Subcategories

Articles

What is 1099 Tax Form? Who Needs One & How to File It?

Find out all you need to know about "what is 1099 tax form": who needs it, when and how to file it. Learn the basics of this important IRS form now!

Read More

Uncovering the Secret Tax on Your Bonus: The Bonus Tax Rate

Did you know that your bonus may come with a hidden tax? Learn about the bonus tax rate and how it affects the extra income you receive.

Read More

Unlock the IRS 706 Requirements for Estate Tax Returns!

Learn about IRS 706 requirements for Estate Tax Returns: what are the rules? What documents need to be filed? Get all the details here!

Read More

Unveiling The Benefits of Filing Multiple State Tax Returns

Increase your tax savings! Learn about the benefits of filing multiple state tax returns, from credits to deductions and more.

Read More

LLC Taxed: Should You Choose S Corp or C Corp?

Wondering how to tax your LLC? Weigh the pros and cons of S vs. C Corporations & find out if an llc taxed as an S Corp or C Corp is right for you.

Read More

What is a Tax Nexus? Uncover the Potential Consequences!

Learn what is a tax nexus and why it’s important to your business: the definition, how it applies to you, and its implications. Save on taxes!

Read More

Discover How to Use IRS Form 843 and Claim Your Refund!

Learn about IRS Form 843 and how it can help you get your money back. Discover the easy steps to follow and maximize your refund today.

Read More

Capital Gains Taxes on Property: A Comprehensive Guide

Discover how much are capital gains taxes on property, rates, and deductions in our comprehensive guide for sellers and investors.

Read More

Capital Gains Taxes in Washington State: A Homeowner's Guide

Learn about capital gains taxes in Washington State, including tax rates, exemptions, and reporting requirements to minimize your tax liability.

Read More

Minimizing Capital Gains Taxes on Inherited Property

Learn how to minimize capital gains taxes on inherited property, saving you thousands in taxes and ensuring a smooth inheritance process.

Read More

Capital Gains Taxes UK: A Guide to Payments and Compliance

Learn about capital gains taxes UK, calculate your liability and discover how to pay with our expert guide, covering tax rates, allowances and more.

Read More

Capital Gains Taxes Puerto Rico: Understanding the Tax Code

Understand Puerto Rico's capital gains taxes laws, regulations, and exemptions with expert guidance and tax code explanations.

Read More

Maximizing Irrevocable Trust Taxes Capital Gains Effectively

Learn how irrevocable trust taxes capital gains, minimizing tax liabilities and maximizing wealth transfer for beneficiaries & grantors alike.

Read More

What Is True About Capital Gains Taxes Explained

Discover the truth about capital gains taxes: learn what is true about capital gains taxes and how they work, including tax rates and exemptions.

