If you're dealing with Ace Cash Express debt collection, it's essential to know your rights and options. The Fair Debt Collection Practices Act (FDCPA) regulates debt collection activities, including those of Ace Cash Express.

You have the right to dispute a debt and request validation from Ace Cash Express. They must provide proof of the debt, including the original loan agreement and any subsequent communications.

Debt collectors, including Ace Cash Express, are not allowed to harass or intimidate you into paying a debt. This includes making repeated phone calls, using abusive language, or threatening to sue.

If you're being contacted by Ace Cash Express, it's crucial to document all communication, including dates, times, and details of conversations. This can help you track any potential FDCPA violations.

On a similar theme: How to Sue Debt Collectors for Fdcpa Violations

What Is Ace Cash Express Debt Collection?

Ace Cash Express Debt Collection is a legitimate debt collection company originated in Irving, Texas. They operate in over 950 storefronts around the U.S.

If you're dealing with Ace Cash Express, it's essential to know that they offer various financial services, including payday loans, installment loans, and cash advances. They also provide prepaid cards and check cashing services.

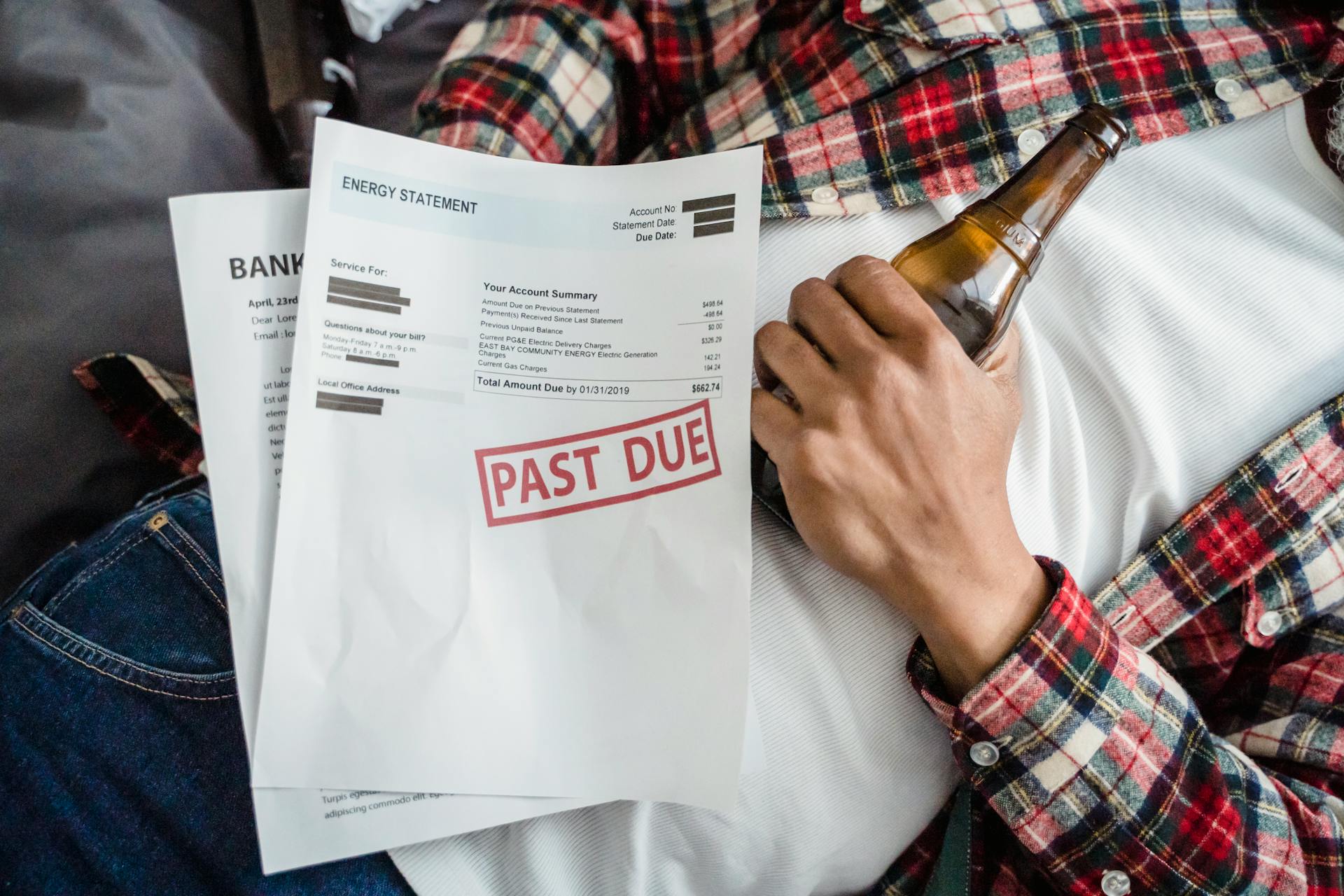

Ignoring Ace Cash Express can hurt your credit score badly. It's crucial to deal with them as soon as possible to avoid further damage.

Here are the services offered by Ace Cash Express:

- Title loans

- Payday loans

- Installment loans

- Cash advances

- Prepaid cards

- Cashing of checks

For more information on how to effectively deal with Ace Cash Express, visit their webpage at https://www.crediful.com/collection-agencies/ace-cash-express/.

