City National Bank of Florida is a community bank that has been serving the state of Florida since 1984. It was founded by a group of entrepreneurs who wanted to create a bank that would cater to the needs of small businesses and individuals.

The bank's headquarters is located in Tampa, Florida, and it has a network of branches across the state. City National Bank of Florida is a subsidiary of CNB Financial Corporation, a bank holding company.

The bank's history dates back to 1984 when it was founded by a group of entrepreneurs who wanted to create a bank that would cater to the needs of small businesses and individuals.

Institution Overview

City National Bank of Florida was founded in 1970, giving it a rich history in the financial industry.

The bank's headquarters is located in Miami, Florida, with a specific address of 33130.

City National Bank of Florida is a commercial bank with a national charter, and it's a member of the Federal Reserve System.

It operates under the oversight of the Office of the Comptroller of the Currency (OCC), ensuring compliance with regulatory requirements.

The bank has a large physical footprint, with 31 domestic offices across various locations.

City National Bank of Florida owns $10 billion in assets and holds $8 billion in deposits, making it a large bank in terms of its financial size.

Its product offerings include savings accounts, checking accounts, money market accounts, CDs, IRAs, and mortgage products, providing customers with a diverse range of financial services.

City National Bank of Florida offers a checking account with no maintenance or monthly fee, making it a convenient option for everyday use.

Seamless transferring of funds between checking and savings accounts allows customers to take advantage of higher interest rates in their savings account while still having access to their money.

Expand your knowledge: Bank Account for Payment

Financial Performance Overview

City National Bank of Florida boasts total assets of $26,506,696k, showcasing its substantial scale and influential market presence.

The bank's total liabilities stand at $23,984,578k, while its total equity capital is $2,522,118k, providing a nuanced breakdown of its financial structure and stability.

A closer look at the bank's operational metrics reveals total deposits of $20,859,402k and net loans and leases at $18,198k, offering valuable insights into its core operations.

The Tier 1 Risk-Based Capital Ratio, a key indicator of the bank's financial stability, is 14.0687, indicating a strong capital adequacy and risk management strategy.

Return on Assets at 0.7 provides a glimpse into the bank's overall profitability, making it an attractive option for investors and customers alike.

City National Bank of Florida's financial performance is a testament to its ability to balance risk and reward, making it a significant player in the financial sector.

Services and Rates

City National Bank of Florida offers a range of deposit products, including savings accounts with a 0.05% APY, which is fair compared to the average U.S. bank.

Their savings account requires just $1 to open and earn interest, making it a low-barrier entry point for new customers. However, if you're looking for higher returns, you may want to consider other options.

The bank's money market account offers a higher rate of 0.15% APY for balances of $10,000 or more, but you'll need to maintain a minimum balance of $3,500 to qualify.

Here's a breakdown of the bank's deposit products:

City National Bank of Florida's CD rates are also fair compared to the average U.S. bank, with a 1.10% APY for a 5-year CD.

Rates

City National Bank of Florida's savings rate is 0.05%, which is fair compared to the average U.S. bank.

Their one-year CD has a rate of 0.45%, which is significantly higher than their savings rate. This makes CDs a potentially attractive option for those looking to earn higher returns.

The minimum balance required for the APY on their savings account is just $1, making it easily accessible. However, it's worth noting that their savings rate is not the best, so you may want to consider other options.

Their five-year CD earns at a rate of 1.10%, which is a notable improvement over the one-year CD. This highlights the potential for higher returns with longer-term CDs.

Here's a breakdown of the bank's deposit products and their corresponding APYs:

Overall, City National Bank of Florida offers a range of deposit products with varying APYs and minimum balance requirements.

Fees

City National Bank of Florida has extremely low fees compared to other U.S. banks, making it perfect for those who want a basic banking experience.

The bank has no monthly fee, which is a huge plus for anyone looking to save money.

Its ATM fee of $1.25 is also relatively low, coming in under the national average.

This makes it a great option for those who need to withdraw cash occasionally.

The overdraft fee at City National Bank of Florida is $33, which is significantly lower than the average overdraft fee charged by U.S. banks.

