nCino Salesforce is a cloud-based banking platform that combines the power of Salesforce with nCino's expertise in banking operations. This powerful tool is designed to help banks streamline their processes and improve customer engagement.

nCino Salesforce integrates with a bank's existing systems to provide a single, unified view of customer relationships and account activity. This allows banks to make more informed decisions and provide better service to their customers.

By leveraging the capabilities of Salesforce, nCino Salesforce enables banks to automate many manual processes, freeing up staff to focus on higher-value activities. This can lead to significant cost savings and improved efficiency.

nCino Salesforce also provides a range of features and tools to help banks enhance their customer experience, including personalized marketing and sales automation.

What is Ncino Salesforce?

Ncino Salesforce is a cloud-based banking platform that combines the power of Ncino's loan origination and servicing software with the flexibility of Salesforce's customer relationship management (CRM) tools.

It's designed to help financial institutions streamline their lending processes and improve customer engagement.

Ncino Salesforce offers a range of features, including loan origination, risk management, and customer relationship management.

This platform is particularly useful for community banks and credit unions that need to manage complex lending processes while providing exceptional customer service.

By integrating Ncino's lending expertise with Salesforce's CRM capabilities, Ncino Salesforce enables financial institutions to automate routine tasks, reduce manual errors, and free up staff to focus on high-value activities.

With Ncino Salesforce, financial institutions can also gain valuable insights into customer behavior and preferences, enabling them to tailor their services and products to meet individual needs.

Key Features

Ncino on Salesforce is a cloud-based platform that offers a range of key features to help financial institutions streamline their processes.

Ncino's integration with Salesforce provides a 360-degree view of customers, allowing users to access all relevant information in one place.

The platform's workflow engine enables organizations to automate complex business processes, reducing manual errors and increasing efficiency.

With Ncino on Salesforce, users can also leverage advanced analytics and reporting capabilities to gain valuable insights into their business operations.

Account Opening

The account opening process can be streamlined and made more user-friendly. Financial institutions can use the nCino platform to allow customers to initiate and complete the process online, eliminating the need for an in-person visit.

This convenience accelerates the account opening process, making it easier for customers to get started. As a result, banks can increase their customer base.

By using the nCino platform, financial institutions can provide a seamless experience for their customers. This can help build trust and loyalty with customers, leading to long-term relationships.

With nCino, customers can complete the account opening process online, saving them time and effort. This is especially helpful for customers who have busy schedules or prefer to do things digitally.

Additional reading: Salesforce Commercial Account Executive West

Analytics and Reporting

Analytics and Reporting is a critical capability of the nCino system. It provides banks with powerful tools to gain insights into their processes and make informed decisions.

nCino's analytics and reporting tools give banks thorough reports on various aspects of their operations, such as loan performance, risk analysis, customer segmentation, and investment profitability. This information enables banks to identify areas of improvement and optimize their strategies.

The platform's advanced analytics capabilities, combined with Salesforce's technology, offer deeper insights into customer behavior, financial trends, and operational efficiency. This level of analysis helps banks to refine their operations and deliver a better customer experience.

Here are some examples of the types of reports that nCino's analytics and reporting tools can provide:

- Loan performance reports

- Risk analysis reports

- Customer segmentation reports

- Investment profitability reports

By leveraging these insights, banks can make data-driven decisions and drive business growth. The ability to analyze and report on various aspects of their operations is a key benefit of the nCino system.

Personalized Customer Experiences

Personalized Customer Experiences are crucial in today's banking industry. nCino's platform offers a range of powerful benefits designed to modernize and streamline banking operations, including enhanced customer relationship management.

The combination of Salesforce's customer-centric approach with nCino's specialized banking services allows for the creation of personalized banking experiences for customers, enhancing satisfaction and loyalty. This is made possible by having a more complete picture of the consumer.

Regions Bank has adopted nCino's technology to support its efforts in delivering an industry-leading customer experience. The platform has enabled the bank to offer its clients a responsive, digital, and insightful experience.

Here are some key features that enable personalized customer experiences:

- Customer Relationship Management (CRM) tool to easily navigate customer data, track interactions, and understand customer requirements.

- Ability to offer personalized service offerings and increase customer loyalty.

- Enhanced customer-centric approach to create personalized banking experiences for customers.

Solarity Credit Union has used nCino to make changes and track how those changes are affecting performance, providing invaluable insights to the institution. This has helped them improve Return on Assets (ROA) and Return on Equity (ROE).

Collaboration Expansion

The collaboration expansion between Salesforce and nCino is a significant development in the financial services industry.

They've extended their successful partnership up to 2031, building on their fruitful relationship that began in 2011.

This extended alliance is a clear indication of the successful synergy between Salesforce and nCino, integrating Salesforce's advanced CRM and AI capabilities with nCino's specialized cloud banking platform.

Their partnership is setting new standards for efficiency, customer engagement, and regulatory compliance in banking.

With this extended partnership, Salesforce and nCino are poised to empower financial institutions worldwide further.

