Green banking is a type of banking that prioritizes environmental sustainability and social responsibility. By investing in renewable energy and reducing carbon emissions, green banks help to mitigate the impact of climate change.

Green banks offer a range of sustainable financial products and services, including green loans, green bonds, and socially responsible investment options. These products help individuals and businesses to invest in environmentally friendly projects and initiatives.

One key aspect of green banking is the concept of environmental impact assessment, which involves evaluating the potential environmental effects of a project or investment. This helps to identify and mitigate any potential negative impacts on the environment.

Green banks also promote sustainable agriculture and forestry practices by providing financing for projects that conserve and restore natural resources.

Here's an interesting read: How Do Investment Banks Differ from Commercial Banks

What Is Green Banking?

Green banking is a financing trend where banks focus on sustainable technologies and environmentally-friendly initiatives.

Banks that adopt green banking strategies are dedicated to promoting clean energy and combating climate change.

The Paris Climate Agreement played a significant role in popularizing green banking among financial institutions.

Green banks invest in renewable energy, reforestation projects, and carbon offsets.

Banks can also become green at a local level by implementing eco-friendly lending policies.

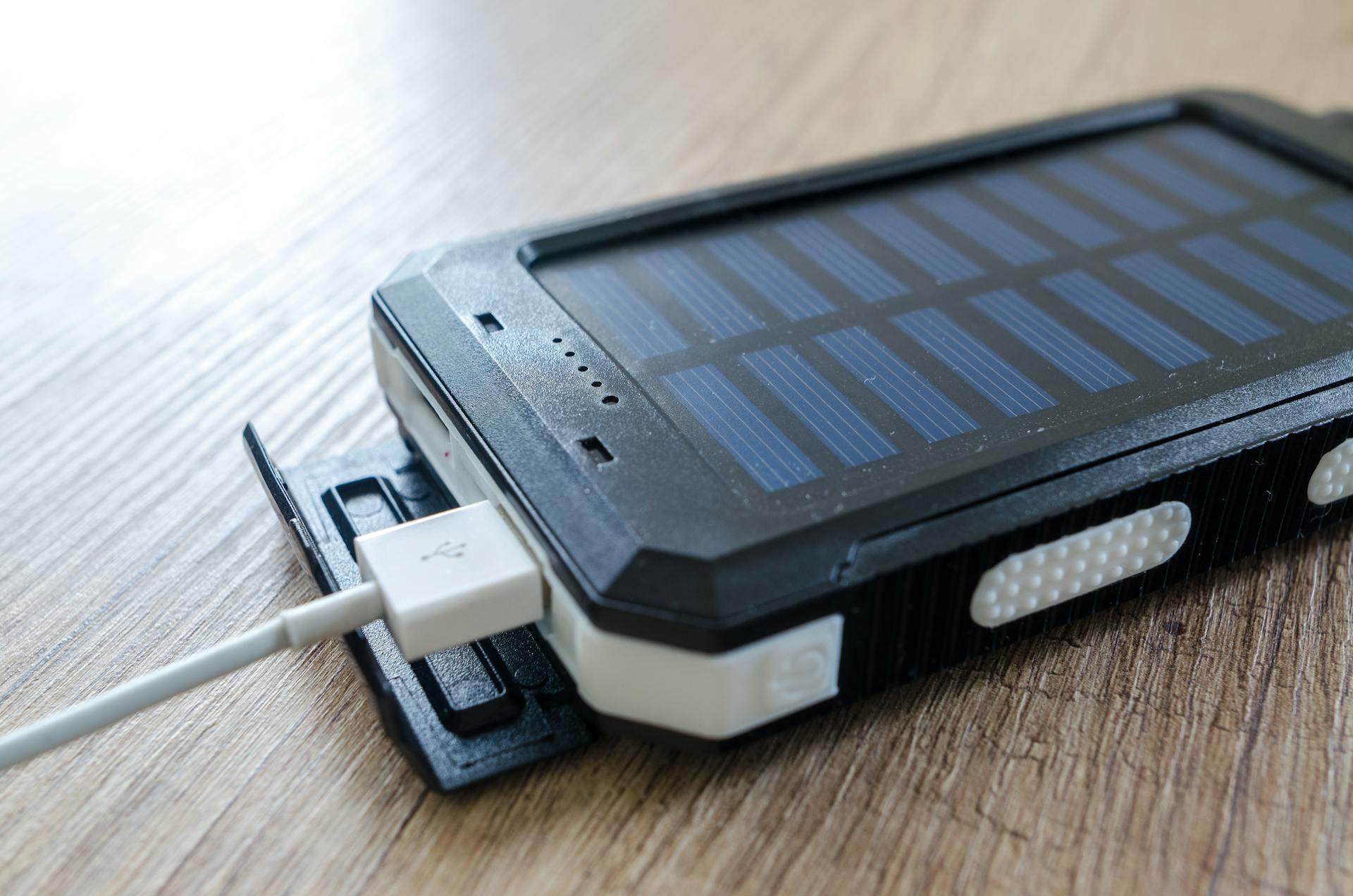

These policies can include loans for electric vehicles and home solar electric systems.

Importance and Benefits

Green banking is crucial for curbing climate change, as businesses must reduce greenhouse gas emissions through their activities. The Intergovernmental Panel on Climate Change warns that if left unmitigated, extreme weather events could cause hundreds of billions of dollars in damage and lead to the loss of many human lives.

The world's 60 largest private banks have invested a staggering $3.8 trillion in coal, oil, and natural gas projects between 2016 and 2020, putting the Paris Climate Agreement goals at risk. However, the adoption of green banking principles by several major banks shows promise for a renewable energy-based economy.

A fresh viewpoint: Climate Bonds

Green banks can be particularly beneficial to historically underserved communities, including low- and moderate-income (LMI) communities and communities of color. By prioritizing investments in these communities, green banks can ensure fair access to clean energy solutions and address unique energy burdens faced by LMI households.

