AMD has a history of stock splits, with the most recent one occurring in 2021. This split resulted in a 3-for-1 ratio, where one share became three.

The first AMD stock split happened in 1979, when the company split its stock 2-for-1. This was a significant move for the company, allowing it to increase its liquidity and make its stock more accessible to a wider range of investors.

Since then, AMD has undergone several stock splits to keep its stock price competitive with other technology companies. Each split has had a 2-for-1 ratio, doubling the number of shares outstanding.

These splits have helped AMD maintain its market capitalization and keep its stock price relatively stable, despite fluctuations in the market.

Additional reading: Stock Quote for Amd

Stock Splits 101

Stock splits don't actually make a stock any cheaper, they just reduce the trading price by splitting it into smaller slices.

A stock split is like selling a quarter of a pizza for $5 instead of the whole pie for $20, it's just a price adjustment.

Most major brokerages now allow investors to buy fractional shares with commission-free trades, making it easy to invest in higher-priced stocks with whatever funds you have available.

Retail investors might prefer to buy round lots (100 shares) of stocks because they're easier to track than odd lots with fewer than 100 shares.

Stock splits can make options trading more affordable, since each options contract is tethered to 100 shares of the underlying security.

See what others are reading: Buy Amazon Stock

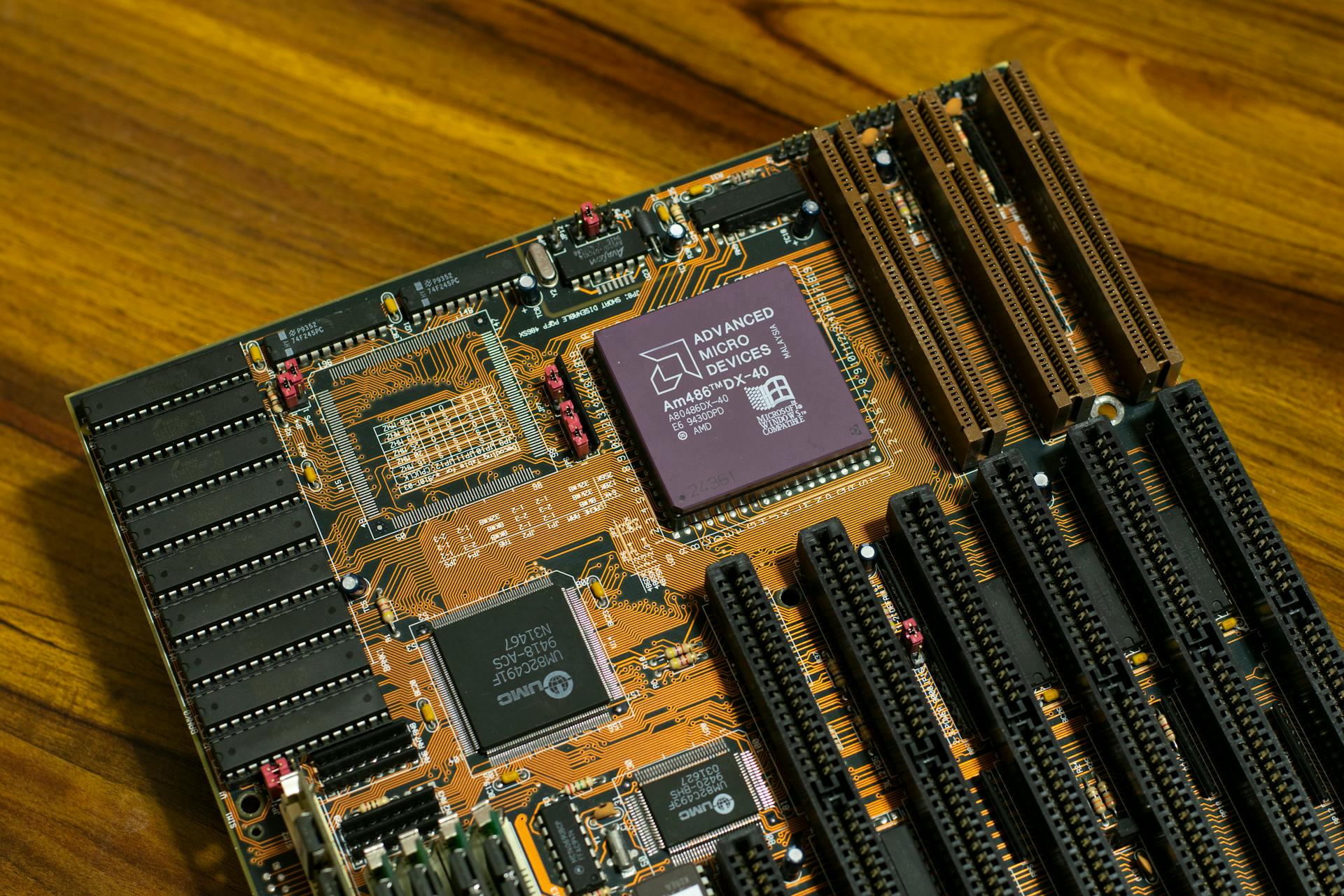

Advanced Micro Devices

AMD, or Advanced Micro Devices, has a history of stock splits. The company's first stock split occurred in 1999, when it split 2-for-1.

