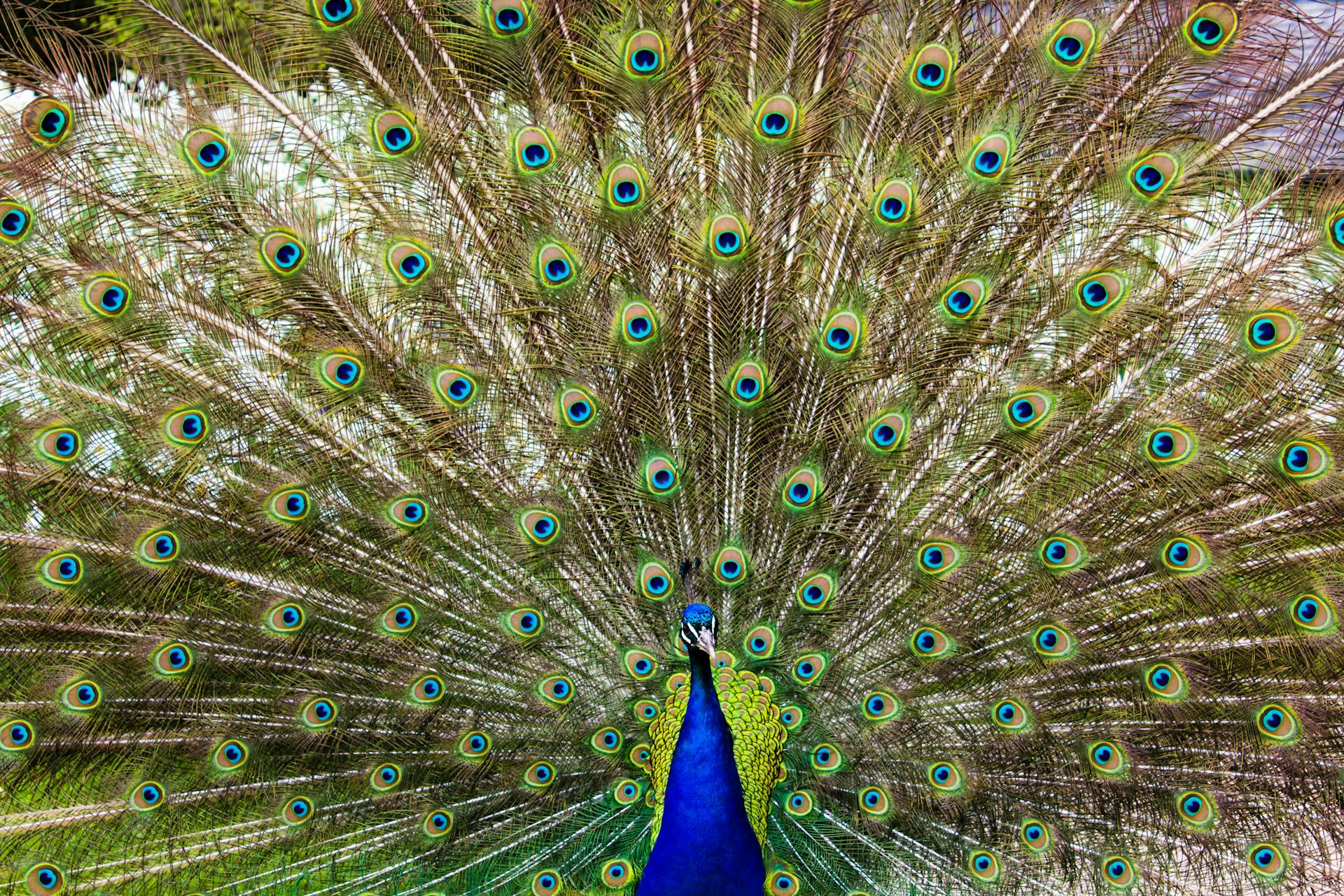

The Chase Sapphire Peacock card is a premium rewards credit card that offers a unique blend of benefits and rewards. It's designed for frequent travelers and foodies who want to earn points and enjoy exclusive perks.

The card's rewards program is based on a points system, where you earn 3X points on dining and 2X points on travel purchases. This means that if you're someone who loves trying new restaurants, you'll be racking up points in no time.

One of the standout features of the Chase Sapphire Peacock card is its generous sign-up bonus. According to the terms, you can earn 80,000 bonus points after spending $4,000 in the first 3 months. This is a significant incentive for anyone looking to maximize their rewards earnings.

Explore further: Chase Sapphire Banking Bonus

Chase Sapphire Peacock Perks and Rewards

The Chase Sapphire Peacock card offers a range of impressive perks and rewards, making it a top choice for travelers.

You can earn 5X points on travel purchases, including flights, hotels, and rental cars, which can be redeemed for travel credits or transferred to airline and hotel loyalty programs.

One of the standout features of the card is its generous sign-up bonus, which can be worth up to $1,250 in travel rewards.

Expand your knowledge: Chase Sapphire Preferred Travel Notification

Benefits and Features

The Chase Sapphire Peacock Perks and Rewards card offers a range of benefits and features that can enhance your travel experience.

You'll earn 5X points on travel purchased through Chase Ultimate Rewards, which can be redeemed for travel, dining, or other experiences.

One notable feature is the complimentary airport lounge access, which can be a game-changer for frequent travelers.

