An echeck merchant account is a type of payment processing system that allows businesses to accept electronic check payments from customers. This payment method is also known as an ACH (Automated Clearing House) payment.

To process echecks, merchants need to have a merchant account that supports ACH transactions. This account is usually provided by a payment processor or bank.

Echeck merchant accounts are often used for recurring payments, such as subscription services or utility bills.

Curious to learn more? Check out: What Is Echeck Ach

What Is an E-Check Merchant Account

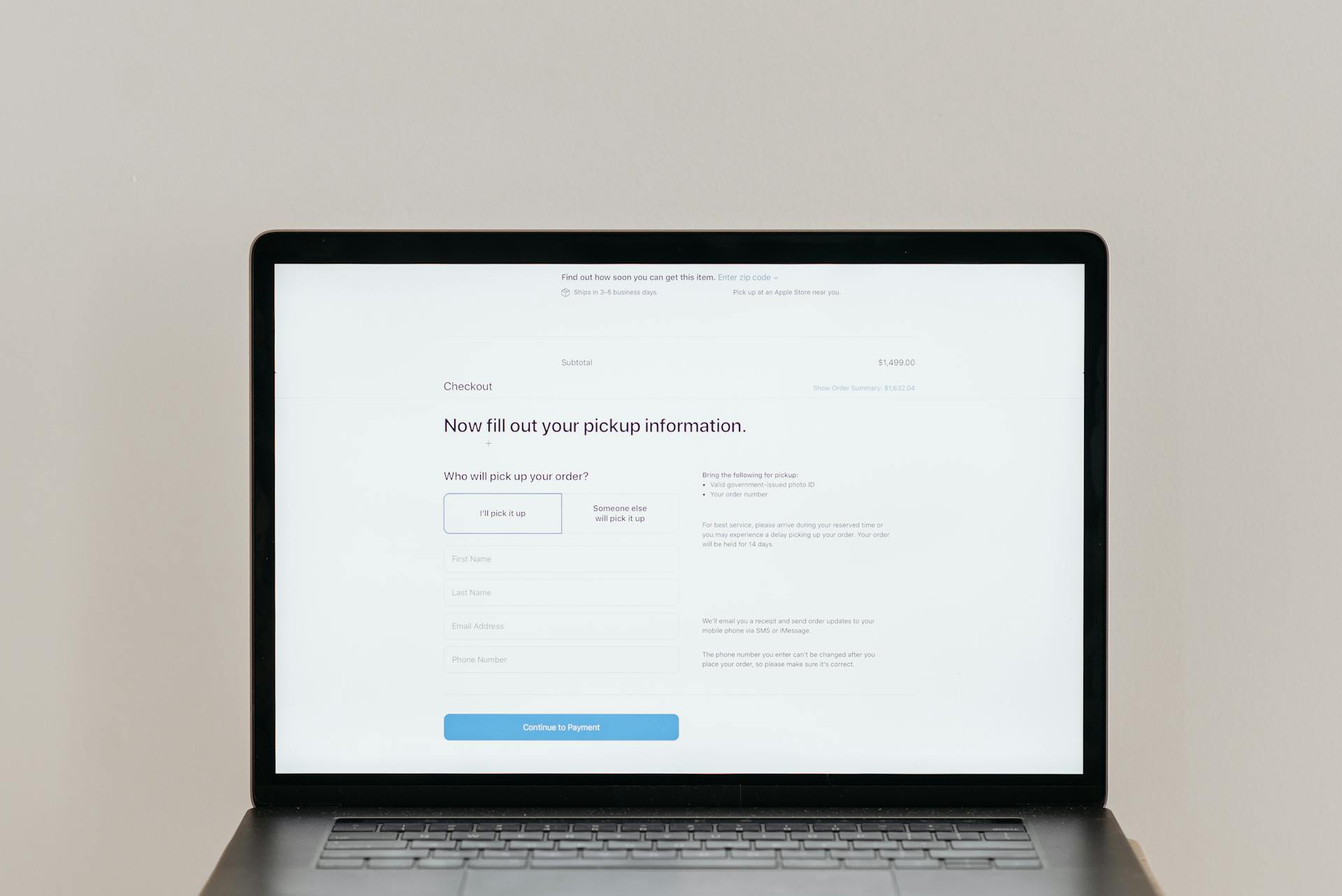

An e-check merchant account is a type of payment processing account that allows businesses to accept electronic checks from customers. This can be a game-changer for businesses that want to attract customers who don't have credit cards or are hesitant to use them online.

