Vendor event insurance is a crucial aspect of hosting a successful event. It protects you from unexpected cancellations, damages, or other unforeseen circumstances that can impact your event's success.

Cancellations can be costly, with some events losing up to 70% of their revenue if they are forced to cancel due to unforeseen circumstances. This is why it's essential to have a solid insurance policy in place.

Having vendor event insurance can also help you recover from losses due to event cancellations or postponements. For example, if a key vendor cancels at the last minute, you can use insurance to cover the costs of finding a replacement.

Insurance can also help you recover from damages or losses caused by accidents or natural disasters.

What is Vendor Event Insurance?

Vendor event insurance is a type of short-term liability policy.

It's designed to protect your business in case something goes wrong during an event where you're participating or hosting. This could be a festival, a wedding, or any other type of gathering where you're selling food.

You'll need special event insurance if your regular policy doesn't have off-premises coverage, which is common for brick-and-mortar restaurants.

For example, if you're hosting an event at a venue, they may require you to have this type of insurance in place.

This is especially important if you're not familiar with the venue or its insurance requirements.

Special event insurance can provide peace of mind and financial protection in case of an accident or other unexpected event.

Readers also liked: K&k Special Event Insurance

Types of Vendor Event Insurance

Special event insurance is a type of short-term liability policy that you'll need for events where your food vendor business is participating or hosting one. The venue may require this insurance, and your regular policy may not cover off-premises events.

Your regular policy, especially if you're a brick-and-mortar restaurant, may not have off-premises coverage, making special event insurance a necessary addition. This type of insurance is specifically designed for short-term events, providing protection for your business in case of accidents or damages.

Readers also liked: Long Term Care vs Life Insurance

What it Covers and Doesn't

Vendor event insurance is designed to protect you from unexpected expenses and lawsuits. It's essential to understand what it covers and doesn't, so you can make informed decisions about your business.

Vendor insurance typically doesn't cover vendors who sell guns, alcoholic beverages, or participate in activities that are considered high-risk, such as fireworks or weight loss supplements. It's also unlikely to cover vendors who specialize in tattooing or face painting.

Some vendors may need specialty insurance to cover their unique business needs. For example, if you're a food vendor who transports your equipment or operates a food truck, you'll need commercial auto insurance.

Here's a breakdown of the types of coverage you can expect from vendor insurance:

Liquor liability insurance is a must for vendors who serve alcohol, as it covers all risks associated with alcohol consumption. This can include property damage or injuries caused by intoxicated patrons.

Coverage

Coverage is a crucial aspect of vendor insurance, and it's essential to understand what's included and what's not.

General liability insurance covers third-party claims for bodily injury, property damage, and advertising injury. This means if someone gets hurt while eating at your food cart, or if you accidentally damage a nearby property, this insurance will help cover the costs.

Commercial property insurance provides coverage for damage to business-owned assets, such as building, equipment, and inventory. If your food cart or equipment gets damaged, this insurance can help you repair or replace it.

Inland marine insurance covers tools and equipment that you take with you to different locations. This is especially important if you have a food truck or cart that you move around to different events.

Commercial auto insurance covers property damage and bodily injury for accidents that are considered to be your fault. If you're involved in an accident while transporting your equipment or food, this insurance will help cover the costs.

Workers' compensation insurance provides coverage for employees' medical bills and lost wages after a work-related illness or injury. If you have employees, this insurance is a must-have.

Here's a breakdown of the different types of coverage:

Auto Liability

Commercial auto insurance is a must for food trucks, food trailers, and businesses using a vehicle for business purposes, requiring liability insurance for property damage and bodily injury.

You'll likely need more coverage than what's offered by some providers, like FLIP, which may only offer an endorsement to extend general liability to the trailer.

You'll want to look into collision and comprehensive first-party coverages, especially if your vehicle has a high value or if you have a loan.

Some personal auto policies may have a liability exclusion if the vehicle is primarily used for business purposes, like hauling a food cart around.

