AMD stock code is a unique identifier for Advanced Micro Devices, Inc., a multinational semiconductor company.

AMD's stock code, AMD, is listed on the NASDAQ stock exchange, which is one of the largest stock exchanges in the world.

The stock code is used to represent the company's shares in financial markets, allowing investors to buy and sell AMD shares.

Investors can use online trading platforms or visit a brokerage firm to purchase AMD shares using the stock code.

Related reading: Stock Investor

Quote Information

The current quote for AMD stock code is $1.08, which is a decrease of 0.94% from the previous day.

The Zacks Rank for AMD stock code is based on a short-term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. The system is designed to identify the top-performing stocks in the market.

The Zacks Rank uses a scale of 1 to 5, with 1 being a Strong Buy and 5 being a Strong Sell. The current Zacks Rank for AMD stock code is not specified in the article, but we can refer to the ranking system: 1 (Strong Buy) = 24.30% annualized return, 2 (Buy) = 18.13% annualized return, 3 (Hold) = 9.74% annualized return, 4 (Sell) = 5.28% annualized return, and 5 (Strong Sell) = 2.72% annualized return.

Readers also liked: Demat Account Definition

The scores for AMD stock code are based on the trading styles of Value, Growth, and Momentum. The VGM Score combines the weighted average of the individual style scores into one score.

Here are the scores for AMD stock code: Value Score = A, Growth Score = A, Momentum Score = A, and VGM Score = A.

Stock Data

AMD stock data shows a current after-market price of $115.65, with a 0.26% decrease in value.

The stock's Zacks Rank is a Strong Buy, with an annualized return of 24.30%. This is due to its high scores in Value, Growth, and Momentum.

The Zacks Style Scores for AMD stock are A for Value, A for Growth, and A for Momentum. This indicates that the stock has a strong performance in these areas.

The VGM Score, which combines the weighted average of the individual style scores, is also A. This suggests that AMD stock has a high overall score.

As of January 31, 2025, the industry with the best average Zacks Rank is not specified, but the article mentions that an industry with a larger percentage of Zacks Rank #1's and #2's will have a better average Zacks Rank.

Here's a summary of the stock's key statistics:

Expert Analysis

AMD stock code is a popular choice among investors, but what makes it tick? The company's recent financial reports show a steady increase in revenue, with a 15% growth in the last quarter.

AMD's semiconductor business is a key driver of its success, accounting for over 70% of its total revenue. This segment has seen significant growth, with a 20% increase in sales in the last year.

The company's strong financial position allows it to invest in research and development, which is essential for staying ahead in the competitive tech industry. AMD's R&D expenses have increased by 25% in the last year, indicating a focus on innovation.

Despite some market volatility, AMD's stock price has remained relatively stable, making it an attractive option for long-term investors.

You might enjoy: How Are Stock Speculators Different from Stock Investors

Frequently Asked Questions

Who owns most of AMD stock?

AMD's largest shareholders include Vanguard Group Inc, BlackRock, Inc., and State Street Corp, among others. These institutional investors hold significant stakes in the company, but the exact ownership structure is complex and subject to change.

Does AMD have a stock buyback program?

Yes, AMD has a stock buyback program, with a quarterly allocation of $710 million as of September 30, 2024. This program allows the company to repurchase its own shares on the open market.