Some businesses that can benefit from an e-check merchant account include eCommerce businesses, nonprofits, service businesses, wholesale/B2B companies, retail stores, and mobile merchants. By offering e-checks as a payment option, these businesses can attract a wider range of customers and increase their sales.

e-checks can also help businesses reduce the hassle of dealing with paper checks, which can take longer to process and deposit. This means faster accounts receivable and less administrative work for merchants.

Intriguing read: Payment Account

What Is an

An E-Check merchant account is a type of payment processing account that allows businesses to accept electronic checks as a form of payment.

E-checks are essentially digital versions of traditional paper checks, and they work in a similar way.

E-checks are processed through the Automated Clearing House (ACH) network, which is a secure and reliable system for transferring funds electronically.

This system allows businesses to receive payments from customers in a timely and efficient manner.

The ACH network is used by millions of businesses and consumers to transfer funds every day, making it a trusted and widely accepted payment method.

E-checks are a cost-effective alternative to traditional credit card processing, with lower transaction fees and no risk of chargebacks.

Recommended read: Payment Account Meaning

What Is

An E-Check merchant account is a type of payment processing account that allows businesses to accept electronic checks, also known as e-checks, as a form of payment.

E-checks are a type of electronic payment that is similar to a traditional check, but is processed online or through a mobile device. They are essentially an electronic version of a paper check.

E-checks are a convenient and cost-effective way for customers to pay for goods and services online, and they can be used by businesses of all sizes.

E-checks are processed through the Automated Clearing House (ACH) network, which is a secure and reliable system for processing electronic payments.

E-checks typically take 2-5 business days to clear, which is faster than a traditional paper check, but slower than a credit card transaction.

Benefits and Features

The benefits of having an eCheck merchant account are numerous. By automating recurring payments, you can eliminate the need to manually collect payments, making your business more efficient.

One of the biggest advantages is that eCheck transactions are typically inexpensive, with average costs between 26 and 50 cents. This is significantly lower than the costs associated with paper check transactions, which can range from $1.01 to $2.

eChecks also save time and reduce errors. The process of receiving and depositing a paper check has multiple opportunities for human error, which can be costly and time-consuming.

Here's an interesting read: Can Someone Check My Bank Account Balance with Account Number

With an eCheck merchant account, you can offer customers the option to pay with an eCheck, which can be especially helpful for those without access to credit. This makes your business more inclusive and welcoming to a wider range of customers.

Here are some key benefits of eCheck transactions:

- Save time: eChecks are processed electronically, eliminating the need to wait for a paper check to arrive in the mail.

- Reduce errors: The process of receiving and depositing a paper check has multiple opportunities for human error.

- Low costs: eCheck transactions are typically inexpensive, with average costs between 26 and 50 cents.

- Small dispute window: The period for a customer to issue a chargeback period for an eCheck is 60 days from the purchase date.

How E-Checks Work

An eCheck transaction works by routing the payment through the Automated Clearing House (ACH) network. This infrastructure is specifically designed for electronic transactions in the U.S.

Businesses with an ACH merchant account can draw money from a customer's bank account directly, avoiding network dues and fees associated with debit and credit card networks. This makes eChecks a lower-cost option compared to other forms of payment.

eChecks are easy, convenient, fast, and secure, which is why regularly scheduled payments like rent, mortgage payments, membership fees, or loan repayments are often set up via eCheck. This ease and convenience also improve customer satisfaction.

To conduct an eCheck transaction, the merchant requests authorization for payment from the customer and then initiates the transaction on the ACH network. Funds are transferred directly from the customer's bank account to the merchant account.

Most ACH payments are settled the same business day, making the process fast and safe. This is because monies are transferred through the Automated Clearing House (ACH) Network.

eCheck operates in a specific sequence, but it's not explicitly stated in the examples.

Suggestion: Transaction Account

Transaction Process

Transactions via eCheck should be submitted with the Authorize and Capture (authCaptureTransaction) type, as no real-time validation occurs and Authorize Only submissions will simply take longer to settle and fund.

