Bitcoin is the first and most widely recognized cryptocurrency, launched in 2009 by an individual or group of individuals using the pseudonym Satoshi Nakamoto. It's the largest cryptocurrency by market capitalization and is widely accepted as a form of payment.

Bitcoin's decentralized and open-source nature allows for peer-to-peer transactions without the need for intermediaries, making it an attractive option for those looking to avoid traditional banking systems. This has contributed to its widespread adoption and popularity.

Ethereum, launched in 2015, is the second-largest cryptocurrency by market capitalization and is known for its smart contract functionality. It has a large and active community of developers working on various projects and applications.

Ethereum's versatility and ability to support a wide range of use cases have made it a favorite among developers and entrepreneurs. Its popularity has also led to the creation of numerous Ethereum-based tokens and projects.

See what others are reading: Cryptocurrency Ethereum

What Are Cryptocurrencies?

Cryptocurrencies are virtual or digital currencies that use cryptography to secure their transactions and control the creation of new units. This technique protects electronic information by converting it into a code that is difficult to crack.

What makes cryptocurrencies unique is that they are distributed in a somewhat anonymous fashion, and they're also 100% transparent.

Every transaction is recorded on a digital ledger called a blockchain, which contains a public record of every transaction that has ever occurred. This system is why cryptocurrencies are often referred to as being "decentralized."

There is no one central authority that oversees or regulates the currency, making it a truly decentralized system. The blockchain facilitates this movement and tracking without the need for a central authority.

Blockchain technology is an important feature of the crypto ecosystem, and it's open-source, meaning that any developer can view and build on this technology.

You might enjoy: Do All Cryptocurrencies Use Blockchain

Types of Cryptocurrencies

There are over 5,000 cryptocurrencies out there, and they're often referred to as altcoins.

Altcoins are alternative versions of Bitcoin, with some having underlying differences that set them apart. For example, Litecoin processes a block every 2.5 minutes, which allows it to confirm transactions faster than Bitcoin.

Ethereum, on the other hand, has smart contract functionality that enables decentralized applications to be run on its blockchain. This makes it a popular choice for developers.

As of early 2020, Ethereum was the most used blockchain, according to Bloomberg News. It also had the largest following of any altcoin in 2016, according to the New York Times.

Consider reading: Ethereum Bull Run

Blockchain and Network

Blockchain technology is the backbone of most cryptocurrencies, providing a secure and transparent way to record transactions. It's a continuously growing list of records, called blocks, which are linked and secured using cryptography.

Each block contains a hash pointer as a link to a previous block, a timestamp, and transaction data. This makes it virtually impossible to alter the data without the collusion of the network majority.

A blockchain is an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. This is made possible by a peer-to-peer network collectively adhering to a protocol for validating new blocks.

Nodes are the computers that connect to a cryptocurrency network, supporting the network through relaying transactions, validation, or hosting a copy of the blockchain. Each network computer has a copy of the blockchain, allowing them to verify transactions and maintain the integrity of the network.

Node owners can be volunteers, hosted by the organization responsible for developing the cryptocurrency, or those who receive rewards for hosting the node network.

Blockchain

A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography. Each block typically contains a hash pointer as a link to a previous block, a timestamp, and transaction data.

Blockchains are inherently resistant to modification of the data, making them a secure and reliable way to record transactions. They are an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way.

A blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for validating new blocks. This decentralized consensus has been achieved with a blockchain, making it a robust and trustworthy system.

Decentralized consensus has been achieved with a blockchain, which is an example of a distributed computing system with high Byzantine fault tolerance.

Nodes

A node is a computer that connects to a cryptocurrency network. It supports the network through relaying transactions, validation, or hosting a copy of the blockchain.

Each node has a copy of the blockchain of the cryptocurrency it supports. This copy is used to broadcast transaction details to other nodes throughout the network.

Node owners can be volunteers, hosted by the organization responsible for the cryptocurrency, or those who receive rewards for hosting a node.

Cryptocurrency Mining

Mining is the validation of transactions on a blockchain, and successful miners obtain new cryptocurrency as a reward. This reward decreases transaction fees by creating a complementary incentive.

The rate of generating hashes, which validate any transaction, has been increased by the use of specialized hardware like FPGAs and ASICs running complex hashing algorithms. This has led to an arms race for cheaper-yet-efficient machines.

Mining is measured by hash rate, typically in TH/s, and a 2023 IMF working paper found that crypto mining could generate 450 million tons of CO2 emissions by 2027, accounting for 0.7 percent of global emissions.

Timestamping

Timestamping is a crucial aspect of cryptocurrency mining, allowing transactions to be verified without the need for a trusted third party.