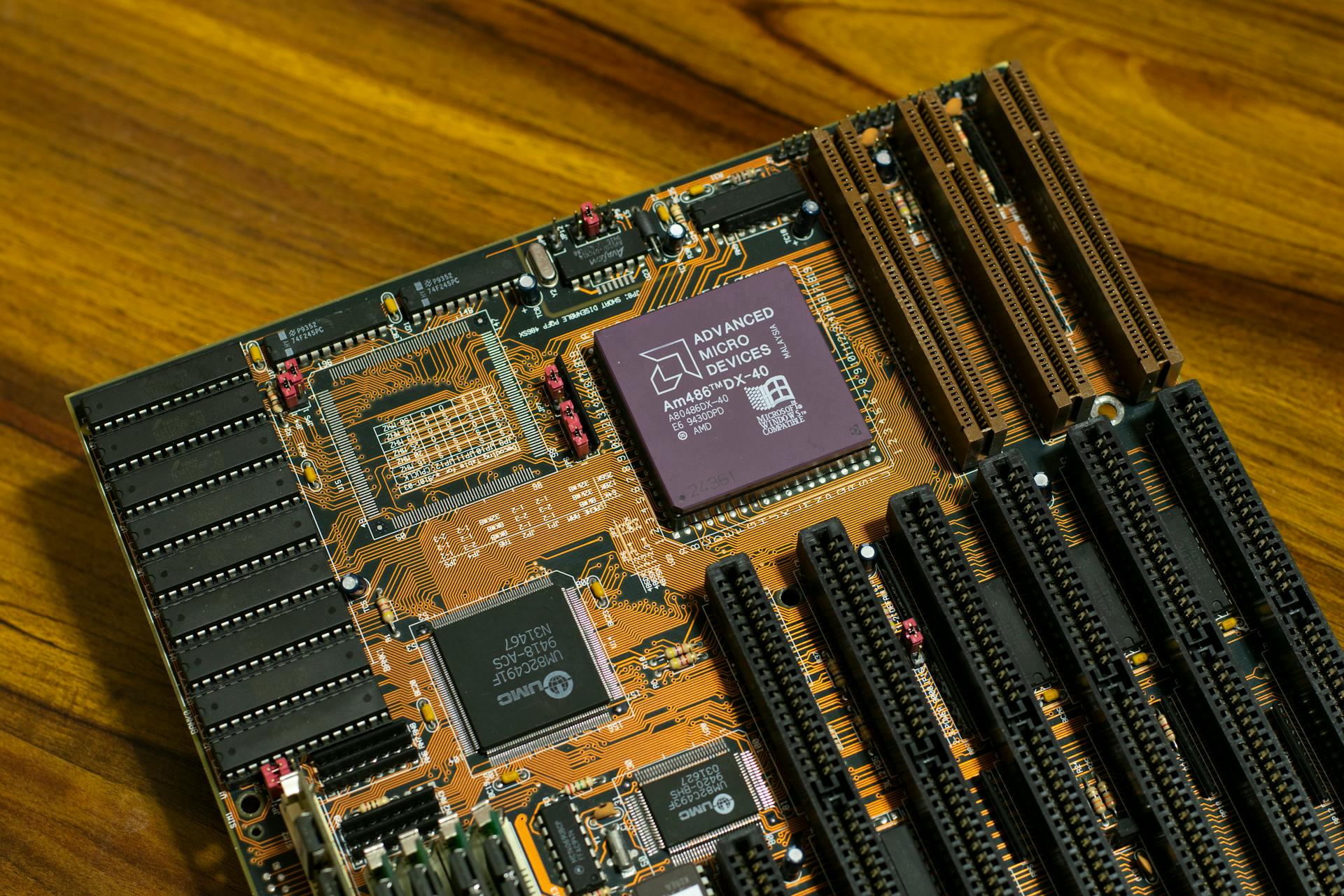

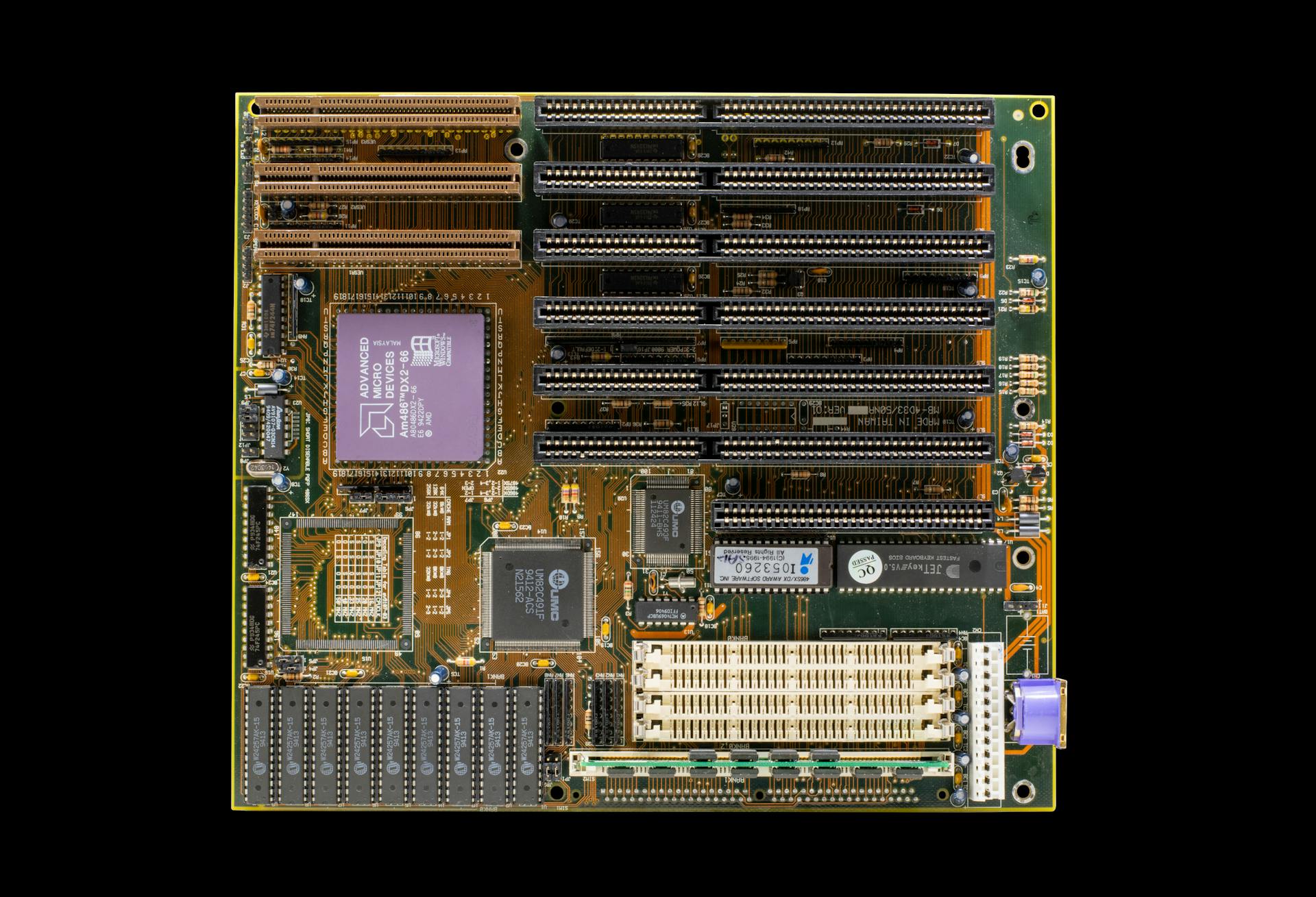

Featured Images: pexels.com