Green banks can also help communities lower energy bills by funding energy efficiency measures and renewable energy generation, saving individual households and businesses money. By investing in clean energy projects, green banks help communities move away from fossil fuels and reduce greenhouse gas emissions.

Importance of Banking

The world's 60 largest private banks funneled a shocking $3.8 trillion into coal, oil, and natural gas projects between 2016 and 2020. This massive investment in fossil fuels risks jeopardizing the achievement of the Paris Climate Agreement goals.

Businesses have to do their part to reduce greenhouse gas emissions through their activities, especially in the face of extreme weather events that could cause hundreds of billions of dollars in damage and lead to the loss of many human lives.

Our planet will warm by about 3 to 5 degrees Celsius by 2100 if businesses continue to operate as usual, making sustainable investment strategies crucial to curbing climate change.

Expand your knowledge: Commercial Banks vs Investment Banks

Advantages

Green banks can help communities lower energy bills by funding energy efficiency measures and renewable energy generation, saving individual households and businesses money.

By investing in clean energy projects, green banks can assist in the creation of many new jobs in communities. The clean energy sector is a growing job market, and green banks can play a key role in advancing the transition to a low-carbon economy.

Green banks' mission-driven approach allows them to prioritize investments in underserved communities, ensuring fair access to clean energy solutions. This helps address the unique energy burdens faced by low- and moderate-income (LMI) households and communities of color.

Green banks increase a bank's competitive advantage by encouraging investment in sustainable, low-carbon industries that provide long-term profits. This attracts eco-conscious investors, such as those interested in renewable energies.

By financing clean energy projects, green banks help communities move away from fossil fuels and reduce greenhouse gas emissions. This contributes to a cleaner environment, benefiting public health and reducing healthcare costs associated with environmental degradation.

Core Principles and Criteria

Green banks prioritize commercially viable technologies, which have been tested and can reliably generate revenue for project owners. This reduces the associated "technology risk" and allows green banks to focus on projects with a proven track record.

A key element of green banks is their connection with the government, which typically provides public funds to capitalize them. This public purpose entity model sets green banks apart from other financing institutions.

