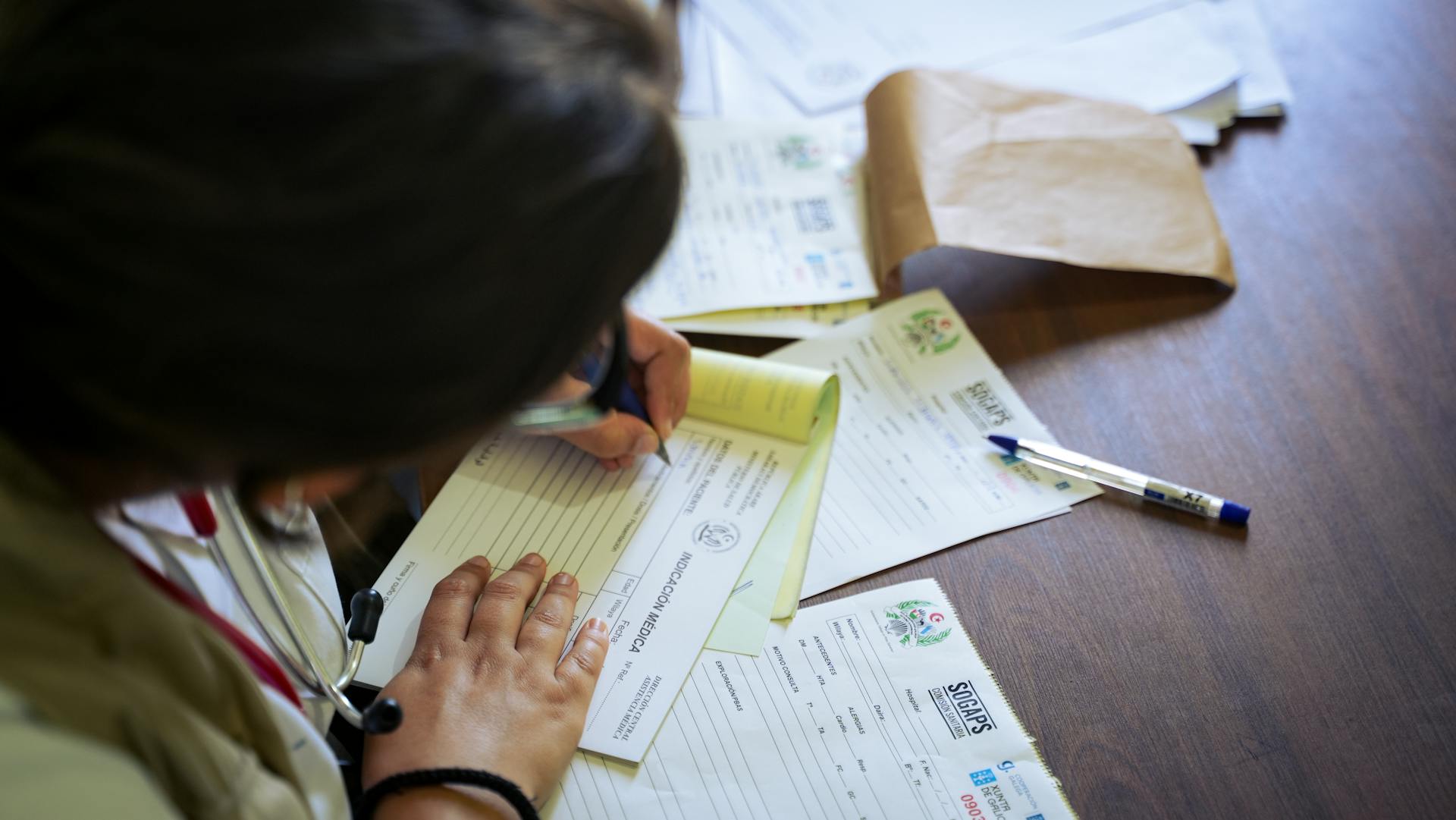

The coverage exception form BCBS can be a bit overwhelming, but understanding the process can make a big difference. To start, you'll need to submit a written request to Blue Cross Blue Shield (BCBS) to request a coverage exception.

This request should be made in writing, and it's essential to include specific details about the treatment or service you're requesting. The BCBS coverage exception form will guide you through this process, but it's crucial to provide all the necessary information.

BCBS has a specific timeframe for reviewing coverage exception requests, which is typically 30-60 days from the date of submission.

Related reading: S Buys a 50000 Whole Life Policy

Submitting a Supporting Statement

You have a few options to submit a supporting statement to the plan sponsor. You can submit it verbally, but be prepared to follow up in writing if required.

A verbal submission may not be enough, so it's a good idea to also send a written statement. You can use the Model Coverage Determination Request Form found in the downloads section, or any other written document prepared by you.

