A good net expense ratio is a crucial factor to consider when evaluating investment options. A net expense ratio of 0.50% or less is generally considered to be in line with industry standards.

Investors should be aware that a higher net expense ratio can significantly impact their investment returns over time. For example, a 1% difference in net expense ratio can result in a 10% difference in investment returns over a 20-year period.

The net expense ratio is calculated by subtracting the management fee from the total expense ratio. This calculation provides a clear picture of the true cost of investing in a particular fund or ETF.

Understanding Net Expense Ratio

A net expense ratio is the amount you pay for investment fees after accounting for discounts and temporary fee waivers. It reflects what you're actually paying to invest in a fund.

The net expense ratio is often the same as the gross expense ratio, but not always. If the numbers are different, the gross expense ratio will always be higher since it doesn't account for discounts.

Explore further: Gross Expense Ratio vs Net

To calculate the total cost of a net expense ratio, you can use the formula mentioned above. For example, if you invest $1,000 in an ETF with a 0.2% net expense ratio, that means 0.2%, or $2 of your investment, will go toward fees, while the other 99.8%, or $998, will be invested.

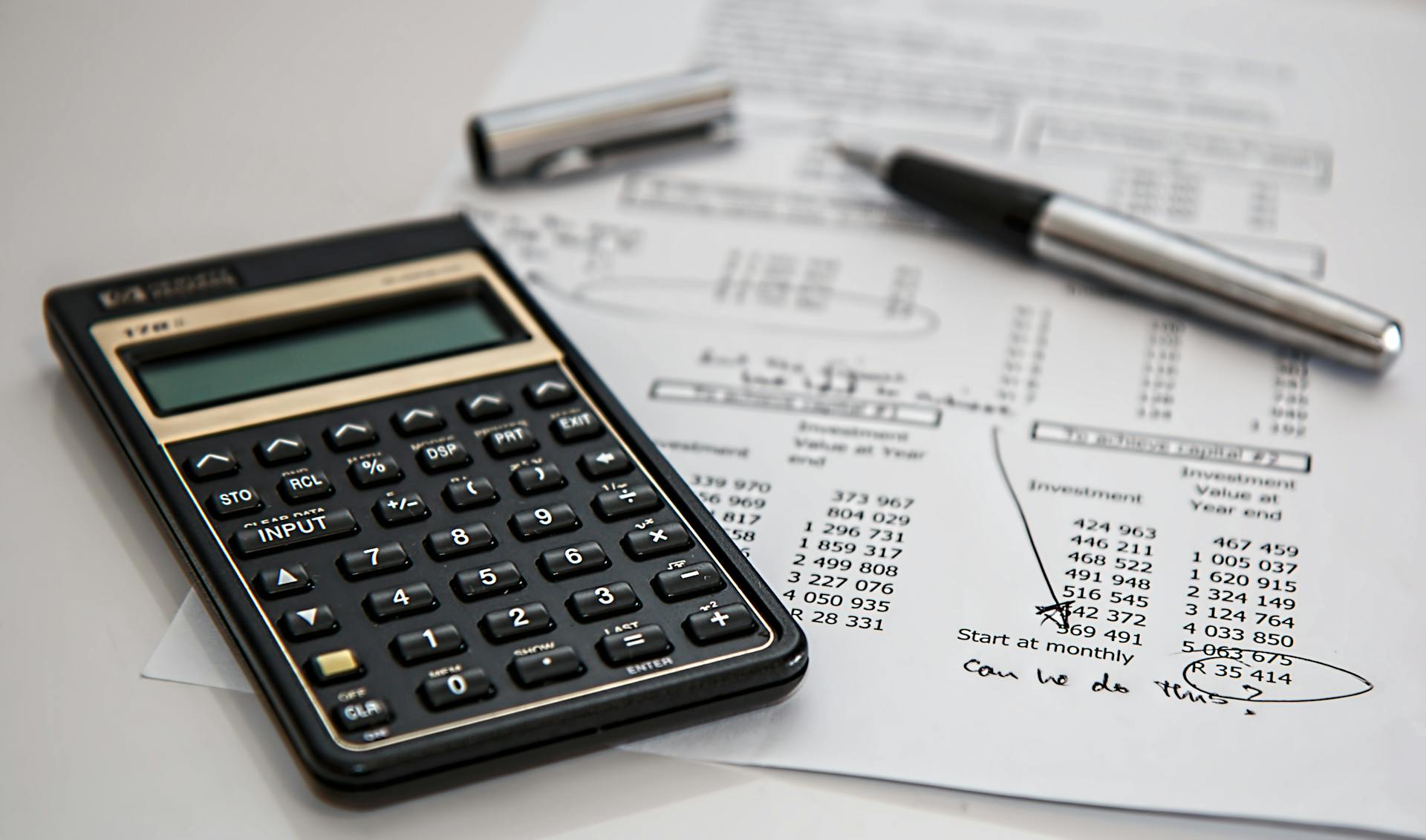

Here's a breakdown of how a net expense ratio can add up over time:

As you can see, even a small difference in expense ratio can result in a significant cost savings over the long term.

