Homeowners who have polybutylene pipes installed in their homes may be eligible for insurance coverage to replace these pipes. Some insurance companies offer specialized coverage for polybutylene pipe replacement.

Many standard homeowners insurance policies may not cover polybutylene pipe damage, so it's essential to check your policy. Some insurance companies may offer additional riders or endorsements to cover this type of damage.

Some insurance companies that offer polybutylene pipe coverage include State Farm and Allstate. These companies may offer specialized coverage for pipe replacement and other related expenses.

Insurance Coverage for Polybutylene Pipe

Insurance companies have varying stances on polybutylene pipe coverage, with some policies explicitly excluding damage from these pipes due to their known issues.

If your home was built before 1978, it might be grandfathered into certain coverage allowances that newer homes don't have, but this doesn't guarantee coverage. If your home was built after 1978, damage caused by polybutylene pipes is likely excluded from standard home insurance policies.

Most policies will only cover the cost of replacing damaged pipes if the damage was caused by an event covered by the policy, such as a fire or severe weather. Insurance companies may also limit how much they'll pay out for repairs, so homeowners might still have to pay for some repairs themselves.

Here's a summary of insurance responses to different types of leaks:

It's essential to review your policy carefully and understand the specific terms and conditions regarding polybutylene pipe coverage. If you're unsure, contact your insurance company to ask about your coverage.

Does Insurance Cover Pipe Replacement Costs?

Insurance policies may not cover the cost of replacing polybutylene pipes, but it depends on the specific details of your policy and the age of your home.

If your house was built before 1978, it's considered "grandfathered" and may be covered for the cost of replacing polybutylene pipes, but only if your policy doesn't expressly exclude coverage for pre-existing conditions.

Standard policies typically exclude polybutylene due to the high risk of failure, which means you won't be covered for the cost of replacement.

Some insurers might offer special endorsements for homes with these pipes, but these usually come with higher deductibles and limited coverage amounts.

Conditional coverage might be possible following a thorough plumbing inspection, but there may be limitations on claims for water damage.

Most insurance companies added specific exclusions to their policies after 2012 to avoid paying for polybutylene pipe replacements, following a court ruling in a lawsuit between a homeowner and State Farm Insurance.

In fact, we don't believe there are any situations where a current homeowners insurance policy would pay for a full or even partial replacement of polybutylene pipes.

If you're a homeowner in Florida with polybutylene pipes, securing insurance coverage can be challenging, but some insurers may still provide coverage under specific conditions.

Here's a summary of your options:

- Standard Policies: Not covered for polybutylene pipe replacement

- Special Endorsements: May be available with higher deductibles and limited coverage amounts

- Conditional Coverage: Possible following a thorough plumbing inspection, but with limitations

Can Insure Home With?

You can still get homeowners insurance, even if you have polybutylene pipes. However, it's becoming increasingly difficult to insure against plumbing failures.

Most states will allow you to maintain coverage for losses from fire, theft, liability, etc. But, it's a different story when it comes to plumbing failures. In Florida, for example, Citizens Property Insurance Corporation won't insure any property with polybutylene plumbing.

The presence of polybutylene pipes is unlikely to prevent you from getting homeowners insurance in most states. You should be able to maintain coverage for losses from fire, theft, liability, etc.

However, it's essential to review your policy carefully to confirm that you don't have a blanket exclusion for polybutylene-related leak damage. If you are currently covered for sudden polybutylene leaks, be aware that this coverage may change upon renewal or when switching companies.

Here's a quick guide to help you determine if you have polybutylene pipes and what to do next:

- Check your pipes for the Quest, Qest, poly-b, pb-1 pipe, or just plain "poly pipe" label.

