A checkbook is a simple, yet essential tool for managing your finances. Checkbooks typically come in a standard 3.5 x 6.5 inch size, but can vary depending on the bank or financial institution.

The most common checkbook format is the standard checkbook, which features a grid of columns for recording transactions and a line for writing checks. Some checkbooks also include additional features, such as a register or a section for tracking deposits and withdrawals.

The layout of a checkbook can vary, but most include columns for date, payee, amount, and balance. This helps users keep track of their spending and stay organized.

Setting Up the Register

You can start by setting up the register with a simple template. The Check Book Register (Original Version) is a great starting point, with a column for recording expense categories and a formula that makes it easy to add and delete rows.

The formula used for the Balance column is a game-changer, allowing you to sort and move rows around manually without messing up the balance. It also keeps track of reconciled items and provides a balance for just those items.

To add more rows to the template, simply drag down on the circle underneath all the row numbers at the bottom left. Alternatively, you can right-click on a row number and choose "add row above" or "add row below" to add a new row in the middle.

The Numbers checkbook register is another option, but it requires some specific knowledge to use effectively. If you're new to Numbers, you might want to start with a simpler template like the Check Book Register (Original Version).

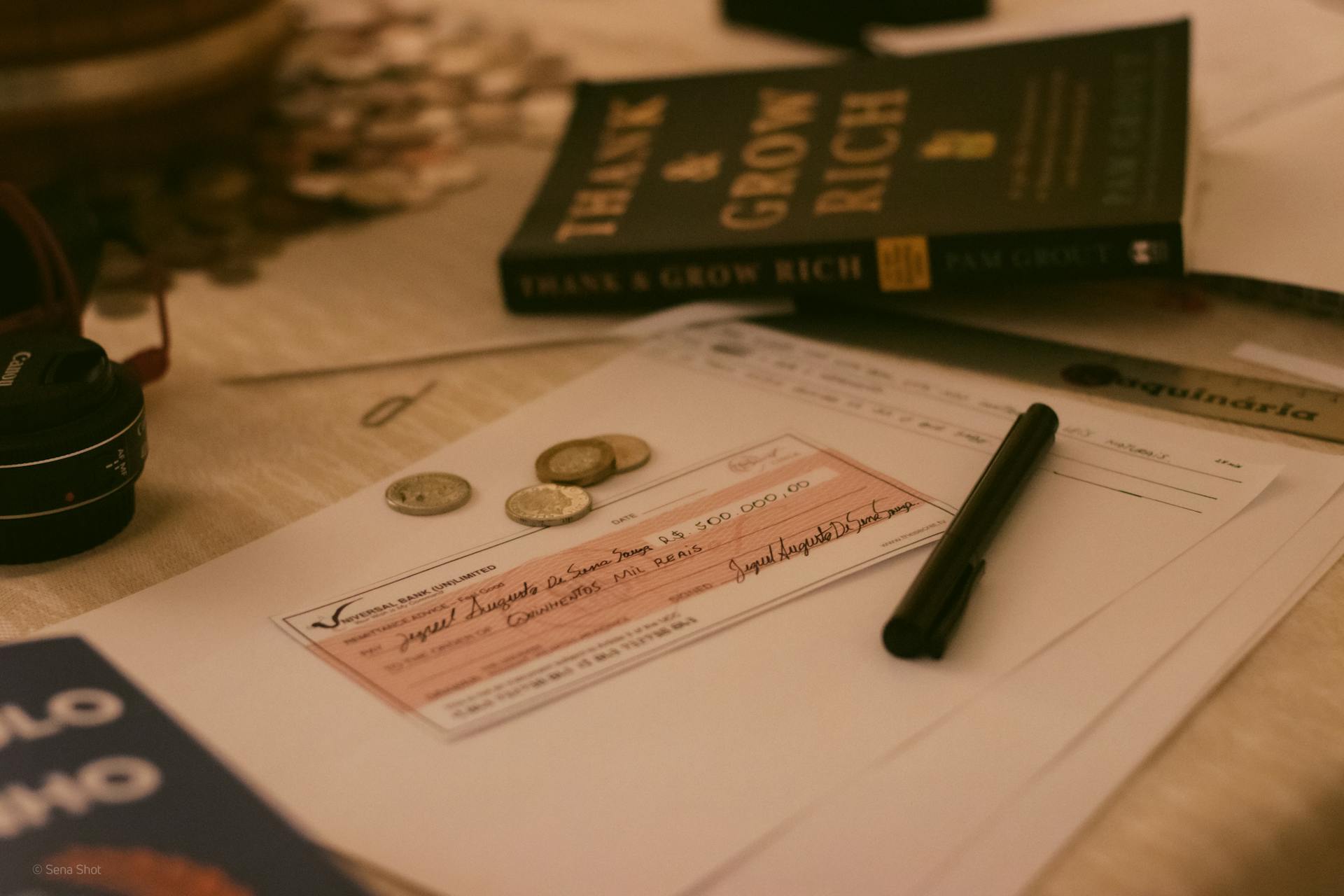

Understanding Checks

Understanding the format of a check is crucial for writing one, but it's also useful for other purposes. Knowing the parts of a check helps you order new checks correctly.

The top of a check has a diagram of a properly filled-out check, and the blank check below labels the different parts of a check.

Personal information on a check provides details about the account owner, who is the one paying money. This section is usually located at the top left corner of the check.

The payee line designates who can receive the money. This is where you write the name of the person or business you're paying.

A check has two sections for the amount: the dollar box displays the value in numerical format, and the amount of your check is written out in words instead.

The memo line is a space for any notes about the purpose of the check. This can be useful for keeping track of payments or for including a description of the payment.

The date line serves as a timestamp for the check, indicating when the payment is made. This is usually located at the top right corner of the check.

The signature line verifies that the account owner has approved the payment. This is where you sign your name to confirm the payment.

Your bank's contact information and logo are usually printed on the check. This can be a helpful way to identify the bank and verify the check's authenticity.

Here are the key parts of a check:

The check number appears in two places and is a security measure to identify each payment and prevent fraud.

Entering Transactions

Start by entering your name in the "Name" field of the "Checkbook" worksheet. This will be the first step in setting up your checkbook register.

