China was the first major country to ban Bitcoin, but it's not the only one. In 2017, the People's Bank of China declared Bitcoin and other cryptocurrencies "illegal payment tools".

The ban was a direct result of a surge in Bitcoin prices, which had a significant impact on the Chinese economy. The prices had risen from $1,000 to over $4,000 in just a few months.

China isn't the only country to have taken action against Bitcoin, however. In 2018, the government of South Korea announced plans to ban anonymous cryptocurrency trading, citing concerns over money laundering and other illicit activities.

The ban was a major blow to the cryptocurrency market, with many investors losing significant amounts of money as a result.

Additional reading: Crypto Exchange Ban in India

Regulations and Laws

China has cracked down on bitcoin mining and trading, signaling a forthcoming crackdown. A government financial oversight committee in China issued a notice following a recent policy meeting.

In Russia, cryptocurrency mining is recognized as a legitimate activity, but only registered Russian legal entities and individual entrepreneurs are allowed to engage in it. Individual miners can operate without registration as long as their energy consumption remains within government-set limits.

Intriguing read: Russia Legalizes and Regulates Bitcoin and Crypto Mining

Russia has also implemented seasonal restrictions on cryptocurrency mining in certain regions, including Dagestan, Ingushetia, and Chechnya. The restrictions will run from January 1 to March 15, 2025, and extend from November 15 to March 15 in subsequent years.

Russia's president, Putin, has acknowledged the potential of Bitcoin, describing its rise as an inevitable development in technology. He noted that digital currencies are a natural progression in global finance and will continue to evolve regardless of the dollar.

Here are some key takeaways on regulations and laws surrounding cryptocurrency:

- An outright ban is unlikely, but restrictions and greater government scrutiny are imminent.

- Dispersion of mining away from China would be beneficial for bitcoin's resiliency.

China Cryptocurrency Laws

China has a complex and ever-changing regulatory environment for cryptocurrencies. In 2017, the Chinese government issued a joint announcement from seven government agencies, including the People's Bank of China (PBOC), to prevent financial risks from initial coin offerings (ICOs).

The Chinese government has signaled a crackdown on bitcoin mining and trading, with miners taking the news seriously and considering migration to other countries. In fact, a near-term dropoff in hashrate was already expected as miners conduct annual migration to seasonally wetter regions with inexpensive hydroelectric energy.

For more insights, see: Ccb China

Miners are likely to migrate to countries with favorable energy conditions, such as Kazakhstan, Russia, and Pakistan. This dispersion of mining away from China would be beneficial for bitcoin's resiliency, making the network more robust as hashrate becomes more distributed.

Here's a summary of the Chinese government's stance on cryptocurrency mining:

Other Legal Issues

Bitcoin's pseudo-anonymity has led to many illicit uses, including being used by drug traffickers.

The Silk Road market was a notorious example of this, where users could buy illicit drugs using bitcoin.

Bitcoin addresses do not require Social Security Numbers (SSNs) or other personal information, which initially raised concerns about its uses in illegal activities.

Regulators in the U.S. are still grappling with issues related to Bitcoin, with no centralized issuing authority to oversee its use.

The European Union and Japan have implemented regulations and frameworks, but the U.S. is still lagging behind in this area.

Taxation and Guidance

The IRS has issued guidelines for U.S. taxpayers regarding bitcoin and cryptocurrency, considering them property and issuing Notice 2014-21 to provide information on tax treatment.

Taxpayers in the U.S. are now required to declare if they engaged in any virtual currency transactions on Form 1040, with a question added in 2020 asking about financial interests in virtual currency.

The IRS has also published additional guidance to clarify taxes and reporting activity in cryptocurrency, making it easier for taxpayers to comply with regulations.

Here's an interesting read: Crypto Currency Regulation Artciles

IRS Guidance for Taxpayers

The IRS has issued guidelines for U.S. taxpayers regarding bitcoin and cryptocurrency. The agency considers virtual currency, which is the term used by the IRS for cryptocurrency, to be property.

In 2014, the IRS issued IRS Notice 2014-21 to provide information on the tax treatment of virtual currencies. This notice helped clarify the tax implications for taxpayers.

Taxpayers are now required to declare if they engaged in any virtual currency transactions on the first page of Form 1040. The IRS added this question in 2020.

If you received, sold, sent, exchanged, or otherwise acquired any financial interest in virtual currency at any time during the year, you must answer yes to the question on Form 1040.

Related reading: Are Cryptocurrencies Securities

Cryptocurrency Regulation and Taxation: A Brief Primer

In the U.S., the IRS considers bitcoin and cryptocurrency property and has issued guidelines.

The IRS issued IRS Notice 2014-21 to provide information on the tax treatment of virtual currencies.

You're required to report cryptocurrency transactions on your tax return.

IRS Form 1040 now asks: "At any time during [year], did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?"

The IRS has published additional guidance to clarify taxes and reporting activity in cryptocurrency.

In 2020, the IRS added a question on the first page of Form 1040 requiring taxpayers to declare if they engaged in any virtual currency transactions.

Cryptocurrency is considered property by the IRS, not a currency.

The IRS has issued guidelines to help taxpayers understand the tax implications of cryptocurrency.

Here's an interesting read: Imf Crypto Currency

China's Role

China has been a major player in the world of cryptocurrencies, and its decision to ban bitcoin has sent shockwaves through the industry.

The People's Bank of China (PBOC) has been actively working to regulate the use of cryptocurrencies in the country, and its efforts have been paying off.

Discover more: Regulated Cryptocurrencies

In 2017, the PBOC banned initial coin offerings (ICOs), a type of fundraising used by many cryptocurrency projects.