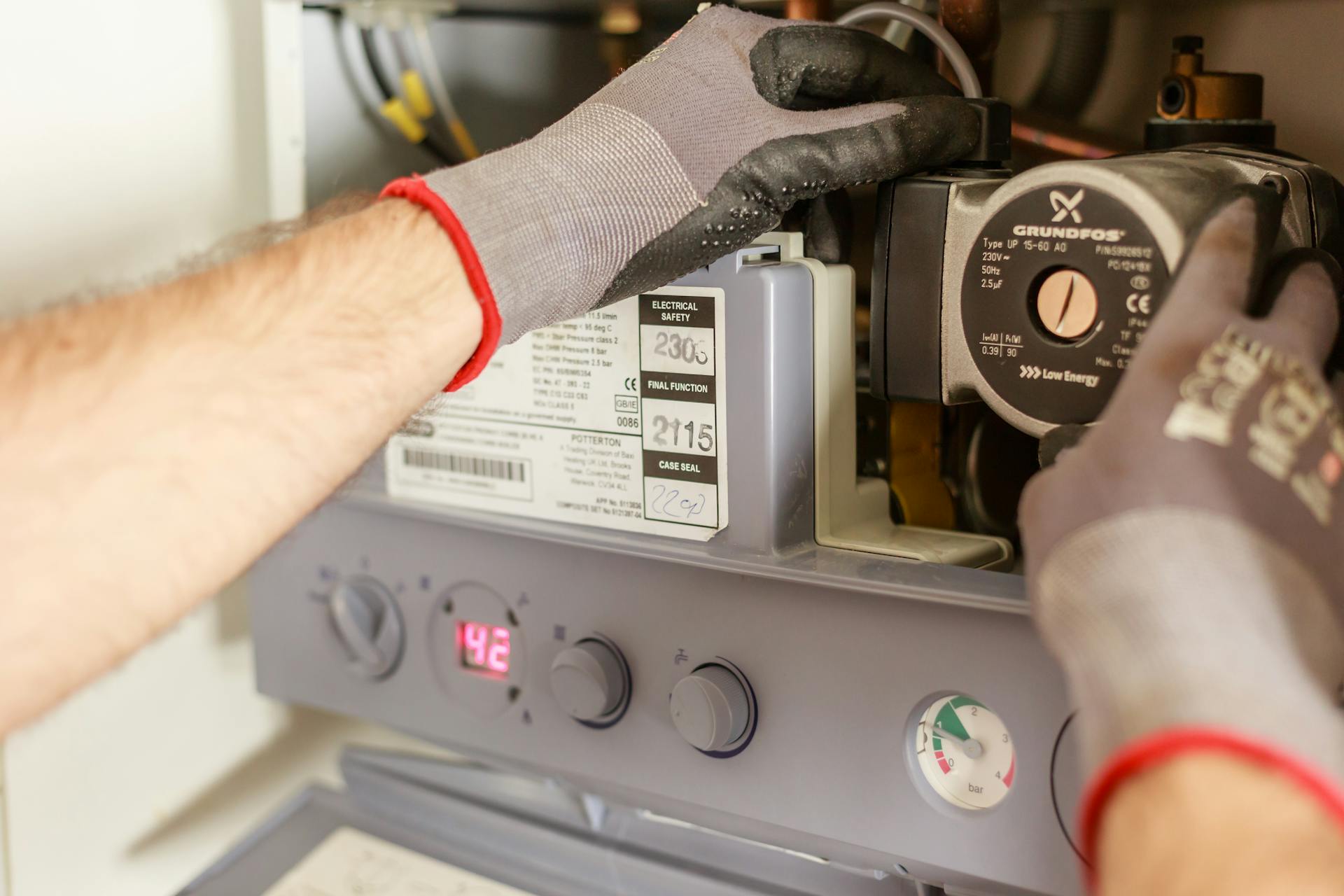

- Contact a professional plumber to assess your plumbing system.

- Review your policy and contact your insurance provider to discuss your options.

Understanding Policy Stance on Poly B Plumbing

Homeowners in Kelowna must carefully examine their insurance policies regarding poly B pipe.

Policy coverage for these systems varies significantly between insurers.

Understanding policy limits, exclusions, and maintenance requirements is crucial for protecting one's investment and ensuring successful claims in case of Poly B failures.

Homeowners should review their policy terms to see if they have specific coverage for polybutylene pipes.

The age of the home is also a factor, as homes built before a certain year (usually around 1978) might be "grandfathered" into certain coverage allowances.

Policy exclusions for damages caused by polybutylene pipes are common and are typically based on the high risk associated with these installations.

Some insurance policies may cover the cost of replacing polybutylene pipes, but this depends on the specific details of the policy.

If a homeowner's policy doesn't expressly exclude coverage for pre-existing conditions, then they may be covered for the cost of replacing their polybutylene pipes.

Homeowners should review their policy carefully to know what is and is not covered.

If homeowners are unsure whether or not their policy covers pipe replacement, they can always call their insurance company and ask.

Factors Influencing Insurance Coverage

- Policy Terms

- Age of the Home

- Event-Driven Damage

- Policy Exclusions

Coverage Limits and Exclusions

Insurance policies often have specific coverage limits for polybutylene pipes, which can leave homeowners responsible for significant out-of-pocket expenses. These limits determine the maximum amount an insurer will pay for repairs or replacements.

Homeowners should carefully review their policy to understand these limits, as they can vary significantly between insurers. Some policies may not cover the cost of replacing polybutylene pipes, especially if the house was built before a particular year (usually 1978).