Green banks operate similarly to commercial banks, providing capital and owning debt, which requires a balance sheet. This structure allows them to leverage private investment in clean energy projects.

To facilitate private entry into the clean energy market, green banks use limited public funds to attract private investment. This approach helps to scale up clean energy projects and reduce reliance on public funds.

B Corporation Certification

B Corporation Certification is a badge of honor for socially responsible banks. It's a guarantee that the bank meets the highest public transparency and social and environmental performance standards.

B Corp certified banks take a leading role in driving social change in the communities they serve.

By choosing a B Corp certified bank, you're supporting businesses that work to build a more inclusive and sustainable economy.

Starting and Scaling

Starting and scaling a green bank is a crucial step in achieving national and global climate targets. Green banks play a major financing role in scaling up crucial, low-carbon technologies.

Extra funding from government organizations and eco-conscious investors enables green banks to grow their operations. This capital helps them pursue more national and global climate targets.

Recruiting more technical experts is also essential for green banks to bolster their investments in climate-positive technologies.

Simple Ways to Start Today

One of the simplest ways to reduce your carbon footprint is to find a green banking institution to do business with. The right green banking partner can help you save, invest, and donate your money to positively impact the climate.

You can start by re-allocating existing funds, such as underused or dormant investment funds, to support a green bank. This can put these funds to work in furthering clean energy initiatives.

Green banks also play a major financing role in scaling up crucial, low-carbon technologies, allowing them to receive extra funding from government organizations and eco-conscious investors. This capital enables them to grow their operations to pursue more national and global climate targets.

State and local governments have established green banks under a variety of structures, legislative directives, and funding sources.

Michigan Saves

Michigan Saves is a great example of how to scale a business. It employs a loan loss reserve mechanism to absorb some of the risks of clean energy lending.

This approach allows Michigan Saves to partner with area credit unions, making it easier to access funding for clean energy projects. By focusing on installers and related energy companies, Michigan Saves is able to reach a wider audience and increase its impact.

By targeting the right partners, Michigan Saves is able to create a ripple effect that benefits the entire clean energy industry.

What Is the Design Platform?

The Green Bank Design Platform is a game-changer for countries looking to establish green banks. It's a hub that provides financial and technical resources to help jurisdictions adapt the green bank model to their unique needs.

Green banks offer countries access to climate finance, enabling domestic ownership of project development and implementation of Nationally Determined Contributions. This can be a challenging process, typically taking years to set up.

The Green Bank Design Platform's primary beneficiaries are countries seeking assistance in the green bank establishment process.

Strong Accountability

Green banks are committed to accountability, publishing their financial reports annually to inform investors and customers about their investments and carbon emissions. This transparency promotes trust between the green bank and its stakeholders.

Green banking encourages banks to establish strong governance structures that are responsive to climate trends. This helps green banks take the long view and invest in projects with positive social outcomes.

Almost all the world's biggest banks are reluctant to divest from fossil fuels, as seen in a quick survey of their investment portfolios.

Financial Products and Services

Green banks offer a variety of financial products that cater to different needs, including home and business owners, finance providers, building owners, and clean energy developers.

These products can help lower risks and reduce transactional costs, making it easier for private capital to flow into the clean energy market.

Green banks can assist consumers in securing long-term, low-interest loans, which can be a game-changer for those looking to invest in clean energy.

By employing a range of financing techniques, such as credit enhancements, co-investment, and securitization, green banks can make clean energy more accessible and affordable.

Focusing on Carbon Footprints Reduction

Green banks are crucial in reducing carbon footprints by redirecting capital flows to environmentally responsible projects. They've helped establish a climate-resilient infrastructure that reduces carbon emissions.

Green banks have been instrumental in promoting the adoption of low-carbon technologies, such as home geothermal power systems. These systems can significantly contribute to reducing carbon emissions.

The Paris Agreement sets ambitious goals for reducing carbon emissions, and green banks are playing a vital role in achieving these objectives. They're helping to create a low-carbon future by increasing the availability of community-level renewable energy systems.

