Patelco Credit Union members were unable to access their accounts online due to a system glitch.

The glitch occurred on a Thursday morning, causing widespread disruption to online banking services.

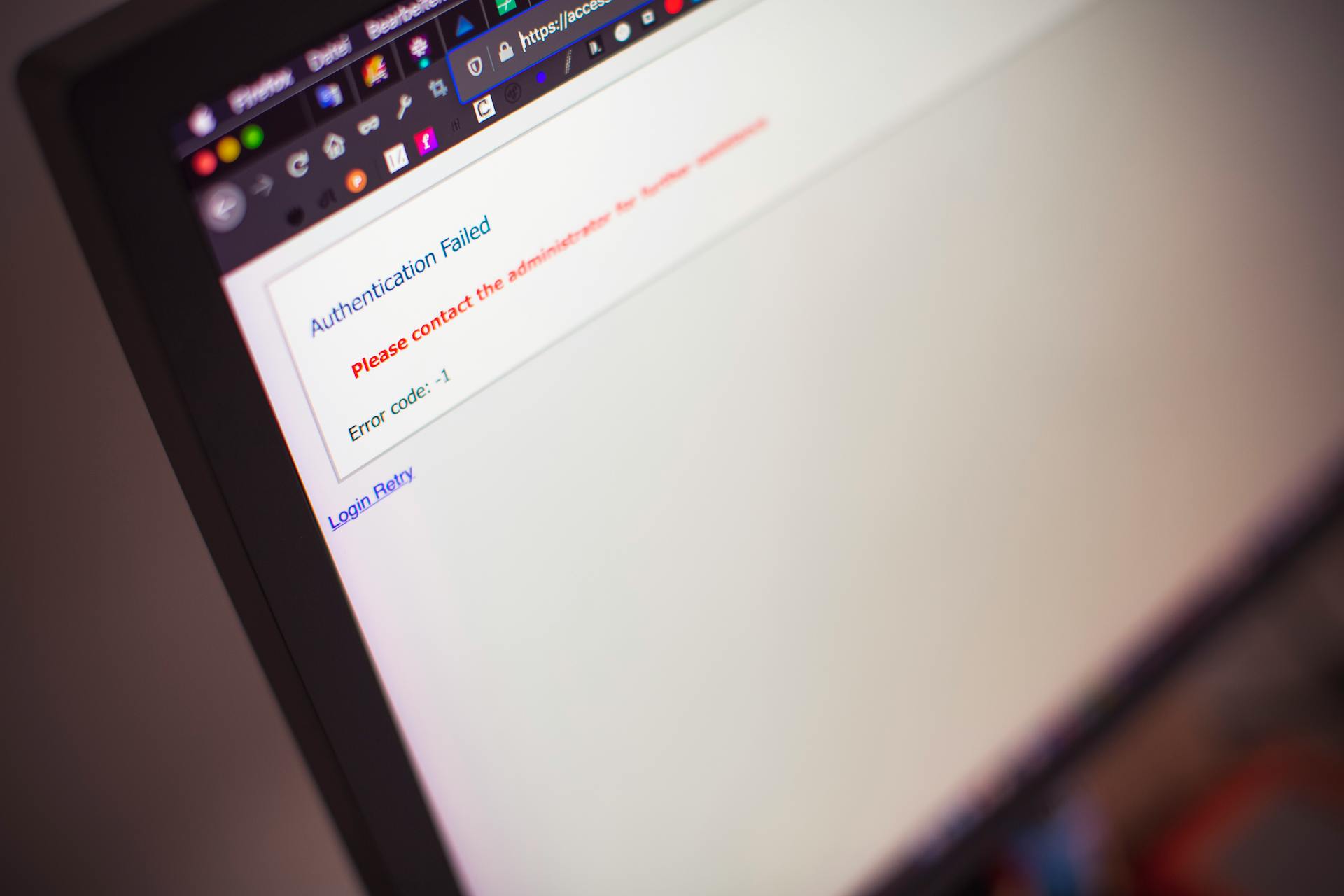

Members reported being unable to log in to their accounts, check their balances, or pay bills.

The credit union's technical team worked to resolve the issue as quickly as possible.