The first timestamping scheme invented was the proof-of-work scheme, which has been widely adopted in the industry.

Proof-of-work schemes are based on hashing algorithms, with SHA-256 and scrypt being the most commonly used.

Some alternative hashing algorithms used for proof-of-work include CryptoNote, Blake, SHA-3, and X11.

These algorithms are designed to be computationally intensive, making it difficult for malicious actors to manipulate the blockchain ledger.

The use of proof-of-work schemes has become a cornerstone of cryptocurrency mining, enabling the secure and decentralized verification of transactions.

A different take: What Are Cryptocurrencies Used for

Mining

Mining is the validation of transactions on a blockchain, where successful miners obtain new cryptocurrency as a reward.

The reward decreases transaction fees by creating a complementary incentive to contribute to the processing power of the network.

Mining is measured by hash rate, typically in TH/s, and a 2023 IMF working paper found that crypto mining could generate 450 million tons of CO2 emissions by 2027.

The rate of generating hashes has been increased by the use of specialized hardware such as FPGAs and ASICs running complex hashing algorithms like SHA-256 and scrypt.

This arms race for cheaper-yet-efficient machines has existed since bitcoin was introduced in 2009.

Mining is a costly business, requiring expensive equipment and cooling facilities to mitigate the heat produced, as well as a significant amount of electrical power.

By July 2019, bitcoin's electricity consumption was estimated to be approximately 7 gigawatts, around 0.2% of the global total, or equivalent to the energy consumed nationally by Switzerland.

Some miners pool resources, sharing their processing power over a network to split the reward equally, according to the amount of work they contributed to the probability of finding a block.

A "share" is awarded to members of the mining pool who present a valid partial proof-of-work.

In 2021, Kazakhstan became the second-biggest crypto-currency mining country, producing 18.1% of the global exahash rate.

The country built a compound containing 50,000 computers near Ekibastuz.

Cryptocurrency Security and Anonymity

Bitcoin is pseudonymous, rather than anonymous, which means owners are not immediately identifiable, but all transactions are publicly available in the blockchain.

Cryptocurrency exchanges are often required by law to collect the personal information of their users, which can compromise anonymity.

Some cryptocurrencies, such as Monero, Zerocoin, Zerocash, and CryptoNote, implement additional measures to increase privacy using zero-knowledge proofs.

A 2020 study demonstrated that anonymity techniques in cryptocurrencies are not sufficient safeguards, and researchers suggested new cryptographic schemes and mechanisms to hide the IP address of the source.

Economics and Regulation

Cryptocurrencies are used primarily outside banking and governmental institutions and are exchanged over the Internet.

Regulation of cryptocurrencies is becoming increasingly important. The Financial Action Task Force (FATF) has defined cryptocurrency-related services as "virtual asset service providers" (VASPs) and recommended that they be regulated with the same money laundering (AML) and know your customer (KYC) requirements as financial institutions.

The FATF has also introduced the "Travel Rule" for cryptocurrencies, a measure which mandates that VASPs obtain, hold, and exchange information about the originators and beneficiaries of virtual asset transfers.

Here are some key regulatory developments:

- June 2020: FATF updated its guidance to include the "Travel Rule" for cryptocurrencies.

- September 2020: The European Commission published a digital finance strategy, including a draft regulation on Markets in Crypto-Assets (MiCA).

- June 2021: The Basel Committee on Banking Supervision proposed that banks that held cryptocurrency assets must set aside capital to cover all potential losses.

- May 2024: The US Congress advanced a bill to the full House of Representatives to provide regulatory clarity for digital assets.

Economics

Cryptocurrencies are primarily used outside of banking and governmental institutions, and are exchanged over the Internet.

This means that they operate in a decentralized manner, without the need for intermediaries like banks. This can be beneficial for people in areas with limited access to traditional financial services.

Cryptocurrencies are often exchanged over the Internet, which can be a fast and convenient way to make transactions.

However, this also means that they can be vulnerable to cyber attacks and other online risks.

Here are some key facts about the economics of cryptocurrencies:

Increasing Regulation

Regulators are taking a closer look at cryptocurrencies, and it's not just a matter of if, but when, we'll see more rules in place. The Financial Action Task Force (FATF) has defined cryptocurrency-related services as "virtual asset service providers" (VASPs) and recommended regulation to prevent money laundering and know your customer requirements.

In June 2020, FATF updated its guidance to include the "Travel Rule" for cryptocurrencies, which requires VASPs to obtain and exchange information about the originators and beneficiaries of virtual asset transfers. This is a significant step towards standardizing cryptocurrency transactions.