You can verify transactions as they happen, which can take weeks to show up on a statement, unlike traditional checks.

Electronic check processing is a secure, convenient, and cost-effective way to pay, making it perfect for any business, with no security scares and no postage fees.

Here's an interesting read: Zerodha Account No

Internet-Initiated Entry (Web)

Internet-Initiated Entry (Web) allows customers to charge their checking or savings account with a one-time or recurring transaction originated via the internet.

The payment authorization for Internet-Initiated Entry (Web) is obtained from the customer online, making it a secure way to process payments.

This transaction type is simple and secure, and it's a great option for businesses that want to streamline their payment processing.

By using Internet-Initiated Entry (Web), businesses can save time and money by eliminating the need for paper checks and long bank queues.

With Oak Trust's echeck processing service, businesses can take advantage of the benefits of electronic check processing, including faster payment processing and reduced costs.

Internet-Initiated Entry (Web) is a convenient option for customers, who can authorize payments online without having to visit a bank or wait for paper checks to arrive in the mail.

Required Info for Transaction

To initiate an eCheck transaction, you need to provide the following information: a nine-digit ABA routing number, bank account number, bank account type (checking, business checking, or savings), eCheck type, the name on the bank account, and the transaction amount.

A different take: Transfer Cash from Your Brokerage Account into Your Checking Account

You'll also need to obtain payment authorization from the customer, which should include a clear and conspicuous statement of the terms of the transaction, including the amount, and a written language displayed to the customer that is readily identifiable as an authorization by the customer to the transaction.

The customer's bank account address can be helpful in validating transactions flagged by the OFAC sanctions list, and it's recommended to supply as much information about the customer and their bank account as possible.

To facilitate refunds via eCheck, you'll need the valid gateway-assigned Transaction ID of the original transaction, last four digits of the routing number, last four digits of the bank account number, amount, bank account type, and eCheck type (PPD or CCD).

Here's a summary of the required information for eCheck transactions:

Obtaining proper authorization from the customer is crucial before initiating ACH debit or credit entries to the customer's account at any financial institution, as per Regulation E, NACHA regulations, and paragraph 12 of the eCheck Merchant Agreement.

Transaction Types and Fees

As an eCheck merchant account holder, it's essential to understand the various fees associated with processing eChecks. You'll be charged an eCheck Setup Fee for setting up eCheck.Net processing for your gateway account.

There are several types of fees to keep in mind, including the eCheck Chargeback Fee, which is charged for each chargeback received for a transaction processed through your account. The eCheck Returned Item Fee is also worth noting, as it's charged for each returned eCheck.Net transaction.

Here's a breakdown of the fees you can expect to pay:

Transaction Types

For eCheck transactions, you'll want to use the Authorize and Capture (authCaptureTransaction) type. This is because no real-time validation occurs, so Authorization Only submissions aren't necessary.

eCheck transactions submitted with the Authorize and Capture type will settle and fund quickly, assuming they're captured promptly.

A unique perspective: Is a Credit Account a Type of Financial Accounts

What Fees Apply?

If you're considering eCheck as a payment option, you should know about the different fees involved. There's an eCheck Setup Fee charged for setting up eCheck.Net processing.

The eCheck Chargeback Fee is a significant one, as it's charged for each chargeback received for a transaction processed through your account. This can add up quickly, so it's essential to minimize chargebacks.

You'll also be charged an eCheck Returned Item Fee for each returned eCheck.Net transaction. This fee is a reminder to ensure the funds are available before processing an eCheck.

In addition to these fees, you'll be assessed an eCheck Batch Fee for each eCheck.Net batch processed for your account. This fee is a necessary cost of doing business.

To give you a better idea of the fees involved, here's a breakdown of the different types of eCheck fees:

- eCheck Setup Fee: charged for setting up eCheck.Net processing

- eCheck Chargeback Fee: charged for each chargeback received

- eCheck Returned Item Fee: charged for each returned eCheck.Net transaction

- eCheck Batch Fee: assessed per eCheck.Net batch processed

- eCheck Minimum Monthly Fee: the minimum eCheck.Net processing service fee charged per billing cycle

- eCheck Per-Transaction Fee: charged for each eCheck.Net transaction processed

- eCheck Discount Rate: a percentage of the total amount of each eCheck.Net transaction submitted

Security and Risk Management

Our echeck payment gateway boasts a highly secure and robust authentication process and unmatched fraud detection software. This ensures the security of customer data and helps prevent security issues.

