For growing companies, finding the right CRM accounting and billing software can be a game-changer. It helps streamline operations, reduces manual errors, and provides real-time financial insights.

Automated invoicing and payment tracking can save up to 30% of administrative time. This allows businesses to focus on high-priority tasks and scale more efficiently.

A good CRM accounting and billing software can also help companies manage cash flow more effectively. By tracking accounts receivable and payable in real-time, businesses can identify potential cash flow issues before they become major problems.

With the right software, growing companies can make informed decisions about pricing, discounts, and payment terms. This can lead to increased revenue and improved customer satisfaction.

Additional reading: Black Owned Publicly Traded Companies

Benefits and Features

A good CRM accounting and billing software should have a client list with basic information like names, addresses, emails, and other billable addresses. This makes it easy for accountants to keep track of clients' information.

With a CRM, you can add notes and task features that can be shown to the client, helping to create leverage and improve work efficiency. Notes and task addition play a huge role in communicating with the client effectively.

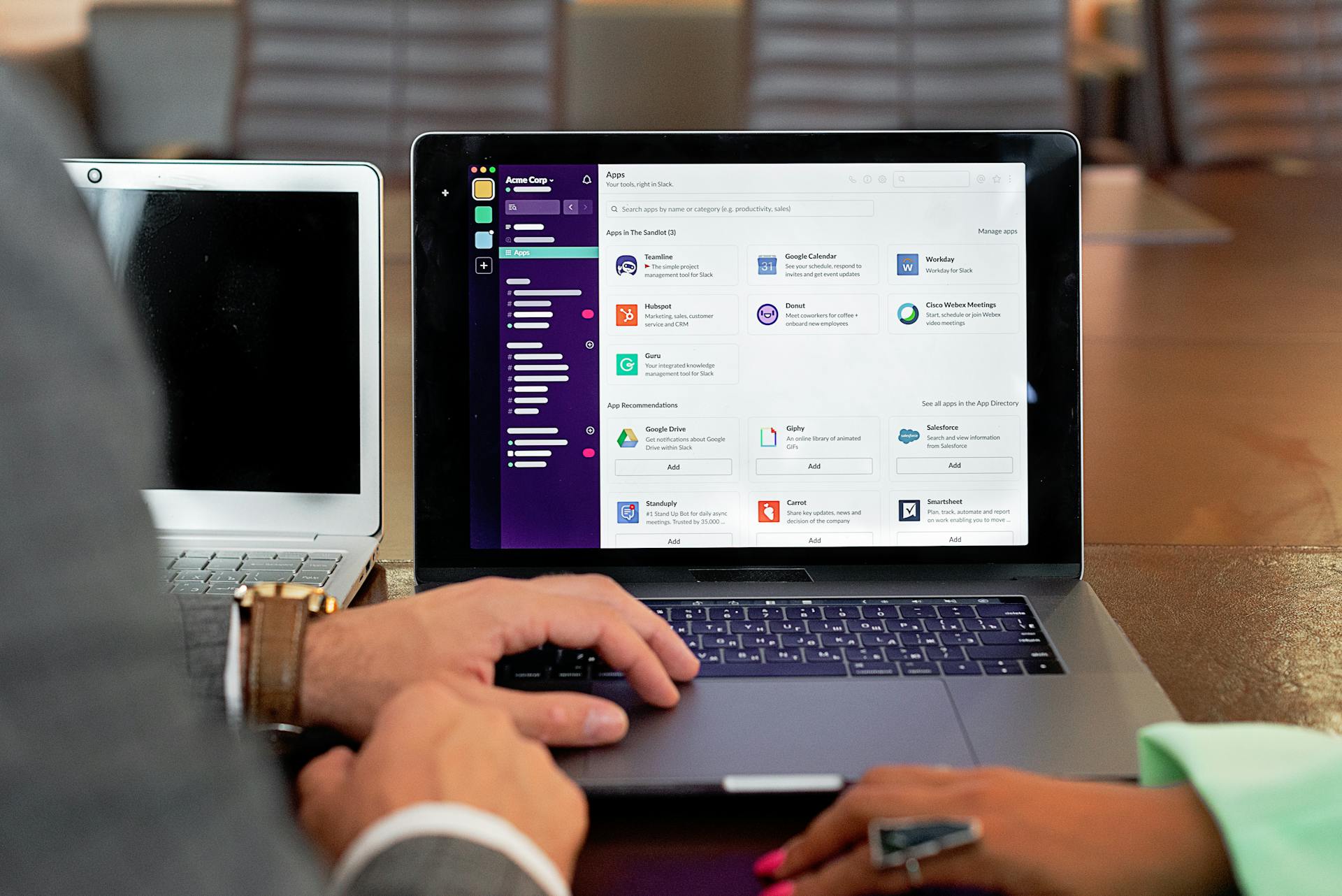

The software should also have features like workflow automation, tailoring your lead routing, and managing processes, which can be found in CRM platforms like Insightly. This allows businesses to automate their CRM processes and focus on central tasks.

A CRM platform like Accelo can help manage clients and resources, streamlining all processes in one place. It's divided into sections for the management of each domain, like projects, sales, retainers, and services.

Some popular CRM features include transparency, quality customer service, and tight integration, which can be found in platforms like Insightly. This helps businesses go beyond sales and better connect with their clients.

Integrating accounting and CRM software can help accountants provide consistent, professional accounting services. This can be done by choosing CRM software that integrates with existing accounting software, such as QuickBooks.

Here are some key benefits of a CRM for accountants:

- Establishes a central location for all client data

- Allows anyone in the firm to access and update client information

- Provides a single system for managing client relationships

- Automates tasks and streamlines workflows

By using a CRM accounting and billing software, accountants can improve their workflow efficiency and provide better customer service. This can be achieved by integrating accounting and CRM software, automating tasks, and streamlining workflows.

