Setting realistic goals is crucial for company growth, as it helps you stay focused on what's achievable. According to a study, companies that set ambitious but realistic goals are 50% more likely to achieve success.

Having a clear vision is essential for planning. A well-defined mission statement can help guide decision-making and ensure everyone is working towards the same objective. For instance, a company with a strong mission statement is 25% more likely to experience growth.

A realistic plan requires careful consideration of resources, including time, money, and personnel. Companies that allocate their resources wisely are 30% more likely to achieve their goals.

A unique perspective: Goals for Company Growth

Why Company Growth Matters

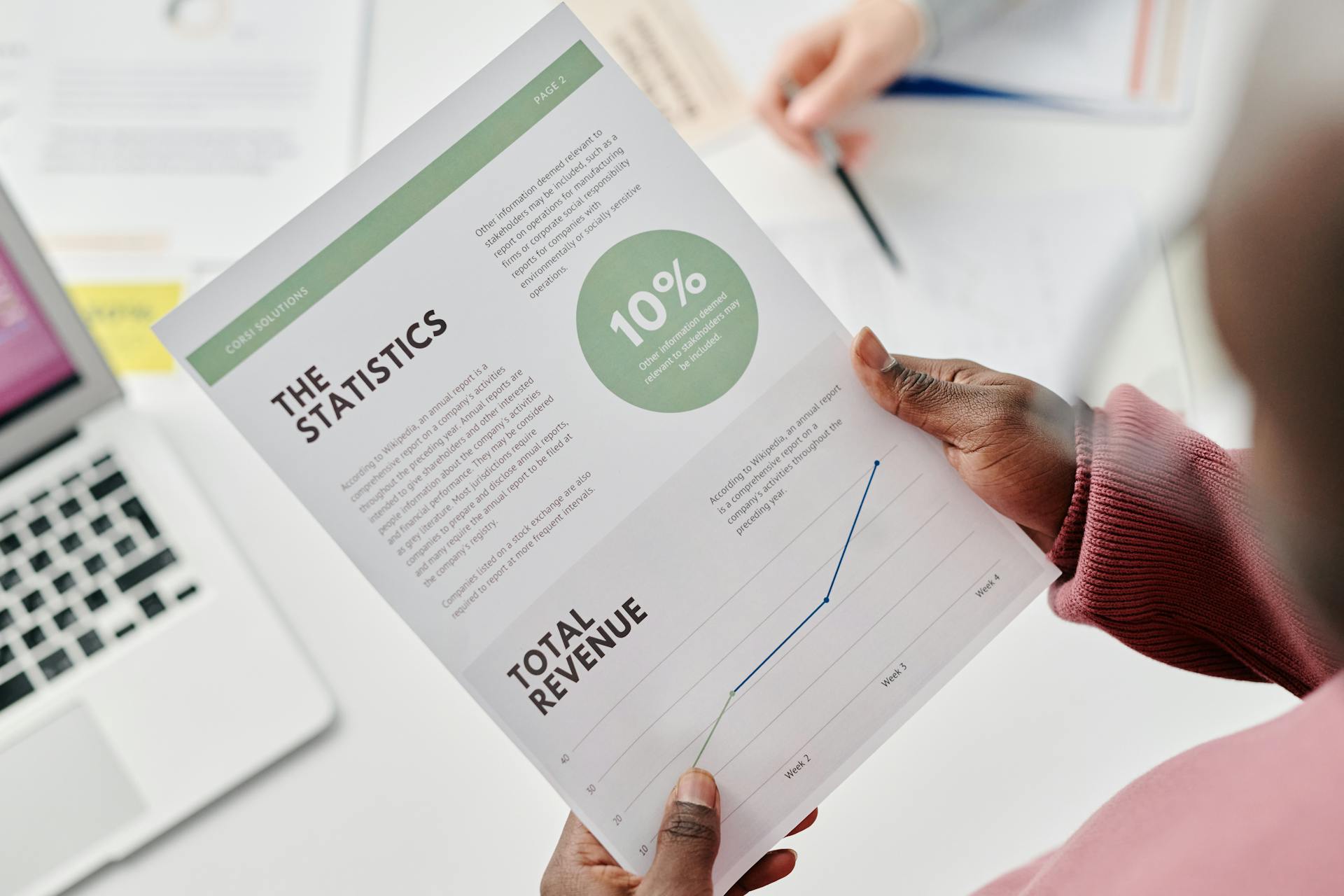

Company growth is a robust indicator of a thriving enterprise. It's a measure of organizational performance that matters to stakeholders, including shareholders, employees, and suppliers. A global study by McKinsey found that revenue growth of 5% per year led to an average increase in shareholder returns between 3 and 4%.