They're dedicated to delivering solutions that meet current demands and are scalable and adaptable to future challenges and opportunities.

This long-term collaboration is expected to usher in a new wave of innovation and efficiency, cementing their position as leaders in the field and shaping the future of digital banking.

Benefits and Advantages

nCino Salesforce offers a range of powerful benefits designed to modernize and streamline banking operations. These benefits enhance the efficiency of financial institutions and greatly improve the customer experience.

The platform excels in unifying the mortgage experience, connecting financial institutions, third parties, and borrowers on a singular, streamlined platform. This unity eradicates time-consuming manual tasks, speeds up account opening, and facilitates easier lending procedures.

nCino's cloud technology improves interactions between customers and bank employees, leading to improved account openings, shortened loan closing times, and enhanced operational efficiency. This is achieved by minimizing data entry chores and decreasing delinquency rates.

With nCino's CRM tool, banks can easily navigate customer data, track interactions, and understand customer requirements. This leads to more effective cross-selling opportunities and personalized service offerings, which ultimately increase customer loyalty.

Here are some key benefits of nCino Salesforce:

- Optimizes entire range of commercial banking operations, from customer onboarding to loan origination and portfolio management.

- Synchronizes operations across the front, middle, and back-office, leading to faster credit delivery and improved risk assessments.

- Enhances customer experience through unified mortgage experience, account openings, and lending procedures.

Technical Aspects

Ncino on Salesforce is a cloud-based platform that integrates the Salesforce Financial Services Cloud with Ncino's loan origination and servicing system. It's designed to streamline the lending process for financial institutions.

Ncino's platform uses Salesforce's Einstein AI technology to automate tasks and improve decision-making. This integration enables financial institutions to access a 360-degree view of their customers and make more informed lending decisions.

The platform's technical aspects are built on a scalable and secure architecture, ensuring high performance and reliability.

Complexity of Customization

Customization is a double-edged sword - it offers banks the freedom to tailor nCino to their specific needs, but it also makes automation testing more challenging.

nCino's flexibility allows for a wide range of custom workflows, user jobs, and integrations with other banking systems, which can be very different from one institution to another.

This complexity can be overwhelming, but it can be managed with a modular testing system that allows test parts to be reused, reducing the need for extensive rewriting.

Using data-driven testing methods can also help keep track of the various test cases and setups, making it easier to adapt to different customization needs.

By setting up a modular testing system and using data-driven testing, banks can efficiently test and deploy nCino, even with complex customizations.

Integration

Integration is a key aspect of nCino's capabilities, particularly when paired with Salesforce. This integration streamlines banking processes, reducing turnaround times for customers.

By leveraging the power of Salesforce, nCino's loan origination, processing, and account opening capabilities become even more efficient. Automatic tests, however, require special tools to handle Salesforce's changing features and security measures.

To overcome this challenge, test automation tools specifically designed for Salesforce systems are used. These tools need to be updated regularly to keep pace with Salesforce's release cycle.

The integration of nCino with other Salesforce solutions offers numerous benefits. For instance, a unified customer view is achieved by integrating nCino with Salesforce Financial Services Cloud.

This integration enables businesses to provide a personalized and connected customer experience. A list of benefits includes:

- Unified Customer View: Gain a unified view of each customer throughout their entire banking and lending journey.

- Enhanced Marketing Capabilities: Run marketing campaigns based on core data such as financial accounts, loans, and deposits.

- Improved Operational Efficiency: Manage all banking operations from a single platform, eliminating the need for multiple systems.

- Increased Customer Satisfaction and Loyalty: Provide a streamlined and connected customer experience, driving customer satisfaction and loyalty.

By combining Salesforce's CRM expertise with nCino's banking operations platform, financial institutions can manage customer relationships and banking processes seamlessly in one place.

Test Environment Scalability

Test Environment Scalability is crucial for banks using nCino, as it needs to grow along with the increasing demand for testing.

As banks use nCino more, testing needs to be done on a bigger scale, which can be challenging to manage, especially when trying to make sure that test environments are very similar to production settings.

Using test automation tools in the cloud that can grow or shrink based on the testing requirements is a solution to this challenge. These platforms enable creating one-time test settings that can be quickly set up and taken down after use.

This approach saves banks money and time, as they don't have to invest in setting up and maintaining multiple test environments.

Updated

Imagine a world where banking is as effortless as ordering your favorite coffee online. This isn't a glimpse into a distant future; it's the reality shaping up today, thanks to the revolutionary combination of nCino and Salesforce.

Streamlining deployment and faster go-live times are crucial for complex systems like nCino, allowing banks to reduce the time from software implementation to go-live.

Automating testing processes can significantly reduce the time from software implementation to go-live, enabling banks to benefit from nCino's features sooner.

By automating testing, banks can deploy systems quickly and efficiently, improving operational capabilities and customer service without prolonged disruptions.

