As a motorcycle enthusiast, you know how thrilling it is to hit the open road on two wheels. The cost of motorcycle insurance in South Carolina can vary depending on your location, with riders in urban areas like Charleston paying more than those in rural areas.

In South Carolina, the minimum liability coverage required by law is $25,000 for bodily injury to one person, $50,000 for bodily injury to two or more people, and $25,000 for property damage. This is a crucial factor to consider when planning your insurance budget.

The average cost of motorcycle insurance in South Carolina is around $100 per month, but this can range from $50 to $200 per month depending on your individual circumstances.

Motorcycle Insurance Basics

In South Carolina, motorcycle insurance is a must-have for riders. You'll need to consider the type of coverage you need.

Comprehensive and collision coverage are optional unless you're financing or leasing your motorcycle. If your bike is paid in full, you can choose to add these coverages as safeguards against physical damage.

See what others are reading: Do I Have to Have Motorcycle Insurance in Florida

Comprehensive coverage can protect your bike against theft, vandalism, and damage from animals, fire, or weather-related issues. This type of coverage is a good idea if you want to be prepared for unexpected events.

Collision coverage can help repair or replace your motorcycle if it collides with another object or vehicle, regardless of who's at fault. This coverage is a must-have if you want to be protected in the event of an accident.

Do I Need?

If you're financing or leasing your motorcycle, your lender may require comprehensive and collision coverage.

Comprehensive and collision coverages are optional unless you're financing or leasing your motorcycle.

Comprehensive coverage can protect your bike against events out of your control, such as theft, vandalism, or hitting an animal.

Collision coverage can cover your motorcycle if it collides with another object or vehicle, regardless of who's at fault.

In South Carolina, motorcycle insurance is required for all bikers who ride on any state road.

You may not need motorcycle insurance if you only ride your dirt bike on private property, but it's still a good way to protect yourself and your bike in case of an accident.

Types of Coverage

Liability coverage is the minimum required insurance coverage for motorcyclists in South Carolina, paying for the other driver's property damage and medical bills if you cause an accident.

Collision coverage is essential for covering your bike and medical bills if you're in an accident.

Comprehensive coverage helps repair or replace your bike in the event of storm damage, theft, or vandalism.

Uninsured/underinsured motorist coverage is a must-have, as it can save you the hassle and cost of taking an uninsured driver to court.

Bodily injury motorcycle coverage covers medical expenses and lost wages for the other driver if you're at fault in an accident.

You can also add optional coverages to your policy, such as:

- Motorcycle accessory coverage: pays for damage to upgrades you've made to your bike, including chrome pieces, electronics, and custom paint and wheels

- Medical payments: pays for injuries you or your passenger suffer, regardless of fault

- Total loss coverage: pays for the full value of your bike in the event of a total loss, protecting against depreciation (available only for bikes no more than one model year old on a new policy)

- Carried contents and personal belongings: pays to replace any personal effects you're carrying when a covered loss occurs, including theft

- Enhanced injury protection: pays up to $250 a week for two years if you can't work due to injuries sustained during a crash

- Roadside assistance: covers the cost of towing your bike to the nearest repair shop

Cost and Planning

The cost of motorcycle insurance in South Carolina can vary depending on the age and value of your bike, as well as your driving record. Our insurance agents can help you find ways to reduce your premiums.

If you're a rider in South Carolina, you'll need to have insurance at all times while riding on a state road, or you'll be required to show proof of insurance when requested by a law enforcement official.

The state does not require coverage if you're riding on private property or if your bike is in storage, but it's always a good idea to have some level of coverage in case of an accident.

Explore further: Washington Motorcycle Insurance

Cost

The cost of motorcycle insurance can vary depending on several factors, including your age and driving record. In South Carolina, the annual cost for a Progressive motorcycle insurance policy with liability-only coverage was $271.49 in 2023.

Many factors influence your price for motorcycle insurance, including your age, driving history, location, type of bike, and coverage selection. This means that even small changes to your policy can make a big difference in your premiums.

If you're looking to save money, consider bundling your motorcycle insurance with other policies, such as homeowners or auto insurance, to get a multi-policy discount. This can be a great way to reduce your costs and still get the coverage you need.

For another approach, see: Who Is the Insured on a Life Insurance Policy

Planning to Ride

Planning to ride is a crucial step before hitting the road. It's essential to prep your motorcycle for safe riding.

Before you start the engine, check your tires for any cracks or bulges. Low tire pressure and other anomalies can cause blowouts.

Under the motorcycle, look for oil or gas leaks. This is a common issue that can be easily fixed.

Make sure all lights are functioning, including the headlight, taillight, and signals. Test the high and low beams to ensure they're working properly.

Hydraulic and coolant fluids should be checked weekly. This will help prevent engine damage and keep your bike running smoothly.

Once you're on the motorcycle, check that the clutch and throttle are working smoothly. This will help you ride safely and avoid any sudden stops.

Clean and adjust all mirrors to ensure the best viewing. This will help you stay aware of your surroundings while riding.

Test the front and rear brakes for firmness and hold the motorcycle still when fully applied. This will help you stop safely and avoid any accidents.

Finally, test the horn to make sure it's working properly. This will help you alert other drivers and pedestrians to your presence.

Additional Coverages Available

If you're looking to add extra protection to your motorcycle insurance policy in South Carolina, you have several options.

Motorcycle accessory coverage can pay for damage to upgrades you've made to your bike and equipment, including chrome pieces, electronics, handlebars, and custom paint and wheels.

