The Yale Endowment Fund is a legendary investor, with a long history of outperforming the market. It's no wonder that investors and financial professionals alike look to the endowment as a model for their own investment strategies.

One of the key factors behind the endowment's success is its diversification strategy, which includes allocating a significant portion of its assets to private equity investments. This approach has yielded impressive returns, with the endowment's private equity portfolio returning an average of 15.1% per year over the past decade.

The endowment's investment team takes a long-term view, with a focus on generating returns over 10-20 year periods rather than trying to time the market. This approach has allowed the endowment to ride out market fluctuations and stay focused on its investment goals.

Worth a look: Vc Fund Returns

Investment Strategies

Yale University's endowment has been a pioneer in alternative investing, starting with a 15% target allocation to absolute return strategies, also known as hedge funds, in 1990.

Tom Steyer's Farallon Asset Management was the first to be approached by David Swensen, Yale's CIO, to manage a portion of the endowment for no fee. This partnership helped prove the effectiveness of hedge funds in providing positive returns in both bull and bear markets.

To mimic the investment strategy of a university endowment, consider the following key points:

- Economies of scale are crucial, with funds over US$1 billion generally outperforming smaller endowments.

- Access to alternative investments, which require longer gestation periods and higher minimum investments, is essential for optimal returns.

- Expertise from investment committees and vast social networks can provide a significant advantage in investment opportunities.

Invest Like

Endowments earn vastly different returns from one another, although funds with assets north of US$1 billion generally outperform smaller endowments. This is mainly because their chosen investment strategies require economies of scale.

One key takeaway from the Stanford University endowment's investment strategy is that they have a high allocation to alternative investments, with over 50% of their portfolio invested in this area. This is a stark contrast to individual investors, who may have an allocation of only 5-20% to alternatives.

The endowment's ability to invest in alternatives is partly due to their comfort with the risk profile and their lack of need for liquidity. In fact, most endowments are comfortable with a 5-6% annual return, which is a more conservative goal than what many individual investors aim for.

Building a large enough financial nut can make a big difference in investment returns. For example, a 6% return on a $5 million portfolio is a healthy $300,000. This can provide a middle-class lifestyle for a family in a big city, covering expenses such as housing, food, travel, taxes, and charity.

Here's a comparison of the benefits and challenges of investing like endowments:

Ultimately, investing like endowments requires a long-term perspective and a willingness to take on more risk. However, with the right strategy and allocation, it's possible to achieve significant returns and build a secure financial future.

Custom Indexing

Custom indexing is a tax-efficient equity strategy that invests in select stocks to track the risk and return profile of a specific index. It's preferred to indexed or active equity in an after-tax allocation.

This strategy allows investors and their advisors to be in control of when gains and losses are recognized through direct ownership of the underlying securities. It's also known as direct indexing.

Take a look at this: Super Fund Tax

Custom indexing provides more opportunities for tax-loss harvesting, which can generate significant tax savings. In fact, a study published in the CFA Journal found that tax-loss harvesting can generate 108 basis points (1.08%) of annual tax savings.

By directly owning the underlying securities, custom indexing holds more securities that inherently have more variability, mathematically creating more opportunities to harvest losses. This can lead to better after-tax performance compared to comparable ETFs, mutual funds, and market indices.

Readers also liked: Distressed Securities Fund

Risk Management

The Yale endowment fund's risk management strategy is a key factor in its success. The fund's asset allocation is diversified across various asset classes, including public equities, private equity, real assets, and fixed income.

Yale's investment office has a history of taking calculated risks to achieve long-term returns. The fund's willingness to invest in alternative assets, such as private equity and real assets, has paid off in the past.

A key aspect of Yale's risk management strategy is its use of diversification to minimize risk. The fund's asset allocation is designed to balance returns with risk, with a focus on generating consistent returns over the long term.

Drawdowns

Drawdowns can be a significant concern for investors, as they refer to the decline in value from a relative peak value to a relative trough.

A maximum drawdown is the maximum observed loss from a peak to a trough of a portfolio before a new peak is attained. This is a crucial metric to understand, as it can help you gauge the risk of a particular investment.

In essence, drawdowns measure the magnitude of a portfolio's decline from its peak value. This can be a valuable tool for evaluating investment performance and risk.

Understanding drawdowns is essential for effective risk management, as it allows you to anticipate and prepare for potential losses.

Discover more: Stable Value Fund

Seasonality

In David Swensen's Yale Endowment Portfolio, it's essential to consider the seasonality of investments. The time period from January 1985 to December 2024 reveals valuable insights.

