The concept of Bitcoin ASIC mining dates back to the early days of cryptocurrency. The first ASIC chip was released in 2013 by a company called Butterfly Labs, but it was met with controversy and ultimately shut down by the US government.

In 2013, the first Bitcoin ASIC miner, the Butterfly Labs ASIC, was released, but it was not a commercial success. The company was shut down due to allegations of false advertising and other issues.

The release of the ASIC miner by Butterfly Labs marked a significant shift in the mining landscape, as it allowed for faster and more efficient mining. However, it also led to a decline in CPU and GPU mining.

The first major ASIC miner was the Antminer S1, released in 2013 by Bitmain, which was a significant improvement over the Butterfly Labs ASIC.

Take a look at this: Bitcoin Miner Script

Early Mining Methods

The first bitcoin block was mined on January 3, 2009, by Satoshi Nakamoto using an average personal computer.

Computers with a central processing unit (CPU) were sufficient for creating new blocks and earning mining rewards in the early days of the Bitcoin network.

The lack of miner competition allowed Nakamoto to process the computational energy required to create new blocks on a CPU device.

Take a look at this: Cpu Mining vs Gpu Mining

CPU

The early days of bitcoin mining were quite different from today. On Jan. 3, 2009, Satoshi Nakamoto mined the first bitcoin block using an average personal computer.

These personal computers contained a central processing unit, or CPU, which controls how commands on a computer are processed and executed. The CPU is the brain of the computer.

Satoshi Nakamoto didn't need specialized equipment to launch the bitcoin blockchain, thanks to the lack of miner competition at the time. The computational energy required to create new blocks and earn mining rewards could be easily processed on CPU devices.

A fresh viewpoint: Bitcoin Mining Quantum Computer

GPUs

GPUs revolutionized mining by leveraging their optimized performance for specific computational tasks.

In October 2010, GPUs became a game-changer in mining, quickly overtaking CPU mining equipment in popularity.

Miners

In 2013, ASIC miners entered the market, revolutionizing Bitcoin mining with unmatched efficiency.

ASICs were solely built for mining Bitcoin, making them far more effective than other processing units available at the time.

The development of ASICs led to a significant increase in mining efficiency, but since then, there hasn't been much innovation beyond shrinking the chip size.

Manufacturers like Intel continue to work on improving ASIC computers, but technological limits in the semiconductor industry have hindered further progress.

Suggestion: Gpu Mining vs Asic

Modern Mining

In 2013, ASIC miners entered the market, revolutionizing Bitcoin mining with unmatched efficiency.

The development of ASIC miners was a game-changer, but since then, there hasn't been significant innovation besides a chip size reduction in ASICs.

Manufacturers like Intel continue to innovate toward building better ASIC computers.

To maximize Bitcoin mining efficiency and profitability, optimizing ASIC miners is crucial.

Selecting the right ASIC miner involves considering three key factors: compatibility with the Bitcoin SHA-256 algorithm, hash rate, and power consumption.

A higher hash rate means the miner can solve cryptographic puzzles faster, increasing your chances of earning mining rewards.

The hash rate is measured in TH/s (terahashes per second), so balance the cost of the miner with its hash rate to find a model that offers the best value for money.

The best hash rate to power consumption ratio is often denoted as J/TH (joules per terahash), which reduces operational costs and enhances overall profitability.

You might like: Bitcoin Mining Energy Consumption

Adequate cooling is essential to prevent overheating and ensure your ASIC miner operates at optimal efficiency.

High-quality fans, good ventilation, and additional cooling systems can help keep your miners running smoothly.

Regular maintenance extends the life of your ASIC miner and prevents downtime.

Dust and debris can reduce cooling efficiency, so clean your miners regularly and check connections to keep your miner in top condition.

Firmware updates can improve performance, add features, or enhance security, so regularly updating your ASIC miner's firmware is essential.

By implementing these strategies, you can significantly impact the efficiency and profitability of your Bitcoin mining operations.

Here are some key considerations for selecting the right ASIC miner:

- Compatibility with the Bitcoin SHA-256 algorithm

- Hash rate (measured in TH/s)

- Power consumption (measured in J/TH)

Energy and Impact

Bitcoin's energy consumption is often a point of contention, but it's essential to consider the bigger picture. The collective energy usage of the Bitcoin network is significant, but it's comparable to that of some countries.

However, critics often overlook the fact that traditional banking infrastructure consumes nearly twice as much energy as the Bitcoin network, without offering the added benefits of a decentralized digital money system.

