Paper trading is a fantastic way to get a feel for the markets without risking any real money. You can practice trading with virtual money, which is great for beginners.

To get started with Zerodha paper trading, you'll need to open a Zerodha account, which can be done in just a few minutes online.

Zerodha offers a free paper trading facility, allowing you to trade with virtual money. This means you can practice trading without any financial risk.

You can start with a small virtual amount of money, such as ₹10,000, to begin your paper trading journey.

A fresh viewpoint: How Do Day Traders Make Money

Getting Started

To get started with zerodha paper trading, it's essential to start small. Begin with small trades to minimize risk and gradually increase the trade size as you gain confidence and experience.

Understanding Paper Trading

Paper trading is a simulated market where you can practice buying and selling without any financial risk. It's a vital tool for both novice and experienced traders to test strategies, understand market dynamics, and get a feel for the trading platform.

On a similar theme: Ibkr Pre Market

The key benefits of paper trading include:

- Risk-Free Environment: No financial risk involved.

- Strategy Testing: Evaluate the effectiveness of trading strategies.

- Skill Building: Enhance trading skills without the pressure of real money.

Paper trading allows you to practice buying and selling financial instruments without risking real money, making it a fantastic way to hone your trading skills and test strategies in a risk-free environment.

Definition of a Trade

A trade is essentially a simulated buy or sell transaction that allows you to practice trading without risking real money.

Paper trades, as we've discussed, are a type of simulated trade that allows you to hone your trading skills in a risk-free environment. This is especially useful for new and novice investors who want to learn the basics of buying and selling stocks without using real money.

In a paper trade, you record all trades by hand or use an electronic stock market simulator to keep track of hypothetical trading positions, portfolios, and profits or losses. This helps you understand how different trading strategies might play out in real-time.

Discover more: Currency Carry Trade Definition

To get the most benefits from paper trading, it's essential to follow real trading practices and objectives, just as you would with a live account. This means considering your risk-return objectives, investment constraints, and trading horizon, just as you would with actual money on the line.

A paper trade can be applied to various market conditions, such as high levels of market volatility, where you might experience higher slippage costs due to wider spreads.

How Trades Work

Paper trading is a simulated market where you can execute buy and sell orders without any financial risk. This is a vital tool for both novice and experienced traders to test strategies, understand market dynamics, and get a feel for the trading platform.

In a paper trading environment, you can evaluate the effectiveness of trading strategies and enhance trading skills without the pressure of real money. This allows you to make mistakes and learn from them without losing a dime.

Here's an interesting read: Daytrading Strategy

To get the most benefits from paper trading, it's essential to follow real trading practices and objectives. This means considering the same risk-return objectives, investment constraints, and trading horizon as you would with a live account.

You can use simulated trading to familiarize yourself with various order types such as stop-loss, limit orders, and market orders. This is especially useful for understanding how different orders can impact your trades.

Here are some key differences between market conditions that you can practice in a paper trading environment:

In a paper trading environment, you can monitor the progress of your virtual trades, track their performance, and analyze the outcomes to refine your trading strategies. This is a valuable learning experience that can help you become a more confident and effective trader.

Advantages and Disadvantages

Paper trading offers several advantages that make it an attractive option for traders of all levels. One of the main benefits is that it eliminates the risk of loss, allowing you to trade without using your own real money.

Here are the key advantages of paper trading:

- Risk-Free Environment: No financial risk involved.

- Strategy Testing: Evaluate the effectiveness of trading strategies.

- Skill Building: Enhance trading skills without the pressure of real money.

By using paper trading, you can study and test different trading strategies and techniques before going live with real money. This helps you familiarize yourself with various tools and decide which ones are best for you.

Risk-Free Environment

Paper trading offers a risk-free environment, allowing you to practice buying and selling without risking real money. This is a huge advantage, especially for beginners who are still learning the basics of trading.

According to Example 1, the key benefits of paper trading include a risk-free environment, strategy testing, and skill building. These benefits are essential for anyone looking to improve their trading skills without the pressure of real money.

In a paper trade, you can record all trades by hand to keep track of hypothetical trading positions, portfolios, and profits or losses (Example 2). This hands-on approach helps you understand the process and make informed decisions.

Related reading: Learn How to Trade Penny Stocks for Free

The primary benefit of using the Zerodha Paper Trading App is that it provides a risk-free environment (Example 7). Traders can make transactions without the fear of losing real money, which is especially beneficial for beginners.