The European Commission published a digital finance strategy in September 2020, which included a draft regulation on Markets in Crypto-Assets (MiCA) to provide a comprehensive regulatory framework for digital assets in the EU. This is a major development in the regulatory landscape.

The Basel Committee on Banking Supervision proposed that banks holding cryptocurrency assets must set aside capital to cover all potential losses, a more extreme standard than for other assets. This proposal is a sign that regulators are taking cryptocurrency risks seriously.

The IMF is seeking a coordinated approach to supervising cryptocurrencies, aiming to maintain financial stability while harnessing the benefits of underlying technological innovations. This is a promising development for the cryptocurrency industry.

U.S. Tax Status

In the United States, bitcoin is treated as property for tax purposes. This means that virtual currencies are considered commodities subject to capital gains tax, as ruled by the Internal Revenue Service (IRS) on 25 March 2014.

The IRS made this ruling to clarify the tax status of bitcoin and other virtual currencies. This clarification is important for individuals who buy, sell, or trade virtual currencies, as it affects their tax obligations.

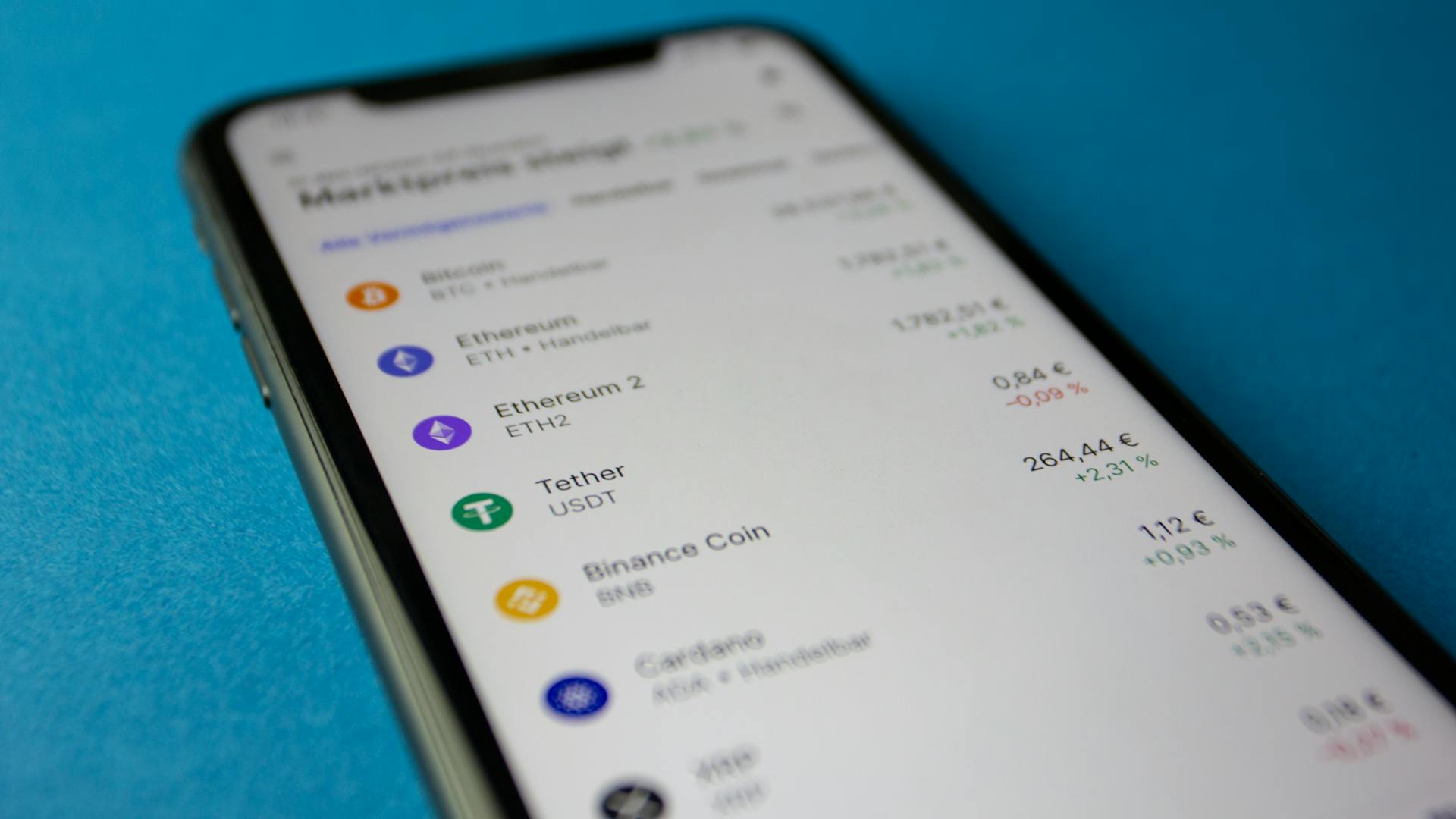

Cryptocurrency Exchanges and Trading

Cryptocurrency exchanges allow customers to trade cryptocurrencies for other assets, such as conventional fiat money, or to trade between different digital currencies. This means you can swap your Bitcoin for US dollars or trade it for another cryptocurrency like Ethereum.