What Is an Expense Ratio?

An expense ratio is the cost of owning a mutual fund or ETF, expressed as a percentage of its assets under management. This fee is paid to the fund's manager and covers operating costs such as administrative expenses, marketing, and salaries.

Mutual fund expense ratios tend to be higher than those of ETFs, averaging around 0.22% for ETFs but can be significantly higher for mutual funds.

The expense ratio varies greatly depending on the investment category, investment strategy, and the size of the fund. For example, international funds are typically very expensive to operate because they invest in many countries and may have staff all over the world.

To determine the expense ratio of a fund, you can check the fund prospectus, which is mailed or sent electronically to shareholders each year. The prospectus typically lists the expense ratio under the "Shareholder Fees" heading.

You can also find expense ratio information on financial news websites such as Google Finance and Yahoo! Finance by typing in a fund's ticker symbol. Additionally, you can use fund screeners to compare expense ratios across similar investments.

Here are some ways to determine the expense ratio of a fund:

- Fund Prospectus: Check the "Shareholder Fees" heading

- Financial News Websites: Type in a fund's ticker symbol on Google Finance or Yahoo! Finance

- Fund Screeners: Compare expense ratios across similar investments

- News Journals: Check print newspapers such as Investor's Business Daily and The Wall Street Journal

Understanding Costs

The expense ratios for mutual funds are generally higher than those of ETFs, averaging around 0.22% for ETFs, while mutual fund costs can be significantly higher.

Operating fund costs vary greatly depending on the investment category, investment strategy, and the size of the fund. A fund's expense ratio might be relatively high if its assets are small, because it has a restricted asset base from which to meet its expenses.

International funds are typically very expensive to operate because they invest in many countries and may have staff all over the world. Large-cap funds, on the other hand, tend to be less expensive to operate.

You can determine a fund's expense ratio by checking its prospectus, which is mailed or sent electronically to shareholders each year, or by using online resources such as Google Finance and Yahoo! Finance.

Here are some ways to research a fund's expense ratio:

- Fund Prospectus: You can find the expense ratio under the "Shareholder Fees" heading.

- Financial News Websites: Websites like Google Finance and Yahoo! Finance have expense ratio information for mutual funds and ETFs.

- Fund Screeners: Online tools like FINRA's Mutual Fund Expense Analyzer allow you to compare up to three mutual funds or ETFs.

- News Journals: Print newspapers like Investor's Business Daily and The Wall Street Journal also print information regarding funds, including expense ratios.

Expense ratios may seem like a minor expense, but they can add up quickly. If you invested $1,000 a year for 30 years in a fund with a 1% expense ratio and the fund had a 10% annual rate of return, you'd pay more than $36,000 in fees over three decades.

Calculating Net Expense Ratio

The net expense ratio is a crucial number to understand when investing in a fund, but it can be a bit tricky to calculate. You'll usually find the numbers you need in the fund's investment prospectus, but if you want to DIY the calculation, the formula is: (Total operating expenses - fee waivers and reimbursements)/ Total fund assets.

To break it down further, you'll need to find the total operating expenses and the fee waivers and reimbursements, which can be found in the fund's shareholder report. The total fund assets are also listed in the report.

For example, let's say a fund's fees add up to $10 million and the fund has $1 billion of assets. If $2 million of that goes toward management fees, and the fund's manager agreed to temporarily waive the fee, the net expense ratio would be 0.8%.

In general, the net expense ratio reflects what you're actually paying to invest in a fund, but it's essential to consider the gross expense ratio as well, especially since discounts and fee waivers are often temporary.

For another approach, see: Operating Ratio

Here's a quick summary of the steps to calculate the net expense ratio:

- Find the total operating expenses in the fund's shareholder report

- Identify the fee waivers and reimbursements

- Divide the total operating expenses by the total fund assets

- Subtract the fee waivers and reimbursements from the result

- Multiply the final result by 100 to get the net expense ratio as a percentage

Net Expense Ratio and Investment Returns

A fund's net expense ratio can make a significant difference in your investment returns. According to Example 2, if you invested $1,000 a year for 30 years in a fund with a 1% expense ratio, you'd pay more than $36,000 in fees over three decades.

Even a small difference in expense ratio can cost you a lot of money over time, as seen in Example 1. If you invested $10,000 in the fund with a 2.5% expense ratio, the value of your fund would be $51,524 after 20 years, compared to $64,122 if you invested in the fund with a 0.5% expense ratio.

It's essential to consider the gross expense ratio since it represents what you might be paying after temporary promotions end. Fortunately, it's pretty easy to find passively managed funds that track a broad market index, like the S&P 500 index, with expense ratios of 0.1% or less, as mentioned in Example 2.

Here's an interesting read: Scion S Capital Meaning Michael Burry

The average ETF price is 0.45%, according to Example 3. So, any ETF expense ratio above that value has to justify its costs with an outstanding performance.

To put this into perspective, let's look at the following table:

This table illustrates the significant difference in fees paid over 30 years, depending on the expense ratio.