By using a paper trading platform, you can familiarize yourself with various order types, such as stop-loss, limit orders, and market orders (Example 3). This knowledge is crucial for making informed trading decisions.

Here are some key features of a paper trading environment:

- Risk-free trading

- Strategy testing and skill building

- Hands-on approach to tracking trades

- Familiarization with order types

Overall, paper trading provides a safe and controlled environment for you to practice and refine your trading skills.

Setting Up and Using

To set up paper trading in Zerodha, you need to follow a few simple steps.

First, create a Zerodha account, which will serve as your gateway to the trading platform.

Once your account is set up, you can access the Kite platform, Zerodha's trading interface, where you'll find a user-friendly interface for trading activities.

You might enjoy: Webull Interface

From there, switch to paper trading mode by navigating to the settings or account preferences section in the Kite platform, where you'll locate the option specifically designed for switching to the paper trading mode.

By enabling this mode, you can simulate trades, explore the market, and test your strategies using virtual funds provided by Zerodha.

Setting Up

To set up paper trading with Zerodha, you need to follow a few simple steps.

First, create a Zerodha account, which will serve as the foundation for your trading activities.

After creating a Zerodha account, you can proceed to access the trading platform, called Kite, which provides a user-friendly interface for trading activities.

To access the Kite platform, visit Zerodha's website and log in using your account credentials, including your unique client ID and password.

Once logged in, you'll gain entry to the Kite platform, which offers a range of features and tools for trading in various financial instruments.

If this caught your attention, see: Algorithmic Trading Platforms

The Kite platform is available in over 10+ languages, making it accessible to a wide range of users.

Zerodha launched the Kite website in 2015 and has since updated the platform many times, with the latest version being Kite 3.0, which comes with improved performance and enhanced UI and UX.

Other Charges

Setting up a trading account with Zerodha comes with some additional costs you should be aware of. Zerodha charges Rs 50 per executable order for Call & Trade Charges.

These charges can add up quickly, so it's essential to factor them into your trading strategy. RMS Auto Square Off Charges are also Rs 50 per executable order.

One thing to note is that Zerodha does not have any hidden charges. This transparency is a plus when it comes to managing your expenses.

Here are the other charges you can expect to pay:

- Call & Trade Charges: Rs 50 Per Executable Order

- RMS Auto Square Off Charges: Rs 50 Per Executable Order

- Hidden Charges: No

Best Practices and Strategies

To make the most out of your paper trading experience in Zerodha, consider the following best practices.

Test various trading strategies without any financial consequences using the app. This helps in understanding which strategies work best in different market conditions.

Regularly review your paper trading results and adjust your strategies based on performance. Continuous improvement is key to successful trading.

Take a look at this: Best Macbook for Trading Stocks

Learning and Testing Strategies

You can use the Zerodha app to test various trading strategies without any financial consequences. This allows you to understand which strategies work best in different market conditions.

Start by testing different strategies to see what works for you. Traders can use the app to test various trading strategies without any financial consequences.

A well-defined trading plan is essential for evaluating strategy effectiveness. Develop a trading plan that outlines your goals, risk tolerance, and strategies.

Begin with small trades to minimize risk and gradually increase the trade size as you gain confidence and experience. Start small to avoid significant losses.

Regularly review your paper trading results to identify areas for improvement. Review and adjust your strategies based on performance.

Maintain a trading journal to track your trades, strategies used, and outcomes. Keep a trading journal to record your trades and strategies.

Additional reading: Placing Trades with Trading View from Tradestation

Mistakes to Avoid

Even though paper trading is a risk-free environment, it’s easy to make mistakes that can hinder your learning process. Here are some common pitfalls to avoid.

One common mistake is failing to set clear goals for your paper trading. This can make it difficult to track your progress and stay motivated.

Don't get too attached to your winning trades - it's easy to get caught up in the excitement and overtrade.

Emotional decision-making can also lead to poor choices. It's essential to stay calm and rational, even when the market is volatile.

Paper trading in isolation can be counterproductive - it's crucial to learn from others and get feedback on your strategies.

App and Platform Features

Zerodha's paper trading feature is equipped with several functionalities that can enhance your trading experience.

You can use real-time market data, charts, and research tools to analyze various stocks, commodities, or derivatives within the Zerodha platform.