The "Checkbook Period" and "Statement Balance" fields will be filled in later, but for now, focus on entering your beginning balance. If your account is new, the "Beginning Balance" is simply the amount you deposited when you opened the account.

You can also pull the "Beginning Balance" field from the "Statement Balance" of your last statement if you're starting this register after using your checkbook for a while. Just be careful not to include non-cleared transactions, which can affect your available balance.

Non-cleared transactions are those that appear on your online balance but not on your statement, and they need to be added to your register so you can account for that money. This ensures you have an accurate picture of your available funds.

Use the data in the Dataset image to fill in the rest of the worksheet, and don't worry if some fields are blank for now – you'll get to those later.

Managing the Register

You can easily add or delete rows in the checkbook register without messing up the balance. The formula used for the Balance makes it easy to add and delete rows.

To add more rows, simply drag down on the circle underneath all the row numbers at the bottom left. Alternatively, you can right-click on a row number and choose "add row above" or "add row below."

The checkbook register also keeps track of reconciled items and provides the balance of just the reconciled items, allowing you to easily compare it to your statement.

Entering Bank Statement

Entering Bank Statement Information is a crucial part of managing your register. You'll need to record the statement balance, which is the current balance of your account according to the bank.

Checkbook Period is also important to note, as it helps you keep track of the time frame covered by the statement. In our example, the checkbook period is September 30, 2019.

The statement balance is $1,500, but if you've made transactions that haven't cleared the bank yet, it may not reflect your actual available funds. This is why it's essential to reconcile your checkbook register with the bank statement.

Transactions that haven't cleared the bank will be listed on the statement, but marked as pending. This means you should consider them in your balance, even though they haven't yet been deducted from your account.

By keeping track of your budget with a checkbook register, you can ensure that your available funds are accurate and up-to-date. This is especially important when comparing your register to your latest statement, which may not reflect all transactions.

Robust Balance Formula

A robust balance formula is essential for a checkbook spreadsheet. This formula helps prevent errors when deleting rows or sorting the table.

You'll want to avoid using a simple formula like =previous_cell-payment+deposit, as it can easily get messed up.

Instead, consider using a formula that displays " - " if you haven't entered the date. This way, you'll always know when a date is missing.

The formula G2 =SUM(OFFSET(G2,−1,0,1,1))−D2+E2 is a great example of a robust balance formula. It uses the OFFSET function to prevent errors when deleting rows or sorting the table.

This formula can be filled down to complete the column, except for the footer row.

Featured Images: pexels.com