Software investment bankers are revolutionizing the way deal work is done. They're using technology to streamline processes and increase efficiency.

With the help of software tools, they can now analyze data and identify potential deal opportunities in a fraction of the time it would take manually. This allows them to focus on higher-level tasks and add more value to clients.

One software investment banker was able to automate 70% of their due diligence process, freeing up time to focus on more complex and high-value tasks.

Services and Expertise

DueDash supports investment bankers with tools and expertise to optimize deal outreach, research, and investor engagement. This includes detailed profiling, segmenting, and targeting to connect with investors.

Our team combines industry expertise with best-in-class process execution, making us a unique resource for software investment bankers. We've spent years in the industry, developing insight, fluency, and relationships within our subsectors of focused coverage.

We have a team of senior and junior bankers with depth of experience, rooted in thorough preparation, financial analysis, positioning, and process intelligence. This allows us to bring a relevant and expert perspective to our clients.

Analysts and Associates Roles

In technology investment banking, analysts and associates will spend most of their time working on pitch books, deals, and random tasks.

Your day-to-day activities will be heavily influenced by the type of companies you work with and the specific sector you're in.

If you're at a boutique bank, you can expect to work on many private placements for early-stage software and internet companies, which may involve little modeling or valuation work.

You'll learn about the market, but the skills you gain may not be very useful for most exit opportunities.

Working in the TMT group of a bulge bracket bank will give you the chance to work on M&A deals and leveraged buyouts involving mature companies, with occasional debt or convertible bond issuance.

These deals can be interesting at first, but running 253 slightly different merger models can get repetitive and tiresome.

The IT services, semiconductors, and hardware sectors tend to be more mature, so you'll focus on concepts like profitability, cash flows, and the breakeven formula.

Working in internet and software, on the other hand, will expose you to a wide range of companies, from mature and profitable firms to early-stage companies that are bleeding money.

Team with Expertise and Class Process

We're lucky to have a team that combines industry expertise with best-in-class process execution. They're among the largest teams of software-focused investment bankers and advisors in the world.

Their senior team has a wealth of experience, having been through the technology bull market of the 1990s, the market maturation and resets of the 2000s, and the significant expansion of the private equity capital markets. This experience has given them a unique perspective on the industry.

We take pride in recruiting the highest caliber talent from leading colleges, and our junior team members are smart and driven leaders who are respected and trusted throughout the industry. They're the future of our organization and are already making a name for themselves in the industry.

Our team's process execution is rooted in thorough preparation, financial analysis, positioning, and process intelligence, which requires a full team of senior and junior bankers with depth of experience. This approach has allowed us to achieve great results for our clients.

We're proud of our alumni network, which is spreading throughout private equity, venture capital, and corporate development and strategy teams of the software ecosystem. This speaks to the quality of our team and the opportunities we're creating for our junior members.

League Tables: Top Banks

The top banks in technology investment banking are a diverse group, but some stand out from the rest. Goldman Sachs and Morgan Stanley are often considered the best in the business.

These two banks have strong tech teams, but they're not the only ones advising on tech mega-deals. JPM, BAML, Citi, and many others also place well in the league tables.

Among the middle market banks, Harris Williams, William Blair, Jefferies, and Raymond James are known for their strength in tech. They're not as big as the bulge brackets, but they have a strong presence in the industry.

The elite boutiques also do well in tech, with Qatalyst leading the pack since it specializes in the industry. Evercore, Lazard, Guggenheim, Centerview, and Moelis also pop up on many deals.

There are dozens, if not hundreds, of boutique banks in the space, making it a crowded market. Names like Union Square Advisors, GCA, CODE Advisors, and Raine Group are also worth mentioning.

Software

Software investment bankers often specialize in the technology sector, which is expected to grow to $5 trillion by 2025, up from $3.5 trillion in 2020.

They work with companies to raise capital for software development, mergers and acquisitions, and other tech-related transactions.

Software investment bankers may also advise on the sale of software companies, with the average sale price of a software company being around $1 billion.

These bankers often have a strong technical background, with many having a degree in computer science or a related field.

They use their technical expertise to understand the software industry and identify opportunities for growth and investment.

In addition to their technical knowledge, software investment bankers must also have strong analytical and communication skills.

They use data and financial models to analyze the potential of a software company and present their findings to clients.

Software investment bankers often work long hours, but their compensation is typically high, with salaries ranging from $100,000 to over $200,000 per year.

Their work can be challenging, but it's also highly rewarding for those who are passionate about technology and finance.

Deal Workflows and Execution

With the right software, you can gain visibility into deal workflows by accessing real-time insights into buyer and seller interactions through a centralized dashboard.

This allows for seamless management of key documents and communications, consolidating deal tracking into one place. You can keep track of everything in one spot, making it easier to stay on top of your deals.

By streamlining execution, you can create professional deal presentations and target them to the right investors. This helps maintain momentum and enables faster and more effective deal closures.

Gain Visibility into Deal Workflows

Having a clear view of your deal workflows is crucial for success.

Access to real-time insights can help you stay on top of buyer and seller interactions. This allows you to make informed decisions and adjust your approach as needed.

A centralized dashboard can consolidate deal tracking and ensure seamless management of key documents and communications. This streamlines the process and reduces the risk of errors or missed steps.

Enhance ROI with Streamlined Execution

Creating professional deal presentations is a crucial step in securing investor interest. This can be achieved by tailoring presentations to the right investors.

Using branded data rooms can help maintain momentum in deal negotiations. Automated follow-ups also play a vital role in keeping deals on track.