Quality and Health

City National Bank of Florida is in terrific financial well-being, with a Texas Ratio of 2.04%. This means it's extremely unlikely to fail.

The bank is also FDIC-insured, which means your money is protected up to $250,000 in the event of bank failure.

City National Bank of Florida has a large asset base of $10 billion and $8 billion in deposits.

Here's a quick rundown of the bank's financial health:

The bank has a strong financial foundation, which gives customers peace of mind.

Latest News

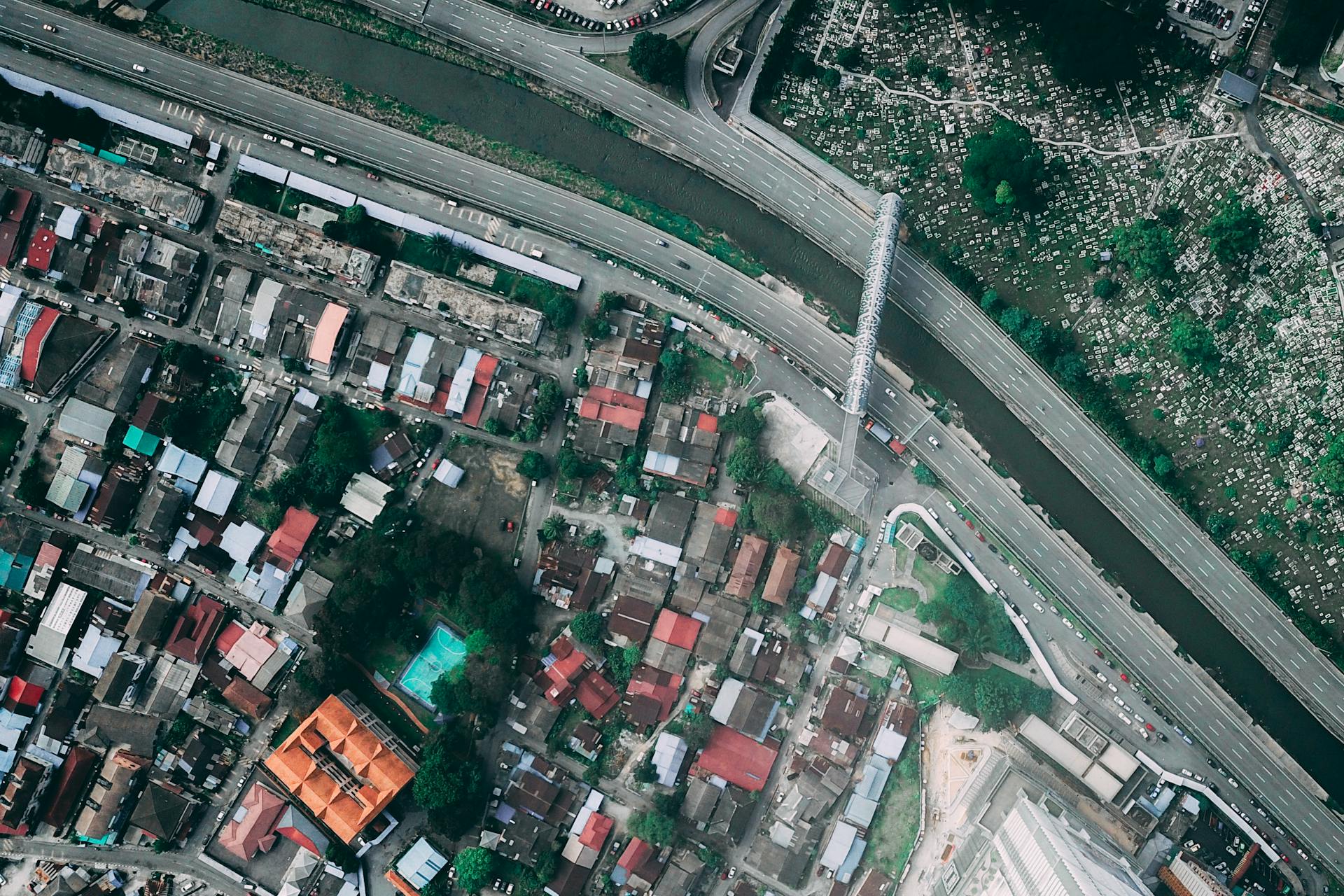

City National Bank of Florida has made a significant move in the Miami real estate scene. They've secured a $25.2 million construction loan for a boutique office building in Coconut Grove.