With Zerodha's market exploration capabilities, you can make informed investment decisions based on thorough analysis, ensuring you stay up-to-date with market trends and maximize your trading potential.

You can explore different investment opportunities, study historical price trends, and evaluate company fundamentals within the platform.

The platform allows you to utilize technical indicators and drawing tools to identify potential entry and exit points.

By using Zerodha's market exploration capabilities, you can gain a deeper understanding of the market and make more informed decisions.

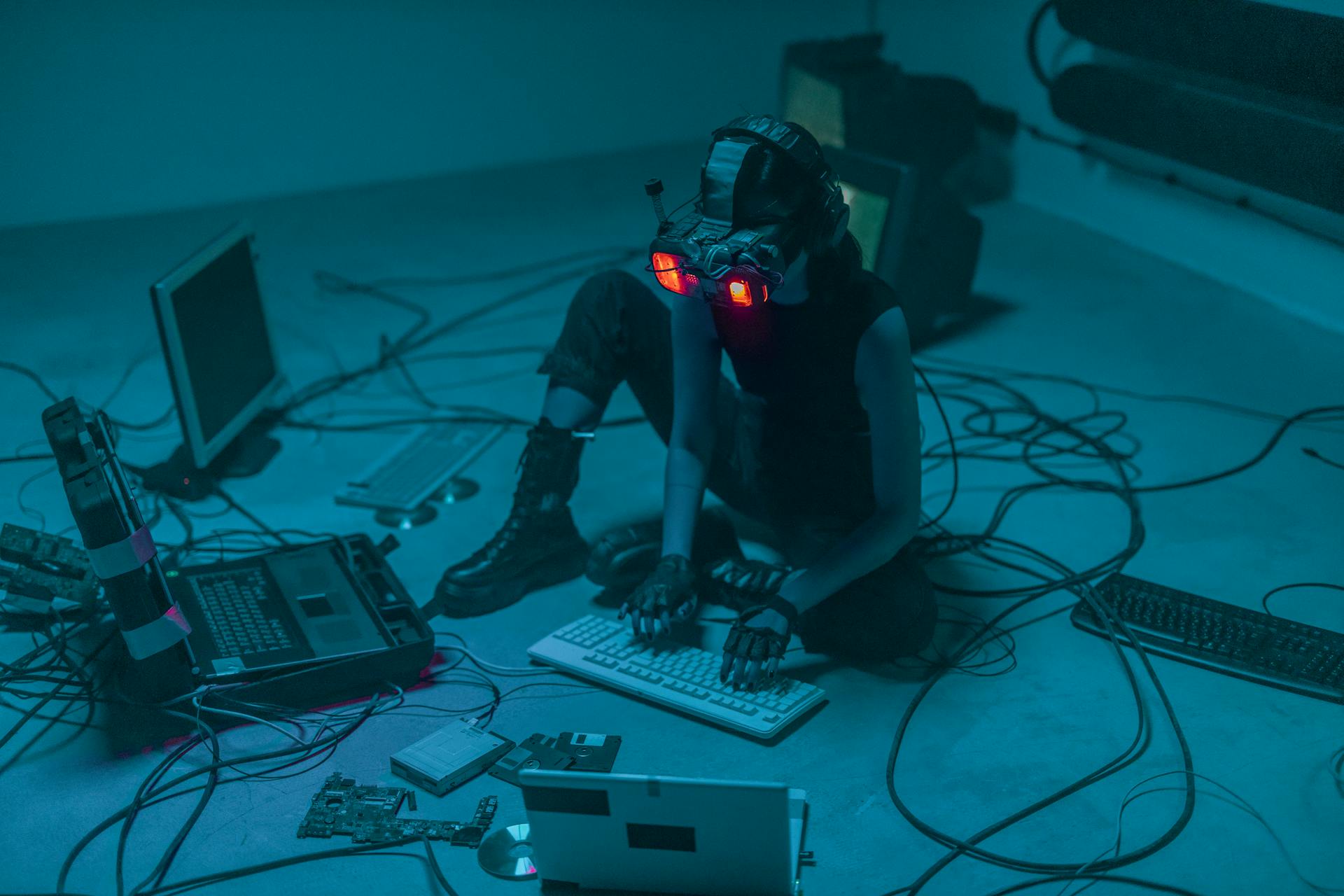

Featured Images: pexels.com