This move was a significant blow to the cryptocurrency market, and it's clear that China is serious about cracking down on the use of cryptocurrencies.

The Chinese government has also been working to develop its own digital currency, which could potentially compete with bitcoin.

Suggestion: Bitcoin and Cryptocurrency

Market Reaction

Markets were already volatile following a major correction, which made the news from China even more uncertain.

The FSDC announcement was published on Friday, May 21 at 10pm Chinese Standard Time, causing a 12.5% drop in BTC in the first hour.

BTC had dropped as much as 20% by 2pm EST, and continued to slide throughout the weekend, bottoming out around $31,100 at noon EST Sunday.

Information from regulators was scarce, with our contacts on the ground anticipating more clarity over the next week.

Some miners were liquidating their machine inventories and panic-selling their Bitcoin, as reported by our sources on the ground.

On-chain data showed an increase in outflows from miner wallets, suggesting that miner selling played a role in the volatility.

The late announcement added to the uncertainty, making it a challenging time for the market.

Frequently Asked Questions

Can the US government seize your Bitcoin?

Yes, the US government can seize your Bitcoin if they believe it's linked to criminal activity. This can happen through civil asset forfeiture proceedings under 18 U.S.C. § 981(a)(1)(C) or 21 U.S.C.

Sources

- https://freemanlaw.com/cryptocurrency/china/

- https://www.investopedia.com/ask/answers/121515/bitcoin-legal-us.asp

- https://www.financemagnates.com/trending/russia-bans-crypto-mining-in-10-regions-for-6-years-following-putins-signed-law/

- https://www.justice.gov/opa/pr/bitcoin-fog-operator-convicted-money-laundering-conspiracy

- https://www.galaxy.com/insights/research/examining-the-latest-china-bitcoin-ban/

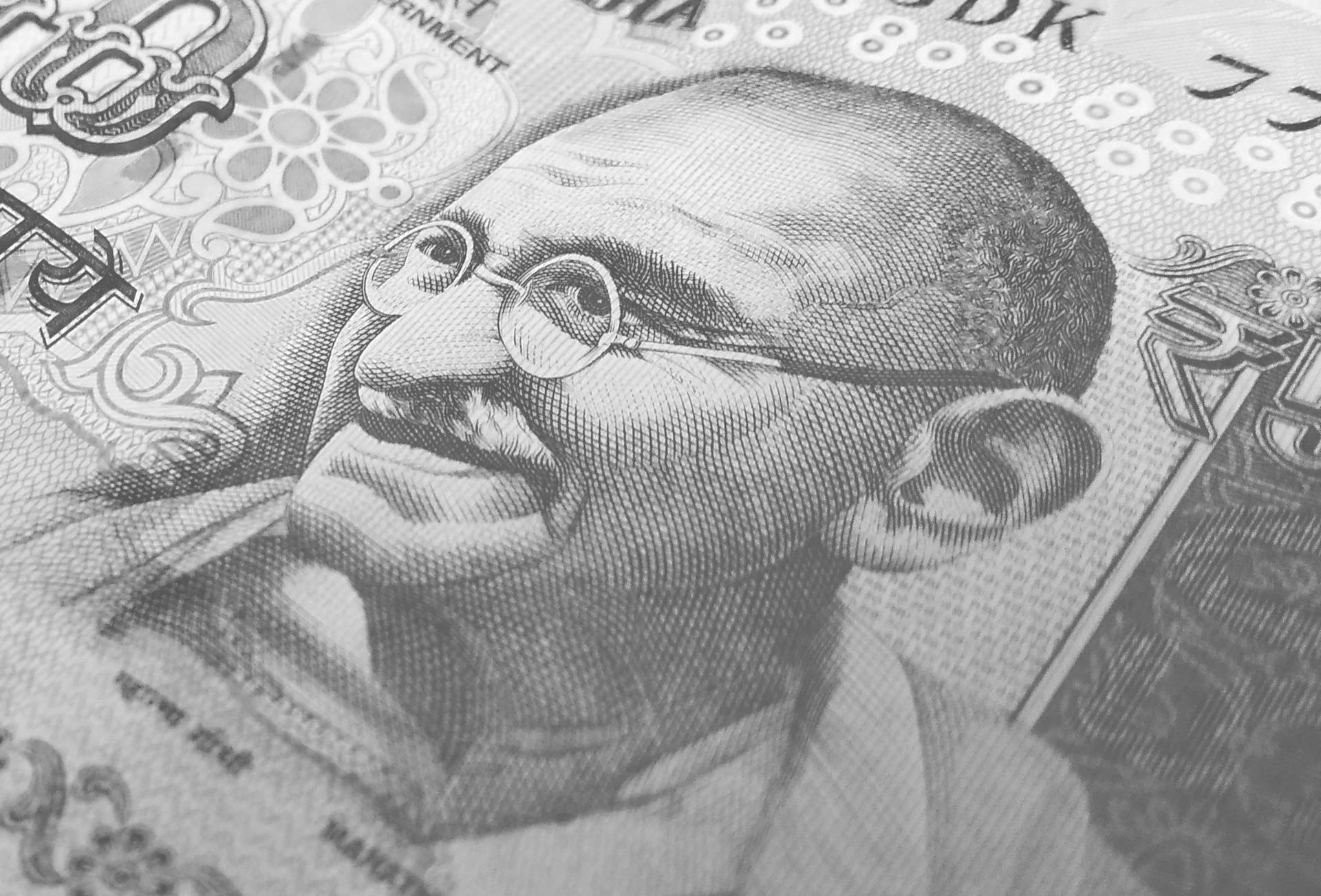

Featured Images: pexels.com