In that case, an endorsement on general liability, as well as hired and non-owned autos, is a good idea to extend your general liability coverage to the vehicle being driven.

See what others are reading: Insurance for a Business

What Doesn't Typically Cover

Vendor insurance typically has its limitations, and it's essential to know what's not covered. Very few insurance companies are willing to cover bartenders who serve alcoholic beverages, for instance. This is a common issue for vendors who specialize in something that's generally considered high-risk.

If you're planning on participating as a vendor in a larger event, such as a weapons trade show to sell guns, you'll be hard pressed to find a vendor insurance policy. It's crucial to research and understand what's not covered before signing up for an event.

Finding vendor insurance for certain types of businesses can be challenging. For example, fireworks businesses, tattoo businesses, and weight loss supplement businesses may have a hard time finding coverage. Some insurance companies even hesitate to provide vendor insurance to face painters.

Here are some examples of vendors who may struggle to find insurance coverage:

- Bartenders serving alcoholic beverages

- Vendors selling guns at weapons trade shows

- Fireworks businesses

- Tattoo businesses

- Weight loss supplement businesses

- Face painters

Liquor

Liquor liability insurance is a must for vendors selling alcohol, covering legal fees, property damage, and medical costs if alcohol is sold to a visibly intoxicated person who damages property or injures people.

If you serve alcohol at your food stand or truck, Liquor Liability Insurance is a must. This covers all risks specifically associated with alcohol consumption, such as property damage or injuries caused by intoxicated patrons.

Some providers will make liquor liability coverage available as an endorsement with general liability insurance, so be sure to check your policy.

General liability insurance has exclusions for losses related to alcohol, so liquor liability insurance is a specialized type of liability insurance that's necessary for vendors selling alcohol.

Discover more: Event Insurance with Liquor Liability

Why Bother with One-Day?

Many event managers require all participating vendors to have vendor insurance, but they don't pay for it themselves, so it's up to you to cover the cost.

Purchasing a one-day vendor insurance policy might seem like an unnecessary expense, especially if you're only working the event for a single day. However, it's a crucial investment for most vendors.

You might be thinking, "Why bother with the hassle of purchasing a vendor insurance policy?" But the truth is, many venues require vendors to carry liability insurance in order to participate.

Even if a venue doesn't have vendor insurance requirements, it can be a smart investment for your business. Selecting the vendor add-on for your General Liability insurance policy ensures that your coverage better matches your needs.

A standard General Liability insurance policy may not match the exact risks that come with participating as a vendor in an event. You need a policy that specifically addresses vendor-specific claims and injuries.

In addition to liability coverage, you may also need business property insurance to protect your equipment and inventory.

Additional reading: When a Business Pays for Insurance Prepaid Insurance Is

Who Needs Vendor Event Insurance?

If you deal with the public, you're at risk of a liability lawsuit. Anyone can sue over a bodily injury, damaged personal property, or other reasons.

Many venues require vendors to carry liability insurance to cater, sell, or display their goods. This includes trade shows, farmers' markets, art fairs, ballparks, and universities.

Some businesses that need vendor insurance include food trucks, bakeries, ice cream shops, caterers, artisans, and exhibitors at conferences and special events. Even if you're only working an event for a single day, it's a good idea to purchase a vendor insurance policy.

Here are some specific businesses that need vendor insurance:

- Food trucks

- Bakeries

- Ice cream shops

- Caterers

- Artisans

- Exhibitors at conferences and special events

- Farmers' market vendors

- Concessionaires

- Personal and private chefs

- Restaurants at an event

- Cottage bakery

Why Do They Need?

Many venues require vendors to carry liability insurance to cater, sell, or display their goods. This is a common practice, and most trade shows, farmers' markets, art fairs, ballparks, and universities have the same requirement.

Event managers often request a Certificate of Insurance from vendors as proof that they'll have a vendor insurance policy for the event. This ensures that vendors have the necessary coverage.