To create a net-zero emissions world, we need to rapidly increase the availability of renewable energy systems, and green banks are helping to make this happen.

Take a look at this: In a Fractional Reserve Banking System Banks Create Money Because

Most Environmentally Friendly

Aspiration is a notable example of an eco-friendly financial institution that prioritizes the financing of green practices and initiatives.

They offer customers the option to invest in ethical stocks through their Redwood Fund, which includes socially responsible businesses that commit to sustainable supply chains and the use of clean energy.

Aspiration doesn't invest in any fossil fuels, instead using its profits to fund forest and water conservation projects across the planet.

These banks are a great alternative for climate change-conscious individuals who want to align their finances with their values.

B Corp certification is a sign that a bank prioritizes people and the planet over profits, making it a good indicator of eco-friendliness.

By choosing an eco-friendly bank, customers can feel confident that their money is being used for good, not harm.

Suggestion: Eco Currency

Products

Green banks offer a variety of financial products, including those targeted at end users like home or business owners, as well as finance providers, building owners, and clean energy developers.

These products can help crowd-in private capital by lowering risks and reducing transactional costs.

Paperless Billing

Going paperless with your bank statements and bills is a simple yet effective way to reduce your environmental impact.

You can request electronic bank statements from your bank almost anytime, so you don't have to wait to receive them in the mail.

The average household can reduce up to 9 paper bills a month by going paperless, which translates to about 3 kg of carbon emissions over a year.

SELF Solar and Energy Loan Fund

SELF Solar and Energy Loan Fund is a pioneering green bank that has been making a significant impact in the renewable energy sector. Founded in 2010, SELF was the first local green bank in the United States.

SELF was initially funded by the U.S. Department of Energy's Energy Efficiency and Conservation Block Grant (EECGB) program. This funding enabled SELF to establish itself as a Community Development Financial Institution (CDFI) certified by the U.S. Treasury Department.

SELF is a member of the American Green Bank Consortium and partners with various organizations to provide low-cost loan capital for energy efficiency, resilience, and solar technologies. These partners include bank Community Reinvestment Act (CRA) investors, faith-based organizations, and crowdfunding platforms like KIVA.org and CNote.

SELF has expanded its operations to four states, including Florida, Georgia, Alabama, and South Carolina, and has introduced satellite programs in cities such as St. Petersburg, Tampa, Orlando, Miami, and Atlanta. By July 2022, SELF had successfully expanded its reach to serve more communities.

SELF's commitment to serving low- and moderate-income (LMI) and underbanked communities is commendable, and its work has made a significant impact in the renewable energy sector.

For more insights, see: Additionality Impact Investing

Alternatives and Options

You can leave big banks behind and opt for socially responsible eco banks that prioritize transparency and sustainability. These banks are more likely to avoid investments in fossil fuels, weapons manufacturers, and private prisons.

With a green bank account, you'll have access to environmentally-friendly products that help you grow your wealth and reduce your climate footprint. At Aspiration, you can earn up to 3.00% APY on your savings with a $10k balance and a spend requirement.

Leave Bank for Climate-Friendly Alternative

Leaving your bank for a more climate-friendly alternative is a great way to bank responsibly.

You can find socially responsible eco banks that are transparent about their investments and lending policies. They often have commitments to not invest in fossil fuels, weapons manufacturers, and private prisons.

With a green bank account, you'll have access to environmentally-friendly products that help you grow your wealth and reduce your climate footprint. Aspiration offers accounts with up to 3.00% APY on savings with a $10k balance and a spend requirement.

The California Lending for Energy and Environmental Needs Center, or CLEEN Center, is a green bank that exclusively focuses on facilitating commercial projects and upgrades.

CDFIs

CDFIs can play a pivotal role in co-investing or providing initial capital for green banks. They can also offer valuable technical expertise in specific areas related to green bank activities.

CDFIs are the main recipients of the $6 billion Clean Communities Investment Accelerator. This funding can be a game-changer for CDFIs looking to support green bank initiatives.

Financing and Investment

Green banks are becoming strong alternatives to traditional banks, especially as more consumers question the long-term viability of fossil fuel as an energy source. Nearly $14.5 trillion has been committed to the fossil fuel divestment effort.