Patelco Credit Union's technical team was able to resolve the issue within a few hours.

Members were able to access their accounts and resume normal banking activities.

The credit union apologized for the inconvenience caused by the system glitch.

Patelco Credit Union's technical team implemented additional security measures to prevent similar glitches in the future.

A review of the incident was conducted to identify the root cause of the system glitch.

The credit union's technical team was able to implement a fix to prevent similar issues from occurring in the future.

Consider reading: Accounts That Earn Interest Patelco

Half a Million Credit Union Members Await Account Access

As of now, half a million Patelco credit union members are eagerly waiting to access their accounts, but a glitch is standing in their way. Patelco, a California-based credit union, has been experiencing technical difficulties that have left many of its members unable to log in to their online accounts.

The issue is reportedly affecting a significant portion of Patelco's 500,000-strong member base. This is a major inconvenience for those who rely on online banking for their financial needs.

Patelco members are unable to check their account balances, transfer funds, or pay bills through the credit union's website or mobile app. This lack of access is causing frustration and worry among those affected.

The credit union has acknowledged the problem and is working to resolve it as quickly as possible.

Current Status

The Patelco credit union's system has been stabilized, but customers are still facing some challenges. Patelco credit union's system has been stabilized.

Customers are limited to withdrawing $500 at a time, which can be frustrating for those who need to make larger payments. This is the worst time for it, as Carlos Garcia said on Tuesday.

The company has 500,000 customers and did not specifically state how much customers could take out on its website. The company said a hacker illegally broke into their systems, blocked access to some of the company's computer infrastructure and then demanded ransom to fix the damage.

Patelco's online banking and mobile app systems aren't working right now, and customers can't use the app or use Zelle. Over the weekend, Patelco said their network was stabilized, and some transactions were being processed.

Credit Union System Stabilized

Patelco credit union's system has been stabilized, but customers are still facing limitations on their withdrawals.

The credit union is allowing customers to withdraw $500 at a time, which is frustrating for those who need to make larger payments.

Customers are showing up to various Patelco branches with questions about the cyberattack and its aftermath.

The credit union has acknowledged that its online banking and mobile app systems aren't working right now.

Customers can't use the app or use Zelle, either, which is causing inconvenience.

Over the weekend, Patelco said their network was "stabilized" and some transactions were being processed.

Patelco Banking Services Down

Patelco credit union's system has been stabilized, but customers are still facing limitations on their withdrawals.

Customers are only allowed to withdraw $500 at a time, which is frustrating many who need to make payments that are much more than that.

This is the worst time for it, especially for customers who need to access more of their money to make final payments on things like houses.

The credit union has 500,000 customers, and many are showing up to branches with questions about what happened during the cyberattack.

Customers are being told that the online banking and mobile app systems aren't working right now, and they can't use Zelle either.

Patelco wrote on its website that the credit union has a cybersecurity forensic firm helping to investigate the hackers and recover all of its systems.

The company has no evidence that anyone's money was taken during the cyberattack.

Location and Scope

Patelco's glitch occurred on a Monday morning, affecting thousands of customers in the Bay Area, particularly in Alameda and Contra Costa counties.

The glitch was reportedly isolated to the credit union's online banking platform, which was unavailable for several hours.

Patelco's headquarters are located in Pleasanton, California, a city in Alameda County.

The affected counties, Alameda and Contra Costa, are both part of the San Francisco Bay Area.

Patelco serves over 300,000 members in the region.

Frequently Asked Questions

Who attacked Patelco Credit Union?

The RansomHub group claimed responsibility for the attack on Patelco Credit Union. They gained access to sensitive data and published it online.

Sources

- https://www.berkeleyside.org/2024/07/02/patelco-credit-union-security-breach-east-bay

- https://www.northbaybusinessjournal.com/article/banking-finance/patelco-credit-union-cyberattack-070224/

- https://www.ktvu.com/news/patelco-credit-union-500-limit-after-cyberattack-frustrating-customers

- https://www.nbcbayarea.com/news/local/east-bay/patelco-stabilizes-network/3586829/

- https://www.theregister.com/2024/07/03/patelco_ransomware_outage/

Featured Images: pexels.com