Term life insurance is a type of life insurance that provides coverage for a specific period of time, typically ranging from 10 to 30 years. This type of insurance is often chosen by individuals who need coverage for a specific period, such as until their children are grown and independent.

One key difference between term and permanent life insurance is the level of coverage. Term life insurance generally offers lower premiums and a higher death benefit, but the coverage expires after the specified term. In contrast, permanent life insurance provides lifelong coverage, but at a higher premium.

If you're on a tight budget, term life insurance might be the more affordable option.

Types of Life Insurance

Types of life insurance are divided into two broad categories: term and permanent. Term life coverage lasts for a set period of years, while permanent life insurance can last as long as you live.

There are several types of permanent insurance, including whole life, universal life, indexed universal life, and variable universal life. Whole life insurance features guaranteed premiums, death benefits, and cash value, while universal life policies are flexible and may allow you to raise or lower your premium or coverage amounts throughout your lifetime.

Expand your knowledge: What Are the 4 Types of Permanent Life Insurance

Permanent life insurance can provide premiums that won't go up as you age, and it builds cash value that accumulates over time. Some insurers even offer life insurance for specific costs, debts, or expenses, such as mortgage life insurance.

Here's a breakdown of the main types of life insurance:

To determine which type of life insurance is right for you, consider your individual needs and circumstances, and don't forget to reevaluate your coverage amount periodically to ensure it still meets your needs.

Whole

Whole life insurance is a type of permanent life insurance that offers both insurance and savings. It has fixed premiums and guaranteed death benefits that won't change throughout a person's lifetime.

A whole life insurance policy can be thought of as a combination of insurance and a savings account. Part of your premium pays for insurance, and the balance goes into a savings account that pays dividends and grows over the years.

Discover more: What Percentage of Term Life Insurance Pays Out

You can withdraw from your savings or borrow (and pay back) funds, making it a versatile option. Everyday Life, which offers term policies with up to $2 million coverage, also provides whole life insurance for people up to age 85, and says 90% of applicants never have to take a medical exam.

With a whole life insurance policy of $150,000, a person might be expected to pay $180 each month. The policyholder will have to pay this amount to keep their life coverage.

Whole life insurance plans also have a savings or cash value component, which allows policyholders to build up a cash amount in their policy. This cash value can be used in different ways, such as investing, borrowing, or spending.

Here are some key features of whole life insurance:

Overall, whole life insurance offers a combination of insurance and savings, making it a popular choice for those who want to provide for their loved ones and build a nest egg.

Variable Universal

Variable Universal life insurance combines the flexibility of Universal life with the investment potential of Variable life. This hybrid policy allows you to adjust your death benefit and premiums like Universal life, and invest in stocks, bonds, and money market mutual funds like Variable life.

The investment side of Variable Universal life carries risks and rewards similar to Variable life, meaning your death benefit and cash value may decrease if your investments don't do well. However, some policies may guarantee that your death benefit will not fall below a certain level.

You can use your policy's cash value to pay your premiums for periods, similar to Universal life. This can be especially helpful if you have seasonal work, like paying premiums during your six months of work.

Variable Universal life policies are more flexible than whole life insurance, and you may be able to increase your death benefit if you take and pass a medical exam. However, if you use up your savings, your policy may lapse.

Consider reading: Term Life Insurance Accelerated Death Benefit

What Is

Term life insurance is a type of life insurance that provides coverage for a specific period of time, typically ranging from 10 to 30 years.