Net Expense Ratio and Fund Management

A net expense ratio of 0.1% is a good benchmark to aim for, as it can save you thousands of dollars in fees over the long term.

Investing $1,000 a year for 30 years in a fund with a 1% expense ratio can cost you over $36,000 in fees, but with a 0.1% expense ratio, you'd only pay $4,000 in fees.

Passively managed funds that track a broad market index, like the S&P 500 index, often have expense ratios of 0.1% or less.

The gross expense ratio is also important to consider, as it represents what you might be paying after temporary promotions end.

Additional reading: Auto Insurance Broker Fees

For actively managed mutual funds, the total expense ratio (TER) limits vary depending on the assets under management (AUM) and the type of scheme.

In fact, if you're looking at two similar mutual funds, the expense ratio can be a key factor in deciding which one to invest in.

Net Expense Ratio and Investment Decisions

The net expense ratio plays a crucial role in investment decisions, significantly affecting the overall return of your mutual fund investment.

A higher expense ratio can erode your overall return from the mutual fund, which can have a higher impact on debt funds due to their relatively lower returns. For example, a return of 7% with an expense ratio of 2% will be reduced to 5%, making it difficult to beat inflation.

According to the Investment Company Institute, mutual fund expense ratios have declined substantially over the past 27 years. In 2019, the weighted average expense ratio for ETFs was 0.45%, a significant drop from 1999.

Here are some general guidelines to consider when evaluating a fund's expense ratio:

- A lower expense ratio is generally favorable, but it's essential to align your investment objectives with the mutual fund.

- A fund with a higher AUM is likely to have a lower expense ratio, as the management costs are distributed among more investors.

- ETFs tend to have lower expense ratios, often below 1%, making them an attractive option for investors.

- A good rule of thumb is to exclude funds with expense ratios higher than 1% from consideration.

Things to Remember

The expense ratio is a crucial aspect of investment decisions, and it's essential to understand how it affects your returns. A lower expense ratio is always favorable, but it's not the only factor to consider. You should align your investment objectives with the mutual fund.

A lower expense ratio can make a significant difference in your long-term returns. According to Example 1, a 24% improvement can be achieved by investing in a fund with a lower expense ratio. This is why it's essential to compare the expense ratios of different funds.

The expense ratio of regular plans is higher than direct plans, and actively managed funds have higher expense ratios than passively managed funds. This is because regular plans involve commissions to distributors, which are factored into the expense ratio. A fund with a higher AUM is likely to have a lower expense ratio, as the management costs are distributed among more investors.

On a similar theme: No Load Mutual Funds May Have Lower Expense Ratios

Even a small difference in expense ratio can cost you a lot of money in the long run. According to Example 4, a 1% difference in expense ratio can cost you $13,598 over 20 years. This is why it's essential to prioritize investing in funds with competitive and stable expense ratios.

A good rule of thumb is to not invest in any fund with an expense ratio higher than 1%. This is because many ETFs have expense ratios that are much lower. For example, according to Example 6, a good ETF expense ratio is one that is below 1%.

Here are some key things to remember about expense ratios:

- The expense ratio is the cost you are paying to the AMC for the management of the fund.

- A lower expense ratio is always favorable.

- The expense ratio of regular plans is higher than direct plans.

- Actively managed funds have higher expense ratios than passively managed funds.

- A fund with a higher AUM is likely to have a lower expense ratio.

- Even a small difference in expense ratio can cost you a lot of money in the long run.

Index Fund vs. Fund:

Index funds generally have lower expense ratios than mutual funds. For example, index equity ETFs had an average expense ratio of 0.15% in 2023.

Passively managed index funds like ETFs tend to keep management fees low. This is because they track a specific market index, rather than trying to beat the market.

Many ETFs have expense ratios that are much lower than 1%, making them a good option for investors. In fact, you can often find ETFs with expense ratios as low as 0.05%.

Index funds are a good choice for investors who want to minimize their fees. They're also a great way to diversify your portfolio by investing in a variety of sectors and indexes.

Overall, index funds are a low-cost and efficient way to invest in the market.

You might enjoy: Low Expense Ratio Etfs

Frequently Asked Questions

Which ETF has the lowest expense ratio?

The iShares Core S&P 500 ETF (IVV) has the lowest expense ratio at 0.03%. This ultra-low cost ETF is a top choice for investors seeking to minimize fees.

Is the .35 expense ratio high?

An expense ratio of 0.35% is considered low, falling below the standard benchmark of 0.5% for actively managed portfolios. This low expense ratio can help investors save on costs and potentially increase their returns.

Sources

- https://www.investopedia.com/articles/personal-finance/092613/pay-attention-your-funds-expense-ratio.asp

- https://www.fool.com/terms/n/net-expense-ratio/

- https://www.omnicalculator.com/finance/expense-ratio

- https://www.etmoney.com/learn/mutual-funds/what-is-expense-ratios/

- https://www.fool.com/terms/e/etf-expense-ratio/

Featured Images: pexels.com