The plan sponsor may also accept a supporting statement on an exceptions request form they've developed, or even on a simple letter.

On a similar theme: With Disability Income Insurance an Insurance Company May Limit

What is a Supporting Statement

A Supporting Statement is a document that accompanies your job application, providing additional context and information about your skills and experience. It's usually a maximum of two pages long.

It's meant to support your application and help the employer understand how your skills and experience make you a strong candidate for the job. The Supporting Statement should be tailored to the specific job you're applying for.

The Supporting Statement should be concise and focused, highlighting your most relevant skills and experience. It's not a summary of your entire CV, but rather a focused document that showcases your suitability for the role.

The employer will use the Supporting Statement to assess your skills and experience in more detail, so be sure to use specific examples from your experience to demonstrate your abilities.

Curious to learn more? Check out: How to Become an Insurance Adjuster with No Experience

How to Submit a Supporting Statement

You can submit a supporting statement to the plan sponsor verbally, but be prepared to follow up in writing if they request it.

A written supporting statement can be submitted on the Model Coverage Determination Request Form, which can be found in the "Downloads" section.

You can also use an exceptions request form developed by the plan sponsor or another entity, or even a letter prepared by you as the prescriber.

Worth a look: Bcbs Aba Request Form

Required Information

To submit a supporting statement, you'll need to provide a clear and concise document that highlights your relevant skills and experiences. This document should be tailored to the specific job you're applying for.

The supporting statement should be no more than two pages in length, so make sure to keep it brief and to the point. A good rule of thumb is to keep each paragraph to around 5-7 sentences.

When writing your supporting statement, remember to use the language of the job description to describe your skills and experiences. This will help you to demonstrate how you meet the requirements of the job.

On a similar theme: Solo 401k Plan Document

Plan Sponsor Exception Request Process

The plan sponsor exception request process is a crucial step in getting the medical coverage you need. If your request is approved, you'll receive notice of approval, which will include the date that your exception will expire.

For requests for benefits, the plan sponsor must provide written notice of its decision within 24 hours for expedited requests or 72 hours for standard requests. This notice can be provided verbally, as long as a written follow-up notice is mailed to the enrollee within 3 calendar days.

Consider reading: Gross Premiums Written

You can request a coverage determination in various situations, including if coverage was denied at the pharmacy for a drug you think is covered, or if your drug requires a Prior Authorization. You can also request an exception to a restriction or limit applied to a drug, or if a drug you believe you need is not covered on the formulary.

Here are some reasons to request a coverage determination:

- If coverage was denied at the pharmacy for a drug you think we do cover

- If we notify you that coverage for a drug you take will be reduced or stopped

- If your drug requires a Prior Authorization

- If, based on your situation, you want to request an exception to a restriction or limit applied to a drug

- If a drug you believe you need is not covered on the formulary

- If you want to request coverage at an out-of-network pharmacy

- If you want to request coverage of a drug at a lower tier than the one assigned on the formulary

- If you want to request an exception to a plan rule

How to Request an Exception

If you want to request an exception to a plan rule, you can do so for various reasons. You may want to request an exception to a restriction or limit applied to a drug if, based on your situation, you believe it's necessary.

Here are some specific scenarios where you can request an exception: If you think a drug you take will be reduced or stopped, you can request an exception to the plan rule. If a drug you believe you need is not covered on the formulary, you can request an exception to the plan rule. If you want to request coverage of a drug at a lower tier than the one assigned on the formulary, you can request an exception to the plan rule.

Requesting an exception can be a bit of a process, but it's worth it if you think it will benefit your health.

A different take: Will My Insurance Cover Me If My License Is Suspended

Plan Sponsor Responsibilities

As a plan sponsor, it's essential to understand your responsibilities in the exception request process. Plan sponsors are responsible for ensuring that all plan participants are eligible for benefits and that benefit payments are made accurately.

You must have a clear process in place for handling exception requests, including a defined decision-making framework and a system for tracking and documenting requests.

Plan sponsors must also provide clear guidance to participants on the exception request process, including the required documentation and timelines for submitting requests.

The plan sponsor is ultimately responsible for making a decision on the exception request, and must be able to provide a clear explanation for their decision.

Plan sponsors must also maintain accurate records of all exception requests, including the request itself, the decision made, and any supporting documentation.

A different take: How to Appeal a Car Insurance Claim Decision

Arkansas Blue Cross Medical Forms

If you're a provider or a member of an Arkansas Blue Cross plan, you'll need to familiarize yourself with their medical forms. These forms are used for various purposes, such as requesting prior authorization, filing claims, and changing provider data.