The good news is that Bitcoin mining can be used to offset the costs of renewable energy production, as seen in some solar farms that utilize mining to help power their operations.

Energy Consumption

The energy consumption of Bitcoin's network of ASIC miners is a topic of much debate. It's true that the collective energy required to mine bitcoins is significant.

Critics often compare the energy usage of the Bitcoin network to that of some countries, but this comparison doesn't tell the whole story. The traditional banking infrastructure, which Bitcoin is designed to replace, consumes nearly twice as much energy as the Bitcoin network.

The energy consumption of Bitcoin's network is often seen as a negative aspect, but it's essential to consider the larger picture. The added benefits of having a decentralized network of digital money, such as increased security and transparency, are often overlooked in these discussions.

Economic and Social Impact

ASIC mining has both centralized wealth and democratized access to Bitcoin, making it a double-edged sword in the cryptocurrency market. The high upfront costs associated with purchasing and operating ASIC hardware have led to the concentration of mining power in the hands of a relatively small number of large-scale mining operations or pools.

This centralization can influence Bitcoin's market value, as these entities possess significant control over the hash rate and, by extension, the network's security and transaction processing capacity. Centralization can also stifle innovation and limit opportunities for new entrants.

On the other hand, ASICs have made mining more efficient and profitable, contributing to the overall growth and stability of the cryptocurrency market. The continual innovation and competition among ASIC manufacturers drive down costs over time, potentially making mining more accessible to a broader audience.

ASIC mining has also fostered the development of vibrant communities and cultures around Bitcoin and cryptocurrency mining. Online forums, social media platforms, and conferences have become spaces for miners to share knowledge, discuss strategies, and advocate for the broader adoption of cryptocurrencies.

By participating in the mining process, individuals contribute to the operation of a global, decentralized financial system outside the control of traditional banking institutions and government entities. This has empowered people in regions with unstable currencies or restrictive financial policies, providing them with an alternative means of saving, investment, and transaction.

For another approach, see: Bitcoin Market Cap History

Challenges and Future

The history of Bitcoin ASIC mining has been marked by significant advances, but challenges lie ahead. The industry has reached a plateau, with chip size reduction in ASIC devices slowing down since 2015. We're hitting fundamental limits, and a new kind of device is needed to leapfrog mining efficiency gains.

The semiconductor industry as a whole is facing similar challenges, and without a radical new technology, Bitcoin miners will need to find alternative ways to gain a competitive advantage. This could involve innovations in energy sourcing, financial planning, or product diversification.

Challenges and Controversies

The challenges and controversies surrounding Bitcoin's growth are many. The introduction of ASIC miners has led to concerns about network centralization, with a small number of entities potentially controlling a significant portion of the network's hash power.

This consolidation has raised fears of a 51% attack, which could undermine the network's integrity and trustworthiness. The high cost and expertise required for ASIC operation have led to the emergence of mining pools and large-scale mining operations.

The environmental impact of ASIC mining is also a hotly debated issue, with the global Bitcoin network consuming more electricity than some countries. Critics argue that the carbon footprint associated with ASIC mining contributes to climate change.

The Bitcoin Mining Council has emerged to promote transparency and encourage the use of sustainable energy in mining operations. However, the reliance on fossil fuels in regions where electricity is cheapest remains a significant concern.

Scalability issues are another major challenge facing the Bitcoin network, with the blockchain only able to handle a limited number of transactions per second. The development of solutions like the Lightning Network aims to alleviate these issues by handling a portion of the transaction load off-chain.

The Lightning Network enables faster and more cost-effective transactions by allowing users to create payment channels between any two parties on that extra layer. This approach aims to enhance the network's capacity to process transactions.

Related reading: How Much Electricity Does Crypto Mining Use

Bitcoin's Future

Bitcoin has a rich history of technological advances, with the Lightning Network providing a realistic solution for mass adoption and scalability.

The industry has been pushing towards better and faster mining equipment, from CPUs to ASICs, but chip size reduction in ASIC bitcoin mining devices has been slower and less dramatic since 2015.

A new technology is needed to leapfrog mining efficiency gains, just like GPU mining did for CPU mining and FPGA mining did for GPU mining.

We're hitting fundamental limits, and the entire industry, not just bitcoin mining, is facing this problem.

Without a radical new technology, bitcoin miners will soon stop competing primarily on the basis of hardware and equipment.

Miners will be forced to consider other areas in which to gain a competitive advantage, such as innovations in energy sourcing, financial planning, or even product diversification.

Competition for bitcoin mining rewards will continue to spur technological evolution, but it's unclear what the next major leap in mining technology will look like.