Read More

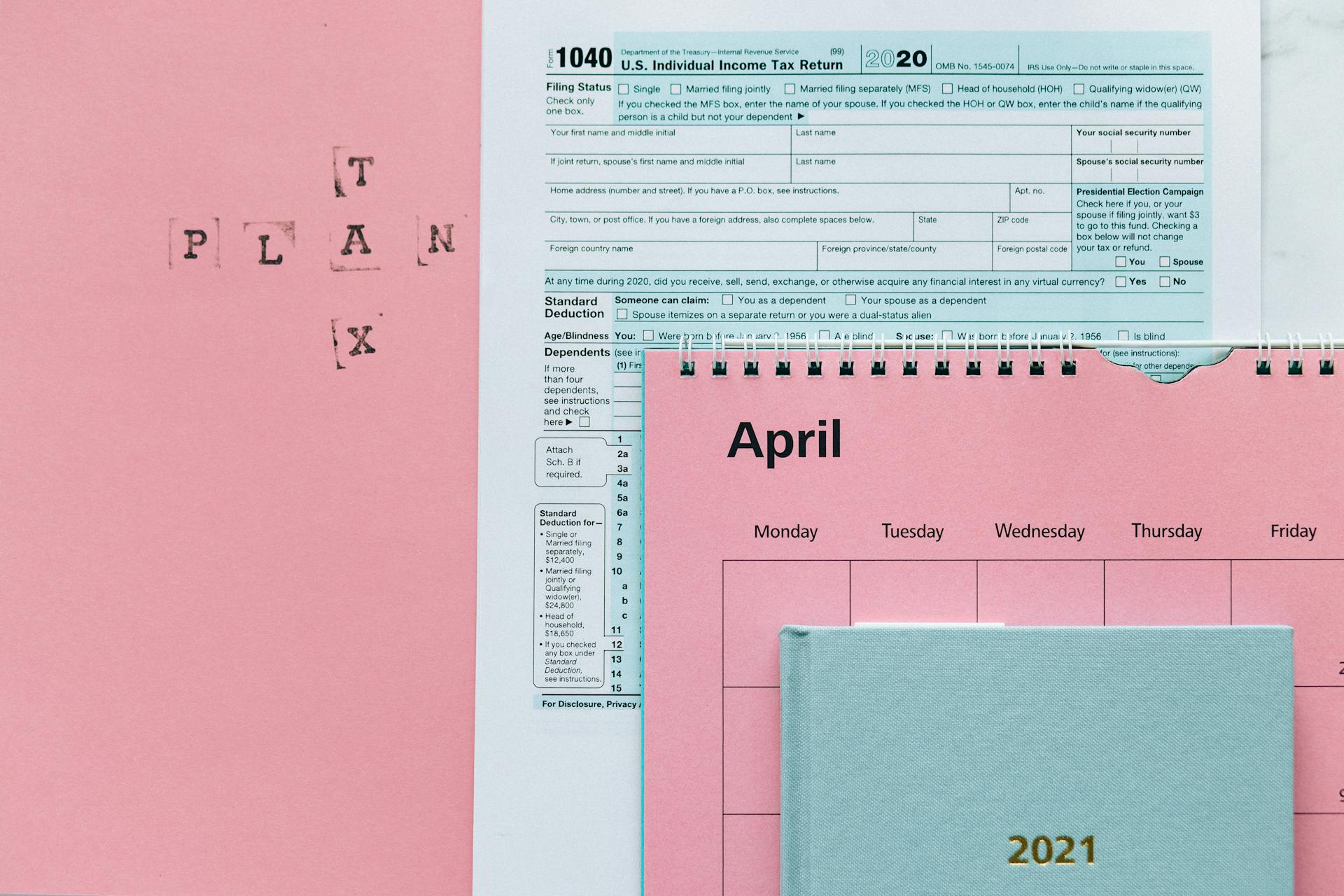

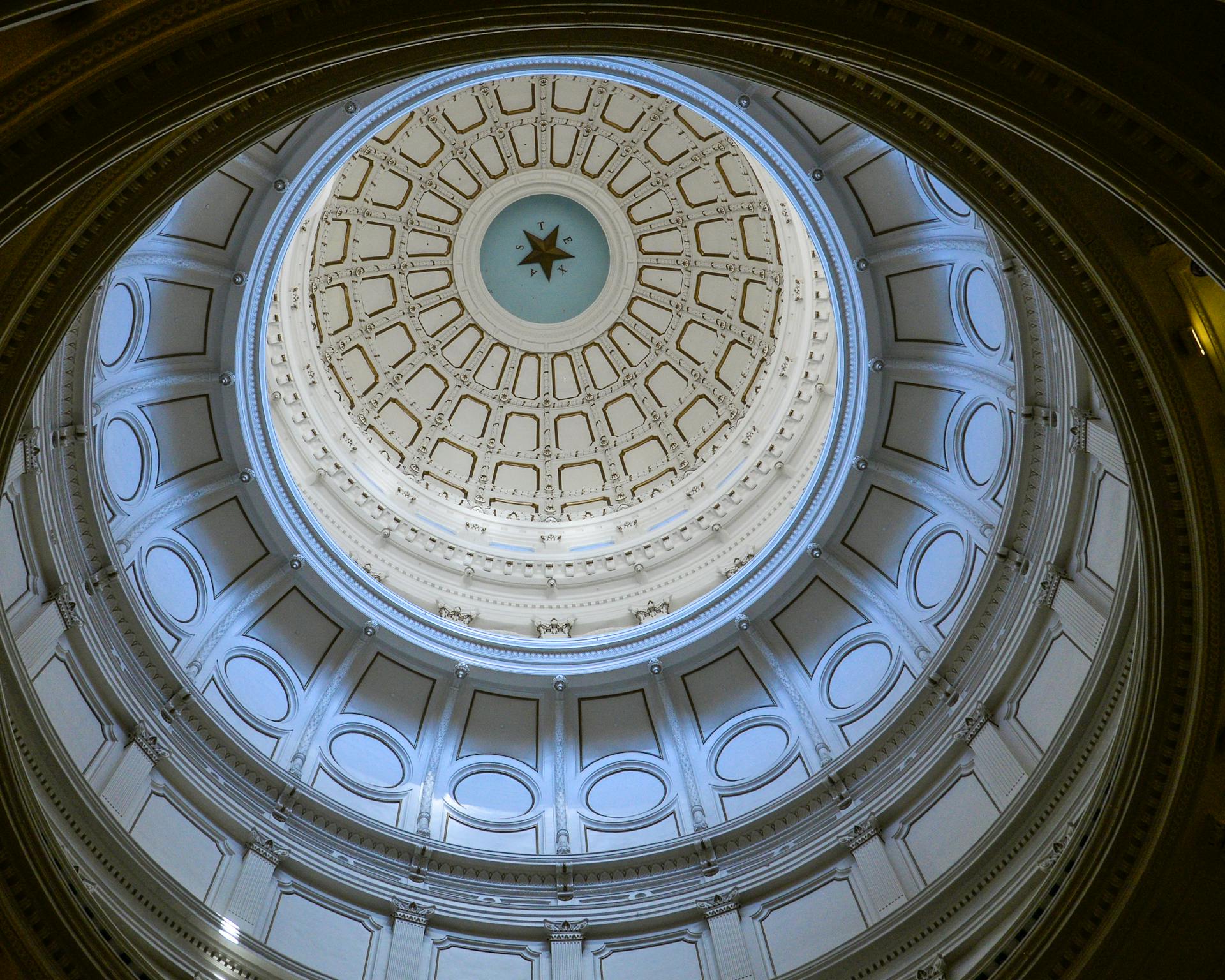

Understanding Capital Gains Taxes in Texas: A Guide

Learn about capital gains taxes in Texas, including tax rates, exemptions, and filing requirements. Get informed and save on your tax bill.

Read More

Navigating Capital Gains Taxes in Florida for Homeowners

Learn about capital gains taxes in Florida, exemptions, and rates. Understand how to minimize taxes on investments, real estate, and more.

Read More

Do You Pay Taxes on Roth IRA Capital Gains? A Tax-Free Guide

Discover how tax laws apply to Roth IRA capital gains. Learn if you owe taxes on withdrawals and investments, including rules and exceptions.

Read More

Canada Capital Gains Taxes Explained Simply and Effectively

Learn about Canada Capital Gains Taxes with our comprehensive guide, covering tax rates, rules, and strategies to minimize your liability.

Read More

Mastering Business Taxes in Texas: A Step-by-Step Guide

Learn about business taxes in Texas, including rates, forms, and deadlines, to ensure compliance and optimize your company's financial health.

Read More

Are High Corporate Income Taxes Bad for Business Growth?

Discover how high corporate income taxes impact business growth and the economy, exploring if higher tax rates stifle innovation and investment.

Read More

Navigating Day Trader Taxes and Investment Income Reporting

Master day trader taxes and investment income with our comprehensive guide, navigating tax laws and deductions for active traders.

Read More

UK Introduces Decimalisation: A New Currency System

Learn about Decimalisation UK, a groundbreaking currency shift for Britain, and how it impacted the country's economy and everyday life.