Growth is the yardstick by which we measure a company's competitive fitness and health. Analysts, investors, and boards pepper CEOs about growth prospects to get insight into stock prices. Employees are attracted to faster-growing companies because they offer better opportunities for advancement, higher pay, and greater job security.

Sustained profitable growth is a nearly universal goal, but it's an elusive one for many companies. Most companies barely grow when inflation is taken into account, with only 15% of the top growth quartile in 1985 able to sustain their performance for at least 30 years.

Why Is Important?

Business growth is a crucial indicator of a company's success, but achieving it has become increasingly challenging due to global economic uncertainties.

Over the last 15 years, the global economy has been marked by slow growth, with only one in eight of the world's largest public companies achieving growth rates exceeding 10% per year.

A 5% annual revenue growth can lead to an average increase in shareholder returns between 3 and 4%.

Organizations that grow faster generate shareholder returns six times higher than the industry average.

Grand ambitions for unparalleled business growth can be unrealistic and even fatal for some companies.

Suggestion: South Pacific Business Development

Idea in Brief

Sustained profitable growth is a nearly universal corporate goal, but it's an elusive one. Most companies barely grow at all, even when inflation is taken into account. This is not because of external factors alone, but also because many companies approach growth in a highly reactive, opportunistic manner.

According to empirical research, firms in the top quartile grew at an inflation-adjusted average of 11.8% per year, but those in the lower three quartiles experienced little or no growth. This shows that even among top-performing companies, sustaining growth is a challenge.

A study by McKinsey found that over the last 15 years, 5,000 of the world's largest public companies grew by an average of just 2.8% per year, with only one in eight achieving growth rates that exceeded 10% per year. This slow growth has significant implications for shareholder returns, with revenue growth of 5% per year leading to an average increase in shareholder returns between 3 and 4%.

Here are some key statistics on company growth:

These statistics illustrate the difficulty of sustaining profitable growth, but also show that it's not impossible. In fact, only about 15% of the companies in the top growth quartile in 1985 were able to sustain their top-quartile performance for at least 30 years.

Evaluating and Mitigating Risks

Scaling your operations can be a challenge, as many companies experience growing pains when increasing their sales volumes or market share.

Straining operations is a common issue, especially when combining different systems and processes after a merger or acquisition.

Overwhelming staff can also occur when taking on more tasks, affecting the level of service you offer to customers and potentially damaging employee motivation and well-being.

Squeezing capital can be a fundamental issue, leaving you without the working capital you need to manage the business effectively on a day-to-day basis.

Every business is unique, and what may be a challenge for one company can be a competitive advantage for another.

Take a look at this: Growth Capital

Evaluating Risks First

Evaluating risks first is crucial when growing your business. Many companies experience growing pains when scaling their operations, which can create bottlenecks and inefficiencies.

Straining operations is a common challenge, especially when combining different systems and processes through mergers and acquisitions. This can lead to inefficiencies and decreased productivity.

Overwhelming staff is another risk to consider, as taking on too many tasks can affect the level of service you offer to customers and damage employee motivation and well-being. This can lead to increased staff turnover rates.

Squeezing capital is a fundamental risk, as increasing sales can strain your cash flow and leave you without the working capital you need to manage the business effectively. This can be particularly challenging for businesses that don't have a solid financial foundation.

Every business is unique, and the challenges one faces during growth could be another company's competitive advantage. With careful planning and strategic decision-making, businesses can avoid growing too quickly and ensure they have the necessary resources and infrastructure to support their growth.

Investing in staff training, capacity building, and recognition is essential to maintain motivation and well-being. This can help mitigate the risks associated with overwhelming staff and ensure that employees are equipped to handle the demands of a growing business.

You might like: Growth Capital Company

Milestone Referrals

Milestone referrals add an engaging element to the referral process by offering progressively more valuable rewards for hitting specific benchmarks.

Companies like Harry's Shave have successfully used this strategy with rewards for referring one, five, and 10 friends.

The rewards can be increasingly enticing, such as tangible products, making it easier to share the referral process with others.

Milestone referrals can be simple to share with relatively straightforward objectives, which can help encourage users to bring on a volume of friends and family that suits the business's specific goals.