Medical payments coverage can pay for injuries you or your passenger suffer, regardless of fault. This can be a lifesaver in the event of an accident.

Total loss coverage may pay for the full value of your bike in the event of a total loss, protecting against depreciation. This is only available for bikes no more than one model year old on a new policy.

Carried contents and personal belongings coverage can pay to replace any personal effects you're carrying when a covered loss occurs, including theft. This is a great option if you often ride with a lot of gear.

Enhanced injury protection may pay as much as $250 a week for two years if you can't work due to injuries sustained during a crash. This can help you stay afloat financially while you recover.

Related reading: Income Protection Insurance South Africa

Roadside assistance covers the cost of towing your bike to the nearest repair shop. This can be a huge relief if you're stuck on the side of the road with a broken-down bike.

Here are some additional coverages you may want to consider:

- Motorcycle accessory coverage

- Medical payments

- Total loss coverage

- Carried contents and personal belongings

- Enhanced injury protection

- Roadside assistance

Frequently Asked Questions

Who is the cheapest for motorcycle insurance?

According to national averages, Dairyland offers the cheapest motorcycle insurance, with an average monthly cost of $22.

Sources

- https://www.progressive.com/answers/south-carolina-motorcycle-insurance/

- https://learnandserve.org/south-carolina-motorcycle-insurance-facts/

- https://www.bikebound.com/motorcycle-insurance/states/south-carolina/

- https://edwardsinsurance.net/motorcycle-insurance/

- https://nmjfirm.com/motorcycle-accident/how-to-choose-the-right-motorcycle-insurance-policy-in-south-carolina-and-georgia/

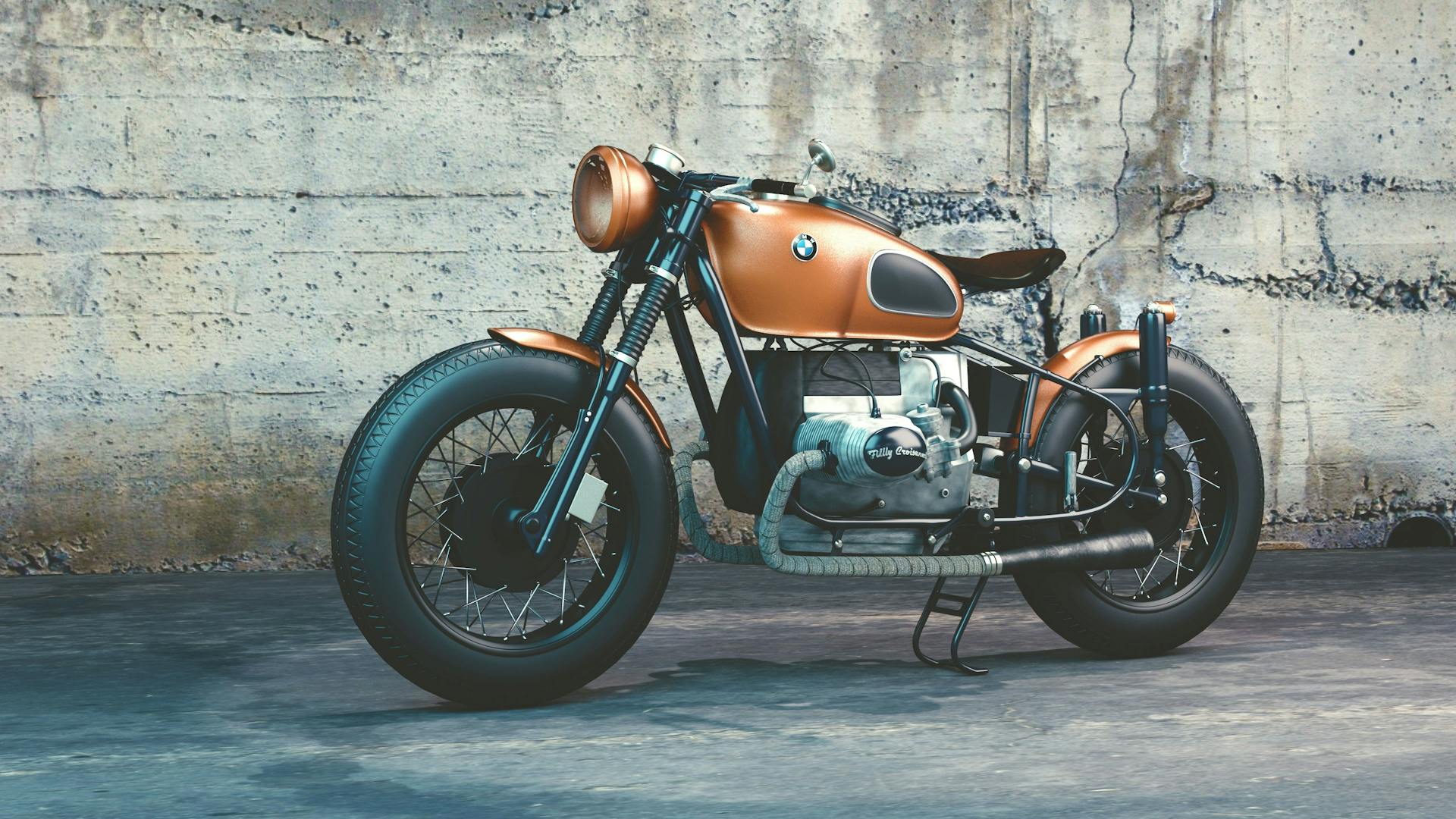

Featured Images: pexels.com