As of 2022, AMD's shares outstanding have been steadily increasing, reaching a total of 4.32 billion shares.

AMD's shares outstanding have more than doubled since 2018, when they were at 1.87 billion shares.

This significant growth can be attributed to the company's expansion and increased investor interest.

Share Statistics

AMD has 1.62 billion shares outstanding. This is a significant number, and it's good to know the company's share count.

The number of shares has increased by 0.74% in the past year, which is a relatively small change. However, it's worth noting that the number of shares has decreased by 0.12% in the past quarter.

Here's a breakdown of the share statistics:

Shares Outstanding

AMD has 1.62 billion shares outstanding. This is a significant number that can impact the company's financial decisions and investor confidence.

The number of shares has increased by 0.74% in one year, which is a relatively small change. However, it's worth noting that this growth can be a sign of a company's expanding operations and increasing popularity.

Here's a breakdown of the shares outstanding and the changes over time:

In terms of ownership, insiders own a relatively small percentage of the company, with 0.57% of the shares. This means that the majority of the company is owned by external investors.

Share Price

The share price is a crucial aspect of share statistics. It's the current market price at which a share can be bought or sold.

On average, a company's share price can fluctuate by up to 10% within a single trading day. This volatility can be influenced by various market and economic factors.

The highest share price ever recorded was $2,050 for a single share of the company Tesla. This price was reached in 2021 and is a notable example of the company's impressive growth.

A share price can also be influenced by the company's financial performance, with strong earnings and revenue growth often leading to an increase in share price. This is reflected in the example of Apple, which has consistently delivered strong financial results and seen its share price rise accordingly.

In some cases, a company's share price can be affected by external factors such as changes in government regulations or global economic trends. For instance, the COVID-19 pandemic led to a significant decline in share prices across various industries.

Readers also liked: Formula Economic Value Added

Financial Information

AMD shares outstanding have been steadily increasing over the years, reaching a total of 4.31 billion as of 2022.

As of 2022, AMD has a market capitalization of around $150 billion, which is a significant increase from its market capitalization in 2018.

AMD's shares outstanding have been influenced by various factors, including stock splits and the issuance of new shares.

The company's largest shareholders include institutional investors such as The Vanguard Group, Inc. and BlackRock, Inc.

AMD's shares are listed on the NASDAQ stock exchange under the ticker symbol AMD.

Recommended read: Thin Capitalization Rules

Company Data

AMD's shares outstanding have been steadily increasing over the years, with a significant jump in 2019.

As of 2022, AMD has approximately 1.45 billion shares outstanding, according to the company's most recent financial reports.

The majority of AMD's shares are held by institutional investors, with the largest shareholder being Vanguard Group, Inc.

AMD's shares outstanding have been influenced by various factors, including stock splits and the company's acquisition of Xilinx in 2020.

AMD's market capitalization has fluctuated over time, but as of 2022, it stands at around $140 billion.

Market Activity

AMD's shares outstanding have been steadily increasing over the years, reaching a peak of 4.64 billion shares in 2020.

In 2019, AMD's shares outstanding were 3.85 billion, a significant increase from the 2.56 billion shares outstanding in 2015.

The company's strong financial performance and growing demand for its products have contributed to the increase in shares outstanding.

AMD's net income has also been on the rise, reaching $1.1 billion in 2020, up from $192 million in 2015.

The increase in shares outstanding has led to a decrease in AMD's earnings per share, from $0.51 in 2015 to $0.23 in 2020.

As a result, AMD's market capitalization has also increased, reaching $130 billion in 2020, up from $20 billion in 2015.

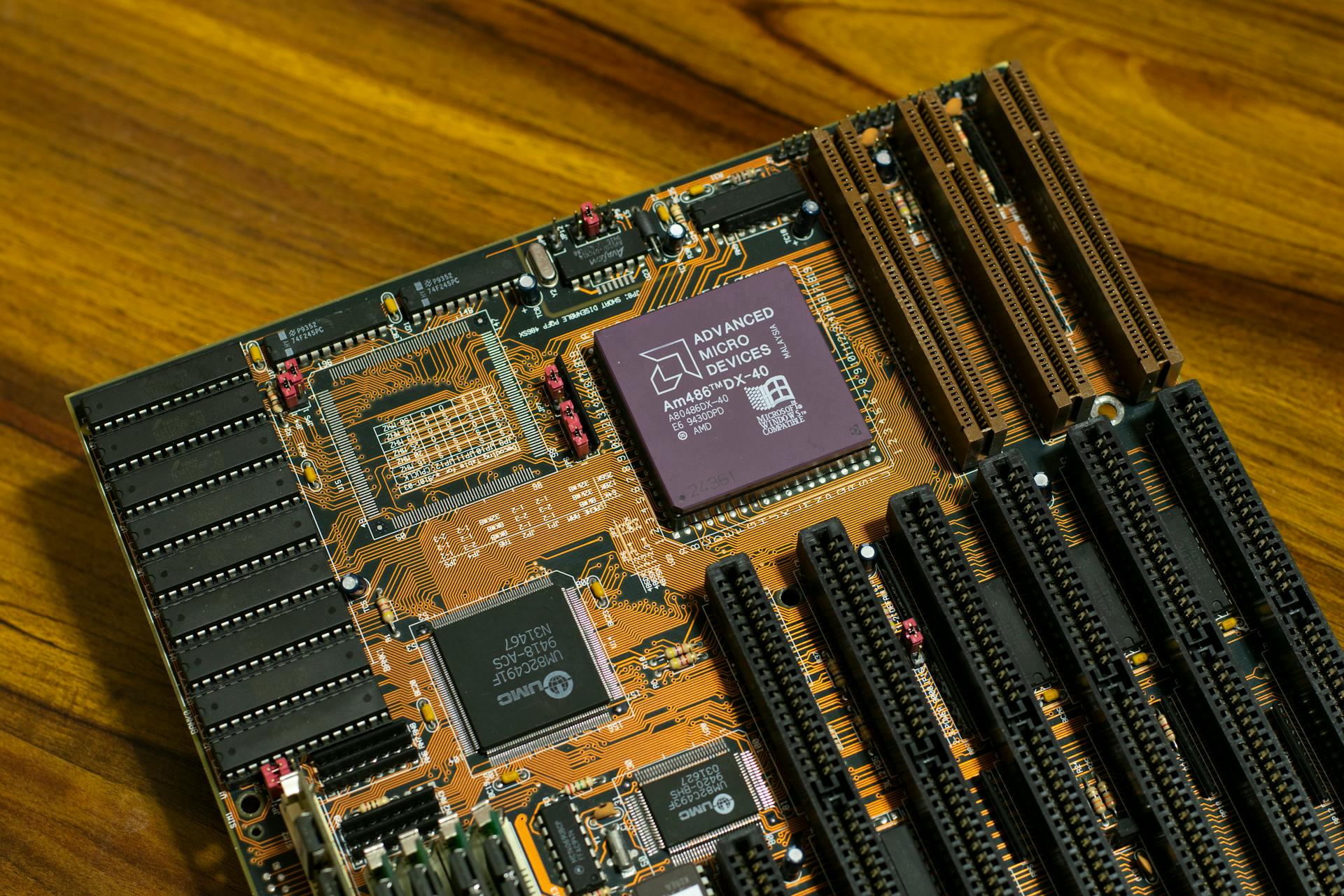

Featured Images: pexels.com