Crypto marketplaces do not guarantee that an investor is completing a purchase or trade at the optimal price. As a result, it was possible to arbitrage to find the difference in price across several markets as of 2020.

Atomic Swaps

Atomic swaps are a mechanism where one cryptocurrency can be exchanged directly for another cryptocurrency without the need for a trusted third party, such as an exchange. This means you can trade your Bitcoin for Ethereum, for example, without having to go through an intermediary.

The beauty of atomic swaps is that they're a decentralized way to trade cryptocurrencies, meaning you can do it without relying on a third party to hold your funds or facilitate the transaction.

Atomic swaps use smart contracts to ensure the exchange happens in a secure and trustless manner, making it a more efficient and cost-effective way to trade cryptocurrencies compared to traditional exchanges.

This technology has the potential to disrupt the traditional cryptocurrency exchange model and provide users with more control over their funds and trading experience.

Expand your knowledge: Cryptocurrency Exchange

Transaction Fees

Transaction fees for cryptocurrency depend mainly on the supply of network capacity at the time, versus the demand from the currency holder for a faster transaction. You can often manually set the fee, but this depends on the wallet software used.

Some exchanges allow you to choose between different presets of transaction fee values during currency conversion. LiteBit, for example, offered this feature before it ceased operations due to market changes and regulatory pressure.

The recommended fee suggested by the network often depends on the time of day, due to varying network load. In February 2023, the median transaction fee for Ether corresponded to $2.2845, while for bitcoin it corresponded to $0.659.

Some cryptocurrencies have no transaction fees, with the most well-known example being Nano (XNO).

Worth a look: Cryptocurrencies Crash

Exchanges

Cryptocurrency exchanges are platforms where you can trade cryptocurrencies for other assets, such as conventional fiat money, or trade between different digital currencies.

These exchanges don't guarantee that you're completing a purchase or trade at the optimal price, which means you can potentially find better deals by shopping around.

As of 2020, it was possible to arbitrage, or find the difference in price across several markets, to make a profit.

Worth a look: Top 50 Cryptocurrency Exchanges

Popular Cryptocurrencies

Bitcoin is the original cryptocurrency and is still the most well-known, created in 2009 and currently the largest by market capitalization.

Many shops accept Bitcoin, making it the most common cryptocurrency for use, similar to traditional currencies.

Bitcoin is often seen as a way to store value, considered a good investment with a long history of steady growth, and is the cryptocurrency that most people place the most value in.

History

In 1983, American cryptographer David Chaum conceived of a type of cryptographic electronic money called ecash.

David Chaum implemented ecash through Digicash in 1995, which required user software to withdraw notes from a bank and designate specific encrypted keys before sending them to a recipient.

The National Security Agency published a paper in 1996 called How to Make a Mint: The Cryptography of Anonymous Electronic Cash, describing a cryptocurrency system.

This paper was first published in an MIT mailing list in October 1996 and later in The American Law Review in April 1997.

Wei Dai described "b-money" in 1998, an anonymous, distributed electronic cash system.

Nick Szabo described bit gold shortly after, an electronic currency system that required users to complete a proof of work function.

In January 2009, bitcoin was created by pseudonymous developer Satoshi Nakamoto, using SHA-256, a cryptographic hash function, in its proof-of-work scheme.

Namecoin was created in April 2011 as an attempt at forming a decentralized DNS.

Litecoin was released in October 2011, using scrypt as its hash function instead of SHA-256.

Peercoin, created in August 2012, used a hybrid of proof-of-work and proof-of-stake.

Cryptocurrency has undergone several periods of growth and retraction, including several bubbles and market crashes.

In June 2021, El Salvador became the first country to accept bitcoin as legal tender.

The government of China declared all cryptocurrency transactions illegal in September 2021, completing a crackdown on cryptocurrency that had previously banned the operation of intermediaries and miners within China.

On 15 September 2022, Ethereum transitioned its consensus mechanism from proof-of-work to proof-of-stake in an upgrade process known as "the Merge".

