Ncino's stock has experienced significant growth, with a 52-week high of $43.20 and a 52-week low of $23.50.

The company's financial performance has been strong, with revenue increasing by 25% in 2020.

Ncino's market capitalization has grown to over $2 billion, reflecting investor confidence in the company's future prospects.

Investors have been encouraged by the company's ability to expand its customer base and increase its market share in the financial services industry.

If this caught your attention, see: Canaccord Financial Stock

Company News

nCino has announced a significant appointment in their EMEA region, naming Joaquín de Valenzuela as the new Managing Director. He brings extensive experience in leading cross-functional teams and driving revenue growth for tech and fintech companies.

nCino's presence in the EMEA region is expected to accelerate with de Valenzuela's appointment. He previously held roles at Temenos and Salesforce, where he led teams and drove business growth.

See what others are reading: What Is Ncino Salesforce

Sean Desmond Appointed President and CEO

Sean Desmond has been appointed as the new President and Chief Executive Officer of nCino, effective immediately. He succeeds Pierre Naudé, who will transition to Executive Chairman of the Board.

Desmond joined nCino in 2013 and has been instrumental in managing a significant portion of the company's employees, including serving as Chief Customer Success Officer. He has also played a key role in driving product innovation through data and AI.

The appointment follows a comprehensive Board-led succession planning process that evaluated both external and internal candidates. Desmond's experience in scaling multinational organizations and driving product innovation will undoubtedly be valuable assets to the company.

Chris Gufford will succeed Desmond as Chief Product Officer, bringing his expertise in commercial banking to the role.

A unique perspective: Is Simple Mobile a Good Company

Joaquín De Valenzuela, EMEA Managing Director

nCino has appointed Joaquín de Valenzuela as the new Managing Director for the EMEA region.

De Valenzuela brings extensive experience in leading cross-functional teams and driving revenue growth for tech and fintech companies.

He previously held roles such as EVP, Chief Digital and Business Operations Officer at Temenos and Head of Financial Services in EMEA and LATAM for Salesforce.

Charlie McIver, the former EMEA Managing Director, has transitioned to a position focusing on EMEA strategic operations.

This strategic appointment aims to accelerate nCino's growth and market presence in EMEA.

De Valenzuela's experience will be crucial in achieving this goal.

On a similar theme: Salesforce Ncino

About NCNO

nCino, Inc. is a software-as-a-service company that provides cloud-based software applications to financial institutions in the US and internationally. Its platform connects employees, clients, and third parties on a single cloud-based platform.

The company's nCino Bank Operating System is a powerful tool that includes client onboarding, deposit account opening, loan origination, and an end-to-end mortgage suite. These features help financial institutions streamline their operations and improve customer service.

nCino's platform utilizes data analytics and artificial intelligence to provide its clients with valuable insights and tools to make informed decisions. This technology helps financial institutions stay ahead of the competition and adapt to changing market conditions.

Consider reading: Saas Billing Software

Investor Information

nCino is a leading provider of intelligent banking solutions, listed on the NASDAQ under the ticker symbol NCNO.

The company has announced its participation in two upcoming investor conferences. It will present at the Scotiabank Second Annual Global Technology Conference on Tuesday, December 10, at 12:45 p.m. ET, and at the Barclays 22nd Annual Global Technology Conference on Wednesday, December 11, at 6:05 p.m. ET.

A live webcast of the Barclays presentation will be accessible through the company's Investor Relations website.

Upcoming Investor Conferences

nCino will participate in two upcoming investor conferences, the Scotiabank Second Annual Global Technology Conference and the Barclays 22nd Annual Global Technology Conference.

The Scotiabank conference will take place on Tuesday, December 10, at 12:45 p.m. ET, where nCino will present its intelligent banking solutions.

A live webcast of the Barclays presentation, which will be held on Wednesday, December 11 at 6:05 p.m. ET, will be accessible through nCino's Investor Relations website.

nCino is a leading provider of intelligent banking solutions, with a strong presence in the global technology sector.

The company's participation in these conferences is a testament to its commitment to engaging with investors and sharing its vision for the future of banking.

For your interest: Banking as a Service Platform

Shareholder Returns

As an investor, it's essential to understand how your investments are performing compared to the industry and market as a whole. NCNO, for example, has shown a 7-day return of 0.7% and a 1-year return of 11.1%.

The US Software industry, on the other hand, has seen a 1-year return of 12.4%. This means NCNO has underperformed the US Software industry over the past year.

Let's take a closer look at the performance of NCNO compared to the US Market. Over the past year, the US Market has returned 23.1%, while NCNO has returned 11.1%. This indicates that NCNO has underperformed the US Market as well.

