Credit cards with chip and pin technology have become the norm in recent years, and for good reason. They offer a more secure way to make transactions compared to traditional magnetic stripe cards.

The chip embedded in the card stores your account information, making it more difficult for thieves to clone your card. This added layer of security is a major advantage.

To use a chip and pin card, you simply insert the card into a terminal and enter your pin number. This process is quick and easy, and it's becoming increasingly common in stores and restaurants.

The chip and pin technology also helps to reduce the risk of card skimming, which is a common problem with traditional magnetic stripe cards.

Consider reading: Capital One Bank Credit Card Pin

What Is a Chip Card?

A chip card is a type of credit card that requires the cardholder to authorize the transaction by entering their personal identification number (PIN).

Chip cards are less susceptible to fraud than previous generations of credit cards.

They're designed to be more secure, making them a great option for those who want to protect their financial information.

History and Implementation

The introduction of chip and pin technology revolutionized the way we make credit card transactions. Until then, all face-to-face transactions involved a magnetic stripe or mechanical imprint to read and record account data, and a signature for identity verification.

The use of signatures as a verification method had several security flaws, including the ease with which cards could be stolen and the forgery of correct signatures. The invention of the silicon-integrated circuit chip in 1959 led to the idea of incorporating it onto a plastic smart card in the late 1960s.

The first standard for smart payment cards was the Carte Bancaire B0M4 from Bull-CP8 deployed in France in 1986, followed by the B4B0' in 1989. EMV, which stands for Europay, Mastercard, and Visa, was designed to allow cards and terminals to be backwardly compatible with these standards.

EMVCo, a consortium of financial companies, now manages the standard. The top vendors of EMV cards and chips are: ABnote, CPI Card Group, IDEMIA, Gemalto, Giesecke & Devrient, and Versatile Card Technology.

Here are the key players in the EMV standard:

History

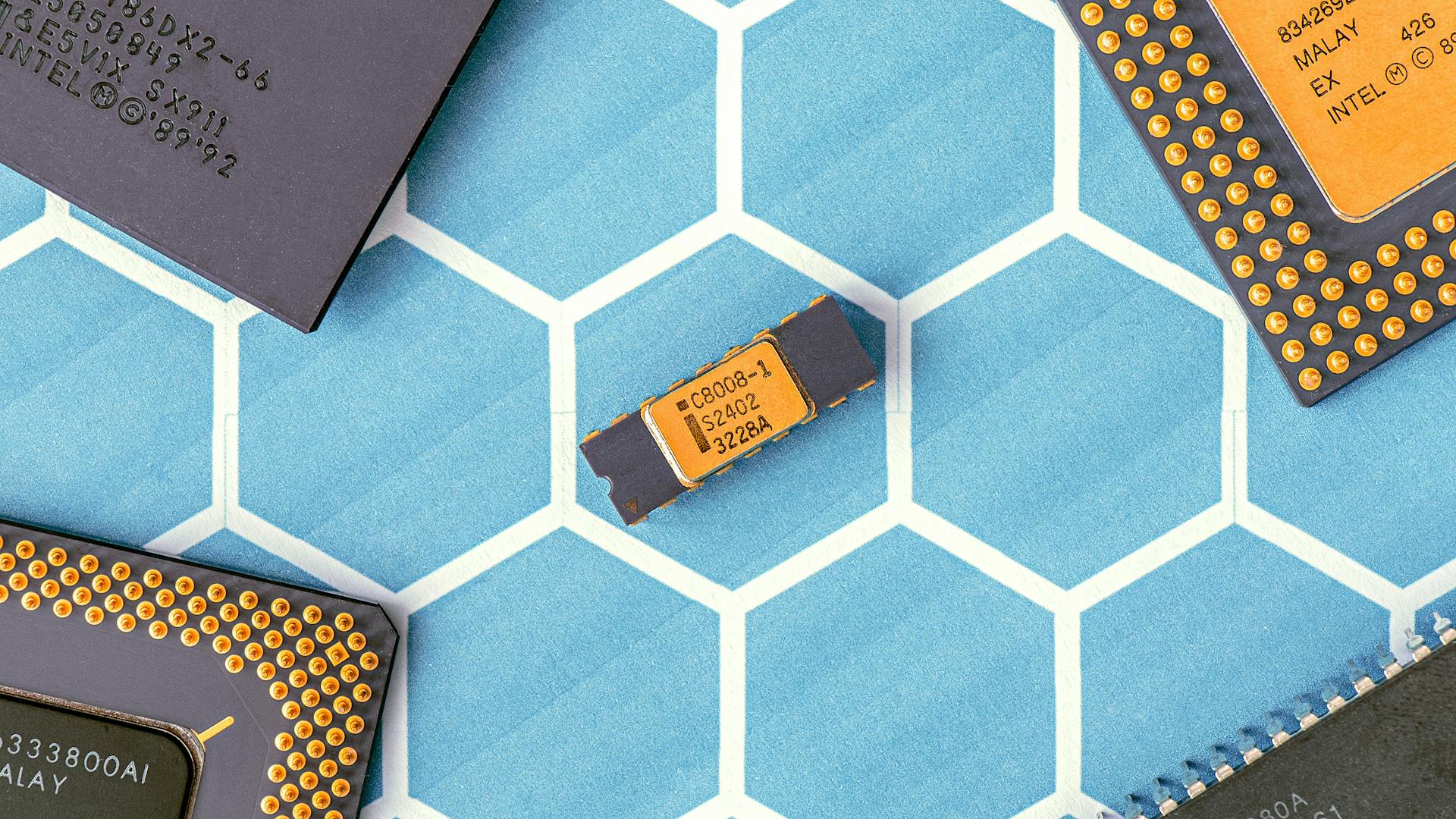

The history of chip & PIN technology is a fascinating story that dates back to the late 1960s. Two German engineers, Helmut Gröttrup and Jürgen Dethloff, invented the idea of incorporating a silicon-integrated circuit chip onto a plastic smart card.

The first smart cards were introduced as calling cards in the 1970s, before being adapted for use as payment cards. The earliest smart cards used MOS integrated circuit chips and memory technologies like flash memory and EEPROM.

In the 1980s, France led the way in adopting smart payment cards, deploying the Carte Bancaire B0M4 standard in 1986 and the B4B0' standard in 1989. This was followed by the introduction of EMV, a standard created by Europay, Mastercard, and Visa to allow cards and terminals to be backwardly compatible with these earlier standards.

The EMV standard has undergone significant changes over the years, with JCB joining the consortium in 2009, China UnionPay in 2013, and Discover in 2013. Today, the standard is managed by EMVCo, a consortium with control split equally among six major payment companies.

Curious to learn more? Check out: Emv Chip and Pin Credit Cards

Implementation

EMV, or Europay, Mastercard, and Visa, has a long history of implementation. The standard is now managed by EMVCo, a consortium of financial companies.

Visa and Mastercard have developed standards for using EMV cards in devices to support card not present transactions (CNP) over the telephone and Internet. Mastercard's implementation is known as EMV-CAP and supports a number of modes.

The EMV standard has been widely adopted, with additional widely known chips including AEIPS: American Express, UICS: China Union Pay, J Smart: JCB, D-PAS: Discover/Diners Club International, Rupay: NPCI, and Verve.

A liability shift has been implemented in many countries, where the ATM or merchant's point of sale terminal is liable for fraudulent transactions if they do not support EMV.

The liability shift dates vary by country and card network. Here are some key dates:

It's essential to note that not all countries or card networks have implemented the liability shift. If you're traveling, it's a good idea to check with your bank or card issuer to see if your card will be accepted in the countries you plan to visit.

Versions

The EMV standard has undergone significant upgrades over the years, with the first version, EMV 2.0, emerging in 1995.

EMV 2.0 was later upgraded to EMV 3.0 in 1996, also known as EMV '96. This marked a notable improvement in the standard.

By 1998, EMV 3.1.1 was in effect, with further amendments to the standard. EMV 4.0 was introduced in December 2000 and became effective in June 2004.

Version 4.1 of the EMV standard was implemented in June 2007. This was followed by the introduction of Version 4.2 in June 2008.

Version 4.3, the latest in the series, was put into effect in November 2011.

