Turtle Beach Corporation is a leading gaming accessory brand, known for its high-quality headsets and audio equipment.

As of the latest financial report, Turtle Beach's revenue has consistently increased over the past few years, reaching $1.43 billion in 2020.

Investors are drawn to Turtle Beach's strong brand recognition and market share in the gaming industry.

With a market capitalization of over $2 billion, Turtle Beach is a significant player in the gaming accessories market.

The company's financial performance has been impressive, with a net income of $69.6 million in 2020.

Investors should consider the company's growth prospects, product pipeline, and competitive landscape when evaluating its stock.

You might enjoy: Allied Gaming Stock Quote

Financial Analysis

Turtle Beach's revenue in 2023 was $258.12 million, a 7.48% increase from the previous year.

The company's financial performance shows a significant improvement in revenue, but it still reported losses of -$17.68 million in 2023.

Turtle Beach's gross profit was $106.8 million in 2023, which is the result of subtracting the cost of revenue from the total revenue.

The cost of revenue was -$219.4 million, which is a significant expense for the company.

Here's a breakdown of Turtle Beach's earnings waterfall for 2023:

Turtle Beach's net income was $4.6 million in 2023, which is a significant improvement from the previous year's net loss.

Company Overview

Turtle Beach Corporation is a leading gaming accessory maker that operates in various regions including North America, Europe, the Middle East, and the Asia Pacific.

The company develops and markets gaming headset solutions for multiple platforms such as video game and entertainment consoles, handheld consoles, personal computers, tablets, and mobile devices under the Turtle Beach brand.

Turtle Beach offers gaming headsets, keyboards, mice, and other accessories for the personal computer peripherals market under the ROCCAT brand.

The company's financial history has been turbulent, but the PDP acquisition has repositioned it into clearly higher margins and better scale at a cheap acquisition multiple.

Turtle Beach Corporation is listed on the Nasdaq stock exchange under the ticker symbol HEAR.

Investor Information

As an investor, it's essential to understand the performance of Turtle Beach Corporation (TBCH) compared to the broader market and its industry peers. TBCH has exceeded the US Tech industry's return of 22% over the past year.

One key metric to consider is the 7-day return, which shows TBCH's performance over a shorter period. In the past 7 days, TBCH's return was -5.3%, significantly lower than the US Tech industry's 3.0% return.

Here's a summary of TBCH's performance compared to the US Tech industry and the overall US Market:

TBCH has also outperformed the US Market, which returned 22.7% over the past year. This suggests that TBCH's stock has been a strong performer in the gaming and audio equipment sector.

Risk and Valuation

Turtle Beach Corp's stock is trading at its lowest valuation over the past 5 years, which could be a sign of undervaluation.

TBCH's price volatility is relatively stable compared to the US market, with an average weekly movement of 6.6%, lower than the market average of 6.5%.

However, it's worth noting that TBCH's weekly volatility has been stable over the past year, at 7%. This suggests that the company's stock price has been relatively consistent in recent times.

Here's a comparison of TBCH's volatility with the industry and market averages:

Wall Street analysts are optimistic about Turtle Beach Corp's future performance, with an average 1-year price target of 23.29 USD, ranging from a low of 20.2 USD to a high of 27.3 USD.

Price Volatility

TBCH's price volatility is a crucial aspect to consider when evaluating its risk and valuation. The company's average weekly movement is 6.6%, which is lower than the market average of 6.5%.

The tech industry average movement is 9.4%, indicating that TBCH is less volatile compared to its peers. This is a positive sign for investors looking for stability.

TBCH's weekly volatility has been stable over the past year, with a consistent movement of 7%. This suggests that the company's price is not subject to sudden and drastic changes.

To put TBCH's volatility into perspective, here's a comparison with other stocks in the US market:

TBCH has not had significant price volatility in the past 3 months compared to the US market, which is a positive sign for investors.

Valuation History

Turtle Beach Corp's stock is trading at its lowest valuation over the past 5 years.

This is a significant fact to consider when evaluating the company's stock. It's essential to understand the historical context of the stock's valuation.

The current share price is US$17.74, which is lower than its 52 Week High of US$19.31.

The stock has experienced a 55.48% change over the past year, which is a substantial increase.

However, over the past 5 years, the stock has shown a 126.85% change, indicating a significant growth.