Green banks play a crucial role in providing financial support for projects with substantial upfront costs. They assist in bridging investment gaps, particularly during economic downturns.

To address the barriers to clean energy market development, green banks assist consumers in securing long-term, low-interest loans. Green banks employ a diverse range of financing techniques, including credit enhancements, co-investment, and securitization.

Green banks' innovative financing techniques are more effective when they can operate through robust delivery mechanisms. These structures enhance the security of debt service payments and enable lenders to offer lower interest rates for clean energy financing.

Innovative approaches to renewable energy credit (REC) financing have also enabled green banks to lower energy costs for consumers. This reduces utilities' compliance costs and enables them to pass on the savings to their ratepayers.

Financing Structures

Green banks have developed innovative financing structures that make clean energy financing more effective. These structures enhance the security of debt service payments, allowing lenders to offer lower interest rates.

Operating through robust delivery mechanisms is key to the success of green banks' financing techniques. This enables them to operate more efficiently and effectively.

Green banks can offer more favorable financing terms thanks to their ability to acquire and monetize renewable energy credits (RECs). This allows them to pass the savings on to consumers, reducing energy costs.

By selling RECs to utilities at a lower price, green banks can help utilities access the credits they need to comply with regulations. This reduces the utilities' compliance costs and enables them to pass the savings on to their ratepayers.

Sources of Funding

Green banks can tap into a diverse mix of public and private sources for funding.

Public funding is a common source, often allocated directly by local and state governments to establish and underwrite a green bank.

This governmental funding can come via legislation, providing a one-time appropriation or ongoing support over time from various revenue streams.

Utility bills can also include a small ratepayer surcharge dedicated to funding a green bank.

Private funding sources are also available, including philanthropic and environmentally-minded non-profit organizations that can provide money to launch or support a green bank.

Green banks can issue bonds to raise capital from private investors who support the bank's environmental goals and seek a return on their investment.

Partnerships with private lenders like commercial banks and other financial institutions can also provide access to additional startup capital.

Repayments on loans and other successful investments begin to flow in, allowing a green bank to repurpose capital and maximize its impact even when its initial resources were limited.

Check this out: Private Banking Banks

Types of Bonds and Revenue

Green banks can raise capital by issuing bonds backed by the state in which the green bank is established. This type of bond offers a secure stream of payments with a low risk of default, making it attractive to debt investors.

Green banks can also capitalize themselves by issuing bonds backed by their own institution. This approach allows them to access capital at relatively low interest rates.

There are several types of bonds that green banks can issue, including project bonds secured by the revenue-generating potential of the projects they will support. For example, the Connecticut Green Bank sold $30 million in bonds backed by commercial efficiency loans to Clean Fund.

Green banks can also generate capital by issuing bonds backed by a dedicated cash stream, such as ratepayer fees or proceeds from emissions allowance auctions.

Additional reading: Acquiring Bank vs Issuing Bank

Bond Issuance

Bond issuance is a great way for green banks to raise capital. Public sector bonds offer the advantage of being tax-exempt.

This means governments and other public authorities can access capital at relatively low interest rates for bondholders. The bonding authority of a green bank provides a secure stream of payments from an institution with a low risk of default.

In return, the green bank gains capital that can be promptly invested in clean energy projects.

Types of Bonds

Green banks can raise capital by issuing bonds backed by the state in which the green bank is established. This is a common approach for green banks looking to finance environmentally friendly projects.

Green banks may also capitalize themselves by issuing bonds backed by their own institution. This allows them to access capital without relying on external sources.

Project bonds can be secured by the revenue-generating potential of the projects they will support. This type of bond is often used for large-scale projects with a clear revenue stream.

Other bonds can be backed by a dedicated cash stream, such as ratepayer fees or proceeds from emissions allowance auctions. This provides a stable source of revenue for the bondholders.

Green banks can also securitize loans they have extended and sell them to other investors in the form of bonds. For example, the Connecticut Green Bank sold $30 million in bonds backed by commercial efficiency loans to Clean Fund.