Liability insurance provides coverage for vendor-specific claims and injuries, which a standard General Liability insurance policy may not match. This is why selecting the vendor add-on for your General Liability insurance policy via Thimble is essential.

Some venues also require vendors to carry workers' comp and commercial auto insurance, which is mandated by state laws. This adds an extra layer of protection for vendors and their business.

Who Needs?

If you deal with the public, you're at risk of a liability lawsuit. Someone could sue over a bodily injury, damaged personal property, or any number of reasons.

Artisans and other vendors who sell homemade crafts, candles, jewelry, or any other goods face a lawsuit risk. A table or booth could collapse, injuring a customer.

Food vendors, including food trucks, bakeries, ice cream shops, and caterers, face a great deal of liability risk. A customer could trip over your display or your cooking equipment could catch fire.

Exhibitors at a conference, tradeshow, or other special events also face risks of third-party injuries or property damage. Fortunately, there are a variety of vendor insurance options available.

You'll need food vendor insurance if you sell food in nontraditional locations, such as concession stands, street fairs, public sidewalks, and outdoor venues. This includes food trucks, food trailers, food carts, caterers, and concessionaires.

Here are some typical small businesses that need food vendor liability insurance:

- Food trucks

- Food trailers

- Food carts

- Caterers

- Concessionaires

- Personal and private chefs

- Restaurants at an event

- Cottage bakery

- Farmers’ market vendors

Even if you're not required to have food vendor insurance, it's a good idea to have it for your business. Many events require food vendors to have insurance, so be sure to check the venue's requirements.

Costs and Coverage

Vendor event insurance costs can vary depending on several factors, including the type and scope of your operations. Annual premiums for food vendor insurance can range from $350 to $1,000, with a median annual premium around $725 for a bundled business owner's policy.

Factors that affect your premium include the level of business risk, types of coverage, coverage limits, your business operations, and location. For example, if you have a food truck with installed equipment worth over $30,000, you'll likely pay more than one with lower-valued equipment.

To give you a better idea, here's a breakdown of estimated monthly costs for general liability, workers' comp, and business owner's policy:

Keep in mind that these are just estimates, and your actual costs may vary depending on your specific business needs and circumstances.

Costs

The cost of food vendor insurance can vary widely depending on several factors. Annual premiums can range from $350 to $1,000, with a median annual premium around $725 for a bundled business owner's policy.

Insurance companies consider a variety of factors when determining premiums, including claims history, operations, location, employees, and equipment value. The level of risk, types of coverage, coverage limits, business operations, and location also influence the cost of food vendor insurance.

For small businesses, insurance can be relatively affordable. For example, food vendors pay an average price of $31 per month for general liability, $101 per month for workers' comp, and $60 per month for a business owner's policy.

Here's a breakdown of some common insurance policies and their estimated annual premiums:

The value of your equipment, policy limits, exclusions, and deductibles can also impact your premium.

Restaurant Quote Form

As a business owner, you know how much hard work and dedication goes into making your restaurant successful. Whether you're a food truck, bakery, or coffee shop, you need a Food Vendor Insurance Policy that covers you from all the unique risks that can affect your business.

Your restaurant's unique risks can put all your hard work in jeopardy, but a Food Vendor Insurance Policy can protect you. This type of policy is specifically designed to cover the unique risks of a food vendor business.

You can get a Food Vendor Insurance Policy that suits your business needs by letting experienced insurance agents take a look at your food vendor business. They can find you a policy that protects you from all the potential day-to-day business risks.

Here's an interesting read: Bike Track Day Insurance

Frequently Asked Questions

How much does insurance cost for a one day event?

Event insurance for a one-day event typically costs between $75 and $235, depending on coverage options and limits. The cost can be lower if you exclude liquor liability or opt for cancellation insurance.