Pricing and Plans

Our crm accounting and billing software offers a range of pricing plans to suit different business needs. The free plan is a great option for small and micro-businesses.

This plan provides a free accounting solution, making it an attractive choice for those just starting out. It's perfect for entrepreneurs who want to get started without breaking the bank.

A different take: Furniture Flipping Business Plan

Professional

The Professional plan is a great option for those who need a bit more power. It's designed to help you confidently take on projects.

You can track your inventory with ease, ensuring you never run out of essential supplies. Prices are exclusive of local taxes.

With this plan, you can also handle purchases efficiently, keeping your finances organized and up-to-date.

Check this out: Sequoia Capital Business Plan

Elite

The Elite plan is a great option for businesses that need advanced accounting and inventory management features.

With the Elite plan, you get advanced accounting bundled with full-fledged inventory management.

This plan is priced at $150, making it a cost-effective solution for businesses that require these features.

The advanced accounting feature allows for streamlined financial management, while the full-fledged inventory management helps keep track of stock levels and orders.

Here's an interesting read: How to Start an Asset Management Firm

Security and Safety

Cloud accounting software provides a layer of security for your accounting company, encrypting data between your device and the cloud server, making it difficult for third-party users to intercept it.

Accountants have a responsibility to keep client data secure, especially finances and confidential contact information, and cloud accounting software helps with that. Close to 4,000 cyberattacks occur daily on businesses, government sites, and medical companies, according to FBI reporting.

Keeping your data offsite reduces the risk of it being compromised if your devices are stolen or physically damaged.

Readers also liked: How GPS & Telematics Data Can Help Your Fleet

Trusted by Businesses

Zoho Books has been a lifesaver for many businesses, including Site Search & Select, who praised its seamless integration with other Zoho One applications.

Businesses like Practical IT Solutions LLC have also made the switch from QuickBooks to Zoho Books, citing its cost-effectiveness and user-friendliness.

Zoho Books has simplified financial processes for many companies, especially with features like inventory management integrated with CRM.

Readers also liked: How to Balance Books for Small Business

One business owner reported that switching to Zoho Books saved them 20-25% less time, which is a significant boost for any company.