Industrial revenue bonds and private activity bonds may be issued for specific green bank activities. These types of bonds are often used for projects that generate revenue through user fees or other means.

Carbon Pricing Revenue

Green banks can secure partial capitalization from revenues generated by various carbon pricing policies, such as carbon taxes, fees, and cap-and-trade systems. This is a creative way to fund environmentally responsible projects.

The New York Green Bank and the Connecticut Green Bank are examples of green banks that receive partial capitalization from their respective states through initiatives like the Regional Greenhouse Gas Initiative (RGGI). This shows how carbon pricing revenue can be a valuable source of funding for green banks.

Carbon pricing revenue can be used to support a wide range of projects, from community-level renewable energy systems to low-carbon technologies like home geothermal power systems. These projects have the potential to drive the world towards net-zero emissions.

Government and Institutional Support

In the United States, there are approximately 20 green bank-type organizations as of 2020.

These organizations have invested nearly $450 million while leveraging another $1.7 billion in private capital. Green banks can access public funding, raise capital in private markets, and receive a steady stream of revenue through utility bill surcharges.

Several green banks have been established by enabling legislation at the state and local level, with several more under development.

U.S. Institutions

In the United States, a network of green banks has been established to support clean energy initiatives. As of 2020, there were approximately 20 green bank-type organizations in the country, which invested nearly $450 million while leveraging another $1.7 billion in private capital.

These green banks can access public funding, raise capital in private markets, and receive a steady stream of revenue through utility bill surcharges. Several green banks have been established by enabling legislation at the state and local level, with several more under development.

Examples of existing green banks in the United States include the NY Green Bank, California Lending for Energy and Environmental Needs, Rhode Island Infrastructure Bank, Montgomery County Green Bank (Maryland), Hawaii Green Energy Market Securitization, and the Nevada Clean Energy Fund.

The Connecticut Green Bank has driven growth in its residential and commercial segments through a residential solar loan and lease program, credit support mechanisms for energy efficiency and solar, and a commercial property assessed clean energy product for energy conservation measures.

Green banks can also tap into various federal sources within the United States to secure funding and support for their clean energy initiatives. The United States Department of Agriculture (USDA) provides funding for infrastructure projects, including those related to energy, in rural communities. The United States Department of Energy (DOE) administers programs such as the Loan Program Office (LPO), which offers federal funding to innovative clean energy companies and project portfolios. The United States Environmental Protection Agency (EPA) manages the Clean Water State Revolving Fund (CWSRF), a lending program that provides low-cost financing for various water and energy infrastructure projects.

The Connecticut Green Bank was established in 2011 and holds the distinction of being the first green bank in the United States. It has emerged as the most advanced green bank in the nation in terms of deal volume, stimulating $663.2 million in investments for clean energy projects in its initial four years of existence.

Additional reading: Federal Bank Online Banking

A state or local government may impose a modest surcharge on energy bills within its jurisdiction and mandate that the funds raised through this charge be allocated to a green bank. This surcharge serves as a recurring source of capital for green banks, with funds replenished annually.

Here are some examples of existing green banks in the United States:

Malaysia

In Malaysia, the government has made a significant effort to support green technology through the Green Technology Financing Corporation, launched in 2010 as part of the National Green Technology Policy.

The corporation offers a 2% interest rate reduction for companies undertaking green technology projects.

State and International Initiatives

The concept of green banking has been implemented at the state and international levels, with notable examples in the US and UK.

The first local government green bank in the US was established in 2010 in St. Lucie County, Florida, by the nonprofit Solar and Energy Loan Fund of St. Lucie County, Inc. (SELF).

Worth a look: Bank of Clarke County Online Banking

Connecticut established the first state green bank in 2011, and New York followed suit in 2013.

By the end of fiscal year 2015, the Connecticut Green Bank had supported $663 million in project investments, demonstrating the effectiveness of green banking at the state level.

In the UK, reports published in 2009 advocated for the creation of a state-backed infrastructure bank to provide financing for green projects.