Investing in the portfolio during certain months can yield better results. The Average Return and Gain Frequency (Win %) metrics suggest that some months are more favorable than others.

Investing in the months with the highest Average Return can help maximize returns. For instance, the months with the highest Average Return are not specified in this section.

However, the Gain Frequency (Win %) metric provides a useful alternative perspective. It shows that some months have a higher frequency of gains, which can be beneficial for investors.

Investors should consider the historical data from January 1985 to December 2024 to make informed decisions. This time period covers nearly four decades of market fluctuations.

By analyzing the Average Return and Gain Frequency (Win %), investors can develop a more informed approach to investing in the portfolio. This can help mitigate risks and make more strategic decisions.

Offsetting Gains and Losses

Equities can play a special role in taxable portfolios when managed tax-efficiently, allowing investors to harvest losses to offset gains elsewhere.

Research indicates that 100–200 basis points in tax savings can be achieved each year through intelligent and systematic loss harvesting.

Investors can use the proceeds of a security sold at a loss to buy a similar investment, maintaining the portfolio's overall balance.

By actively harvesting losses in taxable investment accounts, physicians can create a "bank" of losses that can be tapped into in subsequent tax years until they are fully utilized.

This approach creates the potential for huge tax savings over time while reducing portfolio risk.

Yale Asset Breakdown

Yale's asset allocation is a fascinating topic, and it's worth taking a closer look at their 2021 planned allocation. According to their newsletter, Yale targets a minimum allocation of 30% of the endowment to market-insensitive assets, such as cash, bonds, and absolute return strategies.

This allocation is designed to provide stability and protection during bear markets, while also generating returns during bull markets. Yale's experience with absolute return strategies dates back to 1990, when they became the first institutional investor to define this asset class as a distinct category.

Yale's asset allocation is also notable for its diversification. They limit illiquid assets, such as venture capital, leveraged buyouts, and private real estate, to 50% of the portfolio. This diversification is a key factor in Yale's success, as it allows them to spread risk and generate returns from a wide range of asset classes.

Here's a breakdown of Yale's 2021 asset allocation:

This allocation is designed to provide a balance between stability, growth, and diversification. By allocating a significant portion of their endowment to market-insensitive assets, Yale is able to generate returns during bear markets and protect their assets during downturns.

It's worth noting that Yale's asset allocation is highly diversified, with a focus on non-traditional asset classes. This approach has allowed them to generate returns that are significantly higher than the market average, while also reducing risk.

Exploring Alternatives

The rich invest a significant portion of their assets in alternatives, often exceeding 50% of their net worth. My tenant at Stanford University, who joined the endowment as an analyst, told me that the endowment's alternative investment allocation is well over 50%.

Hedge funds are a popular alternative investment choice, with Yale University being a pioneer in this space. In 1990, Yale became the first institutional investor to define absolute return strategies as a distinct asset class, beginning with a 15% target allocation.

Tom Steyer's Farallon Asset Management was one of the first hedge funds to be chosen by Yale, and it's interesting to note that Steyer received his bachelor's degree from Yale. Farallon's initial success led other college endowments to follow Yale's example.

Alternative investments often have longer gestation periods and impose higher minimum investments, especially in highly illiquid markets. This makes them more suitable for bigger endowments with billions of dollars to invest.

Here are some key points to consider when exploring alternative investments:

- Endowments with assets over $1 billion generally outperform smaller endowments due to economies of scale.

- University endowments benefit from investment committees and social networks that provide access to crucial investment opportunities.

- Endowments are exempt from government taxes, giving them a competitive advantage.

- The best performing endowments access alternative investments, which require longer gestation periods and higher minimum investments.

It's worth noting that many alternative investments outperform traditional stocks and bonds, but they often come with higher risks. As an individual investor, it's essential to carefully consider your risk tolerance and investment goals before allocating a significant portion of your assets to alternatives.

Frequently Asked Questions

How much money does Yale have in endowments?

Yale's endowment value is approximately $41.4 billion as of June 2024. This amount represents a slight increase from the $40.7 billion endowment value in June 2023.

What is the Yale Endowment Fund model?

The Yale Endowment Fund model is a diversified investment strategy that combines traditional assets with alternative investments, emphasizing active asset allocation. Developed by David Swensen, this model has been a benchmark for institutional investors seeking long-term returns.

What is the average allocation of an endowment?

The average allocation of an endowment varies by asset size, with larger endowments allocating around 30% of capital to private capital and smaller ones allocating around 18%. Endowment allocation strategies can significantly impact investment returns and risk.

