Debt collectors can indeed text you, but there are rules they must follow.

The Fair Debt Collection Practices Act (FDCPA) regulates how debt collectors can contact consumers, including through text messages.

Debt collectors must provide their name and the name of the creditor they work for in the initial text message.

See what others are reading: Why Did You Text Me in That Tone?

What Rules Do Collectors Have to Follow?

Debt collectors are allowed to contact you by text, but they have to follow some rules. They can only reach out during reasonable hours, between 8am and 9pm.

Every text message from a debt collector must include instructions on how to opt out of receiving future communications through that method. This is a simple way to stop the messages if you don't want to deal with them.

There's no limit on the number of texts a debt collector can send you, but it's essential to know your rights and options. This includes verifying that the message is indeed from a debt collector and not a scam artist.

Additional reading: Debt Collector

Communicating with Debt Collectors

Communicating with debt collectors can be a daunting task, but it's essential to know your rights and options. Debt collectors must follow specific rules when contacting you by text, including only reaching out during reasonable hours, 8am to 9pm.

To ensure you're communicating with a legitimate debt collector, you can validate the debt and confirm the collector's identity. If you're satisfied, you can choose how to respond, including texting, calling, or using their website chat tool.

If you decide to communicate with the debt collector, take notes about each exchange, including who said what and any agreements reached. This will help you keep track of the conversation and ensure you have a record of any settlements or repayment plans.

Debt collectors may allow you to set up a repayment plan for less than the full balance, so be sure to ask about this option. If you agree to a settlement or repayment plan, ask for the full details in writing to confirm the agreement.

Here are some options for communicating with debt collectors:

- Continuing the conversation via text message

- Calling the debt collector directly

- Using their website chat tool to communicate with representatives

Dealing with Unfair Debt Collectors

If a debt collector is sending you unwanted text messages, you can opt out and stop receiving them. To do this, simply let the collector know that you don't want to receive further messages.

You can communicate with debt collectors in various ways, including via text message, phone call, or even online chat tools. If you decide to respond, be sure to take notes about each exchange, including who said what and any agreements you reach.

Most debt collectors will allow you to set up a repayment plan for less than the full balance. If you agree to a settlement or repayment plan, ask for the full details in writing so you have confirmation of it.

If a debt collector continues to send you unwanted text messages after you've opted out, keep a record of your interactions, including dates, times, and messages exchanged. This record will support your case if you decide to file a complaint.

Suggestion: How to Negotiate with Collections Agency

You can file a complaint with the Federal Trade Commission at reportfraud.ftc.gov, the Consumer Financial Protection Bureau at consumerfinance.gov/complaint, or your state's attorney general at consumerresources.org/file-a-complaint.

Here are the steps to file a complaint:

- The Federal Trade Commission, at reportfraud.ftc.gov

- The Consumer Financial Protection Bureau, at consumerfinance.gov/complaint

- Your state’s attorney general at consumerresources.org/file-a-complaint (click the map for your state)

Electronic Communications

Debt collectors can text you, but there are rules to follow. They can only contact you during reasonable hours, between 8am and 9pm.

Every message must include instructions for a simple way to opt out of receiving future communications through that method. This means you can tell them to stop texting you at any time.

If you're concerned about debt collectors texting you, you can report any problems to the CFPB. It's also a good idea to be cautious and not click on links from people you don't know.

Here are the key rules for debt collectors texting you:

It's worth noting that there's no limit on the number of texts a debt collector can send you, but you can set limits on debt collection communications to reflect your preferences.

Time & Place Limits

Debt collectors can't contact you at unusual or inconvenient times, such as before 8 a.m. or after 9 p.m.

If you're contacted during these times, it's considered inconvenient. You can simply tell the debt collector when it's not a good time for you to receive calls or communications.

Debt collectors must follow reasonable hours for contacting you, which is between 8 a.m. and 9 p.m.

To set limits on debt collection communications, just let the debt collector know your preferred contact times.

Here are the basic rules for debt collectors when texting consumers:

Opting Out of Electronic Communications

You can opt out of electronic communications from debt collectors, and it's actually a requirement for them to provide you with information on how to do so. Debt collectors must include instructions on how to opt out in every electronic message they send.

To opt out, you need to follow the instructions provided by the debt collector, which can vary depending on the method of communication. If you're being contacted by text message, for example, the debt collector must include information on how to opt out of future messages.

Discover more: What Is a Bill Collector

You can opt out of electronic communications at any time, but it's essential to keep in mind that debt collectors may still contact you through other means, such as phone calls or mail.

Here are the steps to opt out of electronic communications from debt collectors:

- Look for the opt-out instructions in the debt collector's message.

- Follow the instructions to opt out.

- Keep a record of your interactions with the debt collector, including the dates and times of messages exchanged.

By opting out of electronic communications, you can help protect your personal information and reduce the number of unwanted messages you receive from debt collectors.

Regulatory Actions

The FTC has finally drawn a line in the sand regarding debt collection via text messages. The agency recently issued a settlement against two debt collection firms, National Attorney Collection Services Inc. and National Collection Services LLC, who sent 1.8 million text messages to consumers in just 18 months.

The FTC needs to work with the Consumer Financial Protection Bureau (CFPB) to implement the regulatory practices and ensure debtors' privacy is secured. This is a crucial step in protecting consumers from unwanted and potentially invasive debt collection practices.