See what others are reading: List of Banks That Have Merged to Form the State Bank of India

NY

The NY Green Bank is a significant player in the clean energy finance space. It was established by Governor Andrew Cuomo with a capitalization structure involving multiple infusions of capital amounting to $1 billion.

NY Green Bank has received over $1 billion in proposals and maintains an active project pipeline of approximately $500 million. This is a testament to the bank's ability to attract investment in clean energy projects.

The bank has a unique approach to financing, relying on the market to discern the financing needs of projects rather than designing specific financing products and programs. This allows it to be a wholesale clean energy finance lender, distinguishing it from other green banks.

NY Green Bank's first series of investments were unveiled in the autumn of 2015, utilizing $49 million of public capital to leverage $178 million in private capital. This achieved a leverage ratio greater than 3:1, demonstrating the bank's ability to mobilize private capital for clean energy projects.

Related reading: Sustainable Finance

History

The concept of green banks has a fascinating history. The idea was first developed in the US by Reed Hundt and Ken Berlin as part of the 2008 Obama-Biden Transition Team's efforts to facilitate clean energy development.

In 2009, a similar concept was incorporated as an amendment to the federal cap and trade bill, known as the American Clean Energy and Security Act, which was introduced in May of that year. This bill received broad bipartisan support in the Senate.

The first local government green bank in America was established in 2010 by the nonprofit Solar and Energy Loan Fund of St. Lucie County, Inc. (SELF). Connecticut followed suit in 2011 by establishing the first state green bank.

By the end of fiscal year 2015, the Connecticut Green Bank had supported $663 million in project investments. This shows the significant impact that green banks can have on clean energy development.

In the UK, two reports were published in 2009 advocating for the creation of a state-backed infrastructure bank to provide financing for green projects.

Here's an interesting read: First Bank Digital Banking

Analysis State

In 2020, a comprehensive analysis was conducted by the GFI, Rocky Mountain Institute, and Natural Resources Defense Council to understand the processes, challenges, and needs of green banks worldwide.

The analysis, known as State of Green Banks 2020, mapped out green bank activities and development efforts globally.

Thirty-six emerging and existing green banks were interviewed and surveyed as part of this research.

This analysis was the first of its kind, providing valuable insights into the green bank landscape.

Based on the needs expressed during the research, the three organizations designed a Platform to support green bank development.

The Platform offers navigation, gap-filling, and knowledge products to help those working to establish green banks.

It also provides technical assistance connections, matching aspiring green institutions with qualified providers.

Additionally, the Platform facilitates peer-to-peer exchange and learning, allowing green banks to share best practices in design and operation.

Here's an interesting read: Asia Green Development Bank

Reports and Analysis

In 2020, a comprehensive analysis of green banks was conducted by the GFI, Rocky Mountain Institute, and Natural Resources Defense Council, surveying 36 emerging and existing green banks.

This analysis, known as the State of Green Banks, aimed to understand the processes, challenges, and needs of green banks around the world.

The mapping of green bank activities and development efforts revealed a need for external support and a "champion" function to drive progress.

The State of Green Banks 2020 analysis led to the design of a Platform offering services such as navigation, gap-filling, and knowledge products.

The Platform also provides technical assistance connections, matching aspiring green institutions with validated technical assistance providers and sources of funding.

A key feature of the Platform is the creation of a community where peers can exchange and learn from each other, sharing best practices in green bank design and operation.

Frequently Asked Questions

What is an example of a green bank?

A green bank example is the New York Green Bank, a division of the New York State Energy Research and Development Authority (NYSERDA). Green banks can also be quasi-public non-profit corporations.

Which US states have green banks?

Several US states have established green banks to support renewable energy projects, including California, Hawaii, Maryland, Michigan, Nevada, New York, Rhode Island, and others. These green banks offer financing options for clean energy initiatives.

What is the NY green bank?

NY Green Bank is a state-funded investment fund that helps bridge financial gaps in clean energy and renewable infrastructure projects. It provides financing solutions to support the growth of sustainable energy markets in New York.

Featured Images: pexels.com