The platform's attentive updates and smooth handling of transitions have deepened trust and simplified day-to-day operations for many businesses.

If you're considering a new accounting solution, you're not alone - thousands of businesses and accountants have already made the switch to Zoho Books.

Explore further: Books Accounting Software

A Secure Solution

Financial Cents offers a secure solution for accountants to store client information and passwords. This is a game-changer for accounting firms that often use multiple tools to operate their practice.

Cloud-based accounting software provides a few security advantages over desktop-based accounting. Data is encrypted between your device and the cloud server, making it difficult for third-party users to intercept it.

Keeping your data offsite reduces the risk of it being compromised if your devices are stolen or physically damaged. This is especially true since close to 4,000 cyberattacks occur every day on businesses, government sites, and medical companies.

A cloud service acts as a backup for your data in case your devices are lost, stolen, breached, or broken. This means you can access your client information and passwords from any device, without worrying about data loss.

Financial Cents speaks to the pain point of accountants by providing a central location for client information, documents, and notes. This keeps everyone in the office on the same page and reduces the risk of missing deadlines or deadlines falling through the cracks.

Software Options

Accelo offers a cloud-based system that streamlines processes for businesses.

This system can scale with your business, allowing it to grow and adapt as needed.

You can purchase packages separately or opt for an all-in-one solution.

With Accelo, you can focus on client interaction while the software handles tedious work.

To maintain long-time customers and nurture prospective clients, Accelo provides a comprehensive toolset.

Here are some key features to consider:

- Scales with your business

- Purchase of packages separately as well as all-in-one

- Management of tedious work

- Maintain longtime customers as well as nurture prospective clients

- 1000 plus integrations

Customization

Customization is a key feature of Zoho Books, allowing you to tailor the software to your business needs. You can create custom templates and fields to suit your specific requirements.

With Zoho Books, you can also get custom reports to help you make informed decisions. This feature is available in multiple countries, including the United States, Australia, Germany, and many more.

Having a customizable CRM is incredibly useful for accountants, as it enables automation of repetitive tasks. This can save you a significant amount of time and reduce errors.

You can automate order status tracking, document storage, and inventory management with a CRM that has flexible workflow automation. This can be particularly helpful if you have a large number of orders or documents to manage.

Some countries where you can use Zoho Books with customization features include the United States, Australia, Bahrain, Canada, and many others.

Having a CRM that works the way you do is essential for meeting the changing needs of your accounting firm. With customization, you can control and update your workflows as desired.

FreshBooks

FreshBooks is an accounting software solution that's perfect for small businesses and independent accounting offices. It's built around the concept of Collaborative Accounting, which brings you and your clients together using an intuitive client portal.

The software offers a wide range of features, including invoicing and payments, accounting, taxes, bookkeeping, client communications, payment processing, and even lightweight project management. FreshBooks has a 30-day free trial, and the Plus and Premium plans cost $33 and $60 per month, respectively.

Additional Team Members are $11 per month apiece, which is a relatively affordable option for growing teams. One of the key benefits of FreshBooks is its ease of use, making it a great option for those who may not be tech-savvy.

With Accelo

With Accelo, you can benefit from a streamlined process through a cloud-based system that scales with your business. This means you can manage your clients and resources more efficiently, without worrying about the software slowing you down as your business grows.

Accelo offers the option to purchase packages separately as well as all-in-one, giving you flexibility in how you use the software. This is especially useful if you're a small business or just starting out, as you can start with the basics and add more features as you need them.

The platform is divided into sections for the management of each domain, such as projects, sales, retainers, and services. This makes it easy to find what you need and stay organized.

Some of the key features of Accelo include the ability to manage tedious work, focus on client interaction, maintain long-time customers, and nurture prospective clients. You can also run your business from prospect to payment, all within the Accelo platform.