What a Stock Split Does

A stock split doesn't make a stock any cheaper, it just reduces the trading price by splitting it into smaller slices.

Think of it like buying a quarter of a pizza for $5 instead of the whole pie for $20 - it's the same amount of pizza, just divided into smaller pieces.

A stock split doesn't change a stock's price-to-earnings ratio or other key fundamentals, because you're simply comparing a smaller slice of the company to its underlying financials.

This means that a stock split doesn't inherently make a stock more affordable, it just makes it easier to buy in smaller increments.

Most major brokerages now allow investors to buy fractional shares with commission-free trades, making it easy to invest in higher-priced stocks with whatever funds you have available.

For example, an options contract on AMD at $120 is pinned to $12,000 in shares, but cutting its stock price in half to $60 would reduce that minimum commitment to $6,000.

Stock splits can also grant companies more flexibility when they pay out their stock-based compensation plans, but unless you're an active options trader or a company employee, stock splits probably won't matter too much in the long run.

For more insights, see: Restricted Stock Units vs Stock Options

Investor Insights

AMD stock splits have been a topic of interest for investors, and understanding the history of these splits can provide valuable insights.

AMD has a history of stock splits dating back to 1999, when the company split its stock 2-for-1.

The first AMD stock split in 1999 was followed by another 2-for-1 split in 2000, which helped increase the stock's liquidity and attract more investors.

In 2005, AMD split its stock 3-for-2, which increased the number of outstanding shares by 50%.

This increase in shares helped AMD's stock price rise by 25% in the following months.

The company's stock price continued to rise, reaching an all-time high in 2006.

AMD's most recent stock split was in 2020, when the company split its stock 4-for-1.

This latest split has made AMD's stock more accessible to individual investors, who can now buy smaller fractions of the stock.

A different take: What Nvidia Stock Split Means for Investors

AMD 42-Year Stock Price History

AMD's stock price has a long history of fluctuations, reflecting the company's growth and challenges over the years.

In 1983, AMD's stock price was around $0.50 per share, a far cry from its current value.

Intriguing read: Amd Stock Code

The company's first stock split occurred in 1986, when it split 2-for-1, doubling the number of shares outstanding.

In 1999, AMD's stock price peaked at $63.13 per share, a significant increase from its 1983 value.

The dot-com bubble burst in 2000, causing AMD's stock price to plummet to $3.91 per share by 2001.

AMD's stock has experienced several splits since then, with a 2-for-1 split in 2005 and a 3-for-2 split in 2007.

By 2017, AMD's stock price had recovered somewhat, reaching $13.95 per share.

Today, AMD's stock price continues to fluctuate, influenced by the company's ongoing efforts to innovate and compete in the tech industry.

A unique perspective: 3m Company Stock Splits

Stock Split News

AMD's last stock split occurred on August 22, 2000, a 2-for-1 split that adjusted the price from $68.88 to $34.13 per share.

The stock has since appreciated by roughly 250% and is currently trading around $120 per share, raising the question of whether investors should anticipate a potential split from AMD in the near future.

Nvidia and Broadcom have recently undertaken stock splits, which may be a sign that AMD will follow suit.

A stock split does not inherently lower the cost of a stock, but rather divides the trading price of a security into smaller units.

For instance, selling a quarter of a pizza for $5 instead of the entire pizza for $20 illustrates this concept.

Most major brokerages now permit the purchase of fractional shares without commissions, making investing in higher-priced stocks more accessible.

Retail investors may prefer to purchase round lots (100 shares), which are simpler to manage compared to odd lots (fewer than 100 shares).

Stock splits can lower the cost of options trading, given that each options contract corresponds to 100 shares of the underlying asset.

For example, an options contract for AMD priced at $120 is linked to $12,000 worth of shares; however, if the stock price is halved to $60, the minimum investment requirement decreases to $6,000.

Curious to learn more? Check out: Trading Stocks

Frequently Asked Questions

Should I hold or sell AMD stock?

Considering current market conditions, it's recommended to hold or avoid making active moves with AMD stock until the market cools down or a stronger business trend emerges. Holding off on buy or sell decisions may be the wisest approach for most investors.

Sources

- https://www.fool.com/investing/2024/12/23/stock-split-watch-is-amd-next/

- https://www.aol.com/stock-split-watch-amd-next-094500559.html

- https://www.theglobeandmail.com/investing/markets/stocks/AMD-Q/pressreleases/30171545/stock-split-watch-is-amd-next/

- https://www.macrotrends.net/stocks/charts/AMD/amd/stock-price-history

- https://kcsos.in/stock-split-watch/

Featured Images: pexels.com