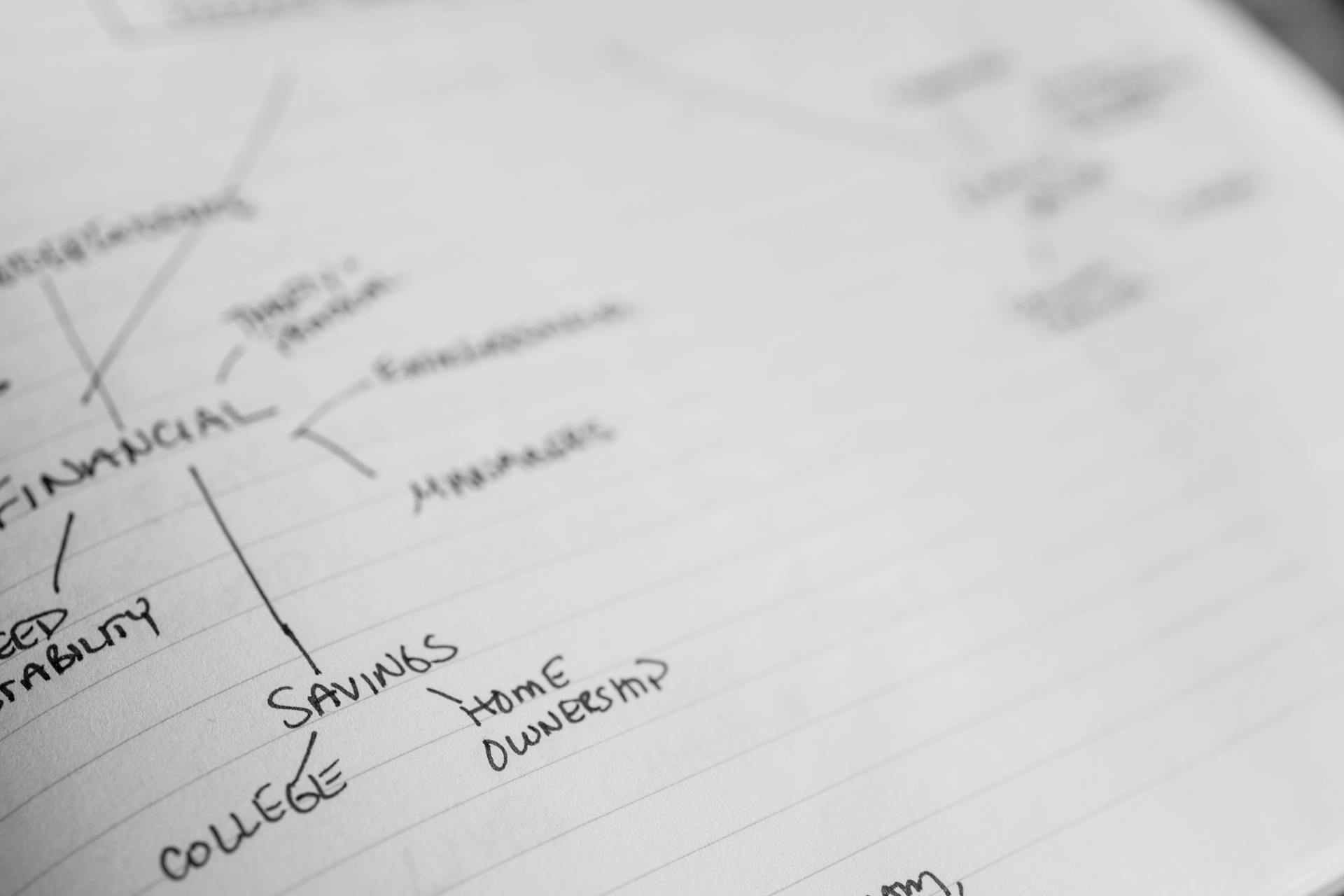

This coverage period is usually chosen based on the policyholder's age and financial obligations, such as paying off a mortgage or supporting dependents. Term life insurance is often less expensive than permanent life insurance.

Permanent life insurance, on the other hand, provides lifelong coverage as long as premiums are paid. This coverage can last a lifetime, even if the policyholder's health or financial situation changes.

One key difference between term and permanent life insurance is the ability to accumulate cash value over time.

On a similar theme: Term Life Insurance Provides Protection for a Specific of Time.

Key Features

The death benefit is the amount of money paid to beneficiaries when a policyholder dies. This amount is detailed in the insurance contract you sign, and there are multiple coverage options.

In exchange for this benefit, policyholders pay the insurer a monthly or one-off premium for the contract to remain in force. If the policyholder stops paying premiums, the contract will end, and the insurer will not payout in the event of death.

Beneficiaries may receive the death benefit in different ways, including a lump sum, an annuity, or an account with funds depending on the contract.

Consider reading: Does Whole Life Insurance Have Guaranteed Death Premium

Universal or Adjustable

Universal or adjustable life insurance policies offer more flexibility than whole life insurance. They allow you to increase the death benefit if you pass a medical exam, for example.

With a universal or adjustable life policy, the savings part usually earns an interest rate equivalent to a money market account. This means you can earn some interest on your savings, but it's not as high as other investment options.

You can lower your premium payments if you have enough savings to cover the cost, which is a big advantage. However, if you use up your savings, your policy may lapse, so be careful.

These policies are great for people who want more control over their life insurance coverage. For instance, a person might purchase universal life coverage in their 30s while married, but later realize they won't need as much life coverage after a divorce.

Additional reading: Difference between Universal Life and Term Life Insurance

Death Benefit

The death benefit is the amount of money paid to beneficiaries when a policyholder dies, and it's detailed in the insurance contract.

This amount can be paid in different ways, including a lump sum, an annuity, or an account with funds, depending on the contract.

A death benefit can be paid in one amount to beneficiaries, known as a lump-sum payment, or it can be paid regularly over a period through installment payments.

For example, a policy with a death benefit of $500,000 could pay a beneficiary $50,000 ten times over five years.

The death benefit is also known as the face value of the policy, and it's the money beneficiaries receive if a policyholder dies.

Policyholders can choose to pay premiums monthly or in one-off payments to keep the contract in force, but if premiums stop, the contract will end, and the insurer won't pay out in the event of death.

Term life insurance requires premiums to be paid to provide a death benefit, but if the policy term or renewal expires before the death of the insured person, there is no death benefit.

Permanent life insurance, on the other hand, provides a death benefit to beneficiaries no matter when the insured person dies, although some policies may offer a graded death benefit.

