Accumulated depreciation is a crucial concept in accounting, and it's essential to understand how it applies to buildings. Accumulated depreciation is calculated by multiplying the original cost of the building by the depreciation rate, which is typically 2-5% per year.

The original cost of a building is its initial purchase price, including any land acquisition costs. For example, if a company buys a building for $1 million, the original cost is $1 million.

The depreciation rate is a key factor in calculating accumulated depreciation. In the United States, the IRS allows a depreciation rate of 2-5% per year for buildings.

Curious to learn more? Check out: Cost Less Accumulated Depreciation Equals

Calculating Accumulated Depreciation

Calculating accumulated depreciation is a crucial step in understanding the financial health of a building.

There are 6 common methods for calculating depreciation of an asset.

A property with a value of $10MM and an estimated useful life of 30 years can be depreciated at a rate of $333,333 per year.

The amount of accumulated depreciation at the end of year five would be $1,666,665.

Straight line depreciation is a straightforward method, but it can be accelerated with a cost segregation study.

A cost segregation study can break a property up into its individual components and depreciate them at an accelerated rate.

For example, interior fixtures and finishes can be depreciated over five years, while land improvements can be depreciated over 15 years.

It's best to have an expert, such as a CPA or tax professional, perform a cost segregation study to ensure it's being completed correctly.