Insurance policies also often contain specific exceptions and exclusions related to polybutylene plumbing systems. These may include denying coverage for gradual leaks, damage from improper installation, or issues arising from neglected maintenance of pressure regulators.

Here are some key things to look for in your policy:

- Review policy for specific Poly B exclusions

- Check for coverage limitations on gradual leaks

- Verify maintenance requirements for pressure regulators

- Look for terms related to polyethylene and polybutylene

- Understand inspection and documentation expectations

Plumbing System Coverage Limits

Insurance policies for plumbing systems often have specific coverage limits for poly b piping, which homeowners must review carefully to avoid out-of-pocket expenses.

These limits determine the maximum amount an insurer will pay for repairs or replacements, potentially leaving homeowners responsible for significant costs beyond just pipe replacements.

Homeowners should consider costs beyond pipes, such as drywall repairs and potential down payments, to ensure their coverage aligns with potential repair needs.

Carefully examining insurance policies regarding poly b pipe coverage is crucial for protecting one's investment and ensuring successful claims in case of Poly B failures.

Property owners must understand policy limits, exclusions, and maintenance requirements to make informed decisions about their coverage and take necessary precautions to maintain their plumbing systems effectively.

Exceptions and Exclusions

Exceptions and Exclusions are crucial to understand when it comes to insurance coverage for polybutylene pipes. Insurance policies often contain specific exceptions and exclusions related to polybutylene plumbing systems.

Some insurers may deny coverage for gradual leaks, damage from improper installation, or issues arising from neglected maintenance of pressure regulators. Homeowners should scrutinize their policies for terms like “polyethylene” or “polybutylene plumbing” to understand how their coverage applies.

Review your policy for specific Poly B exclusions, as many standard policies explicitly exclude damage from polybutylene pipes due to their known issues. Check for coverage limitations on gradual leaks, as most policies will only cover the cost of replacing damaged pipes if the damage was caused by an event covered by the policy.

Verify maintenance requirements for pressure regulators, as some insurers may require regular inspections or use of a client portal for documentation to maintain coverage eligibility. Look for terms related to polyethylene and polybutylene, as understanding these can help you navigate your policy.

Understanding inspection and documentation expectations is also essential, as some insurers may require this to maintain coverage eligibility. Homeowners should review their policies carefully to ensure they understand what is and is not covered.

Here are some key exclusions and limitations to watch out for:

- Gradual leaks

- Damage from improper installation

- Issues arising from neglected maintenance of pressure regulators

- Coverage limitations on gradual leaks

- Maintenance requirements for pressure regulators

- Terms related to polyethylene and polybutylene

- Inspection and documentation expectations

Filing a Claim

Filing a claim for polybutylene pipe failures requires a strategic approach to ensure fair compensation. Homeowners must meticulously document the damage from the initial discovery of a leak.

Engaging a professional plumber for assessment and repair quotes provides crucial information for the claim. This can include quotes for plumbing replacement and structural repairs.

Homeowners must compile comprehensive documentation, including evidence of regular maintenance on plumbing lines and any previous repiping efforts. This is essential to demonstrate how the plastic pipes' failure affected various aspects of the property.

The claims submission process demands meticulous attention to detail and a thorough understanding of insurance policies. Homeowners must clearly demonstrate how the polybutylene pipe failure affected the property, from the foundation to the roof.

The following claim components are crucial for a successful claim:

Effective communication with the insurance adjuster throughout the process can significantly impact the claim's outcome. Homeowners must be well-prepared and proactive to ensure fair compensation.

Specific Scenarios

In some cases, insurance companies may cover the cost of replacing polybutylene pipes if they are damaged due to a leak or rupture.

If you live in an area prone to freezing temperatures, your insurance may cover the cost of replacing your polybutylene pipes, especially if they are more than 20 years old.

However, if you're experiencing issues with your polybutylene pipes, it's essential to check your policy to see if it covers damage caused by corrosion.

In 1995, the U.S. Consumer Product Safety Commission banned the use of polybutylene pipes, and many insurance companies have since excluded them from coverage.

Some insurance companies may offer a separate policy or rider to cover the cost of replacing polybutylene pipes, especially if you're a homeowner with a large property.

Claims and Policy

Homeowners in Kelowna must carefully examine their insurance policies regarding polybutylene pipes, as coverage varies significantly between insurers.

Understanding policy limits, exclusions, and maintenance requirements is crucial for protecting one's investment and ensuring successful claims in case of Poly B failures.

Filing an insurance claim for Poly B plumbing failures requires a strategic approach to ensure fair compensation, starting with meticulous documentation of the damage.

Engaging a professional plumber from Urban Piping for assessment and repair quotes provides crucial information for the claim.

Insurance policies often include specific exclusions for damages caused by polybutylene pipes, typically based on the high risk associated with these installations.