Here are some of the benefits of using Accelo:

- Streamlined process through a cloud-based system

- Scales with your business

- Purchase of packages separately as well as all-in-one

- Management of tedious work

- Maintain long-time customers

- Nurture prospective clients

- Run a business from prospect to payment

Time and Billing

Time and billing software is a must-have for accountants and accounting firms to avoid roadblocks like analysis paralysis, manual work, employee burnout, and lack of scalability. Without it, you can quickly get bogged down in manual processes, wasting time and losing billable minutes.

Time and billing software delivers results like never missing a billable minute with natively built-in time-tracking features. It also helps you explore time tracking features and manage your time and billing processes more efficiently.

Some top choices for time and billing software for accountants include QuickBooks Time, TimeSolv, and Bill4Time. These solutions offer features like time tracking, expense tracking, billing and invoicing, and online payments, as well as management features like client management and task management.

Check this out: How to File Small Business Federal Taxes

Top 8 Time and Billing Choices

So you're looking for the top 8 time and billing software choices for accountants. Well, let's dive right in. Here are the top 8 options, each with its own unique features and benefits.

First up, we have Bill4Time, which offers time tracking, expense tracking, billing and invoicing, and online payments. It also has a variety of management features, including client management, task management, and accounting. And the best part? It's affordable, with a 14-day free trial and a price tag of $29 per user per month.

Next, we have TimeSolv, a billing and time-tracking solution that's breaking out into other professional sectors. It makes it simple to track time in multiple ways, including offline, and has customizable invoices and client payment handling. However, it's not the most user-friendly option, making it a better fit for larger firms with more than 20 employees.

QuickBooks Time is another popular option, offering a simple timesheet, mobile time tracking, and customizable reports. It's geared towards small businesses, especially those with a mobile workforce, but can also work well in accounting firms. And the best part? It's included at no additional cost if you're already paying for QuickBooks Online Payroll.

On a similar theme: Top 10 Core Banking Solutions

Here's a quick rundown of the top 8 options:

As you can see, each option has its own unique features and pricing structure. But one thing's for sure - with the right time and billing software, you can improve profitability forecasting, identify your least and most profitable clients, and provide better customer service to your clients.

Inventory

Managing your inventory can be a tedious task, but it's essential for accurate time and billing.

You can track your inventory and update stock information automatically as you make purchases or sales. This helps you stay on top of your stock levels and avoid overselling or understocking.

Set reorder points and reminders to ensure you never run out of essential items. This feature helps prevent delays in your projects and keeps your customers satisfied.

Updating your inventory in real-time also helps you identify slow-moving or dead stock, allowing you to make informed decisions about your product offerings.

Take a look at this: How to Start a Stock Brokerage Firm

Cloud and Storage

Cloud accounting software provides a central location for your firm to access client information, documents, and notes from any device.

Cloud computing is data storage and access over the Internet instead of on your physical hard drive. This allows your staff to access their software from anywhere in the world and view the same information for easier collaboration.

With cloud computing, you can access your accounting data from multiple locations and devices. This is especially useful for accountants who work with clients remotely or have multiple offices.

Having cloud accounting software provides several security advantages over desktop-based accounting. Data is encrypted between your device and the cloud server, making it difficult for third-party users to intercept it.

You can scale up the number of licenses you need seamlessly with cloud accounting software, which means your overhead is lower.

Here are some benefits of integrating a cloud accounting system with your business operations:

- Access your accounting data from multiple locations and devices.

- Your financial information updates in real-time so your team always has accurate data.

- Your overhead is lower as you can scale up the number of licenses you need seamlessly.

Productivity and Management

With the right CRM accounting and billing software, you can streamline your workflow and boost productivity. By automating repetitive tasks, you can free up time for more important things.

A cloud-based CRM system allows for anywhere, anytime access, making it easy for your team to collaborate and stay on the same page. This is especially important for accounting firms, where accuracy and timeliness are crucial.

A good CRM accounting and billing software should have flexible workflow automation, enabling you to automate order status tracking, document storage, and inventory management. This can help reduce errors and improve relationships with clients.

Some benefits of cloud-based accounting systems include real-time updates, lower overhead costs, and the ability to access data from multiple locations and devices. This makes it easier to scale up or down as needed.