Here's a summary of the stock's performance over the past few years:

This data provides a clear picture of the stock's performance over different time frames. It's crucial to consider these historical changes when evaluating the stock's current valuation.

Frequently Asked Questions

What is the PE ratio of Turtle Beach?

As of December 2024, Turtle Beach's current price-to-earnings (P/E) ratio is -4.61, indicating a significant decline from its P/E ratio of -1.99 at the end of 2022.

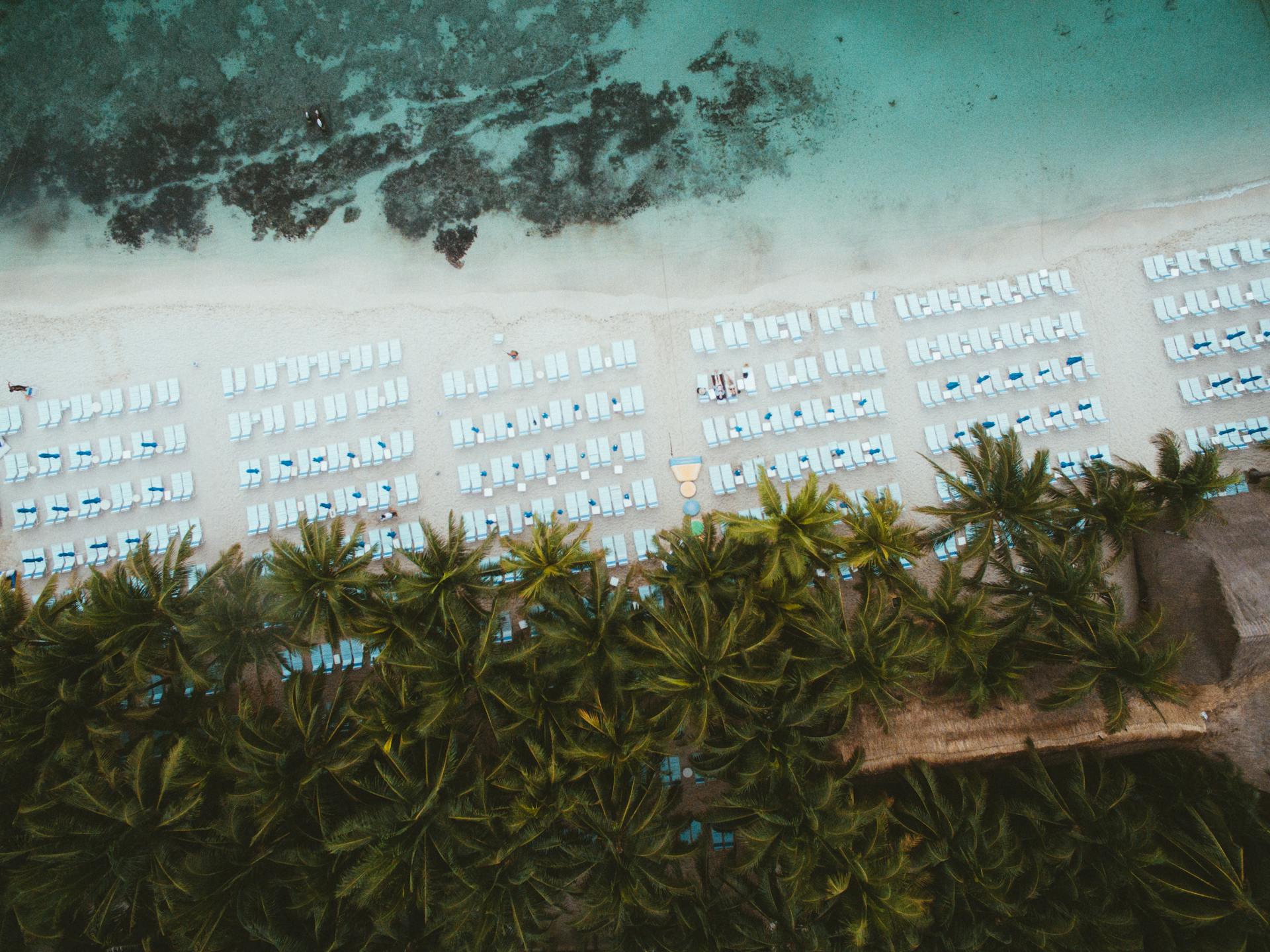

Featured Images: pexels.com