Inland marine insurance is designed to protect businesses that transport goods or equipment across land, but it doesn't cover everything.

Physical damage to the insured items is not covered by inland marine insurance, unless it's caused by a covered peril such as theft, vandalism, or collision.

For example, if a truck carrying equipment breaks down due to a mechanical issue, the owner won't be able to claim for the damage under inland marine insurance.

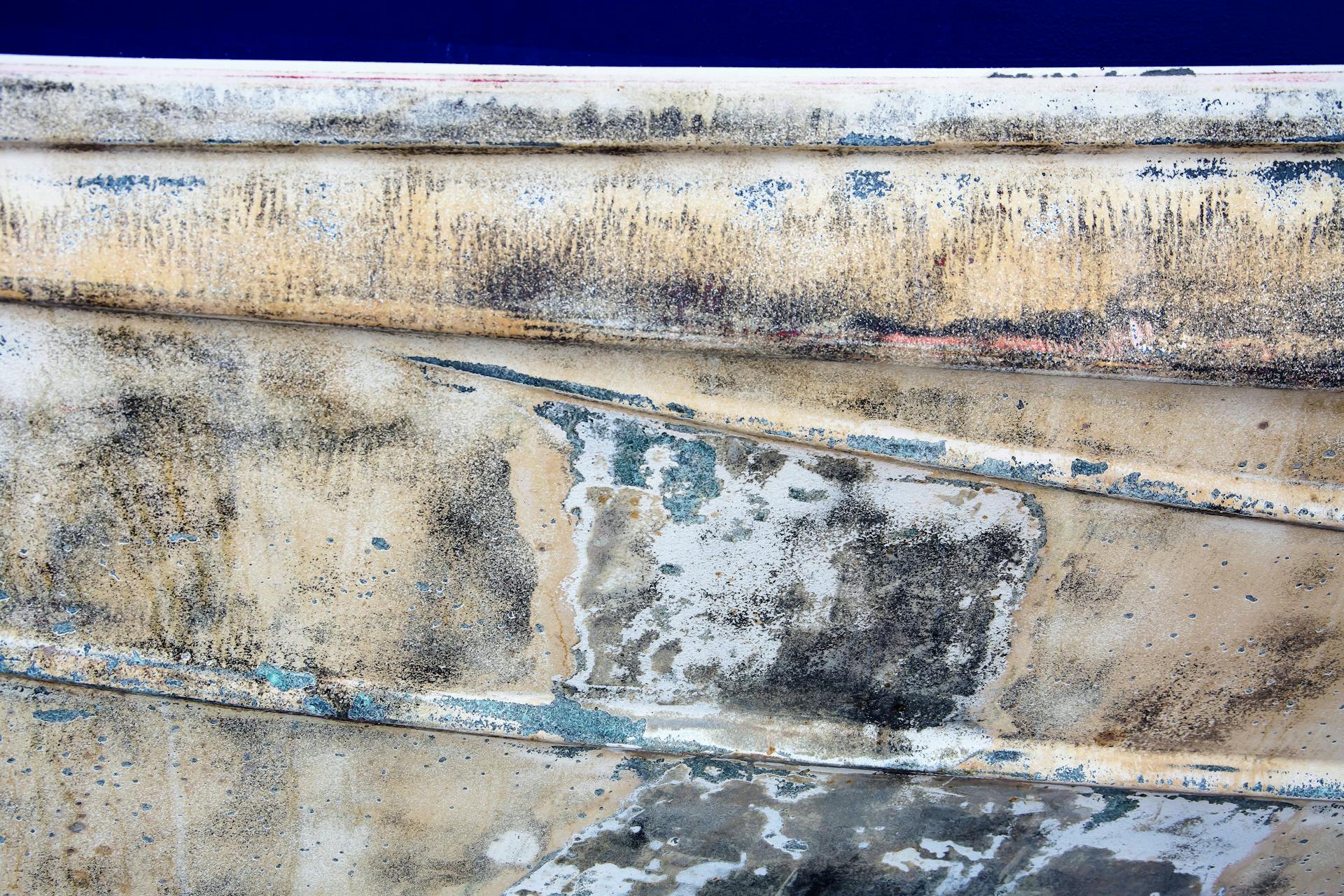

Inland marine insurance also doesn't cover losses due to wear and tear or gradual deterioration of the insured items.

Here's an interesting read: What Is Not Covered under Liability Coverage Bop

What Inland Marine Insurance Doesn't Cover

Inland Marine Insurance typically doesn't cover damage caused by normal wear and tear, which means you're on your own for maintenance-related issues.

Intentional damage, such as vandalism, is also not covered. This includes any damage caused by someone on purpose, whether it's a friend, family member, or stranger.

Acts of war, terrorism, and nuclear hazards are also excluded from coverage. This means if your property is damaged or destroyed due to any of these events, you won't be able to claim on your insurance policy.

Here's a quick rundown of some of the key exclusions:

- Wear and Tear

- Intentional Damage

- Acts of War

- Nuclear Hazard

- Improper Packaging or Handling

- Delay or Loss of Market

- Unexplained Disappearance

- Unauthorized Use or Misuse

- Inadequate Maintenance or Neglect

- Governmental Action

Exclusions in Inland Marine Policies

Exclusions in Inland Marine Policies can be a real gotcha. Inland Marine Insurance Policies typically don't cover damage that occurs due to normal wear and tear.

Intentional damage, such as vandalism, is also not covered. This means if someone intentionally damages your insured property, you're on your own.

Acts of war and terrorism are also excluded from coverage. This includes any losses that occur as a result of a nuclear hazard.

Damage caused by inadequate packaging, ordinary leakage, or improper handling is not covered. This is a common issue with fragile or sensitive equipment.