Pitfalls to Avoid

Scaling a business can be a daunting task, and it's essential to avoid common pitfalls that can lead to cash flow shortages and lasting harm to your brand and customer relationships. One of the biggest mistakes businesses make is accepting new clients without having the resources to meet their needs.

Here are some common pitfalls to watch out for:

- Accepting new clients, even if you don't have the resources to meet their needs.

- Introducing a product to the market before it's fully ready.

- Releasing a product that operations cannot sustainably produce

- Entering a volatile market.

- Taking on a loan without a clear repayment plan.

- Hiring more staff than needed (and can realistically afford to pay).

- Obtaining facilities that are larger (and more expensive) than necessary.

- Expanding into unfamiliar territories.

- Failing to anticipate and manage overhead costs.

These mistakes can lead to unnecessary stress for you and your employees and potentially result in layoffs.

Why Consistency Is Challenging

Consistency is challenging because many companies approach growth in a highly reactive, opportunistic manner. They throw resources at developing new capacity without thinking through the implications.

The usual explanations for slow or minimal growth, such as market forces and technological changes, play a role, but many companies' growth problems are self-inflicted. Firms often destroy the things that made them successful in the first place, such as their capacity for innovation, agility, and great customer service.

Companies can easily destroy their capacity for innovation by chasing growth too quickly. A global study by McKinsey found that over 15 years, only one in eight of the world's largest public companies achieved growth rates that exceeded 10% per year.

The damage caused by reactive growth strategies can only exacerbate growth problems. Pressures to maintain historical growth rates can lead to quick-fix solutions like costly acquisitions or drastic cuts in R&D, other capabilities, and training.

Sustaining profitable growth requires a delicate balance between the pursuit of market opportunities and the creation of the capabilities and capacity needed to exploit those opportunities. Companies need a growth strategy that explicitly addresses three interrelated decisions: how fast to grow, where to seek new sources of demand, and how to amass the necessary resources.

Companies That Grew Too Fast

Companies that grew too fast often found themselves in a world of trouble. Homejoy, for example, expanded too quickly and was eventually shut down due to poor management and unsustainable growth.

The story of Zynga is another cautionary tale. The company's rapid expansion led to a series of poor product releases, ultimately resulting in a significant decline in market value.

In the case of 180s, the company's failure to anticipate and manage overhead costs led to a cash flow shortage, ultimately causing the business to fold.

These companies are just a few examples of the pitfalls of rapid expansion. The common thread among them is a failure to plan and prepare for the challenges that come with scaling a business.

Here are some examples of the challenges that can arise when a business grows too quickly:

By learning from the mistakes of these companies, you can avoid the pitfalls of rapid expansion and create a sustainable and successful business.

Pitfalls to Avoid When Scaling

Scaling a business can be a thrilling experience, but it's essential to avoid common pitfalls that can derail your progress. One of the biggest mistakes businesses make is accepting new clients without having the resources to meet their needs.

This can lead to cash flow shortages and lasting harm to your brand and customer relationships. In fact, a study by McKinsey found that over the last 15 years, 5,000 of the world's largest public companies grew by an average of just 2.8% per year, with only one in eight achieving growth rates that exceeded 10% per year.

Introducing a product to the market before it's fully ready can also be a costly mistake. Companies like Homejoy, Zynga, and 180s have fallen victim to this pitfall, and it's essential to learn from their experiences.

Here are some common pitfalls to avoid when scaling a business:

- Accepting new clients without having the resources to meet their needs.

- Introducing a product to the market before it's fully ready.

- Releasing a product that operations cannot sustainably produce.

- Entering a volatile market.

- Taking on a loan without a clear repayment plan.

- Hiring more staff than needed and can realistically afford to pay.

- Obtaining facilities that are larger and more expensive than necessary.

- Expanding into unfamiliar territories.

- Failing to anticipate and manage overhead costs.

By avoiding these common pitfalls, you can set your business up for success and achieve sustainable growth. It's essential to be proactive and plan carefully to avoid costly mistakes.

It's OK to Shrink

Trying to deliver consistent growth can be a heavy burden, but it's not the only way to succeed. The 10 percent of companies that grew for seven of the ten years between 2010 and 2019 outperformed their peers.

Statistically, the worst thing you can do is try to buy growth with a "big bang" acquisition, as it's unlikely to yield the desired results. Companies that used a "shrink-to-grow" strategy, divesting slow-growing parts of their portfolio and reinvesting the proceeds into new areas, generated five percentage points more annual excess TSR than inconsistent growers and large-deal acquirers.