By choosing a CRM software that all your departments are comfortable with, you can reduce common errors in data entry and communication. This can lead to more personalized service and improved relationships with clients.

Discover more: Time Tracking and Billing Software

Here are some key features to look for in a CRM accounting and billing software:

- Cloud-based system for anywhere, anytime access

- Flexible workflow automation for repetitive tasks

- Real-time updates and collaboration

- Customizable user interface for easy use

- Integration with email and other tools for streamlined workflow

By implementing a CRM accounting and billing software, you can take control of your inbox and work smarter. This can help you declutter your inbox and reduce distractions, allowing you to focus on more important tasks.

What to Look for

When selecting a CRM accounting and billing software, it's essential to look for key features that cater to your accounting firm's needs.

A CRM for accountants should have seven essential features, including the ability to integrate with accounting software, streamline client onboarding, and provide a simplified approach to client management.

Consider the following must-haves in a CRM accounting and billing software:

- Integration with accounting software

- Functionality that streamlines client onboarding

- Simplified client management

- Easy communication and tracking of client interactions

- Portals for client self-sufficiency

- Brand building capabilities

- Flexible workflow automation

These features will help you better serve your clients, gain valuable insights into your sales pipeline, and maximize your productivity by automating tedious tasks.

Features and Benefits

With CRM accounting and billing software, you can benefit from features like real-time notifications, workflow automation, and tight integration with cloud-based software. This allows you to streamline all your processes in one place, making it easier to manage clients and resources.

Some popular CRM accounting and billing software include My CPA Dashboard, Method, Accelo, Insightly, Keap, and Salesforce. These platforms are designed to help businesses of all sizes manage their clients and resources more efficiently.

Key features of these software include transparency, quality customer service, automation, and integration with top platforms. For example, Insightly allows you to automate your CRM processes, update data, delegate tasks, and send emails with a single action.

What Is a?

A CRM, or Customer Relationship Management system, is software that helps professionals manage client interactions and maintain healthy relationships. Almost 62% of accounting firms now use CRM regularly.

Managing client relationships effectively is crucial for any business, and a CRM is designed to make this process easier. Accounting customer relationship management, in particular, is a type of CRM that focuses on managing client financial data.

Recommended read: Gst Billing Software with Inventory Management

With Benefits

Using a CRM can greatly benefit accountants and their businesses. It helps them organize their cash flow and be more progressive in their accounting practices.

One of the most popular CRM for CPAs worldwide is My CPA Dashboard. It allows accountants to reach their customers and receive real-time notifications.

A CRM like Method can optimize admin time and work, making businesses run more smoothly. It's a qualitative CRM that provides quality features to help manage clients and resources.

A CRM platform like Accelo boosts productivity and profitability, particularly for small and medium-sized businesses. It helps manage clients and resources, and is integrated with the cloud.

Some of the major benefits of using a CRM include transparency, quality customer service, tight integration, and automation. This can be achieved with a CRM like Insightly, which allows businesses to automate their CRM processes.

Insightly also provides workflow automation, tailoring lead routing, and managing processes. It has over 250 integrations, three pricing plans to choose from, and advanced security.

Here are some of the benefits of using a CRM for accountants:

- Establishes a central location for all client data

- Allows accountants to know where clients are in their relationship

- Nurture clients at any point

- Critical for getting everyone on the same page and providing great customer service

By integrating accounting and CRM software, accountants can have a clear view of their client's transactions. This can be achieved with a CRM that integrates with existing accounting software, such as QuickBooks.

Here are some of the basic features of a CRM:

These features make it easy for accountants to keep track of clients' information and communicate with them effectively.

Frequently Asked Questions

What is CRM accounting software?

An accounting CRM is a software that helps accountants manage client data and streamline interactions. It's a powerful tool for improving client relationships and business efficiency

What is CRM billing software?

A CRM billing system is a software that helps businesses manage and track customer billing information and transactions. It streamlines billing processes, making it easier to stay organized and provide excellent customer service.

Featured Images: pexels.com