Formal Definition

Cryptocurrencies have a clear definition that sets them apart from traditional forms of currency. According to Jan Lansky, a cryptocurrency is a system that meets six specific conditions.

One of these conditions is that the system does not require a central authority to maintain its state, instead relying on distributed consensus. This means that there's no single entity controlling the entire system. The system also keeps track of cryptocurrency units and their ownership, which is a crucial aspect of any currency.

The definition also states that the system defines whether new cryptocurrency units can be created, and if so, how they're created and who owns them. This is a key aspect of cryptocurrencies, as it allows for the creation of new units without the need for a central authority.

For more insights, see: Newest Cryptocurrencies

Ownership of cryptocurrency units can be proved exclusively through cryptographic means. This is a secure way to verify ownership, and it's a key feature of many cryptocurrencies. The system also allows transactions to be performed, changing the ownership of units, and ensures that only one transaction can be performed on the same units at a time.

In fact, the system's ability to handle conflicting transactions is a critical aspect of its operation. If two different transactions try to change the ownership of the same units at the same time, the system will only process one of them.

What Are Cryptocurrencies Used For?

Cryptocurrencies can be used to purchase goods and services, offering merchants a wider range of alternative payment methods.

For merchants, accepting cryptocurrencies can reduce their cost of acceptance, which is often their largest line-item cost.

As crypto holders hold their own crypto, transactions are peer-to-peer, making it easier for merchants and friends to transfer money between each other.

Investors can use cryptocurrencies to stake, trade, and invest in other blockchain-based projects and decentralized organizations.

Decentralized financial services (Defi) solutions make it easy for crypto holders to collect, hold, and use their cryptocurrencies in various ways.

Stablecoins

Stablecoins are a type of cryptocurrency that's pegged to the value of a specific asset, usually a fiat currency like the US dollar. They're designed to be less volatile than other cryptocurrencies, making them a popular choice for traders and investors.

One of the most well-known stablecoins is Tether (USDT), which is currently the third-largest cryptocurrency. It's used to stabilize other cryptocurrencies by allowing investors to move their money into USDT when the market fluctuates.

Tether's price is anchored at $1 per coin, making it a reliable store of value. However, some people are concerned that it's not safely backed by dollars held in reserve, but rather uses a short-term form of unsecured debt.

USD Coin (USDC) is another popular stablecoin, created by Circle and Coinbase. It's backed 1:1 with the US dollar and is available on Coinbase, making it one of the most accessible stablecoins.

USD Coin is used to stabilize other cryptocurrencies and is often used as a medium when traders move from one cryptocurrency to another. Its founders claim that it's backed by fully reserved assets or those with equivalent fair value.

Worth a look: When Does Altcoin Season Start

Binance USD (BUSD) is yet another stablecoin, created by Binance. It's backed 1:1 with the US dollar and can be used to pay fees on the Binance platform and to buy other cryptos.

Here's a list of some popular stablecoins:

- Tether (USDT)

- USD Coin (USDC)

- Binance USD (BUSD)

- Dai (DAI)

These stablecoins are designed to provide a safe and reliable store of value, making them a popular choice for those looking to invest in cryptocurrencies.

Memecoins

Memecoins have become a fascinating aspect of the cryptocurrency world. They're often created as a joke, but they can still hold significant value.

These coins often take on a life of their own due to their ridiculousness, as seen with Dogecoin and Shiba Inu. One tweet from a prominent figure, like Elon Musk, can send their value skyrocketing.

Dogecoin, for example, was created as a joke after the Bitcoin run-up in 2013. It's based on the Doge meme featuring a Shiba Inu dog and has unlimited issuance.

Its low price makes Dogecoin accessible to everyone, which is part of its appeal. It's been used for charitable causes, such as sending money to Kenya to build water wells.

Shiba Inu, another "joke coin", was created in 2021 on the Ethereum blockchain. This allows for "token cloning", meaning anyone can create their own version of the coin.

As a result, there are now over 100 different versions of Shiba Inu, with a market cap of $5 billion.

Bitcoin (BTC)

Bitcoin (BTC) is the original cryptocurrency and is still the most well-known. It was created in 2009 and is currently the largest cryptocurrency by market capitalization.

Its mysterious creator, allegedly Satoshi Nakamoto, introduced the currency in 2009 and it’s been on a roller-coaster ride since then.

Bitcoin is often seen as a way to store value, and is considered a good investment with a long history of steady growth. Although this is not guaranteed, it is the cryptocurrency that most people place the most value in.

Its value continues to go up, making it a popular choice for investors. In 2024, the Securities and Exchange Commission (SEC) approved the trading of ETFs that invest directly in Bitcoin, giving investors an easy way to bet on Bitcoin.