With nCino's CRM tool, banks can easily navigate customer data, track interactions, and understand customer requirements, leading to more effective cross-selling opportunities and personalized service offerings.

This leads to increased customer loyalty, as banks can offer tailored services that meet their customers' needs.

By combining Salesforce's CRM expertise with nCino's banking operations platform, financial institutions can manage customer relationships and banking processes seamlessly in one place.

This connection provides a more complete picture of the customer, enabling enhanced service and customization.

Here are some key benefits of the nCino and Salesforce partnership:

- Personalized, efficient services in financial institutions

- Efficiency and satisfaction through the shift from traditional to digital banking

- Data security and risk management in banking

- Opening new markets and broadening customer reach for banks

Frequently Asked Questions

What does the nCino do?

nCino provides a platform that helps financial institutions make better decisions, manage risks, and improve customer satisfaction with tailored solutions. It brings people and data together to create personalized experiences that meet their unique needs.

How to install nCino in Salesforce?

To install nCino in Salesforce, log in to Salesforce, navigate to Setup, and search for "App Manager". From there, follow the next steps to successfully install nCino.

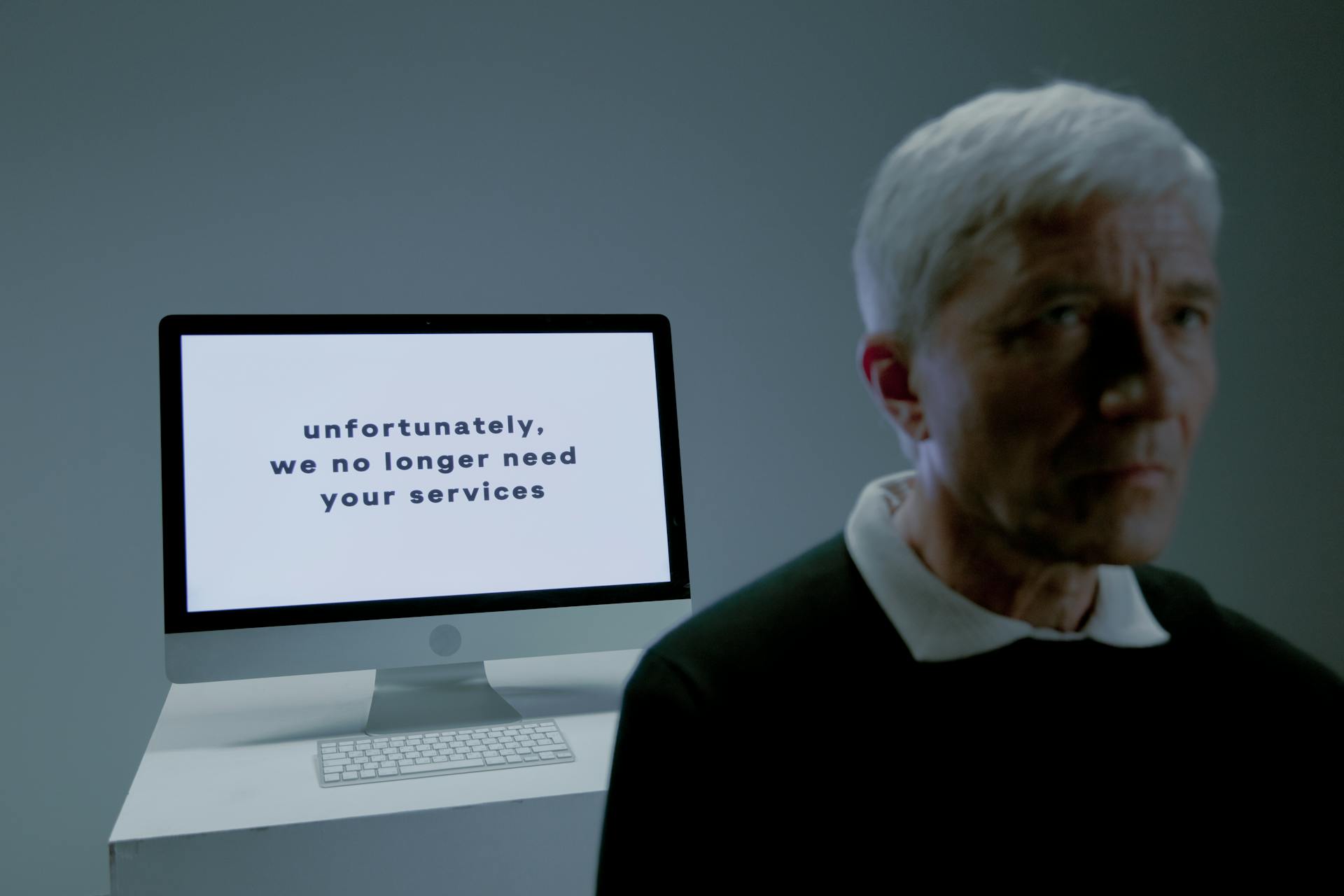

Featured Images: pexels.com