The building, developed by Vizcaya Capital, will house 34,856 square feet of office space at 2871 Oak Avenue. This is a prime location, as it's across the street from architecture firm Arquitectonica's headquarters.

Vizcaya Capital will occupy a portion of the office space, and the firm bought the 12,000-square-foot lot in 2021 for $5 million. Office developments have become hot commodities in Coconut Grove, a wealthy neighborhood with a low office vacancy rate of 3.8 percent.

Broaden your view: Bank Muscat Head Office

The average asking rent in Coconut Grove is a whopping $71.15 a square foot, one of the highest in the city. In fact, Related Group, Miami's largest condo developer, completed a 10-story office building a block east in 2021.

The neighborhood is seeing a lot of activity, with Michael Comras adding office components to CocoWalk and The Canopy in recent years. However, not all office properties are faring well, with the seven-story 3480 Main Highway office building scheduled to be auctioned this month.

Discover more: Cassa Centrale Banca - Credito Cooperativo Italiano

Awards and Recognition

City National Bank of Florida has been recognized for its community involvement and has held an "Outstanding" community reinvestment rating from the Office of the Comptroller of the Currency (OCC) for the past 18 years.

The bank has consistently demonstrated its commitment to the community, earning it a 5-star "Superior" rating by BauerFinancial since June 2012.

One notable achievement is that City National Bank of Florida was named Business of the Year by the South Florida Business Journal in 2013, a testament to its excellence in business practices.

Consider reading: Florida Community Bank

Jorge Gonzalez, the bank's leader, was recognized as the Ultimate CEO by the South Florida Business Journal, a well-deserved honor for his dedication and vision.

Mara Suarez, a prominent figure at the bank, was named Businesswoman of the Year by the Coral Gables Chamber of Commerce in 2013, a recognition of her outstanding contributions to the business community.

Here are some of the bank's notable awards and recognitions:

- Named Business of the Year by the South Florida Business Journal in 2013

- Voted the Best Business Bank by the readers of the Daily Business Review in 2012

- 5-Star “Superior” rating by BauerFinancial since June 2012

- Jorge Gonzalez named Ultimate CEO by the South Florida Business Journal

- Named the South Florida Business Journal's Local/Community Bank of the Year in 2011

- Mara Suarez named Businesswoman of the Year by the Coral Gables Chamber of Commerce in 2013

Frequently Asked Questions

Are City National Bank and City National Bank of Florida the same?

City National Bank and City National Bank of Florida are the same institution, with the latter being the result of a merger that expanded its reach in Florida. They share a common history and operations, but with a broader geographic presence.

Who is City National Bank owned by?

City National Bank is owned by Royal Bank of Canada (RBC), a leading diversified financial services company in North America. RBC's strong capital position and ratios support its ownership of City National Bank.

What is the ranking of City National Bank of Florida?

City National Bank of Florida is the 5th largest bank in Florida and the 82nd largest bank in the nation.

What is the lawsuit against City National Bank?

City National Bank was sued by the U.S. Justice Department for allegedly discriminating against homebuyers in majority Black or Latino neighborhoods in Los Angeles County. The bank paid $31 million to settle the lawsuit.

Sources

- https://en.wikipedia.org/wiki/City_National_Bank_of_Florida

- https://visbanking.com/call-report/city-national-bank-of-florida-reports-814430/

- https://www.cbinsights.com/company/city-national-bank-of-florida

- https://smartasset.com/checking-account/city-national-bank-of-florida-fl-banking-review

- https://www.americanbanker.com/list/city-national-bank-of-floridas-new-biz-orrstown-financial-downsizes

Featured Images: pexels.com