JDSU, formerly known as JDS Uniphase, is a company with a rich history. It was founded in 1981 by a group of entrepreneurs who saw an opportunity to provide high-performance optical components to the burgeoning telecommunications industry.

The company's name was changed to JDSU in 2001, after it merged with Uniphase. JDSU was a leading provider of optical components and subsystems for the telecommunications industry.

JDSU's products included optical amplifiers, filters, and switches, which were used in a wide range of applications, from fiber optic cables to satellite communications.

Check this out: Stock Symbol B

Financial Information

JDSU's net revenue for the quarter was $410.7 million, which is a significant decrease from the prior quarter's $437.1 million.

The company reported a net loss of $13.2 million, or $0.06 per share, which is an improvement from the prior quarter's net loss of $25.1 million, or $0.11 per share.

JDSU's non-GAAP net revenue was also $410.7 million, with a net income of $27.6 million, or $0.12 per share. This is a notable increase from the prior quarter's non-GAAP net income of $35.4 million, or $0.15 per share.

The company's operating margin and EPS were better than expected, despite muted carrier spending that impacted their Network and Service Enablement businesses.

Company Details

JDSU, now known as Viavi Solutions, is a leading provider of network test and measurement solutions. They offer a wide range of products and services to help companies ensure the quality and performance of their networks.

Their products are used in various industries, including telecommunications, aerospace, and defense. This is due to their ability to provide accurate and reliable measurements of network performance.

JDSU has a long history of innovation, with over 50 years of experience in the industry. Their commitment to research and development has led to the creation of many groundbreaking products.

Expand your knowledge: Zepp Solutions Stock Ticker Symbol

JDS Uniphase Corporation

JDS Uniphase Corporation was a leading telecommunications equipment manufacturer.

The company was formed in 1990 through the merger of JDS Fitel and Uniphase Corporation.

JDS Uniphase was known for its expertise in fiber optic components and optical communication systems.

Its products were used by major telecom companies around the world.

The company's headquarters was located in San Jose, California.

JDS Uniphase was a major player in the telecommunications industry until its bankruptcy in 2001.

JDS Uniphase N.V

JDS Uniphase N.V has a market capitalization of 2.67B, which is a significant figure in the stock market.

The company's enterprise value is 2.61B, indicating its total value including debt. This is a crucial metric for investors to consider when evaluating the company's financial health.

JDS Uniphase N.V has a price-to-earnings (P/E) ratio of 16.75, which is relatively high compared to other companies in the same industry.

The PEG ratio, which takes into account the company's growth rate, is 1.54, indicating that the stock may be overvalued.

Here are some key statistics about JDS Uniphase N.V's stock performance:

The company's annual earnings growth rate over the past five years is 3.78%, which is below the target growth rate of 12%.

Intriguing read: Apple Growth Stock

Share Price and Targets

The share price of JDSU has been fluctuating, with possible weekly targets ranging from $2.52B to $3.59B.

The company's valuation is also worth noting, with a capitalization of $2.52B to $3.59B.

P/E ratio is another important metric, with JDSU's 2025 P/E ratio at 56.5x and 2026 P/E ratio at 31.1x.

The enterprise value of JDSU is significant, ranging from $2.73B to $409B.

EV/Sales is another key indicator, with JDSU's 2025 EV/Sales at 2.52x and 2026 EV/Sales at 2.17x.

JDSU's P/E ratio is below the industry average of 19.63 and the S&P 500 average of 17.50.

Trade and Analysis

We publish public articles on most stocks, including JDSU, once every 10 days. Our articles include rules-based trading plans for JDSU.

You can do a backtest by opening a past article, reviewing the trading plans, and then opening a graph of JDSU to see how the plans would have done.

Introduces Carrier Ethernet Test Applications

JDSU has introduced a suite of test applications that simplify the complexity of carrier Ethernet testing. This suite is called J-Complete.

The company has also been selected by a major mobile service provider for a backhaul test solution. This shows that JDSU's solutions are reliable and effective in the industry.

JDSU's test applications are designed to help carriers develop robust and reliable networks. This is crucial for delivering high-quality services to customers.

In response to the rising need for cost-effective tools, JDSU has developed innovative solutions. These solutions are designed to meet the evolving needs of the industry.

JDSU's J-Complete suite is a game-changer for carrier Ethernet testing. It simplifies the testing process and provides accurate results.

Acquire Agilent's Network Solutions Test Business

JDSU has made a significant move in the technology industry by acquiring Agilent's Network Solutions Test Business. This acquisition targets the emerging LTE/4G wireless market.

The deal was announced on February 11th, and it's a strategic move to strengthen JDSU's position in the market.

JDSU aims to tap into the growing demand for wireless communication services with this acquisition.

For your interest: Frost Bank Stock Market Symbol

Trade Rationale:

When analyzing a company's performance, it's essential to consider its earnings estimates. JDS Uniphase Corporation (JDSU) has beaten two out of the last five analyst's earnings estimates.

Quarterly losses and poor performance are significant red flags. The company's annual earnings growth is also deteriorating.

Our overall score for JDSU is 4.45, indicating a cautious approach. This score is based on the company's pattern of bearish technical signs.

Competitor Comparison

In the world of finance, understanding the competitive landscape is crucial for making informed investment decisions. Let's take a look at the market cap of the companies listed: JDSU has a market cap of $2.67B, while AVGO boasts a significantly larger market cap of $35.75B.