For your interest: Bcbs Provider Inquiry Form

You can find all the necessary forms on the Arkansas Blue Cross website, listed under "Medical forms for Arkansas Blue Cross and Blue Shield plans." Some of the forms include the Arkansas Formulary Exception/Prior Authorization Request Form, the Authorization Form for Clinic/Group Billing, and the Claim Reconsideration Request Form.

To request prior authorization, you'll need to use the Arkansas Formulary Exception/Prior Authorization Request Form. This form is specifically designed for members of Arkansas Blue Cross metallic and non-metallic medical plans.

You can also use the Authorization Form for Clinic/Group Billing to notify Arkansas Blue Cross that a practitioner is joining a clinic or group. This form is used for notification purposes only and does not create any network participation.

Here's a list of some of the medical forms available on the Arkansas Blue Cross website:

- Arkansas Formulary Exception/Prior Authorization Request Form

- Authorization Form for Clinic/Group Billing

- Claim Reconsideration Request Form

- Continuation of Care Election Form

- Designation of Authorized Appeal Representative

- Expedited Appeal Request Form

- New Clinic/Group Application

- Notice of Payer Policies and Procedures and Terms and Conditions

- Other Insurance/Coordination of Benefits (COB)

- Open Negotiation Notice

- Patient Waiver Form

- Physician/Supplier Corrected Bill Submission Form (Note: This form is no longer valid and should be submitted electronically through Availity)

- Timely Filing Review

- Provider Application/Contract Request

- Authorization | Organizational Determination Request Form

- Transplant Prior Authorization/Organizational Determination Form

- Provider Change of Data Form

- Provider Refund Form

- Statistical Questionnaire - Bed Complement Form

- Termination Form for Clinic/Group Billing

It's essential to note that some forms, like the Physician/Supplier Corrected Bill Submission Form, are no longer valid and should be submitted electronically through Availity.

Requesting a Determination

If you're not sure if your prescription is covered, you can request a coverage determination.

You can request a coverage determination if coverage was denied at the pharmacy for a drug you think you do cover.

To request a coverage determination, complete and submit an Electronic Beneficiary Coverage Determination form, or call the number on your Member ID card.

You must submit your request no later than three years from the date of service.

If you want to appoint a representative to act on your behalf, you and your appointed person must complete and sign an Appointment of Representative form and file it with each request for a coverage determination.

There are several reasons to request a coverage determination, including if your drug requires a Prior Authorization or if you want to request an exception to a restriction or limit applied to a drug.

Here are some reasons to request a coverage determination:

- If coverage was denied at the pharmacy for a drug you think you do cover

- If we notify you that coverage for a drug you take will be reduced or stopped

- If your drug requires a Prior Authorization

- If, based on your situation, you want to request an exception to a restriction or limit applied to a drug

- If a drug you believe you need is not covered on the formulary

- If you want to request coverage at an out-of-network pharmacy

- If you want to request coverage of a drug at a lower tier than the one assigned on the formulary

- If you want to request an exception to a plan rule

Request Status

To check the status of your coverage exception form, you can log in to your BCBS account online.

You can also contact BCBS customer service directly to inquire about the status of your form. They can provide you with updates and answer any questions you may have.

The processing time for coverage exception forms typically takes 3-5 business days, but this may vary depending on the complexity of your request.

Worth a look: Does Insurance Cover Observation Status

Request Approved

If your request is approved, you'll receive notice of approval, which will include the date that your exception will expire.

An approved request for Coverage Determination is usually called a formulary exception, granting an exception to a rule established by your plan's formulary.

You'll know your request is approved when you receive formal notice, which will outline the terms of your approval.

This notice will typically include the effective date of your approved exception, so be sure to review it carefully.

For more insights, see: Newborn Coverage under Health Insurance Policies Must Include Coverage for

Request Denied

A "Request Denied" status can be frustrating, but it's not the end of the world. In fact, it's often a temporary setback that can be resolved with a little persistence.

If a request is denied, it's likely because the system has identified a potential security risk or a mismatch in the request details. For instance, if you're trying to access a resource that's not authorized for your user type, the system will deny your request.

Check this out: Factors Affecting the Insurance Claim Management System

Denials can also occur if the request exceeds the system's capacity or if there's a technical issue with the request. In such cases, you might see an error message indicating that the request is too large or that there's a problem with the request format.

In some cases, a denied request might be a result of a system update or maintenance. If this is the case, you might see a message indicating that the system is currently unavailable.

You can try resubmitting the request once the system is back online or after you've addressed the underlying issue.

Sources

- https://www.cms.gov/medicare/appeals-grievances/prescription-drug/exceptions

- https://www.rxmedicareplans.com/members/coverage-determination

- https://www.floridablue.com/providers/forms

- https://provider.bcbst.com/tools-resources/documents-forms/

- https://www.arkansasbluecross.com/providers/resource-center/provider-forms

Featured Images: pexels.com