A brokerage account deficit occurs when the value of your investments falls below the amount you've deposited into your account. This can happen due to market fluctuations, fees, or poor investment choices.

The main cause of a brokerage account deficit is the difference between the value of your investments and the amount you've deposited. This difference can be attributed to various factors such as market downturns, trading fees, or investment losses.

In some cases, a brokerage account deficit can be a result of excessive trading, which can lead to higher fees and lower investment returns. This is because frequent buying and selling can incur significant costs, eating into your account balance.

To avoid a brokerage account deficit, it's essential to set clear investment goals and stick to a well-thought-out strategy. This can help you make informed decisions and minimize unnecessary fees and losses.

What Is a Brokerage Account

A brokerage account is essentially a place to store and manage your money for investing in stocks, options, or cryptocurrencies. You can think of it like a bank account, but instead of just earning interest, you can use the money to buy and sell investments.

Discover more: Withdrawing Money from Brokerage Account Taxes

Buying power is the amount of money you can use to make trades on a brokerage account, and it can come from your cash balance, margin balance, or instant deposits. You can use this buying power to buy stocks, options, or cryptocurrencies.

A brokerage account can be a powerful tool for growing your wealth over time, but it requires some knowledge and discipline to use effectively.

Related reading: What Brokerage Account Should I Use

Understanding the Deficit

A Robinhood account deficit can happen to anyone, even if you're not using margin. It's not just a matter of having a low balance, but rather a specific situation where your account balance becomes negative.

The most common reason for a deficit is when you're charged a fee, such as the gold account fee, and you have $0 or insufficient funds in your brokerage cash balance. This can lead to Robinhood deducting the fee from your brokerage cash balance, leaving your account balance negative.

A different take: Financial Advisor Fee Structure

If you're hit with a deficit, you won't be able to perform any transactions on your account until you've cleared the deficit by making a deposit into your account and clearing the negative brokerage cash balance.

A deficit can also occur due to American depositary receipt fees being deducted from your brokerage cash balance if your cash balance is $0 or below the charged fee. This will leave your balance negative, leading to a deficit.

To avoid a deficit, it's essential to be aware of the upcoming bills that may be charged by Robinhood and plan accordingly. This can help you have enough funds in your brokerage cash balance to cover the fee, or make a deposit when your account is charged.

Here's an interesting read: Webull Minimum Deposit

Fees and Charges

If you're charged a fee and you don't have enough brokerage cash in your account to cover it, you may have an account deficit.

Robinhood Gold fees can be charged monthly based on your margin usage and tier level, causing your account to show a deficit if you don't have enough funds to cover them.

On a similar theme: If You Don't Have Comprehensive Insurance

These fees can be found in the app under History.

You can also incur fees associated with American Depositary Receipts (ADRs), which can range from $0.01 to $0.03 per share, depending on the ADR.

These fees are deducted from your buying power, causing your account to show a deficit if you don't have enough funds to cover them.

You can find information about your past Robinhood Gold fees and interest payments in the app in History, as well as information about your next Gold billing cycle in the Account Overview.

A fresh viewpoint: Is Cash App a Brokerage Account

Managing the Deficit

You can resolve an account deficit by depositing funds or closing positions.

To reverse an account deficit, you need to make an instant deposit into the account. You can use Robinhood's instant deposit feature to deposit up to $1000 into your Robinhood account to reverse the account deficit.

It may take up to 5 business days for your deposit to be fully processed by Robinhood after performing an instant deposit. After the instant deposit has been confirmed and your funds have been settled, it'll take up to 2 business days for the account deficit to be deducted from the deposit made.

This means you'll need to wait a total of up to 7 business days for the account deficit to be resolved after making an instant deposit.

A fresh viewpoint: Minimum Deposit for Interactive Brokers

Options Margin Requirements

Options margin requirements can be a complex topic, but I'll break it down simply.