Read More

Business Taxes in Texas Are Limited to Specific Taxpayers

Discover the specifics of business taxes in Texas Are limited to specific taxpayers and learn how to navigate these regulations effectively.

Read More

Understanding What Are Capital Gains Taxes in California

Discover California capital gains tax laws: what are capital gains taxes in California, rates, exemptions, and tips for tax savings & compliance.

Read More

CGT on Property UK: A Guide to NRCGT Tax Relief Explained

Discover how to navigate CGT on property UK with our comprehensive guide to NRCGT, including key exemptions and tax implications.

Read More

Mastering Business Taxes in the UK: A Comprehensive Guide

Navigate UK business taxes with clarity: learn about tax returns, VAT, PAYE, and more in our comprehensive guide to business taxes in the UK.

Read More

Taxation of Private Equity and Hedge Funds Simplified

Expert guide to Taxation of private equity and hedge funds, covering rules, regulations, and strategies for optimized returns and compliance.

Read More

Mastering Online Business and Taxes: A Complete Tax Guide

Expert guide to navigating online business and taxes: tips, laws, and best practices for successful e-commerce and financial management.

Read More

Texas Corporate Taxes Simplified for Small Business Owners

Learn the basics of Texas corporate taxes, including rates, deductions, and compliance for business owners in the Lone Star State.

Read More

Understanding Michigan Business Taxes: A Comprehensive Guide

Navigate Michigan's complex business tax landscape with our comprehensive guide, covering sales taxes, property taxes, and more.

Read More