Recommended read: Retained Cash Flow / Net Debt

Dealing with Debt Collection

It's never a good idea to contact Ace Cash Express Collections by yourself, especially if you're not prepared. You should sit down and think about your options before dealing with them.

Seeking help from a reputable credit repair company is a good first step. They can help you dispute any debt collection agency's claims and remove negative reports from your credit history.

If you're being harassed by Ace Cash Express, you should consider filing a complaint against them. The FDCPA protects you from certain types of harassment, including:

- Use of obscene or profane language

- Failure to issue a report to the credit bureau that a debt is in dispute

- Calling before 8:00 AM and after 9:00 PM in your time zone

- Calling at work if your employer prohibits them from doing so

- Making a threat of suing or garnishing your wages

Negotiating a settlement or paying Ace Cash Express Collections can make the situation worse, as it will still affect your credit score for up to seven years.

Caldera v. Insurance Services LLC

Ace Cash Express has been accused of making unlawful telemarketing calls to consumers' cell phones without their consent.

The company allegedly used an automatic telephone dialing system (ATDS) to place robocalls to thousands of consumers at a time, without their prior express written consent.

This is a clear violation of the Telephone Consumer Protection Act (TCPA), a federal law that prohibits such activities.

The plaintiff in the lawsuit, Caldera v. Ace Cash Express Insurance Services LLC, claims she began receiving calls from the defendant in June 2021, which she believes were placed using automated technology.

She never provided her consent to be contacted on her cell phone and does not owe the debt at issue.

Ace Cash Express allegedly used a predictive dialer to place these calls, which can be identified by the lack of an agent on the line and a characteristic pause and click before the call is transferred to a live person.

The company has also been accused of violating the federal Fair Debt Collection Practices Act (FDCPA) and California's Rosenthal Fair Debt Collection Practices Act (RFDCPA) by placing repeated and continuous calls to annoy the plaintiff.

You might like: What Organization Protects Consumers from Debt Collectors

Complaints Against Collections

If you're being harassed by Ace Cash Express Collections, you're not alone. Almost all complaints on the Better Business Bureau include multiple harassments, inaccurate reporting, and failure to notify a debt.

Filing a complaint against them might be a good idea. The FDCPA protects you from these kinds of harassment. Exercise your rights and report them immediately.

Some common abuses debt collection agencies do to collect money from you include:

- Use of obscene or profane language

- Failure to issue a report to the credit bureau that a debt is in dispute

- Calling before 8:00 AM and after 9:00 PM in your time zone

- Calling at work if your employer prohibits them from doing so

- Making a threat of suing or garnishing your wages

Paying or negotiating a settlement with Ace Cash Express Collections might seem like an easy way out, but it's actually not a good idea. It can make the situation worse and still affect your credit score for up to seven years.

Contacting Collections

Contacting collections can be a daunting task, but it's essential to approach it with caution and preparation.

First, you should never contact a collection company on your own without thinking through your options.

It's best to seek help from a reputable credit repair company first.

Here's an interesting read: Gla Collection Company Payment

This will give you a clear understanding of your situation and available options, making it easier to deal with the collection agency.

Seeking legal help can also be beneficial, especially if you want to dispute any debt collection agency's claims.

Doing this can help remove negative reports from your credit history, which in turn will improve your credit score.

Take a look at this: Legal Help with Debt Collectors

When to Try

If you have the time to dedicate to doing the process right, it can be worth trying to handle debt collection on your own. This approach requires many steps, so be prepared to put in the effort.

Seeking help from a reputable credit repair company can be a better option, as they have experience deleting negative credit entries for multiple clients. These companies can help you navigate the process and protect your credit history.

Negotiating a settlement or paying debt collection agencies alone can make the situation worse, and any record of collection agencies on your credit report will still affect your credit score for up to seven years. It's best to avoid dealing with them directly.

If you have a good case against the company, seeking compensation and making the issue public can be a way to get results. This approach requires a strong case and a willingness to take on the process.

Intriguing read: Lawyer to Help with Debt Collectors

Frequently Asked Questions

What happens if you pay ACE Cash Express late?

If you pay ACE Cash Express late, a 5% delinquency fee will be charged on each installment payment, up to a maximum of $10.00. This fee is applied to ensure timely payments and maintain the terms of your loan.

Does ACE Cash Express affect credit score?

ACE Cash Express may affect your credit profile with certain consumer reporting agencies, but it won't impact your FICO Score. Learn more about how our services may impact your credit.

Sources

- https://moneyminiblog.com/debt-relief/how-to-deal-with-ace-cash-express/

- https://www.classaction.org/news/lawsuit-alleges-ace-cash-express-placed-illegal-debt-collection-robocalls

- https://www.latimes.com/business/la-fi-ace-cash-express-payday-lender-consumer-financial-protection-bureau-20140710-story.html

- https://www.dallasnews.com/business/2014/07/11/appalling-predatory-lending-practices-cost-ace-cash-express-10m-in-settlement-with-feds/

- https://fairshake.com/ace-cash-express/file-a-claim/

Featured Images: pexels.com