See what others are reading: How Many Years Do You Depreciate a Building

Accounting for Accumulated Depreciation

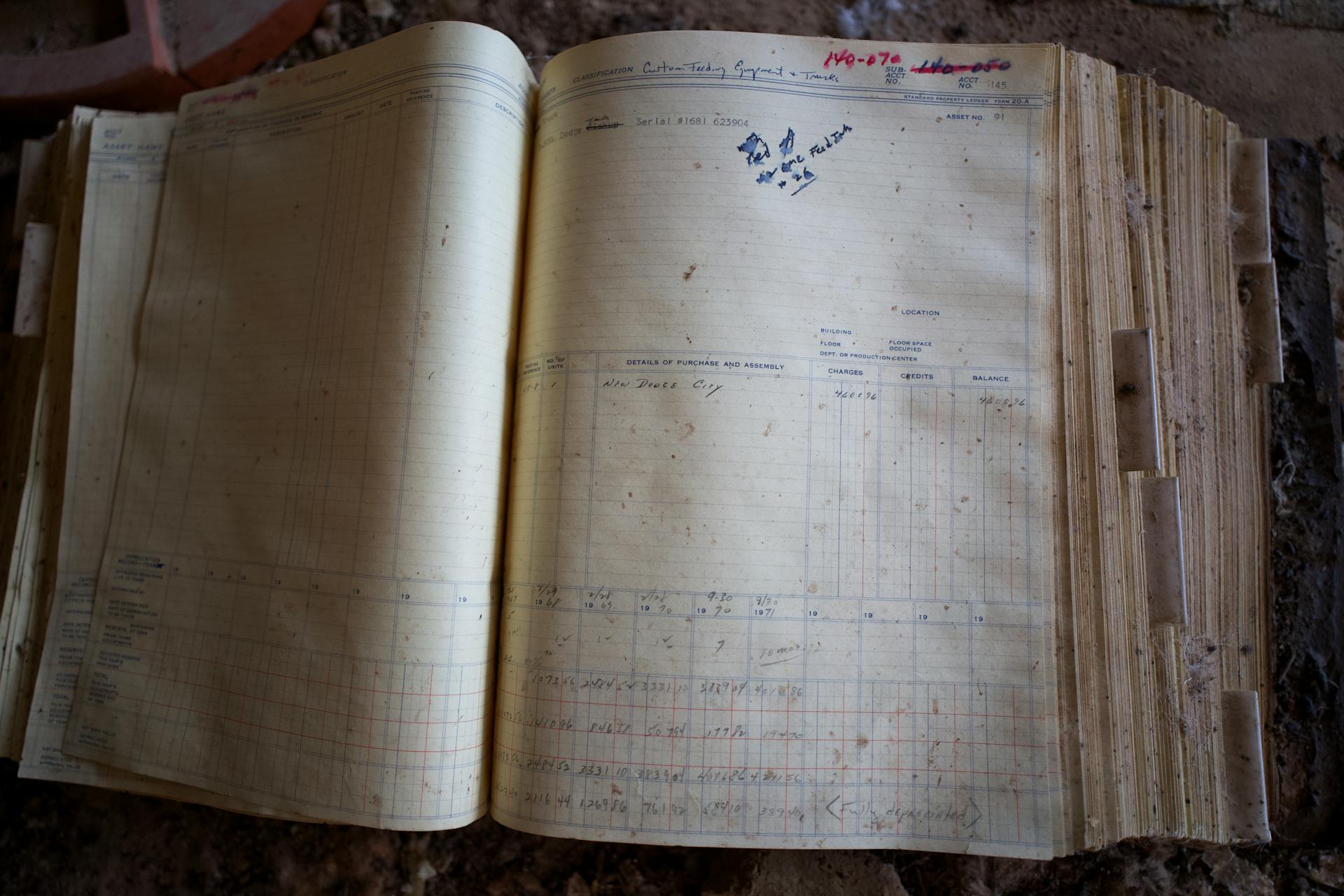

Accumulated depreciation is a crucial aspect of accounting for buildings, and it's calculated by tracking the depreciation of the building over time.

Under Generally Accepted Accounting Principles (GAAP), the carrying amount of a building is calculated by subtracting accumulated depreciation from the purchase cost.

Accumulated depreciation grows over time as the building's useful life is depleted.

For another approach, see: Time Period Concept Accounting

The International Financial Reporting Standards (IFRS) also require companies to track accumulated depreciation, which is essential for maintaining the integrity of financial reporting.

Companies must provide detailed notes in their financial statements explaining the methods used for depreciation, the useful lives of the assets, and any changes made during the reporting period.

Accumulated depreciation is an important consideration when reviewing the financial health of a company, as it affects the company's net income and asset value.

The IFRS standard IAS 16 requires companies to review and adjust the useful life and residual value of buildings regularly, which can impact the accumulated depreciation calculation.

By accurately tracking accumulated depreciation, companies can make informed decisions about their assets and investments.

Expand your knowledge: Financial Reporting Accountant

Types of Depreciation Methods

There are two main types of depreciation methods: the straight-line method and accelerated methods. The straight-line method assumes a consistent rate of depreciation, but it's not the only option.

The declining balance method delivers an accelerated depreciation rate, where depreciation is higher in the earlier years. This method uses the formula: Annual accumulated depreciation = current book value x depreciation rate.

If this caught your attention, see: Treasury Share Method

The longer you own the asset, the lower the annual depreciation rate. For example, if you buy a piece of equipment worth $10,000 and it depreciates by 20% each year, the annual depreciation rate will decrease as the current book value decreases.

The double-declining balance method is another accelerated method that starts with the straight-line method to get the annual depreciation rate. It then uses the formula: Double-Declining Balance Method Rate = (100% / Useful Life In Years) x 2. This method is often used for assets with a shorter useful life.

Check this out: Treasury Stock Par Value Method

Straight-Line

The straight-line method is one of the most common ways to calculate accumulated depreciation.

It's a straightforward approach that works well for assets that depreciate at a steady rate, like buildings.

You can use this method with assets that have a fixed useful life, such as a piece of equipment that you expect to be usable for 10 years.

For more insights, see: Equivalence Number Method

The formula for straight-line depreciation is annual accumulated depreciation = (asset value – salvage value) / useful life in years.

For example, if you purchase a piece of equipment for $10,000 and expect it to be usable for 10 years, you can calculate the annual accumulated depreciation.

Subtract the salvage value ($1,000) from the asset value ($10,000) to get $9,000, then divide that by 10 to get an annual accumulated depreciation of $900.

