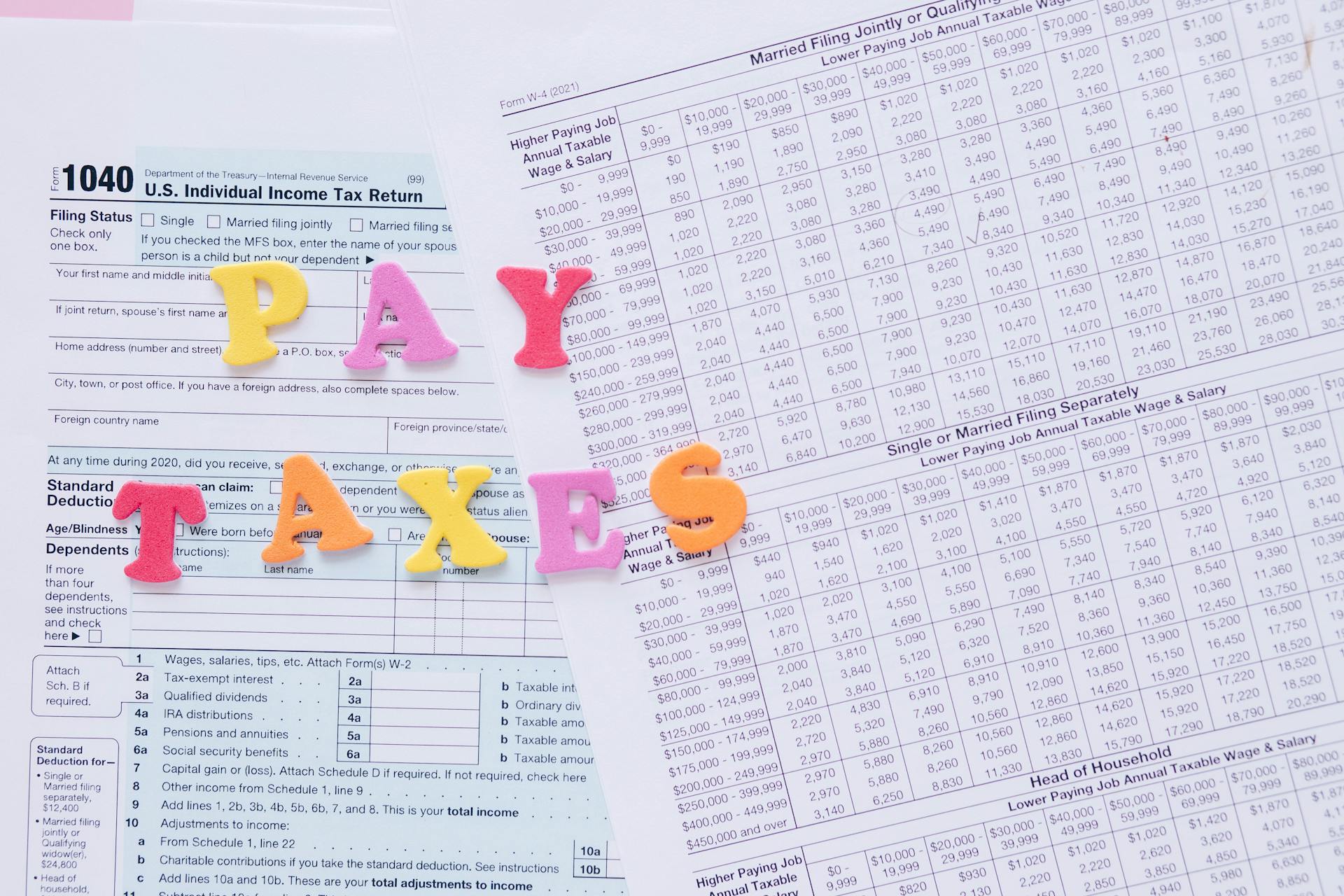

Quarterly business taxes can be a daunting task, but understanding the deadlines is key to staying on track. The IRS requires businesses to make estimated tax payments each quarter, with the first payment due on April 15th.

These payments are based on the business's expected annual tax liability, which is calculated by multiplying the business's annual income by a predetermined percentage. The IRS uses a complex formula to determine this percentage, but it's generally around 25% for most businesses.

As a business owner, it's essential to stay organized and keep track of these deadlines to avoid penalties and interest on unpaid taxes. By setting reminders and creating a budget, you can ensure you're making timely payments and staying on top of your quarterly tax obligations.

Consider reading: Pay Quarterly Business Taxes Online

Filing and Payment

Quarterly business taxes are due on or before the last day of January, April, July, and October for the preceding three-month period. This is for taxpayers assigned a quarterly filing frequency, typically those with a total tax liability consistently less than $100.00.

Check this out: How to Pay Quarterly Business Taxes

The IRS requires estimated tax payments if you expect to owe at least $1,000 in tax for the current year, minus your withholding and refundable credits. This is to avoid penalties or unwelcome surprises at tax time.

You can file quarterly business taxes by mailing a printable voucher in Form 1040-ES or using IRS Direct Pay to pay online. State and local taxes may not require quarterly filing, so work with a tax professional to ensure you're paying taxes correctly.

As a small business or freelancer, you're responsible for managing your own taxes, which can be complex. The IRS has developed a pay-as-you-go estimated tax system to make it easier, using a sliding scale for the amounts you'll owe.

To avoid penalties, you can use the Safe Harbor method, which provides protection if you've underpaid your taxes. This includes paying 90% of the tax you owe for the current year, 100% of last year's taxes, or annualized income installments.

All income that is not subjected to withholding and is more than $1,000 in a business year should be paid quarterly. You'll normally pay state and federal estimated taxes on or before April 15th, June 15th, September 15th, and January 15th.