We use the online platform for echeck processing, which has built-in safety features. This approach sets us apart from other payment methods and helps stop fraud.

eChecks are more secure than paper checks because they have various security features and checkpoints that go far to ensure that every transaction is safe.

It's Secure

Security is a top priority when it comes to online transactions, and eChecks are no exception. They boast a highly secure and robust authentication process and unmatched fraud detection software, setting them apart from other payment methods.

One of the key benefits of eChecks is that they have various security features and checkpoints that ensure every transaction is safe. This is especially important for businesses that process large volumes of transactions online.

To prevent security issues and stop fraud, Oak Trust uses an online platform for echeck processing. This platform has built-in safety features that help protect customer data and prevent unauthorized transactions.

Authorization is also a crucial step in the echeck process. Merchants must obtain authorization from their customer prior to charging the customer's bank account. This involves obtaining payment authorization, authenticating the customer's identity, and providing clear and conspicuous statements of the terms of the transaction.

Here's a breakdown of the required information for authorization:

By following these steps and using a secure echeck payment gateway, merchants can ensure that their transactions are safe and secure.

Chargeback Reduction

One of the biggest advantages of using eCheck payment processing is the lower chargeback fees compared to credit card transactions.

Chargeback fees with eCheck payment processing are lower than those with credit card transactions.

This means you can save money on fees and focus on running your business.

A unique perspective: Merchant Credit Card Account

Authorization for ACH: Required Info

To initiate an ACH debit, merchants must obtain authorization from their customers in writing, either in electronic or hard copy format. This authorization must include a clear and conspicuous statement of the terms of the transaction, including the amount.

The authorization must also include the date the authorization was granted and the effective date of the transaction, ensuring that the transaction may not be processed before the effective date. Additionally, it must include the bank account number to be charged and the nine-digit ABA routing number of the customer's bank.

The authorization must be provided in written language that is readily identifiable as an authorization, and it must be signed by the customer in writing. The customer must then send the completed document to the merchant by postal mail or fax, as delivery by any other electronic means is not permitted.

To facilitate this process, merchants should obtain the following information from their customers:

- Clear and conspicuous statement of the terms of the transaction, including amount

- Date the authorization was granted and the effective date of the transaction

- Bank account number to be charged

- Nine-digit ABA routing number of the customer's bank

- Customer's identity

By following these requirements, merchants can ensure that they are in compliance with Regulation E and NACHA regulations, and that they are obtaining proper authorization from their customers before initiating ACH debit entries.

Merchant Account Options

When choosing a merchant account for echeck payments, you've got several options.

You can opt for a traditional merchant account, which typically requires a credit check and can take several days to set up.

Some echeck merchant account providers offer a virtual terminal, which allows you to process payments online or over the phone.

A virtual terminal is often required for echeck payments, as it enables you to capture payment information and verify funds in real-time.

This feature is especially useful for businesses that need to process payments remotely or have a high volume of transactions.

Every Business Needs Options

Every business needs options when it comes to payment processing. Offering electronic check processing can attract customers who don't have a credit card or are hesitant to use credit cards online.

Electronic check processing is seamless, adaptable, and secure. It's also accessible, allowing customers to make payments easily and efficiently. By accepting electronic checks, businesses can reduce the hassle of keeping track of paper checks and depositing them.

eCheck processing solutions like Payliance's eCheck processing solutions allow merchants to accept eChecks across any payment channel while minimizing processing costs. With real-time cloud reporting, businesses can track every transaction and make informed decisions.

Every business can benefit from eCheck processing options, including eCommerce businesses, nonprofits, service businesses, wholesale/B2B businesses, retail stores, and mobile merchants. These businesses can see faster accounts receivable with echeck payments and lower fees associated with electronic check processing compared to credit card processing.

Here are some examples of businesses that can benefit from eCheck processing options:

- eCommerce Business

- Nonprofits

- Service Businesses

- Wholesale / B2B

- Retail Stores

- Mobile Merchant

Cancellation of High Risk Services

Cancellation of High Risk Services can happen if your business is deemed high risk, which is determined by the eCheck service agreement.