Here are some key facts about Bitcoin:

- Price: $666.48

- Market cap: $95.98 billion

Bitcoin is the most common cryptocurrency for use, similar to traditional currencies. Many shops accept Bitcoin, and many online purchases can be made with Bitcoin.

Ethereum (ETH)

Ethereum (ETH) is a cryptocurrency platform that allows you to use ether, its currency, to perform various functions.

Ethereum was created in 2015 and quickly rose to become the second-largest cryptocurrency.

It's quite different from Bitcoin, designed to serve a different purpose, and is now used for a variety of interesting decentralized applications (DApps).

Ethereum is a decentralized platform that runs smart contracts, which are applications that can be built on top of its blockchain.

Smart contracts are programs that run exactly as programmed without any possibility of fraud or third-party interference.

Worth a look: Cryptocurrency Bitcoin Ethereum

These contracts allow for a wide range of possibilities, from games to financial applications.

Ethereum was the blockchain birthplace of NFTs, which can be created, sold, and programmed in a variety of interesting ways.

Through smart contracts, NFTs can have unique utilities, such as enabling artists to get royalties or allowing gamers to buy outfits and tools with Ether and use them in the game.

See what others are reading: Cryptocurrencies with Smart Contracts

Xrp (Xrp)

XRP (XRP) is a cryptocurrency that offers a way to pay in many different real-world currencies. It's particularly useful for cross-border transactions.

Ripple, the company behind XRP, was created in 2012. This was a significant year for the cryptocurrency space.

XRP uses a trust-less mechanism to facilitate payments, making it a reliable option for users. This mechanism allows for secure and efficient transactions.

The XRP Ledger is the blockchain platform on which XRP is created. It's a unique platform that allows for fast and cheap transactions.

XRP has been adopted by some of the largest banks in the world due to its useful application for financial institutions. This is a testament to its effectiveness in the financial sector.

BNB (BNB)

BNB (BNB) is the cryptocurrency issued by Binance, one of the largest crypto exchanges in the world.

It was originally created as a token to pay for discounted trades on the Binance platform.

BNB can now be used for payments, as well as purchasing various goods and services.

Using BNB to pay fees on the Binance platform can often result in lower fees compared to paying in another currency.

It can also be used to buy other cryptos on the Binance platform.

Paying fees in BNB can be a cost-effective option for frequent traders on the Binance platform.

Here's an interesting read: Cryptocurrencies on Binance

Solana (SOL)

Solana (SOL) is a high-speed blockchain protocol that can process thousands of transactions per second. It's ideal for applications that need to process a lot of transactions quickly, such as video streaming or gaming.

Solana was created in 2017 by Anatoly Yakovenko, the former Chief Technical Officer at Qualcomm. This expertise has helped shape the platform into what it is today.

The issuance of Solana's currency, called SOL, is capped at 480 million coins. This means there will never be more than 480 million SOL coins in circulation.

Solana's main selling point is its speed, which is much faster than other protocols like Ethereum.

Intriguing read: Is Crypto Coins Bitcoin Going down Now

Cardano (Ada)

Cardano is a smart contract platform created in 2015 by Charles Hoskinson, one of the co-founders of Ethereum. It's unique in using a proof-of-stake consensus algorithm instead of proof-of-work, making it more energy efficient.

Cardano's energy efficiency is impressive, consuming significantly less power than other blockchain protocols. For example, processing Bitcoin transactions consumes around 110 Terawatt Hours per year, which is equivalent to the annual energy draw of small countries like Sweden.

Cardano, on the other hand, is said to be 1.6 million times more energy-efficient compared to Bitcoin, as cited by Forbes. This is a major advantage in a world where energy consumption is becoming increasingly important.

Cardano has been around since 2017, but began development back in 2015 with help from an Ethereum co-founder. It's a decentralized, open-source, public blockchain.

Here are some key stats about Cardano:

- Price: $0.8778

- Market cap: $30.83 billion

Cardano is currently working on integrating a new programming language called Plutus, which will make it easier to develop smart contracts. This will likely make Cardano an even more attractive option for developers and users alike.

Tron (Trx)

Tron (TRX) is a decentralized blockchain for creating applications that was established in 2017.

Its native token is known as TRX, and as of now, the price is $0.2437.

TRX has a significant market presence with a market cap of $21.01 billion.

See what others are reading: Bitcoin Cryptocurrency Market Capitalization Decline

Avalanche (Avalanche)

Avalanche is a crypto that launched in 2020, known for its high transaction speeds and low costs.