Take a look at this: Can You Reinvest Capital Gains to Avoid Taxes

Due Dates and Holidays

If the due date for your quarterly business taxes falls on a Saturday, Sunday, or a legal holiday, you're in luck - there's some extra time to get your taxes in order.

According to Directive TA-18-1: Timely Mailing of Returns, Documents, or Payments, you can mail your taxes on the next business day without penalty.

This means you don't have to worry about rushing to meet the deadline if it falls on a weekend or holiday.

You might enjoy: Venture X Dallas - Braniff Centre

Due Dates on Weekends or Holidays

If you're expecting a tax bill or other government notice to be due on a Saturday, Sunday, or holiday, be aware that special rules apply.

The North Carolina tax authority has issued directives to clarify the handling of due dates that fall on these days. Directive TA-18-1: Timely Mailing of Returns, Documents, or Payments and Directive TA-16-1: When a North Carolina Tax Return or Other Document is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday provide the necessary guidance.

Consider reading: North Carolina Business Taxes

These directives state that due dates on Saturdays, Sundays, or holidays are considered to be the next business day.

If you're unsure about a specific due date, it's always best to err on the side of caution and send your payment or document as soon as possible to avoid any potential issues.

Here's a quick reference guide to help you remember the key points:

- Due dates on Saturdays, Sundays, or holidays are considered the next business day.

- Directives TA-18-1 and TA-16-1 provide the necessary guidance for handling these situations.

Unemployment

Unemployment taxes are a must for businesses with employees. You have to deposit federal unemployment taxes (FUTA) by the last day of the month following each quarter.

These taxes are capped at $7,000 per employee, so you don't have to pay more than that. State unemployment insurance taxes (SUI or SUTA) are also a requirement for businesses with employees.

A different take: Accepting Credit Cards Can Be Useful to Small Businesses By:

Self-Employment and Side Businesses

As a self-employed individual or side business owner, you're required to report your income, even if it's just a small amount. If you expect to owe at least $1,000 in tax for the current year, minus your withholding and refundable credits, you should make estimated tax payments.

To avoid penalties, it's a good idea to calculate your estimated tax payments and make quarterly payments. You can use the IRS Direct Pay service to pay online, or mail a check with the printable vouchers in Form 1040-ES.

If you're unsure about how to file quarterly business taxes, consider working with a tax professional to ensure you're paying taxes correctly. They can help you navigate the process and make sure you're meeting all the necessary requirements.

Intriguing read: Washington State Business Quarterly Taxes

Should I File Taxes for a Side Business?

You're considering starting a side business, but you're not sure if you need to file taxes on it. The good news is that it's a good idea to report your business income and pay taxes on it, even if it's just a small amount.

Even if you're not making a lot of money from your side business, you're still required to report that income. This will help your business be legitimate and avoid being classified as just a hobby.

If you expect to owe at least $1,000 in tax for the current year, minus your withholding and refundable credits, you should make estimated tax payments.

For more insights, see: Can You Go to Jail for Not Paying Business Taxes

Self-Employed Savings Reserve

As a self-employed individual, setting aside money for taxes can be a challenge, but it's essential to avoid penalties and surprises at tax time. Save 25-30% of your income for taxes, and take 25-30% of each payment you receive and set it aside in a business savings account.

Your state's income tax rate can vary, so it's crucial to consider this when calculating your tax liability. Some states have higher state income taxes than others, and some states have no state income tax at all.

If you expect to owe at least $1,000 in income tax for the year, it's recommended that you pay estimated quarterly taxes to avoid penalties. This is a good idea to calculate your estimated tax payments and make these quarterly payments to protect yourself.

You'll need to file quarterly returns on or before the last day of January, April, July, and October for the preceding three-month period. The taxes due must be remitted with the quarterly return, so be sure to plan accordingly.

See what others are reading: States with Highest Business Taxes

Self-Employment

As a self-employed individual, you're required to report your business income, even if it's just a small side hustle. If you expect to owe at least $1,000 in tax for the current year, you should make estimated tax payments.

You can file quarterly business taxes by mailing a printable voucher from Form 1040-ES or using the IRS Direct Pay service to pay online. State and local taxes may have their own procedures, so it's a good idea to work with a tax professional to ensure you're paying taxes correctly.

Self-employment taxes cover your Medicare and Social Security taxes, which will contribute to your social security benefits when you retire or become disabled. These taxes can be paid with your estimated taxes on a quarterly basis.

A general rule of thumb for self-employment taxes is to save 25-30% of your income for taxes. This can be done by setting aside 25-30% of each payment you receive in a business savings account.

If you owe too little in estimated taxes, you may face underpayment penalties, so it's essential to follow the 25-30% rule to ensure you're estimating correctly.

Suggestion: How to Check If Irs Owes Me Money

Frequently Asked Questions

What is the tax deadline for small businesses?

For small businesses filing as sole proprietors, the tax deadline is April 15 of each year, without an extension. This deadline applies to the 2024 tax year, filed in 2025, and may vary for other business structures.

What happens if you miss a quarterly estimated tax payment?

Missing a quarterly estimated tax payment may result in a penalty, even if you're due a refund when filing your tax return. To avoid this, make sure to pay enough tax by the due date of each payment period.

Sources

- https://www.ncdor.gov/taxes-forms/sales-and-use-tax/sales-and-use-tax-filing-requirements-payment-options/filing-frequency-and-due-dates

- https://www.revenue.alabama.gov/individual-corporate/due-dates/

- https://bizee.com/blog/post/quarterly-taxes-llc

- https://www.bill.com/blog/quarterly-business-taxes-guide

- https://www.credibly.com/incredibly/when-are-small-business-taxes-due/

Featured Images: pexels.com