This method is easy to understand and apply, making it a popular choice for businesses and individuals alike.

A different take: In Computing Depreciation Salvage Value Is

Declining Balance

The declining balance method delivers an accelerated depreciation rate where depreciation is higher during the earlier years that you own the asset.

This method is different from the straight-line method, which assumes a consistent rate of depreciation. The formula for the declining balance method is Annual accumulated depreciation = current book value x depreciation rate.

The depreciation rate stays the same, but the current net book value changes each year. For example, you buy a piece of equipment worth $10,000 at the outset and you assume that it depreciates by 20% each year.

The annual depreciation is calculated by multiplying the current book value by the depreciation rate. In the first year, the annual depreciation is $2,000, which is $10,000 x 20%.

Curious to learn more? Check out: Nano X Cold Wallet

Sum of Years' Digits (SYD)

The Sum of Years' Digits (SYD) method is an accelerated depreciation method where an asset depreciates more quickly in its early years.

This method is calculated using the formula: Annual Accumulated Depreciation = Depreciable Base x (Inverse Year Number / Sum of Year Digits).

For example, if you expect a 5-year life expectancy, the sum of years is 5 + 4 + 3 + 2 + 1 = 15.

The depreciable base is the outset value of your asset minus the salvage value, or the amount you initially paid for the asset.

In the example, the $10,000 asset has a 5-year life expectancy, so the sum of year digits is 15.

Year 1 depreciation is $3,333, which is calculated by multiplying the depreciable base by (5 / 15).

Year 2 depreciation is $2,666, which is calculated by multiplying the depreciable base by (4 / 15).

Explore further: Are Land Improvements Depreciated over 15 Years

Half-Year Recognition

In many cases, businesses will purchase an asset partway through the year, which is where the half-year recognition method comes in.

Worth a look: What Is Prior Year Accumulated Depreciation

The half-year recognition method helps account for years when an asset is only used for part of the year, by calculating the annual accumulated depreciation using the straight-line method.

You can use the straight-line method to calculate the annual accumulated depreciation of the asset, which is then split between the years the asset is used.

Instead of assigning a full year of depreciation in the first year, half of the calculated depreciation is assigned to the first year, and half to the final year.

All the years in between have a full year of depreciation, which ensures the asset's value is accurately accounted for over time.

Cost Segregation

Cost Segregation is a method of calculating depreciation that allows property owners to maximize depreciation deductions and tax benefits by segmenting the components of a property and depreciating them at different rates.

To utilize the cost segregation method, a third party consultant is typically hired to perform a cost segregation study, which justifies the property's accelerated depreciation schedule.

Furniture, fixtures, carpeting, and window treatments are classified as personal property and can be depreciated over five or seven years.

Sidewalks, paving, and landscaping are classified as land improvements and depreciated over 15 years.

This method is particularly useful for property owners who want to reduce their taxable income and increase their cash flow.

Accumulated Depreciation in Real Estate

Accumulated depreciation can have a significant impact on the value of a building, and it's essential to understand how it works.

As a property is depreciated over time, its accumulated depreciation increases, which can decrease its net book value and cost basis.

The gain on the sale of a property is calculated as the sale price less the asset's cost basis, so when depreciation has decreased the cost basis, it opens the investor up to having to pay capital gains tax upon the sale of the property.

Accurate depreciation records can facilitate better loan terms and interest rates, as they provide a transparent view of the asset's worth and the owner's financial health.

Investors need to monitor their financial statements and understand what their tax liability will be if they choose to sell a property that has been depreciated.

Depreciation schedules can affect the timing of property transactions, with properties having accelerated depreciation offering more immediate tax benefits in the short term.

Check this out: Basis of Accounting

Accumulated Depreciation in Accounting

Accumulated depreciation is the total amount of depreciation expense that has been charged against a building since its acquisition. It's a crucial concept in accounting that helps reflect the decline in value of a building over time.