Your country of legal residence, the exchange where you want to trade, and the product(s) you want to trade all play a role in determining your margin requirements.

To determine your margin requirements, you'll need to consider the following factors: your country of legal residence, the exchange where you want to trade, and the product(s) you want to trade.

The exchange where you want to trade is a key factor in determining your margin requirements.

Not all products listed may be marginable for every location. Your account may be subject to additional house requirements and/or an exposure fee.

Here's a summary of the factors that affect your margin requirements:

Industry-leading commissions and low margin rates are available for professionals, according to StockBrokers.com.

Fees and Reversals

Robinhood Gold fees can cause an account deficit if you're charged a monthly fee based on your margin usage and tier level, and you don't have enough buying power to cover it.

These fees can be checked in the app under History.

If you hold American Depositary Receipts (ADRs), you may have to pay occasional service fees to the depositary bank, ranging from $0.01 to $0.03 per share, which can also cause an account deficit.

ACH reversals can also lead to an account deficit if your bank transfer is reversed, reducing your buying power and potentially causing a deficit.

To avoid this, make sure you have enough funds in your bank account to cover your ACH transfers and avoid canceling or reversing them after using Instant Deposits.

On a similar theme: How to Avoid Taxes on Brokerage Account

Fees and Reversals

You can experience a Robinhood account deficit if you're being charged a fee and you don't have enough funds to pay it back. This is why your account balance might show a negative balance and prompt you to make a deposit to clear the deficit.

The most common fee that triggers an account deficit is the Robinhood Gold fee. This fee is associated with American Depository Receipts (ADRs).

If this caught your attention, see: Is Robinhood a Brokerage Account

If you don't pay back the deficit, your account might be locked or Robinhood may be forced to sell your securities or stocks without your approval. This can be a serious situation, so it's essential to address the deficit promptly.

If you can't pay back the deficit, Robinhood may be forced to block your trading account and remove your account from its database. This is why it's crucial to keep your account balance positive and up-to-date.

To avoid this, you need to pay back your deficit by making a deposit into your account, which will automatically deduct the deficit from your balance.

If this caught your attention, see: Transfer Brokerage Account to Robinhood

ACH Reversals with Instant Deposit

ACH Reversals with Instant Deposit can be a real hassle. If your ACH transfer is reversed, your buying power will be reduced by the amount of the reversed deposits.

Make sure you have enough funds in your bank account to cover your ACH transfers. This will prevent account deficits from arising due to reversed deposits.

If your ACH transfer is reversed after using Instant Deposits, you may end up with an account deficit. Instant Deposits can be used immediately to buy stocks, options, or cryptocurrencies, but if the ACH transfer is reversed, the funds used will be subtracted from your buying power.

Avoid canceling or reversing ACH transfers after using Instant Deposits to avoid account deficits. This will help you avoid any potential financial issues.