Its blockchain is notable for the creation of subnets, which are custom blockchains that have their own rules and use cases.

The Avalanche blockchain is designed to be scalable, secure, and interoperable, making it a great platform for launching decentralized finance applications and enterprise blockchains.

Avalanche uses a proof-of-stake consensus model, where users can earn rewards for staking their tokens on the network.

This model is a key feature of the Avalanche platform, allowing it to offer fast and secure transactions.

Recommended read: Avalanche Cryptocurrency News

Chainlink (Link)

Chainlink (LINK) is a cryptocurrency that powers the Chainlink network, which is used to pay operators for connecting smart contracts to real-world data, making it essential for DeFi apps.

Expand your knowledge: Chainlink Cryptocurrency Price Prediction

Chainlink is a crucial component in the DeFi ecosystem, enabling the integration of real-world data into smart contracts. This functionality is a game-changer for decentralized finance applications.

The Chainlink network relies on a decentralized architecture, allowing for a secure and trustless exchange of data between smart contracts and real-world sources. This architecture ensures the integrity and reliability of the data being used.

Chainlink's use cases are vast and varied, but its primary function is to provide a reliable and secure way to connect smart contracts to real-world data. This has significant implications for the development of decentralized finance applications.

You might like: Chainlink Cryptocurrency News

Polkadot (Dot)

Polkadot (Dot) is a blockchain protocol created in 2016.

It's designed to be scalable, flexible, and interoperable, making it a unique player in the cryptocurrency space.

Polkadot's use of "parachains" allows for a more customizable and efficient use of resources.

This means developers can create chains for specific applications, making it easier to build and deploy blockchain-based projects.

Polkadot is also working on a decentralized exchange called "Polkaswap", which will enable trustless trading of DOT, ETH, and other assets.

Discover more: Polkadot Cryptocurrency News

Polygon (MATIC)

Polygon is a scalability solution for Ethereum, sitting on top of it to improve its scalability. It's a layer 2 solution, which means it helps to process transactions more efficiently.

One of the main features of Polygon is sidechains, which are separate chains that can be used to process transactions. This off-loads some of the work from the Ethereum blockchain.

Polygon's sidechains help to improve the scalability of the Ethereum network. By processing transactions on these separate chains, the network can handle more transactions without slowing down.

Polygon is also working on stake-mining, which will allow users to earn rewards for staking their tokens on the network. This is a new feature that's still in development.

Additional reading: Cryptocurrencies Payment Solution

Litecoin (LTC)

Litecoin (LTC) is a cryptocurrency that was created in 2011 as a “lightweight” version of Bitcoin.

It has a number of different features that make it unique, such as faster transaction times and improved storage efficiency.

Litecoin is often used as a “testnet” for Bitcoin, allowing developers to test new features before implementing them on Bitcoin.

As one of the older cryptocurrencies, outside of Bitcoin, Litecoin has a large community of supporters.

Stellar (XLM)

Stellar is a payments network that allows for fast, cross-border transactions.

It's designed to be scalable and work with existing financial infrastructure. This makes it a more practical option for everyday use.

Stellar doesn't require mining to validate transactions, which makes it more energy efficient than other cryptocurrencies.

The Stellar network is based on a "consensus protocol."

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) is a copy of Bitcoin with some key changes, making it an interesting alternative to the original.

One of the main differences is that Bitcoin Cash has a block size that's eight times larger than Bitcoin, allowing for more transactions to be processed per second.

This increased block size makes Bitcoin Cash more efficient, but it also means that miners need to have access to more powerful equipment to process the larger blocks.

Bitcoin Cash has a different mining algorithm than Bitcoin, which makes it more accessible to miners who don't have access to specialized equipment.

20 Cryptocurrencies to Watch

The world of cryptocurrencies is vast and exciting, with many assets vying for attention. Bitcoin is one of the most popular and widely used cryptocurrencies, with a market capitalization of over $1 trillion.

Ethereum is another top contender, known for its smart contract functionality and vast developer community. It's used for a wide range of applications, from decentralized finance to non-fungible tokens.

Litecoin is a peer-to-peer cryptocurrency and open-source software project, designed to be a faster and more lightweight alternative to Bitcoin. It's often used for everyday transactions.

Monero is a private and secure cryptocurrency that's gaining traction for its anonymity features. It's used for a wide range of purposes, from e-commerce to charitable donations.

Ripple is a real-time gross settlement system (RTGS) that's used by banks and other financial institutions for cross-border payments. It's known for its speed and efficiency.

Bitcoin Cash is a hard fork of the Bitcoin network, designed to increase the block size and improve transaction speeds. It's used for everyday transactions and is gaining popularity.