AVGO's market cap is nearly 13 times larger than JDSU's, giving it a significant advantage in terms of financial resources. FNSR has a market cap of $1.87B, which is roughly 70% of JDSU's market cap.

Here's a snapshot of the companies' market caps, employees, and revenue growth:

The table shows that AVGO has the largest market cap, while JDSU has the smallest number of employees. FNSR has the largest number of employees, but its revenue growth is relatively low at 0.05.

Backtesting

Backtesting is a crucial part of any trading strategy. We publish public articles on most stocks once every 10-days, which can be used for evaluation.

You can test our pivot points and trading plans by applying simple rules of technical analysis to past articles. Our data is updated in real time for Members, but public data can still be used for backtesting.

For example, take a look at our past article on JDSU and review the trading plans. Then, open a graph of JDSU to see how the plans would have done.

Our pivot points for JDSU have proven to be accurate in the past. By following simple rules like buying near support and targeting resistance, you can see the potential of our trading plans.

To backtest, simply open a past article, review the trading plans, and then open a graph of the stock. This will give you a clear idea of how our plans would have performed in the past.

Frequently Asked Questions

What happened to JDSU stock?

JDSU stock is now known as Viavi stock after the company's name change. The spinoff led to a significant increase in value, with Lumentum stock more than doubling in value since the separation.

What stock is JDSU?

JDSU is now known as Viavi Solutions Inc, a leading provider of network and service enablement solutions. The company's stock is listed under the ticker symbol VIAV.

What is the new name for JDSU?

JDSU will be renamed VIAVI Solutions Inc. This change reflects a significant shift in the company's identity.

Sources

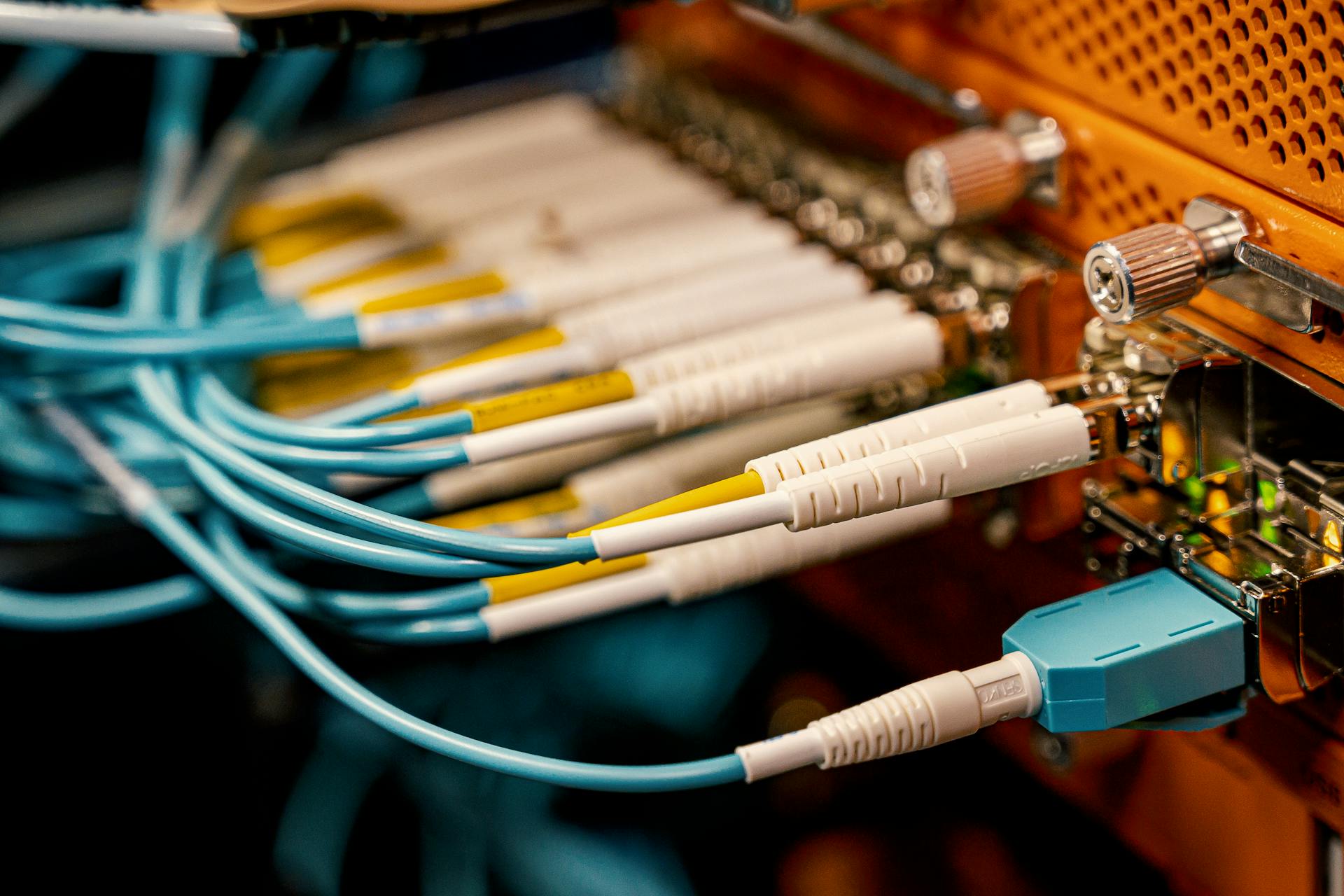

Featured Images: pexels.com