Recommended read: Who Is the Insured on a Life Insurance Policy

Length

When you're choosing a term life insurance policy, you'll select a term length that can range from 2 to 40 years. This is a crucial decision, as it will determine how long you'll be paying premiums.

A term life insurance policy can last up to 40 years, and if not renewed, the policy terminates and coverage ends. If the insured person dies during this time, the beneficiary will receive a death benefit.

The face value of a term life insurance policy will not change prior to renewal, and neither will the amount you pay for the policy. This means you'll have a stable premium for the entire term.

A permanent or whole life insurance policy, on the other hand, lasts for the lifetime of the insured person as long as premiums are paid. This type of policy guarantees a death benefit to the heirs.

Expand your knowledge: Family Income Benefit Term Life Insurance

Pros and Cons

Permanent life insurance tends to be more expensive than term policies, with prices reflecting the lifetime coverage it provides.

The flexibility of permanent life insurance is a major advantage, as it allows policyholders to use the cash value as a source of savings, to pay for future premiums, or as collateral to back up a repayable loan.

However, this complexity can make permanent life insurance policies challenging to understand, and cancellation fees may apply if you decide to cancel your contract.

Here are some key differences between term and permanent life insurance:

Return of Premium (ROP)

Return of Premium (ROP) insurance can be a good option for those who want to get back some of their premiums if they outlive the term.

The premiums for ROP insurance are significantly higher than regular term insurance, which can be a drawback.

You must keep the policy in force until the end of the term to receive the return of premiums, which can be a challenge for some people.

The return of premiums does not include any interest or dividends, so you won't earn any extra money on the premiums you paid.

Expand your knowledge: What Is Return of Premium Term Life Insurance

Pros

Term life insurance is a great option for those who need maximum coverage at minimum cost. It's the most budget-friendly insurance available, making it a good fit for people who want to prioritize their financial responsibilities.

One of the biggest advantages of term life insurance is that it's affordable. According to the facts, term insurance is the most budget-friendly insurance available, making it a great choice for those who need maximum coverage at minimum cost.

You can also customize your term life insurance coverage to fit your specific needs. This means you can take out term life insurance for specific financial responsibilities, such as paying off a mortgage or supporting your children until they're on their own.

Some term life plans can even be converted to permanent life cover, giving you flexibility as your needs change over time. This is a great option for those who want to have the option to switch to a different type of insurance in the future.

Consider reading: Life Insurance Cover Amount

Here are some of the key pros of term life insurance:

- Affordable premiums

- Coverage for a specified period

- Straightforward and easy to understand

This means you can have peace of mind knowing that you have coverage in place for a specific period of time, without having to worry about complicated contract provisions or accumulating cash value.

Cons

Term insurance has its downsides, and it's essential to consider these before making a decision.

One major con of term insurance is that your premiums don't go into savings or investments. At the end of the term, there's no balance to speak of.

Term insurance premiums can also increase at renewal, which may be a concern for those on a tight budget. This is in contrast to permanent insurance, where premiums stay the same for life.

The simplicity of term insurance can be a problem for those who need flexibility in their insurance policy. This includes individuals who want to save money alongside their insurance coverage.

Here are some key cons of term insurance:

- No cash value: Your premiums don't go into savings or investments.

- Premiums can increase at renewal: This can be a concern for those on a tight budget.

- Not as flexible as permanent insurance: The simplicity of term insurance can be a problem for those who need flexibility.

Cost

Cost is a significant factor to consider when choosing between term and permanent life insurance. Term life insurance is generally the least expensive option, with premiums starting at around $30 a month for a healthy 30-year-old male buying a 30-year, $500,000 policy.

Permanent life insurance, on the other hand, can be much more costly, with premiums ranging from $460 a month for the same policy. The cash value component of permanent life insurance adds to the cost, as well as the guaranteed rate of return on the cash value portion of the policy.

Some permanent policies, like Ethos' guaranteed issue whole life, skip the traditional underwriting process and evaluate factors like age and sex instead of health, but this doesn't necessarily make them cheaper. In most instances, term life insurance is the more affordable option.

Here's a comparison of the costs of term and permanent life insurance:

Frequently Asked Questions

What is the main disadvantage of term life insurance?

The main disadvantage of term life insurance is that it ends when the term length expires, leaving you without coverage if you outlive it. This type of insurance does not provide lifetime protection or accumulate cash value.

What happens to term life insurance at the end of the term?

At the end of the term, your term life insurance policy will either end and you'll no longer owe payments or be covered, or you can convert it to permanent life insurance. This decision depends on your insurer's policy and your individual circumstances.

Sources

- https://www.nylaarp.com/Learning-Center/Exploring-coverage/Types-Life-Insurance-Term-And-Permanent

- https://time.com/personal-finance/article/term-vs-permanent-life-insurance/

- https://www.ameritas.com/insights/permanent-life-insurance-versus-term-life-insurance/

- https://policyscout.com/life-insurance/learn/term-vs-permanent-insurance

- https://www.ethos.com/agents/permanent-vs-term-life-insurance/

Featured Images: pexels.com