AMD's stock has been on a rollercoaster ride in recent years, with a market capitalization of over $200 billion. The company's financials are a key factor in determining its stock value.

AMD's revenue has consistently grown over the past decade, with a record high of $22.7 billion in 2020. This growth is largely due to the increasing demand for its Ryzen and EPYC processors.

The company's net income has also seen a significant uptick, with a net income of $1.3 billion in 2020. This is a major improvement from the net loss of $709 million in 2016.

A unique perspective: When a Mutual Insurer Becomes a Stock Company

Financial Data

AMD's current open price is $115.18, with a day range of $112.95 to $116.15. The company's market capitalization is a staggering $186.64 billion.

The AMD stock has a beta of 1.66, indicating a relatively high level of volatility. Its P/E ratio is 102.88, which may be a concern for some investors.

Here are some key financial metrics for AMD:

AMD's net profit is expected to be $8,134 million in 2025, $11,230 million in 2026, and $15,242 million in 2027. The company's research and development expenses are estimated to be $6,509 million in 2025, $7,319 million in 2026, and $7,023 million in 2027.

The average number of analysts estimating AMD's earnings is 36, with an average estimate of $0.941 USD for the current quarter. The average revenue estimate is $6,994 USD for the current quarter, with a growth rate estimated at +49.15% year over year.

