The Vaneck Semiconductor ETF has a rich history of performance, with a long-term track record that's worth exploring. It was launched in 2000.

The ETF has a net asset value (NAV) of $10.50 per share, which is the value of the underlying assets minus liabilities. This value can fluctuate over time.

As of the last update, the NAV has a 1-year return of 50.6% and a 3-year annualized return of 17.1%. These returns are based on the ETF's historical prices.

Historical prices for the Vaneck Semiconductor ETF show significant growth over the years, with a high of $143.91 in 2021 and a low of $10.50 in 2000.

Additional reading: Value vs Growth Etfs

Composition - USD

The VanEck Semiconductor ETF is a diversified portfolio of semiconductor stocks, and its composition is a key factor in its performance. The ETF holds a mix of large-cap and mid-cap stocks, with a focus on companies that are leaders in the semiconductor industry.

A unique perspective: Russell Small Cap Completeness Index Etf

One of the top holdings in the ETF is NXP Semiconductors, with a price of $213.56 USD and a 5-day change of +2.75%. This suggests that the company has been performing well in the short term.

SKYWORKS Solutions is another significant holding, with a price of $92.28 USD and a 5-day change of +0.78%. This indicates that the company has been relatively stable in the short term.

The ETF also holds a variety of other semiconductor stocks, each with its own unique characteristics and performance metrics. For example, MARVELL Technology Group has a price of $116.00 USD and a 5-day change of +0.69%, while UNIVERSAL Display Corporation has a price of $146.56 USD and a 5-day change of +0.41%.

Here's a summary of the top holdings in the VanEck Semiconductor ETF:

The ETF's composition is a key factor in its performance, and understanding the individual holdings can help investors make informed decisions about their investments.

Historical Prices

The Vaneck Semiconductor ETF has a rich history of performance. The fund was launched in 2005 and has been tracking the performance of the PHLX Semiconductor Index since then.

In its early years, the ETF saw significant growth, with a price of around $25 in 2006. This was a great time to invest in the semiconductor sector, with the index growing by over 20% that year.

The ETF's performance was largely driven by the increasing demand for semiconductors in the tech industry. As the use of smartphones and other electronic devices became more widespread, the demand for semiconductors skyrocketed.

In 2009, the ETF hit a low of around $10, but it quickly recovered as the semiconductor industry began to bounce back from the financial crisis. By 2010, the price had risen to over $30.

The ETF's price continued to fluctuate over the years, but it has generally trended upwards. In 2017, the price reached an all-time high of over $120.

Consider reading: Etfs at 52 Week Lows

Frequently Asked Questions

Is VanEck Semiconductor ETF good?

VanEck Semiconductor ETF (SMH) is a strong investment option with a Zacks ETF Rank of 1 (Strong Buy). It's a top choice for those seeking exposure to the Technology ETFs segment of the market.

What is the top semiconductor ETF?

The top semiconductor ETFs are highly liquid and widely traded, but the iShares Semiconductor ETF (SOXX) and VanEck Semiconductor ETF (SMH) are often considered among the most popular and reliable options. These two ETFs offer broad exposure to the semiconductor industry, making them a great starting point for investors.

What is the symbol for VanEck Semiconductor ETF?

The symbol for the VanEck Semiconductor ETF is SMH. This ETF tracks the performance of the Semiconductor Index, providing investors with exposure to the semiconductor industry.

Which companies are in the VanEck Semiconductor ETF?

The VanEck Semiconductor ETF holds a portfolio of leading companies in the semiconductor industry, including NVIDIA Corporation, Taiwan Semiconductor Manufacturing Company Limited, and others. These companies account for a significant portion of the ETF's holdings, providing exposure to the sector's growth and trends.

How to invest in VanEck Semiconductor ETF?

To invest in VanEck Semiconductor ETF, open a brokerage account, research the fund, and place an order based on your investment goals and risk tolerance. Start by understanding the potential risks and regularly monitoring your investment.