Benefits and Differences

Credit cards with chip and pin offer enhanced security, making them a safer choice for transactions. This is because the chip on the card stores the card details, making it harder for thieves to obtain your sensitive information.

The chip and pin technology also reduces the risk of card skimming, a common issue with traditional magnetic stripe cards. Card skimming occurs when a thief attaches a device to an ATM or payment terminal to steal your card details.

Chip and pin cards are widely accepted, making them a convenient choice for travel and online shopping. In fact, many online retailers now require chip and pin cards for transactions.

The chip on the card is also more difficult to replicate than a magnetic stripe, making counterfeit cards less likely. This added security feature provides peace of mind for cardholders.

Chip and pin cards can also be used to make contactless payments, which can be faster and more convenient than traditional chip and pin transactions.

For your interest: Quickbooks Online Payments Bank to Bank

Security and Liability

The EMV liability shift deadlines were set to protect merchants from financial losses due to card-present fraud. This shift was implemented to encourage the adoption of EMV chip technology.

American Express, Discover, MasterCard, and Visa all have similar liability shift deadlines. These deadlines were set for October 1, 2015, with an exception for gas stations, which had an additional year to comply.

Here's a breakdown of the liability rules for each card network:

By understanding these liability rules, merchants can take steps to protect themselves from financial losses due to card-present fraud.

2010: PIN Checking Disabled on Stolen Card

In 2010, PIN checking was disabled on stolen cards, allowing thieves to withdraw cash without entering a PIN.

This change was made to prevent card skimming, a common technique used by thieves to steal card information.

As a result, card issuers had to rely on other security measures to prevent unauthorized transactions.

Card issuers began to use more advanced security features, such as chip technology, to secure transactions.

These new security measures were more difficult for thieves to bypass, making it harder for them to commit card fraud.

Consumers were also advised to monitor their accounts closely for any suspicious activity.

By doing so, they could quickly report any issues to their card issuers and prevent further unauthorized transactions.

Pin Harvesting

PIN harvesting is a serious security threat that can compromise your financial information.

In 2011, researchers uncovered a vulnerability in EMV that allowed arbitrary PIN harvesting despite the cardholder verification configuration of the card.

A chip skimmer can be used to perform PIN harvesting, even when the supported CVMs data is signed.

The Cambridge University researchers demonstrated an attack in 2008 that allowed them to obtain both card data to create a magnetic stripe and the PIN.

APACS disagreed with the majority of the report, saying the attack was difficult to undertake and not currently economically viable for a fraudster.

However, NCR Corporation security researchers showed in 2016 how credit card thieves can rewrite the code of a magnetic strip to make it appear like a chipless card, which allows for counterfeiting.

Terminal Risk Management

Terminal risk management is a crucial step in the payment processing process that helps determine whether a transaction should be authorized online or offline. It's only performed in devices where there's a decision to be made, such as when a transaction amount exceeds an offline ceiling limit.

Transactions that exceed this limit should be processed online. This limit is set by the card issuer, and it's essential to check it against the transaction amount to ensure the transaction is processed correctly.

You might enjoy: Credit Union Credit Cards Online

A hot card list is used to check against a card's status, and this is only necessary for offline transactions. If the card is on the list, the terminal will set the appropriate bit in the terminal verification results (TVR).

The terminal verification results (TVR) are used to determine the outcome of a transaction, and they're set based on the results of the terminal risk management checks. If any of these tests are positive, the terminal will set the appropriate bit in the TVR.

Discover more: Square Terminal Tap Pay

Liability Shift Deadlines

The liability shift deadlines for EMV technology are crucial to understand for businesses and individuals alike. Here are the key dates to keep in mind.

The American Express liability shift deadline is October 1, 2015, with an additional deadline of October 1, 2017 for gas stations. Discover and MasterCard also have the same deadlines, with no distinction for gas stations.

The Visa liability shift deadline is October 1, 2015, with the same additional deadline of October 1, 2017 for gas stations. It's essential to note that Visa's liability shift is based on the party causing a chip-on-chip transaction not to occur.

Here's a summary of the liability shift deadlines for each card network:

Featured Images: pexels.com