Additional reading: Collection Tips for Debt Collectors

Debt collectors must now provide disclosures to consumers before sending them text messages for collecting unpaid debts. The consumer must give explicit written consent for the collectors to use their mobile phone numbers, which were provided to the original creditors.

The FTC settlement is a significant development that extends the limits of the Fair Debt Collection Practices Act (FDCPA). It's a step in the right direction, but there's still more work to be done to protect consumers' rights.

Required Submission Information

To submit a case against a debt collector who has been texting you, you'll need to gather specific information. Your record of interactions with the debt collector is essential.

This includes keeping a log of all conversations, emails, and texts. You should also save any relevant documents or papers related to the debt.

The date and time of when you opted out of text messages is also crucial. Ideally, you should have screenshots showing the request submission.

Frequently Asked Questions

How do debt collectors notify you?

Debt collectors typically notify you in writing, with a debt validation letter, after their first attempt to contact you, and may also contact you by phone. This written notice must be received within five days of their initial contact.

Sources

- https://www.moneymanagement.org/blog/are-debt-collectors-allowed-to-text-me

- https://www.npr.org/2021/12/02/1060597759/debt-collectors-can-now-text-email-and-dm-you-on-social-media

- https://www.fullmanfirm.com/2022/02/can-a-debt-collector-text-or-email-me/

- https://www.ovlg.com/blog/debt-collection-via-text-what-is-allowed-and-what-is-not.html

- https://www.atlasconsumerlaw.com/blog/2019/june/text-messages-from-creditors-for-debts-is-that-a/

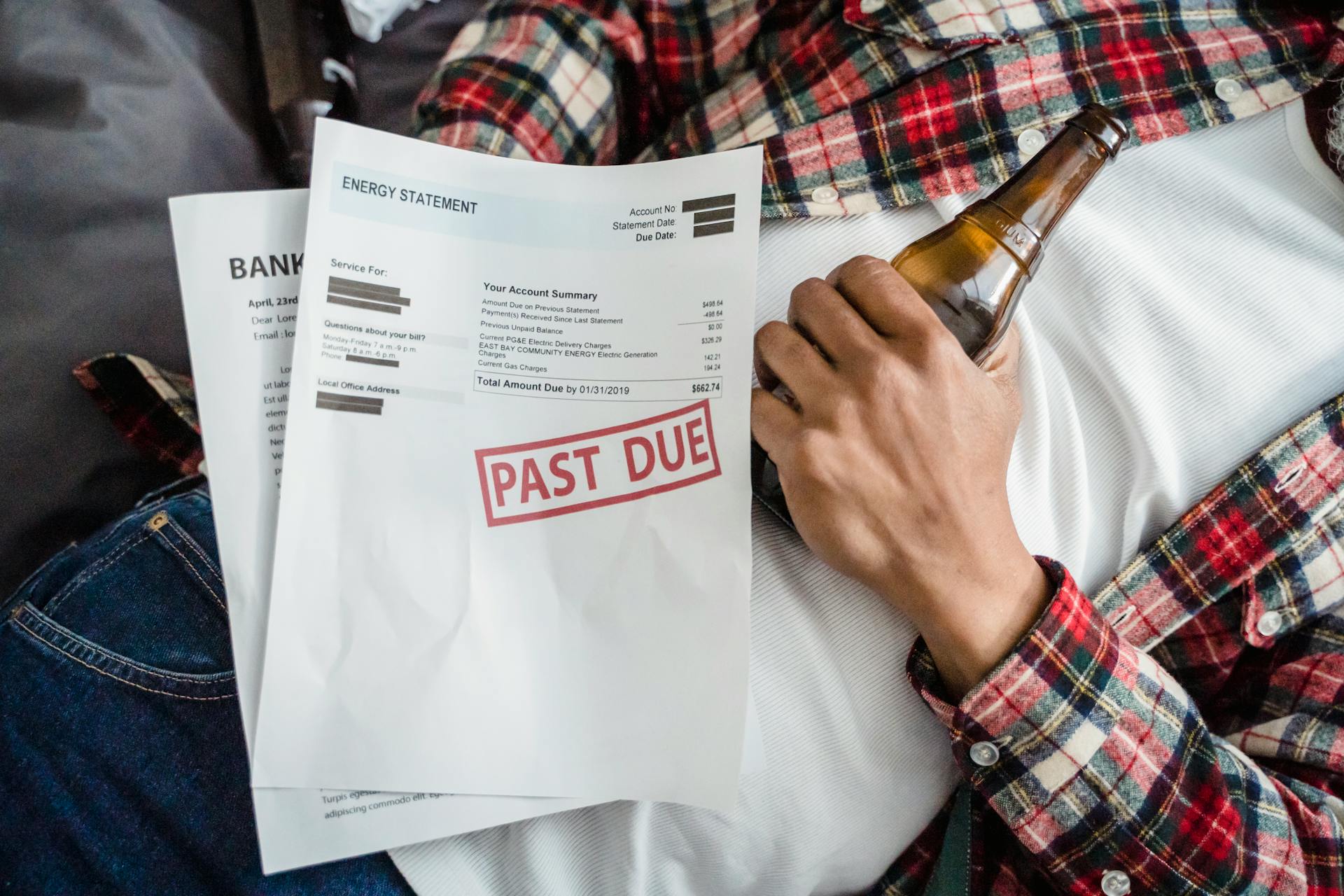

Featured Images: pexels.com