Sources

- https://www.kavout.com/etfs/smh/vaneck-semiconductor-etf

- https://www.moomoo.com/stock/SMH-US

- https://www.marketscreener.com/quote/etf/VANECK-SEMICONDUCTOR-ETF--29426371/

- https://markets.businessinsider.com/etfs/vaneck-semiconductor-etf-us92189f6768

- https://stocklight.com/stocks/us/nasdaq-smh/vaneck-semiconductor-etf

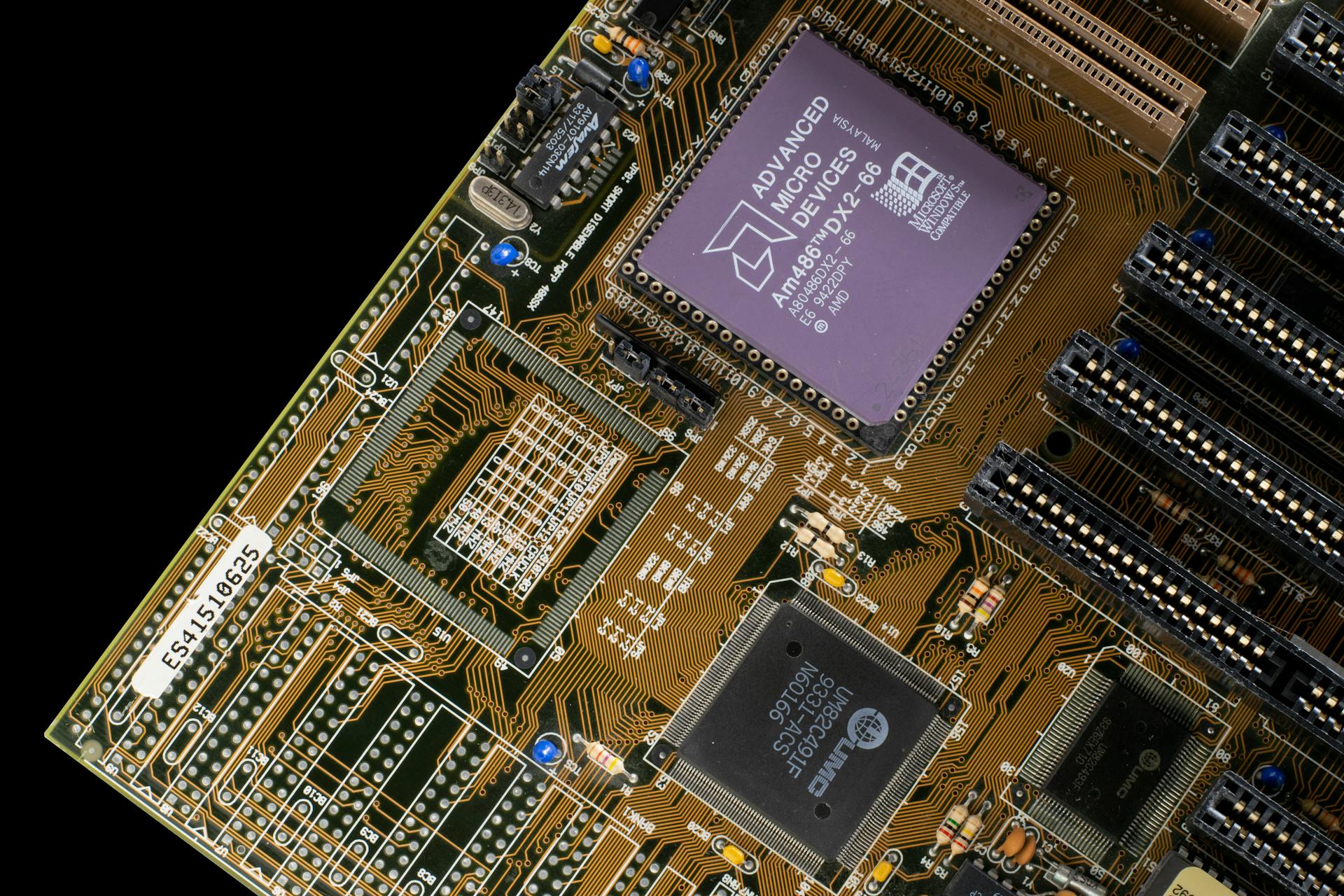

Featured Images: pexels.com