Cardano is a decentralized public blockchain and cryptocurrency project, known for its focus on security and scalability. It's used for a wide range of applications, from decentralized finance to gaming.

EOS is a decentralized operating system that's used for building scalable and high-performance blockchain applications. It's known for its ability to process thousands of transactions per second.

Stellar is an open-source, distributed ledger technology that's used by banks and other financial institutions for cross-border payments. It's known for its speed and efficiency.

IOTA is a quantum-resistant cryptocurrency that's used for the Internet of Things (IoT) and other applications. It's known for its focus on security and scalability.

NEO is a decentralized platform that's used for building scalable and high-performance blockchain applications. It's known for its focus on security and scalability.

TRON is a decentralized operating system that's used for building scalable and high-performance blockchain applications. It's known for its focus on security and scalability.

Dogecoin is a peer-to-peer cryptocurrency and open-source software project, designed to be a fun and lighthearted alternative to Bitcoin. It's often used for charitable donations and other community-driven projects.

Related reading: Is Cryptocurrency a Security

Binance Coin is the native cryptocurrency of the Binance exchange, used for a wide range of purposes, from trading fees to investment opportunities. It's known for its stability and reliability.

VeChain is a decentralized platform that's used for building scalable and high-performance blockchain applications. It's known for its focus on security and scalability.

Qtum is a decentralized platform that's used for building scalable and high-performance blockchain applications. It's known for its focus on security and scalability.

NEM is a decentralized platform that's used for building scalable and high-performance blockchain applications. It's known for its focus on security and scalability.

Lisk is a decentralized platform that's used for building scalable and high-performance blockchain applications. It's known for its focus on security and scalability.

Ontology is a decentralized platform that's used for building scalable and high-performance blockchain applications. It's known for its focus on security and scalability.

Bytom is a decentralized platform that's used for building scalable and high-performance blockchain applications. It's known for its focus on security and scalability.

Siacoin is a decentralized platform that's used for building scalable and high-performance blockchain applications. It's known for its focus on security and scalability.

Waves is a decentralized platform that's used for building scalable and high-performance blockchain applications. It's known for its focus on security and scalability.

Check this out: Cryptocurrency Security Risks

10 Largest Cryptocurrencies

The 10 largest cryptocurrencies are making waves in the market. Bitcoin is the most widespread, with a market capitalization of over $1 trillion.

Ethereum is a close second, with a market capitalization of over $500 billion. It's used for decentralized applications and has a large developer community.

Bitcoin is used as a store of value and a medium of exchange, with many merchants accepting it as payment. Its popularity can be attributed to its widespread adoption and the fact that it's the first and most well-known cryptocurrency.

Ripple has a market capitalization of over $200 billion, making it one of the largest cryptocurrencies. It's primarily used for cross-border payments and has gained popularity due to its fast and low-cost transactions.

Litecoin is another popular cryptocurrency, with a market capitalization of over $100 billion. It's similar to Bitcoin but has faster transaction times and lower fees.

Ethereum Classic is an older version of Ethereum, with a market capitalization of over $50 billion. It's still used by some developers who prefer its original code.

Check this out: Dividend Etfs Popularity Surge

Cardano is a smaller but still significant cryptocurrency, with a market capitalization of over $20 billion. It's known for its focus on security and scalability.

Stellar is a decentralized platform that uses a cryptocurrency called Lumens. It has a market capitalization of over $10 billion and is used for cross-border payments and asset transfer.

Monero is a private and secure cryptocurrency, with a market capitalization of over $5 billion. It's used for anonymous transactions and has gained popularity due to its focus on privacy.

Frequently Asked Questions

What are the top 5 cryptos to buy now?

For investors seeking high-performance cryptocurrencies, consider BlockDAG, Fantom, Bitcoin Cash, Bittensor, and other innovative projects that are revolutionizing the finance and blockchain space. Research each project thoroughly to determine the best fit for your investment goals and risk tolerance.

Which digital currency is the highest in the world?

The highest-valued digital currency is Bitcoin, with a price of $96,596.95 and a market cap of $1.91 trillion. This makes it the largest and most valuable cryptocurrency in the world, with a significant presence in the global market.

Sources

- https://en.wikipedia.org/wiki/Cryptocurrency

- https://www.bankrate.com/investing/types-of-cryptocurrency/

- https://www.tradingview.com/markets/cryptocurrencies/prices-all/

- https://staxpayments.com/blog/most-popular-cryptocurrencies/

- https://corporatefinanceinstitute.com/resources/cryptocurrency/top-10-cryptocurrencies/

Featured Images: pexels.com