Accumulated depreciation is reported on the balance sheet as a contra-asset account, which means it's offset against the original cost of the building. This is done to provide a more realistic view of the building's current worth.

The amount of accumulated depreciation is calculated by multiplying the annual depreciation expense by the number of years the building has been in use. For example, if a building has a useful life of 30 years and the annual depreciation expense is $333,333, the accumulated depreciation at the end of year five would be $1,666,665.

Accumulated depreciation is not a current asset, but rather a long-term contra-asset account. This means it's not something that can be easily converted into cash, but rather a reflection of the building's decreasing value over time.

A fresh viewpoint: Is Accumulated Depreciation a Contra Asset

Here's a breakdown of the key components of accumulated depreciation:

- Initial cost of the building

- Accumulated depreciation

- Net book value of the building

For example, if a building was purchased for $10 million and has an accumulated depreciation of $1.7 million, the net book value would be $8.3 million.

Accumulated depreciation is an important concept in accounting because it helps ensure that financial statements accurately reflect the value of a company's assets. By spreading the cost of a building over its useful life, depreciation helps match expenses with revenues and provides a clearer picture of operational efficiency.

Example and Calculation

Accumulated depreciation can be calculated using a straight line method, where the annual depreciation is determined by dividing the asset's value by its estimated useful life.

For example, a property with a value of $10MM and an estimated useful life of 30 years would have an annual depreciation of $333,333.

The accumulated depreciation at the end of year five would be $1,666,665, calculated by multiplying the annual depreciation by the number of years.

Cost segregation can also be used to calculate accumulated depreciation, but it's a more complicated process that involves breaking down the property into its individual components and depreciating them at an accelerated rate.

For instance, interior fixtures and finishes can be depreciated over five years, while land improvements could be depreciated over 15 years.

The specifics of the cost segregation process can be tricky, but the key point is to remember that it allows real estate owners to accelerate depreciation in an effort to reduce overall tax liability in the earlier years of an asset's useful life.

The IRS rules dictate that a commercial rental property can be depreciated over either 27.5 or 39 years, but a cost segregation study can help real estate owners take advantage of accelerated depreciation.

Additional reading: Prior to the Adjusting Process Accrued Revenue Has

Advanced Topics

Accumulated depreciation is a crucial concept in accounting for buildings. It's calculated by subtracting the cost of a building from its current market value.

The straight-line method of depreciation assumes that the value of a building decreases evenly over time. For example, if a building costs $100,000 and has a useful life of 20 years, the annual depreciation would be $5,000.

Depreciation is not just a financial concept, it also affects the tax liability of property owners. As buildings depreciate, their value decreases, which can lead to lower taxable income. This can result in lower tax payments, which is a significant advantage for property owners.

The accumulated depreciation of a building is typically recorded on the balance sheet as a contra asset account. This means it's subtracted from the cost of the building to calculate its net book value.

Frequently Asked Questions

Is Accumulated depreciation buildings an asset?

No, Accumulated depreciation is not an asset, but rather a contra asset account that reduces an asset's value to reflect wear and tear. It's a unique accounting classification that helps accurately reflect an asset's total depreciation on the balance sheet.

What is the depreciation rate for buildings?

For non-residential buildings, the depreciation rate is 10%. This rate applies to buildings where less than 66.66% of the built-up floor area is used for residential purposes.

Is accumulated depreciation buildings a permanent account?

Accumulated depreciation is a permanent account that doesn't close at the end of the accounting period. It's a key component of a company's balance sheet, reflecting the total depreciation of its assets over time.

Sources

- https://www.freshbooks.com/hub/accounting/is-accumulated-depreciation-current-asset

- https://fnrpusa.com/blog/accumulated-depreciation-asset-liability/

- https://smallbusiness.chron.com/record-depreciation-buildings-accounting-42627.html

- https://accountinginsights.org/building-depreciation-strategies-and-financial-impacts/

- https://corporatefinanceinstitute.com/resources/accounting/ppe-property-plant-equipment/

Featured Images: pexels.com