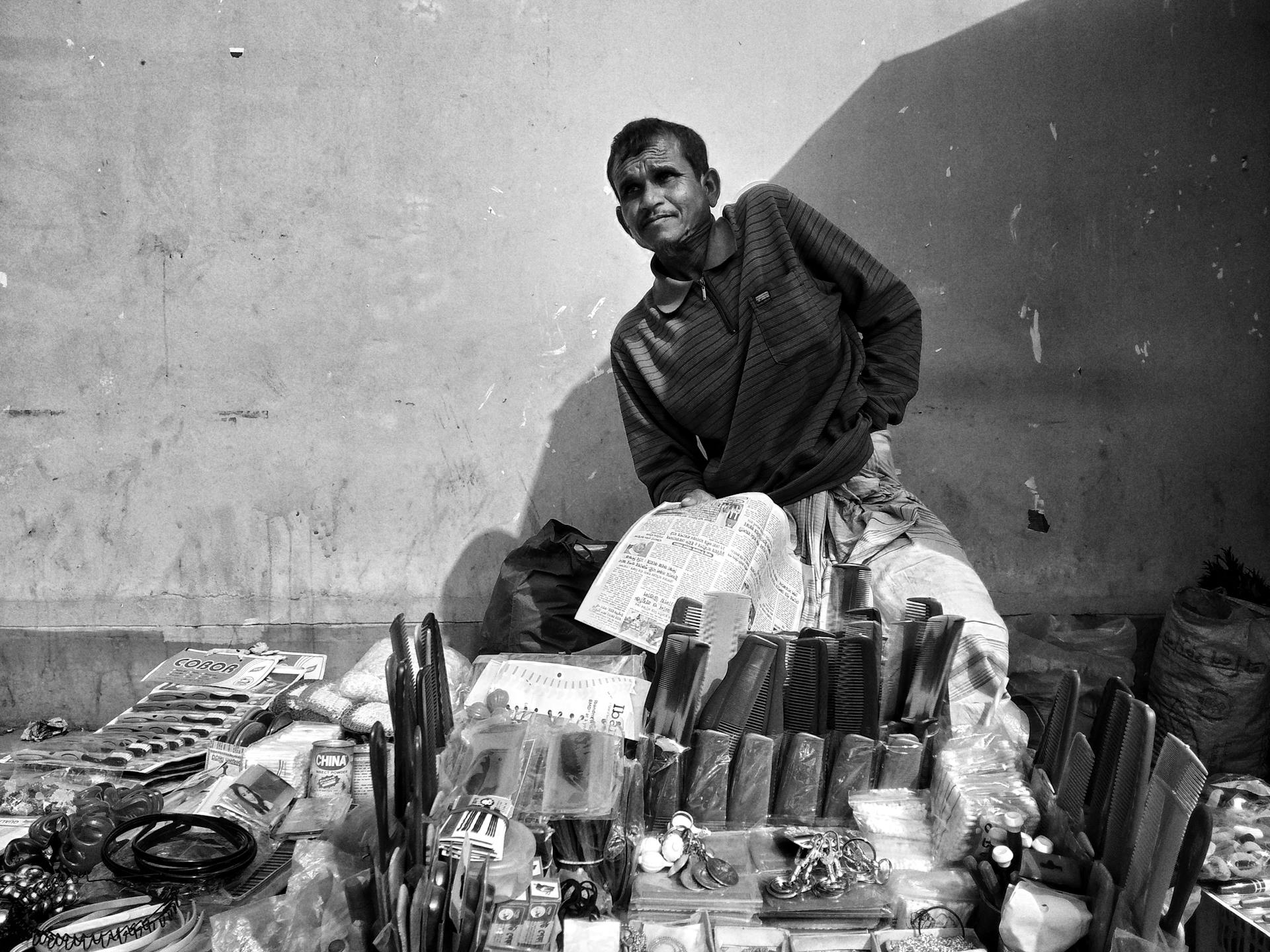

Featured Images: pexels.com