Divesting assets can be a smart move, as seen with one Australian conglomerate that consistently divested less attractive parts of its portfolio and put the proceeds into growth opportunities, resulting in a TSR of more than 10 percent per year from 2009 to 2019.

You might enjoy: Ares Portfolio Companies

Having a clear growth ambition is key, and it's not just about maintaining momentum. It's about setting a quantum of growth that's more than just the momentum of your current businesses.

Developing a coherent set of growth pathways that encompass as many of the rules as possible is crucial for success.

Strategies for Sustainable Growth

Growth opportunities differ from one company to the next, but being courageous and identifying and managing risks can unlock value-creating and sustainable growth opportunities.

Don't solely focus on the financials, as research shows that organizations that prioritize Environmental, Social, and Governance (ESG) goals outperform others in financial performance.

To find the answer to where growth should come from, categorize revenue increases into growth within the core industry, secondary industries, and new industries. A healthy core business is essential for achieving strong growth, with only one in six companies with below-industry median core-segment growth rates managing to achieve overall corporate growth rates above their peers.

Companies that grew into adjacent industries generated an extra 1.5 percentage points per year of shareholder returns above their industry peers.

8 Strategies to Move the Needle

Growing a business sustainably requires careful consideration and planning. It's essential to identify and manage risks to unlock value-creating growth opportunities that give you a competitive edge and promise significant rewards.

Don't solely focus on financials, as organizations that prioritize Environmental, Social, and Governance (ESG) goals also outperform others in terms of financial performance. Research shows that half of the firms that prioritize ESG issues reached or exceeded a 10% annual growth rate, compared to only one in four companies that didn't.

To futureproof your growth, create new work procedures, communication channels, rules and policies, training and development programs, and rewards and recognition schemes. This investment in infrastructure is vital for sustainable and repeatable growth.

Here are eight business growth strategies to try and implement for your business:

• Focus on your core: A McKinsey study found that 80% of growth comes from an organization's core industry, with just 20% originating from secondary or new markets.

• Look beyond the core: Expanding into adjacent industries can help position your portfolio ahead of future trends, and companies that grew into adjacent industries generated, on average, an extra 1.5 percentage points per year of shareholder returns above their industry peers.

• Turbocharge your core: It's improbable that you can achieve strong growth if the core isn't flourishing, and only one in six companies with core-segment growth rates below their industry median managed to achieve overall corporate growth rates above those of their peers.

• Don't neglect brand building and customer service: In today's uncertain and competitive business environment, implementing marketing plans based on economic data and guardrails is more critical than ever.

• Identify and manage risks: By being courageous and identifying and managing the risks, you can unlock value-creating and sustainable growth opportunities.

• Focus on ESG goals: Organizations that prioritize ESG goals also outperform others in terms of financial performance, and research shows that half of the firms that prioritize ESG issues reached or exceeded a 10% annual growth rate.

• Create new infrastructure: Growth cannot happen in isolation, and you must create new work procedures, communication channels, rules and policies, training and development programs, and rewards and recognition schemes to support it.

• Avoid common pitfalls: Premature growth can lead to cash flow shortages and lasting harm to your brand and customer relationships, so be aware of the common pitfalls to avoid when scaling a business, such as accepting new clients without the resources to meet their needs or introducing a product to the market before it's fully ready.

Revamp Recruiting Tactics

To revamp your recruiting tactics, you need to think beyond just posting job descriptions on LinkedIn. You want to find the right people who share your passion for your business and will help you achieve your growth goals.

Always carry your business card with you, as you never know when you might meet someone who would be a great fit for your team.

Viral Loops

Viral loops are a self-sustainable growth strategy that rely on users' enthusiasm to keep them going. They require an initial push, but ultimately, they operate 24/7/365.

The basic premise of a viral loop is straightforward: someone tries your product, they're offered a valuable incentive to share it with others, they accept and share with their network, new users sign up, see the incentive for themselves, and share with their networks, and repeat.

A viral loop flips the traditional funnel upside-down, requiring just one satisfied user to share with others. As long as every referral results in at least 1.1 new users, the system continues growing.

For instance, a cloud storage company might offer users an additional 500 MB for each referral, a compelling incentive that encourages users to actively and enthusiastically encourage their friends and family to get on board.