You might enjoy: Is High Saving Account Investment Account

The eCheck service agreement stipulates that businesses deemed high risk may have their services cancelled, as per paragraph 4, section D.

This means you need to be aware of the agreement and take steps to mitigate any risks that might lead to service cancellation.

The eCheck service agreement is a crucial document that outlines the terms and conditions of your eCheck services, including what constitutes high risk.

If your business is cancelled, you may lose access to eCheck services, which can impact your ability to process payments.

You should review the eCheck service agreement carefully to understand the specific criteria for being deemed high risk.

Payment Gateway and Plans

Setting up a payment gateway and eCheck plan is a straightforward process, and we can help you get started with a monthly gateway fee of just $25.

There's no sign-up fee to worry about, so you can begin processing payments right away.

The eCheck per transaction fee is 0.75%, which is a competitive rate in the industry.

Here are the key fees associated with our payment gateway and eCheck plan:

- Monthly gateway: $25

- eCheck per transaction fee: 0.75%

- Credit card per transaction fee: 10¢ + daily batch fee 10¢

Payment with Partner

Partnering with a payment processing company can greatly simplify the process of accepting electronic checks. This is because they handle the technical aspects of eCheck processing, allowing you to focus on your business.

By partnering with a payment processing company, you can have your eChecks batched and sent as a group, streamlining the process and ensuring funds are collected and disbursed quickly.

Payment processing partners use simple to use APIs and online reporting tools to integrate eCheck payment data with your existing business systems, giving you a comprehensive overview of your financial status.

This integration also provides additional layers of security, validating bank accounts and reducing the risk of fraud.

Here are some of the benefits of partnering with a payment processing company:

- Batching and sending eChecks as a group to streamline processes and ensure funds are collected and disbursed quickly.

- Simple to use APIs and online reporting tools to integrate eCheck payment data with other business systems.

- Additional layers of security to ensure bank accounts are valid and reduce fraud.

Payment Gateway Plan

If you're looking to set up a payment gateway plan, you'll want to consider the options outlined in our payment gateway plan.

A payment gateway plan typically includes a monthly fee, which in our case is $25 per month. This fee gives you access to both credit card and eCheck processing.

Take a look at this: Merchant Account Fee

The sign-up fee is free, so you won't have to worry about any upfront costs.

There are fees associated with each transaction, with eCheck transactions costing 0.75% and credit card transactions costing 10¢ plus a daily batch fee of 10¢.

Here's a breakdown of the transaction fees:

By choosing a payment gateway plan, you can start processing credit cards and eChecks and begin accepting electronic payments from your customers.

Application and Cancellation

If your business is deemed high risk, your eCheck services may be cancelled. This can happen if your business doesn't comply with the eCheck service agreement, which outlines the terms and conditions of using eCheck services.

The eCheck service agreement is a binding contract that outlines the responsibilities of both the merchant and the eCheck service provider. Your business will be required to sign this agreement before using eCheck services.

You might enjoy: Difference between a Business Account and Personal Bank Account

Automatic Invoices

With an echeck merchant account, you can automate your invoices and save time and money. This means no more manual data entry or worrying about lost or misplaced checks.

Electronic check processing verifies transactions in real-time, unlike traditional checks which can take weeks to show up on a statement.

Automating your invoices with an echeck merchant account allows you to get paid faster, as transactions are processed quickly and efficiently.

You can also simplify your business payments by using Oak Trust's echeck processing service, which saves you time and money by eliminating the need to deposit paper checks or wait for them to arrive in the mail.

Frequently Asked Questions

How do I accept an eCheck for my business?

To accept an eCheck for your business, you'll need to set up an ACH merchant account and follow a few simple steps to process electronic check payments securely. Start by setting up an ACH merchant account to begin accepting eChecks today.

What's the difference between ACH and eCheck?

ACH and eCheck differ in scope: ACH encompasses various transactions, while eCheck is a specific type of electronic transaction between checking accounts

Is a merchant account a checking account?

No, a merchant account is not a checking account, as it doesn't allow for accumulating a balance. Instead, it's a temporary holding place for funds, which are then transferred to your business account.

Featured Images: pexels.com