Here's a summary of the returns:

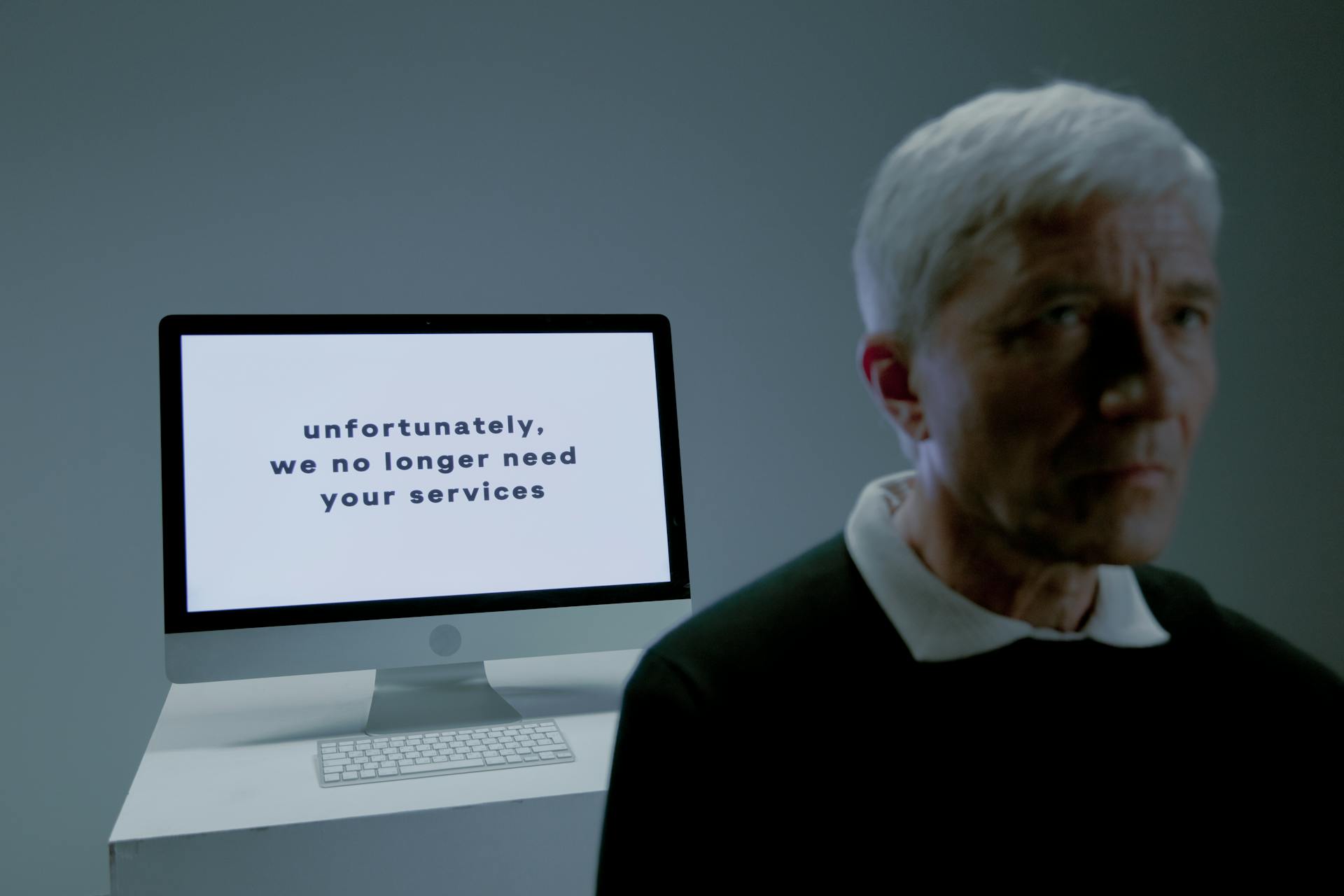

A Painful Day Reinforces Investor Problems

nCino, Inc. shares plummeted 13% due to lower-than-expected GAAP earnings and third-quarter revenue guidance.

This steep decline in shares is a clear indication that investors are facing significant challenges with the company. The drop is a stark reminder of the risks involved in investing in the stock market.

nCino's lower-than-expected GAAP earnings and third-quarter revenue guidance are the primary reasons for the decline. Despite higher-than-expected revenue and adjusted EPS for Q2 2025, the company's future outlook is uncertain.

Investors are likely feeling the pinch of this unexpected news, and it's essential to stay informed about the company's performance. The company remains under scrutiny, and its investors are waiting with bated breath for a turnaround.

You might like: Investors in the Stock Market

Frequently Asked Questions

Is nCino a buy?

According to 14 Wall Street analysts, nCino has a Moderate Buy consensus rating, indicating a neutral to positive outlook. However, individual opinions may vary, and it's worth exploring the analysts' ratings and recommendations for a more detailed understanding.

Does Salesforce own nCino?

nCino is a separate company from Salesforce, but they have a long-standing partnership since 2012. nCino's independence is confirmed by its own filings with the Securities and Exchange Commission in 2020.

How big is nCino?

nCino's total revenue is estimated to be between $126-127 million, with subscription revenues making up a significant portion of that amount. This significant revenue milestone highlights nCino's growth and success in the industry.

Featured Images: pexels.com