Due to the likelihood of failure and extensive damage that can result, many insurers are hesitant to cover homes with polybutylene plumbing without significant limitations or exclusions.

Understanding the intricacies of the insurance policy and navigating the claims submission process are vital steps in protecting one’s real estate investment.

Insurance Companies and Coverage

Insurance companies have varying policies when it comes to covering polybutylene pipes. Some standard policies exclude polybutylene due to the high risk of failure.

If you have a home built before 1978, it might be "grandfathered" into certain coverage allowances that newer homes do not have, but this does not guarantee coverage.

Most policies will only cover the cost of replacing damaged pipes if the damage was caused by an event covered by the policy, such as a fire or severe weather.

You can always call your insurance company and ask if they cover polybutylene pipe replacement, but it's essential to read the policy carefully to know what is and is not covered.

Some insurers might offer endorsements for homes with polybutylene pipes, usually with higher deductibles and limited coverage amounts.

Here are some common types of coverage options for polybutylene pipes:

If you're in Florida, you might find it challenging to get insurance with polybutylene pipes, as some companies like Citizens Property Insurance Corporation refuse to insure homes with polybutylene plumbing.

It's essential to review your policy carefully and understand what is and isn't covered, as some insurers might cover your home for fire, theft, and liability but exclude water damage caused by polybutylene pipes.

Coverage Options and Inquiry

If you're wondering what insurance companies cover polybutylene pipe, the answer can vary significantly depending on your policy terms.

Insurance policies are not created equal, and coverage for polybutylene pipe replacement depends on the individual terms of your homeowner's policy. Some policies will cover the cost of replacing polybutylene pipes, while others will not.

Most standard policies explicitly exclude damage from polybutylene pipes due to their known issues, so you may need to purchase a separate rider or endorsement, which will come at an additional cost. This rider or endorsement can provide coverage for the cost of replacing polybutylene pipes.

If your home was built after 1978, any damage caused by polybutylene pipes is likely excluded from standard home insurance policies. This means you may need to purchase a separate rider or endorsement to cover this type of damage.

Homeowners may be able to purchase a separate rider or endorsement to cover damage from polybutylene pipes, but it will come at an additional cost. Some insurers might offer endorsements for homes with these pipes, usually with higher deductibles and limited coverage amounts.

Here are the key coverage options to consider:

- Standard Policies: Typically, standard policies exclude polybutylene due to the high risk of failure.

- Special Endorsements: Some insurers might offer endorsements for homes with these pipes, usually with higher deductibles and limited coverage amounts.

- Conditional Coverage: Coverage might be possible following a thorough plumbing inspection, with potential limitations on claims for water damage.

Insurance and Polybutylene Pipe

Insurance companies have a complex relationship with polybutylene pipes. Most insurance policies won't cover the cost of replacing polybutylene pipes, but it depends on the specific details of the policy and the age of the home.

In most states, you can still get homeowners insurance even if you have polybutylene pipes, but it may be harder to insure against plumbing failures. This is because polybutylene pipes have a high failure rate, which can lead to costly water damage.

Polybutylene pipes are notorious for their high failure rates, which can lead to severe water damage and costly insurance claims. This is a significant risk for both homeowners and insurance companies.

In some states, like Florida, insurance companies like Citizens Property Insurance Corporation won't insure homes with polybutylene plumbing. This means homeowners in these areas may have limited options for insurance coverage.

Homeowners must carefully examine their insurance policies to understand their stance on polybutylene pipes. This includes understanding policy limits, exclusions, and maintenance requirements to protect their investment and ensure successful claims in case of failures.

The age of the home can also impact insurance coverage for polybutylene pipes. If a house was built before a particular year, usually 1978, it's considered "grandfathered" and may be covered for the cost of replacing the pipes if the policy doesn't expressly exclude coverage for pre-existing conditions.

Frequently Asked Questions

How do I get free replacement of polybutylene pipes?

To qualify for free replacement of polybutylene pipes, you must have a past leak or a leak in the future that meets the program's requirements. Complete a Claim Eligibility Form to start the claim process.

Sources

- https://www.plumbingnerds.com/does-homeowners-insurance-cover-polybutylene-pipe-replacement/

- https://urbanpiping.com/blog/mastering-insurance-claims-for-poly-b-plumbing-failures/

- https://www.dupreeplumbing.com/blog/does-insurance-cover-polybutylene-pipe-replacement/

- https://www.oyerinsurance.com/what-home-insurance-companies-cover-polybutylene-in-florida/

- https://repipe.com/articles/can-i-insure-a-home-with-polybutylene-pipes.html

Featured Images: pexels.com