On a similar theme: When Will Bitcoin Mining End

Table of Contents

Bitcoin mining is the backbone of the cryptocurrency world, embodying both its innovative spirit and technological advancements. It secures the blockchain by verifying transactions and releases new bitcoins into circulation.

ASIC miners are specialized hardware that revolutionized Bitcoin mining, designed to mine Bitcoin with unparalleled efficiency. They're the result of technological advancements that pushed the boundaries of processing power and energy efficiency.

The introduction of ASIC miners marked the beginning of an era where mining transitioned from a hobbyist activity to a professional and industrial operation. This shift underscores the growing importance and complexity of blockchain technology.

ASIC miners have significantly altered the mining landscape, and their impact is felt in the competitive dynamics of mining, network security, and scalability.

Expand your knowledge: What Is Bitcoins Blockchain

Origins and Revolution

The journey of cryptocurrency mining began with the inception of Bitcoin in 2009, conceived by an individual or group under the pseudonym Satoshi Nakamoto.

Bitcoin's decentralized ledger, the blockchain, was revolutionary, and mining emerged as a pivotal process for verifying transactions and introducing new bitcoins into the system. The mining process initially relied on Central Processing Units (CPUs), the general-purpose processors found in most computers.

The low difficulty level of mining tasks at Bitcoin's dawn made CPUs sufficient to solve the cryptographic puzzles necessary for block validation and reward acquisition. This phase epitomized the democratic ethos of Bitcoin, allowing anyone with a computer to contribute to the network and receive bitcoins in return.

The transition to ASIC mining marked a significant shift in the mining dynamics, introducing a new level of computational power and efficiency, but also raising the entry barriers for individual miners due to the higher costs of ASIC devices compared to standard CPUs.

Origins of Cryptocurrency

The Genesis of Cryptocurrency Mining began with the inception of Bitcoin in 2009, conceived by an individual or group under the pseudonym Satoshi Nakamoto.

At the heart of Bitcoin was the revolutionary blockchain technology, a decentralized ledger that records all transactions across a network of computers. This technology was a game-changer, allowing for secure and transparent transactions without the need for intermediaries.

Mining emerged as a pivotal process for verifying these transactions, ensuring network security, and introducing new bitcoins into the system as rewards. In the early days, anyone with a computer could contribute to the network and receive bitcoins in return, epitomizing the democratic ethos of Bitcoin.

The mining process initially relied on Central Processing Units (CPUs), the general-purpose processors found in most computers. Due to the relatively low difficulty level of mining tasks at Bitcoin’s dawn, CPUs were sufficient to solve the cryptographic puzzles necessary for block validation and reward acquisition.

As Bitcoin gained popularity and its network expanded, the difficulty of mining puzzles increased, rendering CPU mining increasingly inefficient. This led to the advent of Graphics Processing Unit (GPU) mining, which introduced a new level of computational power and efficiency.

A fresh viewpoint: When Did Lightning Network Start on Bitcoin

The Revolution

The ASIC Revolution marked a pivotal moment in Bitcoin mining history, commencing in 2013 with the release of the first ASIC devices by companies like Avalon.

These early ASIC miners offered a quantum leap in hashing power and energy efficiency compared to FPGA and GPU miners, dramatically increasing mining efficiency.

The introduction of ASIC mining made mining more profitable for those who could afford and access the new technology, leading to an arms race among miners.

The increased efficiency also meant that the electricity cost per hash was significantly reduced, making mining operations more sustainable in regions with higher electricity prices.

Companies like Bitmain, Canaan, and MicroBT quickly established themselves as leaders in the ASIC manufacturing space, with Bitmain's Antminer series becoming synonymous with ASIC mining.

These manufacturers have continually innovated, releasing successive generations of ASIC miners that offer improved hashing power, energy efficiency, and reliability.

The competition among these companies has driven technological advancements and made ASIC miners more accessible to a broader audience.

The undeniable efficiency and power of ASIC miners have secured their position as the cornerstone of Bitcoin mining, underscoring the relentless pursuit of innovation in the quest to maintain and secure the world's foremost cryptocurrency network.

Take a look at this: Cryptocurrency Mining Companies

Frequently Asked Questions

When were Bitcoin ASICs invented?

Bitcoin ASICs were introduced to the market in 2013, specifically designed for Bitcoin mining. This marked a significant shift in mining efficiency, surpassing traditional processing units.

Who invented ASIC miner?

The first ASIC miner was launched by Canaan in 2013. Canaan is a Chinese company that pioneered the development of mining-specific integrated circuits.