A well-designed viral loop can be a self-perpetuating acquisition machine, but they're not guaranteed to go viral and have become less effective as they've become more commonplace.

Scaling and Expansion

Scaling and Expansion can be achieved through strategic business moves. Buying out or acquiring emerging companies or struggling companies with a significant online presence can help you scale up faster.

You can expand your business portfolio by purchasing a competitor who already has the information and content you need to educate your clients, with little new investment. This can save you hundreds of thousands of dollars.

Mergers, partnerships, and acquisitions can be a high-risk but high-reward growth strategy. A well-executed merger or partnership can help you break into a new market.

Acquisitions offer significant benefits to companies, including faster growth, access to more customers, and lower business risk. Procter & Gamble, founded in 1837, is a great example of a company that has used acquisitions to expand its operations and increase its sales.

Acquisitions can be an easy way to grow, especially since the products or services you acquire are already established and come with a customer base.

Marketing and Sales

Marketing and sales are crucial components of company growth. A clear sales funnel can help you identify drop-off points and improve the stages at which most customers decide not to convert.

To increase sales, you can create a codified sales funnel by delineating the steps that each customer has to take before buying your product or service. This will help you reduce confusion and friction around making a sale.

A marketing growth strategy involves researching different verticals, customer types, audiences, regions, and more to measure the viability of a market expansion. This can include rebranding, launching new products, opening new locations, and adopting different marketing strategies.

Some specific marketing growth tactics include:

- Rebranding to appeal to a new audience

- Launching new products to appeal to buyers in a different market

- Opening new locations in other regions

- Adopting a different marketing strategy, e.g., local marketing or event marketing, to appeal to different markets

- Becoming a franchisor so that individual business owners can buy franchises from you

Improving your conversion rate is another key aspect of company growth. This can be done by calculating the conversion rate and using tried-and-true lead generation tactics like performing A/B tests and setting up clear, concise calls to action.

Additional reading: How to Find Growth Rate of Company

Dominate Local Before Going Global

Winning the local market is crucial before expanding internationally. Research shows that organizations with healthy growth in their domestic markets benefit more from international expansion, with total shareholder returns increasing by 2.6% compared to just 1.3% for businesses that are only treading water locally.

International expansion can bring tremendous challenges and costs that can destabilize a business and threaten its financials. It's essential to anchor your organization by winning the local market first.

Companies that expanded internationally generated 1.9 percentage points more annual TSR than their industry peers, but those with healthy growth in their home markets benefited more than those merely treading water at home. The former category generated an additional 2.6 percentage points of annual shareholder returns through geographic expansion.

To succeed at international expansion, it's critical to have a clear source of competitive advantage that is transferable across regions. Without it, foreign companies will probably struggle to compete with incumbents that better understand the local context.

A European manufacturer of agricultural and municipal vehicles leveraged its equipment's stellar reputation to expand into the United States, where it continued to generate market-beating returns. On the other hand, a European grocer that struggled in its home market expanded aggressively into Latin America, but its TSR trailed that of its peers by seven percentage points per annum over the subsequent decade.

A company's local market performance has a significant impact on its international expansion success. Here's a rough breakdown of the growth contribution from local and international markets:

- Japanese and European companies: 50% of total growth from international markets

- Companies in faster-growing areas, such as China and North America: 30% of total growth from international markets

Remember, dominating the local market is a crucial step before expanding globally. It provides a solid foundation for international expansion and increases the chances of success.

Sales Funnel

A sales funnel is a crucial component of any business's marketing and sales strategy. It's a codified process that outlines the steps a customer takes before making a purchase.

By setting up a clear sales funnel, you can identify drop-off points and areas where customers are getting stuck. This insight will help you improve the stages where most customers decide not to convert.

Creating a sales funnel can also help reduce confusion and friction around making a sale. Your customers will have a clear understanding of where they are in the process, and you can tailor your marketing efforts to address any pain points.

To create a sales funnel, you can start by mapping out the customer journey, from initial awareness to purchase. This will help you identify the most critical stages and areas for improvement.

Here are some key metrics to track in your sales funnel:

By tracking these metrics and making adjustments to your sales funnel, you can optimize your marketing and sales efforts to drive more revenue and growth for your business.

Enhance CRM

Creating a sales funnel is crucial for identifying drop-off points and improving the stages where most customers decide not to convert. By setting up a codified sales funnel, you can see and improve the stages at which most customers decide not to convert.