Unexplained disappearance of the insured property is often excluded from coverage. This means if the property can't be located or its disappearance can't be explained, you may not be covered.

Damage or loss resulting from unauthorized use or misuse of the insured property is not covered. This includes any losses that occur as a result of inadequate maintenance or neglect.

On a similar theme: Most Insurance Policies Exclude Losses by

Losses caused by the destruction, confiscation, or seizure of property by order of any government or public authority are also excluded from coverage.

Here's a summary of some of the key exclusions in Inland Marine Insurance Policies:

- Wear and Tear

- Intentional Damage

- Acts of War

- Nuclear Hazard

- Improper Packaging or Handling

- Unexplained Disappearance

- Unauthorized Use or Misuse

- Inadequate Maintenance or Neglect

- Governmental Action

Inland Marine vs General Liability

Inland Marine insurance is designed to cover specific types of property that are in transit or being transported, such as construction equipment or goods in transit, but it's not a substitute for General Liability insurance.

General Liability insurance, on the other hand, provides broader protection for businesses, covering third-party property damage and personal injury claims.

Inland Marine insurance typically has higher policy limits and deductibles than General Liability insurance, which can make it more expensive.

General Liability insurance, however, is often required by law for businesses to operate, whereas Inland Marine insurance is usually optional.

Businesses that rely heavily on transporting goods or equipment, such as construction companies or transportation services, may find Inland Marine insurance more beneficial.

In contrast, businesses with minimal transportation needs may not need Inland Marine insurance, and General Liability insurance may be sufficient.

Broaden your view: What Does Inland Marine Insurance Cover

Inland Marine Doesn't Cover Water Transport

Inland marine insurance typically doesn't cover water transportation, despite its name including the word "marine." This is because inland marine insurance is an off-shoot of ocean marine insurance that covers shipments over waterways.

If you need protection for water transit, you'll need to pair your inland marine insurance with a policy that offers overseas coverage.

Inland marine insurance was added once rail and motor vehicle transportation became more popular means of transportation, so it's not designed to cover water transportation.

Inland Marine Insurance Basics

Inland marine insurance typically covers equipment, goods, and other valuable items in transit or stored in a non-waterway area.

This type of insurance is often used to protect against losses due to theft, vandalism, and other perils.

It's essential to understand what inland marine insurance covers, so you can make informed decisions about your business or personal property.

Related reading: Life Insurance That Covers an Insured's Whole Life

Inland Marine Insurance

Inland Marine Insurance typically covers a wide range of perils, but there are some exclusions to be aware of.

Wear and tear is not covered, so if your equipment breaks down due to normal use, you're on your own.

Intentional damage, such as vandalism, is also excluded, so if someone intentionally damages your property, you won't be able to claim insurance.

Acts of war and nuclear hazards are also not covered, so if your property is damaged in a war or due to a nuclear incident, you won't be able to claim insurance.

Inland Marine Insurance doesn't cover losses resulting from delay, loss of market, or any consequential loss.

If your property disappears and can't be explained, it may not be covered.

Damage or loss resulting from unauthorized use or misuse of the insured property is also excluded.

Inadequate maintenance or neglect of the insured property can also lead to exclusion from coverage.

Losses caused by government action, such as destruction, confiscation, or seizure of property, are also excluded.

It's worth noting that the name "Inland Marine Insurance" can be misleading, as it typically doesn't cover water transportation.

In fact, inland marine insurance is an off-shoot of ocean marine insurance that covers shipments over land, not water.

Here's an interesting read: Why Is Anucort-hc Not Covered by Insurance?

If you need protection for water transit, you'll need to pair your inland marine insurance with a policy that offers overseas coverage.

Inland Marine Insurance also has some specific exclusions, including business vehicles, damages caused by you or your employees/volunteers, and damages caused by natural disasters.

Here are some specific things that are not covered by Inland Marine Insurance:

- Business vehicles

- Damages caused by you or your employees/volunteers

- Damages caused by natural disasters

- Product damages and defects before shipping

- Property shipped by sea or by air

- Structures or commercial property

Inland Marine Coverage Options

Inland Marine Coverage Options can be a bit tricky to navigate, but don't worry, I've got you covered.

Inland Marine only covers moveable types of property used for business, so you'll need additional coverage for immovable property like commercial buildings.

You might need to consider Commercial Property coverage to protect your business's physical assets.

Completed Operations coverage is also important, as it helps protect your business from claims made after a project is completed.

Cyber Liability coverage is a must-have in today's digital age, as it protects your business from cyber attacks and data breaches.

Recommended read: Boat Rental Business Insurance

Excess Liability coverage can provide additional protection beyond the limits of your standard policy.

General Liability coverage is essential for protecting your business from accidents and injuries.

Liquor Liability coverage is necessary if you serve alcohol in your business.

Personal & Advertising Injury coverage can help protect your business from false advertising claims.

Product Liability coverage is crucial if you manufacture or sell products.

Professional Liability coverage, also known as Errors & Omissions coverage, can protect your business from mistakes made by professionals.

Workers' Compensation coverage is required by law in most states to protect your employees in case of work-related injuries.

Here's a quick rundown of the additional commercial coverages you might need:

Sources

- https://falveyinsurancegroup.com/blog/inland-marine/common-misconceptions-associated-with-inland-marine-insurance/

- https://www.bimakavach.com/blog/inland-marine-insurance-what-does-it-cover-and-exclude/

- https://www.insurancebusinessmag.com/us/news/breaking-news/common-misconceptions-with-inland-marine-insurance-493922.aspx

- https://www.secura.net/business-insurance/inland-marine-insurance

- https://www.insurancecanopy.com/inland-marine-insurance

Featured Images: pexels.com