Sources

- https://asicjungle.com/asic-magazine/articles/the-history-and-evolution-of-bitcoin-mining

- https://www.coindesk.com/tech/2020/04/26/the-rise-of-asics-a-step-by-step-history-of-bitcoin-mining

- https://d-central.tech/tracing-how-asic-hardware-redefined-bitcoin-mining/

- https://www.linkedin.com/pulse/history-evolution-asic-miners-leo-l

- https://blog.bitmain.com/en/the-story-behind-the-asic-evolution/

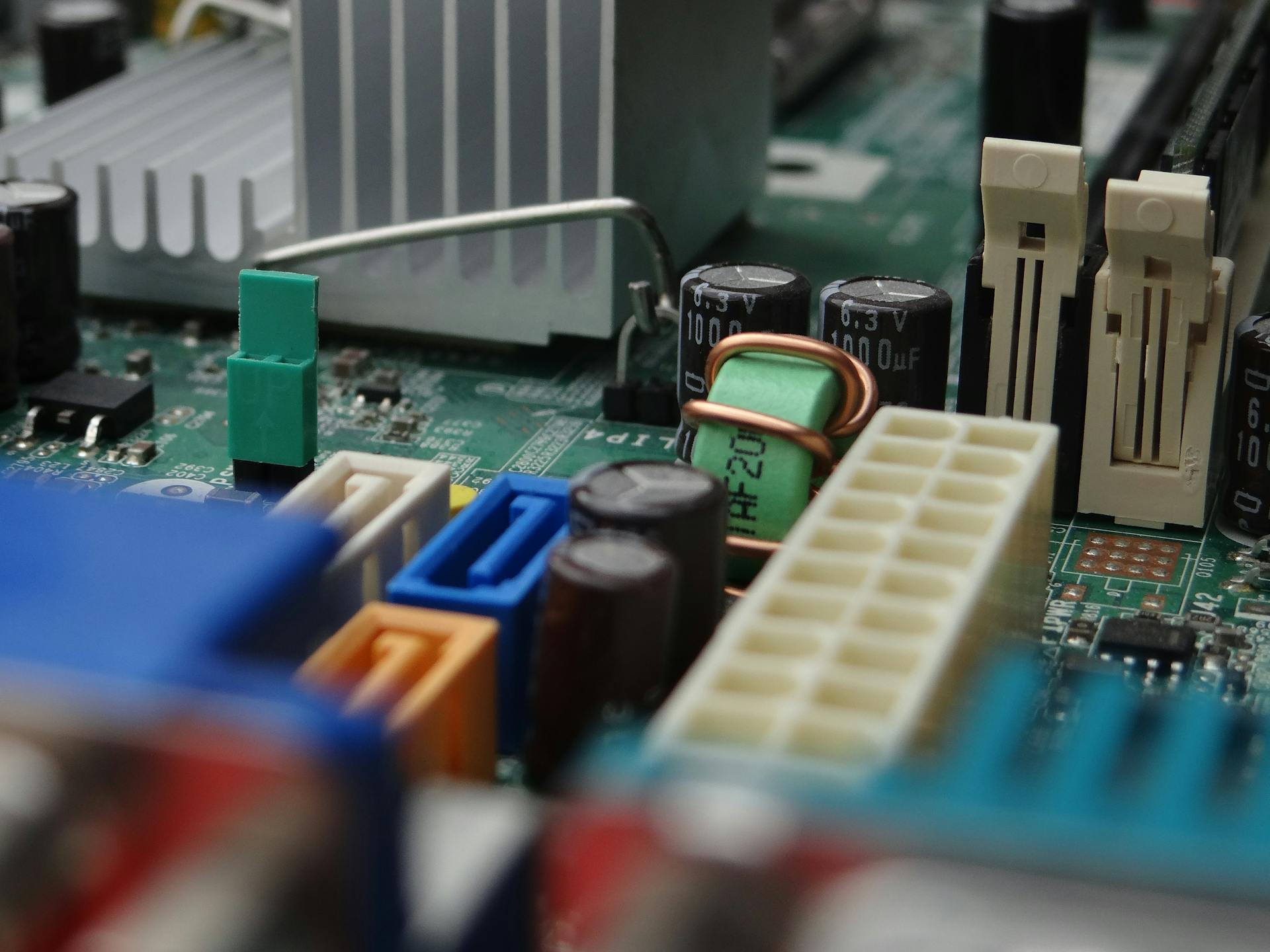

Featured Images: pexels.com