Sources

- https://www.lazyportfolioetf.com/allocation/david-swensen-yale-endowment/

- https://www.financialsamurai.com/a-look-inside-investment-asset-allocation-of-massive-university-endowments/

- https://yaledailynews.com/blog/2022/01/27/venture-capital-gains-drive-universitys-endowment-growth/

- https://www.whitecoatinvestor.com/applying-yales-investment-success-for-physicians/

- https://www.investopedia.com/articles/financial-theory/09/ivy-league-endowments-money-management.asp

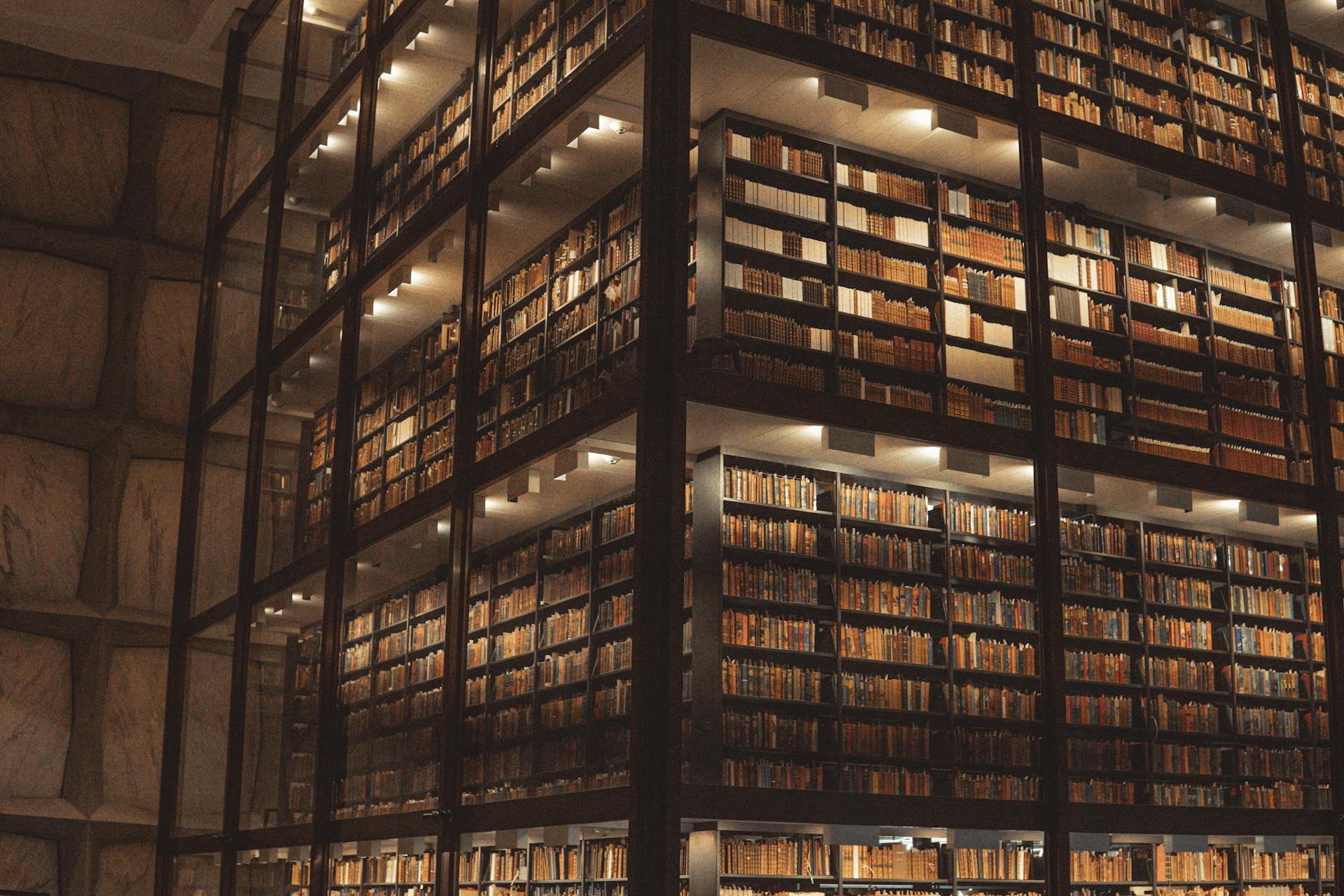

Featured Images: pexels.com