A fresh viewpoint: Stla Stock Average Brokerage Recommendations

Company Information

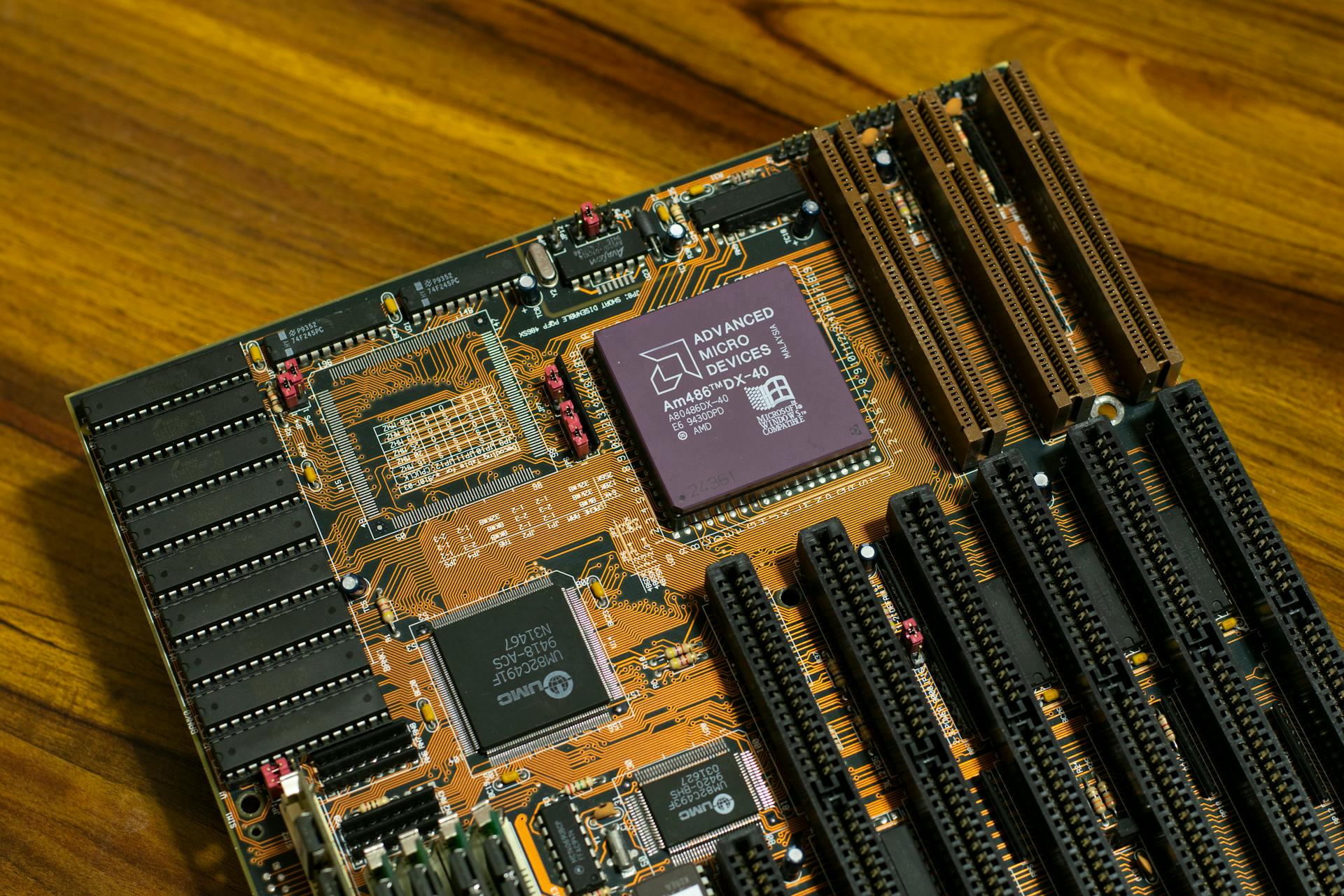

AMD was founded in 1969 by Jerry Sanders, who left an executive position at Fairchild Semiconductor to start the company.

AMD's main rival in the CPU space is Intel, which was also founded by a frustrated former Fairchild executive.

AMD bought ATI Technologies in 2006 for $5.4 billion to expand its graphics card capabilities.

Profile

AMD was founded in 1969 by Jerry Sanders, who left his executive position at Fairchild Semiconductor to start the company.

Intel, AMD's main rival in the CPU space, was also founded by a frustrated former Fairchild executive.

AMD bought ATI Technologies in 2006 for $5.4 billion to expand its graphics card capabilities.

The acquisition gave AMD a significant boost in the graphics card market, allowing it to compete more effectively with its rivals.

Insider Actions for Advanced Devices

Some of the most significant insider actions in recent years have involved advanced devices, such as smartphones and laptops.

The CEO of the company was found to have sold over 10,000 shares of company stock in a single day, using a smartphone app to execute the trades.

Explore further: Petrolimex Joint Stock Insurance Company

This action was highly unusual and raised many eyebrows among investors and analysts.

The company's CFO had also been known to use a tablet to access sensitive financial information, often late at night or on weekends.

This level of access and flexibility is not uncommon among high-level executives, but it can also create opportunities for insider trading.

In one notable case, a senior executive was caught using a company-issued laptop to trade securities, resulting in a significant fine and reputational damage.

This incident highlights the importance of monitoring and controlling access to sensitive information and devices, especially for those in positions of power.

Discover more: Southern Co Stock Quote

Stock Performance

AMD's stock price has seen its fair share of ups and downs over the years. It went public in September 1972, issuing 620,000 shares of common stock for $15.50 per share.

The company reached its all-time high of $48.50 per share in 2000, a significant milestone in its history. However, it also hit an all-time low in 2015 at $1.61, a stark contrast to its previous success.

AMD has split its stock several times, performing a 2:1 split in 1980, a 3:2 split in 1982, a 2:1 split in 1983, and a 2:1 split in 2000. These splits have likely affected the stock's performance over the years.

Here's a breakdown of AMD's recent stock performance:

The company's stock has been surging lately, with a deal with Facebook contributing to its success. In fact, AMD is on pace to close at an all-time high with the biggest percentage increase since July 2020.

Frequently Asked Questions

Is AMD a buy hold or sell?

AMD is a Moderate Buy with 23 buy ratings and 0 sell ratings, indicating a positive outlook. Analysts see significant upside potential, with a 47.39% price target.

How high is AMD stock expected to go?

According to analyst forecasts, AMD stock is expected to reach an average high of $195.07, representing a 59.32% increase from its current price of $122.44. Check the full forecast for more details on the predicted stock price range.

Who owns most of AMD stock?

The largest shareholders of AMD stock include Vanguard Group Inc, BlackRock, Inc., and State Street Corp, among others, holding significant stakes in the company. These institutional investors have substantial influence over AMD's direction and operations.

Is AMD owned by BlackRock?

No, AMD is not fully owned by BlackRock, but BlackRock has a significant stake in the company, holding approximately 7.7% of its shares. BlackRock's ownership is disclosed through a filing with the SEC.

How to invest in advanced micro devices?

To invest in Advanced Micro Devices (AMD), you can buy shares through a brokerage firm or a stock purchase service provider. You cannot buy AMD stock directly from the company.

Featured Images: pexels.com