A customer relationship management system can help you stay on top of customer relationships. They can send out birthday emails with discounts, thank you emails for customers who have hit an anniversary with your business, and you can even use it to get feedback from your most loyal customers if you want.

Investing in a CRM system can help you shore up market share and maintain the customer base you already have. This is especially important as you expand beyond your core customer base.

Here are some key features to consider when enhancing your CRM:

By implementing these features, you can improve customer satisfaction and loyalty, leading to increased market share and business growth.

In-Person Outreach

In-Person Outreach is an effective way to grow your business. This approach can help set things in motion by adding a human element to your strategy.

Prospects are often receptive to a personal approach, and face-to-face interactions can be a great way to get your business the traction it needs. Sometimes, this can be as simple as hosting or sponsoring events to reach your target demographic.

In-person outreach shakes things up and will stand out to consumers who are used to being saturated with ads. This makes it a great way to break through the noise and grab people's attention.

Acquire Programmatically

Acquiring programmatically can be a game-changer for companies looking to grow their revenue. Mergers and acquisitions account for approximately one-third of the revenue growth among companies in our data set.

Companies that use programmatic M&A outperform their peers using other M&A approaches. McKinsey's research has found that programmatic acquirers - those that do at least two small or medium-sized deals a year along the same theme - outperform their peers.

This approach can help companies digitize and enlarge their businesses. For example, a European publishing group made over 60 acquisitions to expand into digital media offerings, and now digital assets account for more than 70 percent of its revenue.

Programmatic M&A allows companies to build organizational capabilities and establish best practices across the M&A process. This includes strategy, sourcing, due diligence, and integration planning.

Companies that pursue large deals often need to overpay and then integrate two businesses of similar size, which can be notoriously difficult. In contrast, doing many small deals enables companies to gain access to new markets or consolidate fragmented ones without the risk of "betting the house."

On a similar theme: Digital Growth Company

Market and Industry Research

Conducting market and industry research is a crucial step in determining the feasibility of your desired growth. It's essential to understand the state of your industry and whether your growth goals are necessary and achievable.

Researching your industry involves gathering knowledge and facts that will shape your expectations and growth goals. This can be done by running surveys and focus groups with existing and potential customers, or by digging into existing industry research.

Understanding your competition is also vital. Knowing who your competitors are and how they're growing and diversifying can help you stay ahead and become or remain a leader in your industry. Visit your competition's websites frequently and research their ad campaigns, landing pages, and social media presence to stay aware of new trends and strategies.

A marketing growth strategy can help you increase your total addressable market (TAM) and existing market share. This involves researching different verticals, customer types, audiences, regions, and more to measure the viability of a market expansion.

Here are some specific marketing growth tactics to consider:

- Rebranding the business to appeal to a new audience.

- Launching new products to appeal to buyers in a different market.

- Opening new locations in other regions.

- Adopting a different marketing strategy, e.g., local marketing or event marketing, to appeal to different markets.

- Becoming a franchisor so that individual business owners can buy franchises from you.

Product Development

Product development is a key strategy for company growth. It involves introducing new or enhanced products to attract new customers and retain existing ones.

Many businesses need to innovate and introduce something new to grow. This can be in the form of a new product or an enhancement of an existing one.

Online fast-fashion retailers like ASOS are a great example of this. They started with clothing but expanded to face and body products to appeal to a broader customer base.

A freemium pricing strategy can also be used in conjunction with product development to increase product usage and sign-ups. This involves offering a basic version of the product for free and charging for premium features or services.

Partnering with new manufacturers and providers can also be a part of a product development strategy. This can help expand the product catalog and increase product adoption.

Here are some examples of how businesses can use product development to grow:

By listening to customer feedback and preferences, businesses can ensure that their product development strategy is on track to meet customer needs.

Frequently Asked Questions

What is the growth of a company?

Company growth refers to an increase in size, revenue, market share, and profitability over time. It can be achieved through various means, such as expanding into new markets or developing new products.

What are the 4 stages of business growth?

The four stages of business growth are startup, growth, maturity, and renewal/decline. Understanding these stages can help entrepreneurs and business owners navigate their company's development and make informed decisions for long-term success.

Sources

- https://hospitalityinsights.ehl.edu/growth-potential-business

- https://www.nerdwallet.com/article/small-business/business-growth-strategies

- https://blog.hubspot.com/sales/growth-strategy

- https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/the-ten-rules-of-growth

- https://hbr.org/2024/03/how-fast-should-your-company-really-grow

Featured Images: pexels.com