card is stolen or compromised.

Embedded chips help merchants avoid card-present fraud, but other lines of protection must come from other methods to prevent card-not-present-fraud.

The chip makes transactions more secure by encrypting information when used at a chip-enabled terminal. This encryption is a significant improvement over traditional magnetic stripe cards.

Here are some key benefits of chip card technology:

- Additional layer of security against skimming

- Encryption security for secure transactions

- Coverage for fraudulent usage in most cases

- Protection against card-present fraud

Banks monitor the chip card's activity by location use, the purchase amount, and the merchant charging the account. If any deceptive activity is detected, the card provider will attempt to contact the customer.

PIN

PINs are commonly used for ATM withdrawals using debit and credit cards in the United States.

In Canada and other countries, consumers are required to use their PINs regardless of how or where they use their cards - even if it's a credit card.

A customer must enter their personal identification number in order to make a purchase or withdraw money from the ATM using their credit or debit card.

This additional layer of security makes Chip-and-PIN cards the most secure option for consumers.

For another approach, see: How to Use Credit Cards

Types of Chip Readers

There are different types of chip readers available, each with its own unique features and benefits.

The Zettle Card Reader 2 by PayPal is a versatile mobile credit card reader that supports card and contactless payments.

It's worth noting that the Chipper 2X BT Device from Shopify, although no longer sold, still provides reliable wireless connectivity for tap, chip, and swipe payments.

Types of

In the United States, most chip card transactions require only a simple insertion into a terminal. This is the standard procedure for executing a transaction.

Chip cards are widely used in other countries, where consumers may need to take additional steps to complete a purchase or withdraw cash from an ATM.

To make a purchase or withdraw cash from an ATM in these countries, consumers may be required to enter their chip card into a terminal.

Swipe Simple Terminals

Swipe Simple Terminals offer two distinct hardware options: the SwipeSimple B250 and the SwipeSimple B200.

The SwipeSimple B250 is a compact all-in-one credit card reader supporting swipe, chip, and contactless transactions. It measures 2.6 inches by 2.4 inches by 0.7 inches and comes with an optional charging dock for countertop use.

This versatile reader accepts EMV, magnetic stripe, and contactless payments like Apple Pay and Google Pay, connecting securely to iOS or Android devices via Bluetooth Low Energy. It's lightweight and suitable for various mobile businesses.

The SwipeSimple B200 is a compact two-in-one card reader, approximately the size of a business card. It supports magstripe and EMV chip transactions and connects via Bluetooth.

Intriguing read: Credit One Credit Cards Review

The SwipeSimple B250 and B200 both offer a simple Bluetooth setup for quick acceptance of credit cards, including contactless payments. This makes them efficient and budget-friendly solutions.

SwipeSimple specifies per-transaction rates for lower-risk retail and restaurant businesses, including Interchange + 0.25% + $0.10 for card-present retail transactions and Interchange + 0.20% + $0.09 for restaurant transactions. Negotiation is possible to secure optimal rates.

There's also a $14.99 monthly account fee for SwipeSimple terminals.

EMV Machines

EMV machines are a must-have for any business that wants to stay ahead of the game. They support EMV technology, which encrypts cardholder data using EMV-chipped credit cards.

EMV machines are not just about security, they're also about customer convenience. Consider using NFC support, which lets customers wave their phones or tap their Apple Watches for contactless payments.

The Zettle Card Reader 2 by PayPal is a great example of an efficient EMV machine. It's a versatile and affordable mobile credit card reader that supports card and contactless payments.

With a transaction fee of 2.29% + $0.09, the Zettle Card Reader 2 is a great option for businesses of all sizes. It's also PCI-certified, which ensures secure transactions.

The Chipper 2X BT Device from Shopify is another reliable option, although it's no longer sold. However, it's still supported and provides wireless connectivity for tap, chip, and swipe payments.

Payment Acceptance Methods

As a business owner, you should want to accept the most payment methods possible. This includes various payment methods like EMV chips, magnetic stripe cards, contactless payments (NFC), and mobile wallets like Apple Pay and Google Pay.

To enhance customer convenience and ensure customer privacy, look for a card reader that supports modern security features like EMV and NFC. EMV technology encrypts cardholder data using EMV-chipped credit cards.

The Square Reader for contactless and chip (2nd generation) is a practical solution for seamless chip and contactless payments. This compact credit card reader ensures secure transactions with features like 24/7 fraud prevention and data security.

A fresh viewpoint: Singapore Qr Code Payment

To choose the right card reader, consider customer preferences and emphasize EMV readiness or embracing NFC for contactless payments. This will help you provide a seamless payment experience for your customers.

The Square Reader offers connectivity through a lightning port or 3.5 mm headphone jack, and a sleep mode for power conservation.

Frequently Asked Questions

What reads the chip on a credit card?

An EMV terminal reads the chip on a credit card when inserted, verifying the card information contained in the chip

Do all credit cards have RFID chips in them?

No, not all credit cards have RFID chips, as the technology is not yet universal among existing cards

Can credit card skimmers read a chip?

Credit card skimmers can now read chip data using a device called a card shimmer, which sits between the card's chip and the card reader. This new technique allows skimmers to access both magnetic stripe and chip card data

Sources

- https://www.capitalone.com/learn-grow/privacy-security/contactless-credit-cards/

- https://www.investopedia.com/terms/c/chip-card.asp

- https://www.emscorporate.com/news/credit-card-readers

- https://www.bankrate.com/credit-cards/advice/chip-cards-skimming-shimming/

- https://www.mycvcu.org/news/credit-card-chips-whats-the-big-deal

Featured Images: pexels.com