Customer Impact

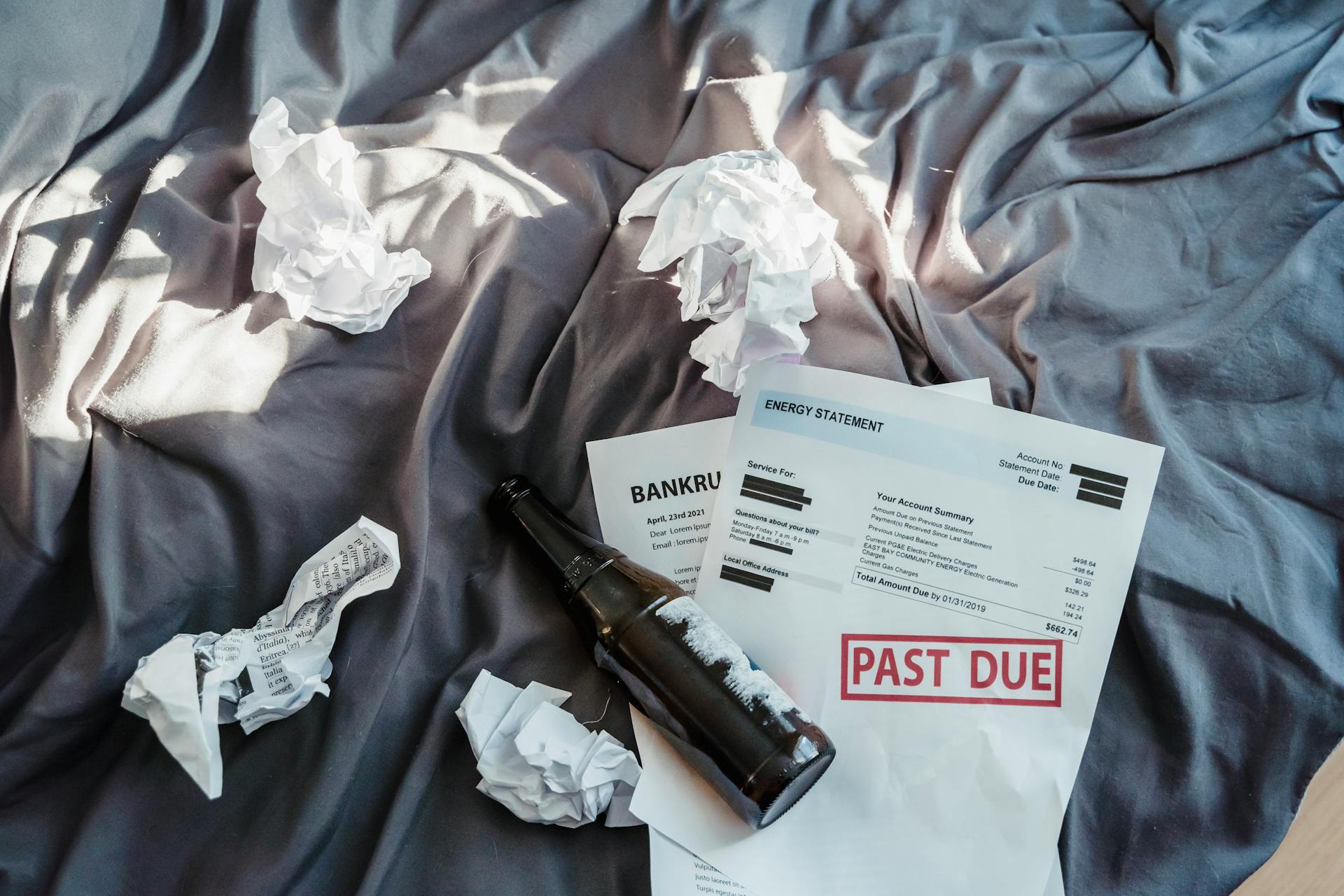

The brokerage account deficit is having a significant impact on customers.

Many customers are struggling to meet their financial goals due to the deficit, with some reporting a decline in their overall savings.

A recent survey found that 75% of customers are feeling stressed about their financial situation.

The deficit is also affecting customers' ability to invest in the future, with 60% of respondents indicating that they are delaying retirement savings.

Customers are being forced to dip into their emergency funds to cover expenses, which is not a sustainable long-term solution.

As a result, customers are experiencing increased financial anxiety and decreased confidence in their financial planning.

Broaden your view: Custodial Bank Account for Minors

Sources

- https://haikhuu.com/education/robinhood-account-defecit

- https://techcrawlr.com/robinhood-account-deficit-why-it-happens-how-to-avoid-it/

- https://robinhood.com/us/en/support/articles/why-do-i-have-an-account-deficit-no-margin/

- https://www.interactivebrokers.com/en/trading/margin-requirements.php

- https://www.tbsnews.net/economy/stocks/brokerage-customer-account-deficit-dwindles-tk48cr-over-tk500cr-635258

Featured Images: pexels.com