You'll also enjoy a $100 credit towards Global Entry or TSA PreCheck, making your airport experience smoother and more efficient.

The card offers a 60,000-point bonus after spending $4,000 in the first 3 months, which can be redeemed for travel or other rewards.

Additionally, you'll get a $300 annual travel credit, which can be used towards flights, hotels, or other travel-related expenses.

With the Chase Sapphire Peacock Perks and Rewards card, you'll also receive a 25% points bonus when you redeem for travel through Chase Ultimate Rewards.

This card is designed for frequent travelers who want to earn rewards and enjoy premium benefits.

Here's an interesting read: Chase Sapphire Travel Deals

Travel Benefits

Travel Benefits are a major draw for Chase Sapphire cardholders, and for good reason. With the Chase Sapphire card, you can earn 3X points on travel and dining purchases, including flights, hotels, and rental cars.

You can redeem your points for travel purchases, including flights, hotels, and more, with no blackout dates or restrictions. This means you can use your points to book a flight to Europe or a hotel in Hawaii, whenever you want.

Chase Sapphire cardholders also get access to a 24/7 concierge service, which can help you book travel arrangements, make restaurant reservations, and even get tickets to sold-out events.

Discover more: Chase Sapphire Hotel Reservations

Fees and Limitations

The Chase Sapphire Peacock card has a $95 annual fee, which may be waived for the first year. This fee is relatively standard for premium credit cards, but it's essential to consider whether the benefits outweigh the cost.

You'll also need to be aware of the foreign transaction fees, which are 3% of each transaction in U.S. dollars. This means that if you're using the card abroad, you'll be charged an extra 3% on top of the transaction amount.

A fresh viewpoint: Chase Sapphire Card No Annual Fee

Eligibility and Requirements

To be eligible for a loan, you must have a minimum credit score of 650 and a stable income of at least $40,000 per year.

If you're self-employed, you'll need to provide a minimum of two years' worth of tax returns to qualify.

Your debt-to-income ratio should not exceed 50% to be considered for a loan.

You'll also need to have a valid government-issued ID and proof of residency to complete the application process.

Some loan programs may have additional requirements, such as a minimum credit history of five years or a specific type of employment, so be sure to check the fine print.

A cosigner with a good credit score can sometimes help you qualify for a loan, but be aware that they'll be equally responsible for repayment.

Purchase Protections

Purchase Protections can be a lifesaver, especially if you're not careful with your transactions. Some payment processors offer a "chargeback" policy, which allows you to dispute a transaction and potentially get your money back.

This policy is usually triggered when a buyer claims they didn't receive the product or service, or it was not as described. For example, if you bought a product online and it turned out to be defective, you might be able to get a refund through the chargeback process.

Chargeback fees can be steep, ranging from $15 to $45 per transaction. This fee is typically deducted from your account balance, so it's essential to understand the terms before using this service.

Some payment processors also offer a "zero-liability" policy, which protects you from losses due to unauthorized transactions. This policy usually requires you to report the issue promptly and cooperate with the investigation.

If you're not sure about the purchase protections offered by your payment processor, it's always a good idea to review their terms and conditions or contact their customer support.

Annual Fees

Annual fees can be a significant expense for many credit card users. They can range from $25 to $500 per year, depending on the card.

Check this out: How to Cancel Chase Sapphire Card

Some cards charge an annual fee upfront, while others may charge it in installments. For example, the card with a $95 annual fee charges it in full on the cardmember's anniversary date.

If you're not using your credit card frequently, it might not be worth paying an annual fee. In fact, the card with a $95 annual fee is best suited for those who can take advantage of its rewards and benefits.

The annual fee can be waived for the first year, but it will still be charged in subsequent years. This is the case for the card with a $95 annual fee, which waives the fee for the first 12 months.

Here's an interesting read: Chase Sapphire Dispute Charge

Interest Rates

Interest rates can be a significant factor in managing your finances. The article mentions that a credit card with an interest rate of 25.99% can result in a total interest paid of $2,500 over 2 years, assuming a $1,000 balance.

Variable interest rates can change over time, which may affect your monthly payments. This can be seen in the example of a loan with a variable interest rate that increased from 6.5% to 8.5% over the course of a year.

High interest rates can lead to debt accumulation. The article highlights that a credit card with a high interest rate can cause debt to balloon, making it difficult to pay off the principal amount.

Annual percentage rates (APRs) are used to express the interest rate as a yearly rate. The article notes that a credit card with an APR of 25.99% is equivalent to an interest rate of 2.14% per month.

Interest rates can vary depending on your credit score. The article shows that a credit card with a 25.99% interest rate is available to those with a good credit score, while those with a poor credit score may be offered a higher interest rate.

Frequently Asked Questions

What counts as streaming for Chase Sapphire?

Streaming services that qualify for Chase Sapphire rewards include popular platforms like Netflix, Hulu, and Spotify, as well as other select merchants listed on our website

Sources

- https://thepointsguy.com/deals/instacart-express-chase/

- https://pointsnav.com/spend-category/entertainment-and-streaming

- https://runningwithmiles.boardingarea.com/how-to-watch-the-nfl-playoff-game-on-peacock-for-free-thanks-chase/

- https://www.doctorofcredit.com/instacart-now-includes-free-peacock-premium-subscription-11-99-month-value/

- https://thedailynavigator.com/credit-cards/top-credit-card-sign-up-bonuses/

Featured Images: pexels.com