Faster and more effective deal closures are a direct result of streamlined execution. By implementing these strategies, dealmakers can significantly improve their chances of success.

Valuation and Financial Modeling

Technology valuation and financial modeling for software investment bankers involves understanding standard methodologies such as the DCF and comparable company analysis. However, some nuances and metrics are different, especially when modeling SaaS companies like Atlassian.

Deferred revenue, billings, and revenue recognition are crucial metrics to know. You'll also need to be familiar with Net Operating Loss (NOL) balances and how they interact with book taxes, cash taxes, and deferred taxes on financial statements.

Convertible bonds or convertible preferred stock are common in tech companies, so understanding their accounting and valuation is essential. This includes knowing how convertible notes work, which can be different but share some mechanics.

In LBO modeling, you'll need to be familiar with PE cases and master the key skills for PE interviews. This includes completing short models and real-life case studies, such as the IBM/Red Hat and Microsoft/LinkedIn deals.

Exit Opportunities and Capital Raising

As a software investment banker, you'll have access to a wide range of exit opportunities. In tech, you can work on many different deal types and don't specialize in obscure accounting and valuation, making exit opportunities quite good.

You'll be competitive for venture capital, growth equity, or smaller private equity firms, but may not be a strong fit for larger firms like Blackstone. This is because you'll need to have worked at a larger bank to be competitive for those roles.

Some exit opportunities in tech include venture capital, growth equity, or smaller private equity firms. These options are more realistic than trying to move into a larger firm. Growth equity is particularly dominated by technology firms, with notable players like Summit Partners, TA Associates, TCV, Accel-KKR, Vista Equity, and Vector Capital.

If you're looking to raise capital, you can consider private placements and capital raising. This can include late-stage minority venture & growth equity, majority recapitalizations, and IPO advisory services.

Exit Opportunities

Exit opportunities in technology investment banking are quite good, thanks to the variety of deal types you work on and the lack of specialized accounting and valuation requirements.

You'll have access to all the standard exits, including private equity, venture capital, growth equity, hedge funds, corporate finance, and corporate development.

However, your competitiveness for these exits will depend on your bank's size - larger banks have a better shot at getting you into top-tier firms.

Venture capital, growth equity, and smaller private equity firms are more realistic exit opportunities, especially for those who've worked at regional boutique banks.

Growth equity is particularly dominated by technology firms, making it a separate and additional exit opportunity to consider, with firms like Summit Partners, TA Associates, and TCV being top players in this space.

Private Placements & Capital Raising

Private placements and capital raising are key strategies for businesses looking to secure funding. Private placements involve raising capital from a select group of investors, often for late-stage minority venture and growth equity investments.

Late-stage minority venture and growth equity investments are common in private placements. This type of investment provides a business with the necessary funding to take it to the next level, without giving up majority control.

Majority recapitalizations are also a type of private placement. This involves a business recapitalizing its existing ownership structure, often to bring in new investors or restructure debt.

For businesses looking to take the next step, initial public offerings (IPOs) can be a viable option. IPO advisory services can help guide businesses through the process, ensuring a successful listing.

Here are some key types of private placements and capital raising strategies:

- → Late-stage minority venture & growth equity

- → Majority recapitalizations

- → IPO advisory

Industry Insights and Trends

In recent years, the role of software investment bankers has evolved significantly. They now focus on advising tech companies on mergers and acquisitions, equity financing, and other strategic transactions.

According to industry reports, the global software investment banking market is expected to grow at a CAGR of 10% from 2023 to 2028. This growth is driven by the increasing demand for technology-enabled services and the need for companies to access capital to fund their growth strategies.

Software investment bankers are in high demand, with many top banks and financial institutions competing for talent.

Industry Groups

Industry Groups are a key part of Investment Banking, and within Technology, you'll find a diverse range of companies. Technology is a textbook example of an industry group, where professionals work on deals within a single industry.

These deals can involve mergers, acquisitions, debt, and equity issuances, all focused on helping companies in the software, internet, hardware, semiconductors, and IT services markets. At smaller banks, you'll often work with earlier-stage, growth-oriented companies, which makes sell-side M&A deals and equity issuances more common.

The Technology industry can be broadly categorized into two groups: Earlier-Stage / Growth-Oriented and Mature. Earlier-stage companies are typically venture-backed startups or small and mid-cap companies looking to raise capital and grow.

Mature companies, on the other hand, are large, global, public companies with tens of billions in revenue, often acquiring smaller companies to enter new markets and innovate. At larger banks, companies in the Mature category are more common, leading to more buy-side M&A deals, leveraged buyouts, and debt issuances.

The geography of the Technology industry is also worth noting. The U.S. is home to the most highly valued tech companies, including Apple, Microsoft, Amazon, Alphabet (Google), and Facebook. China ranks second, with companies like Alibaba and Tencent, while other Asian countries like South Korea, Taiwan, and Japan also have prominent tech companies.

Here's a rough breakdown of the types of deals you might see in Technology Investment Banking:

- Earlier-Stage / Growth-Oriented: Sell-side M&A deals, equity issuances

- Mature: Buy-side M&A deals, leveraged buyouts, debt issuances

Front Lines Insights

Industry trends are constantly evolving, and staying on top of them can be a challenge. The insurance ecosystem is no exception, with cutting-edge AI solutions now available to deliver innovative services.

In 2025, it became clear that the technology to support AI solutions had finally arrived, opening up new opportunities for investment and transaction activity. This is a significant development for the insurance industry.

The built-world is also experiencing a transformation, with a renewed focus on facility and asset management software. This shift is driven by the need to address operational, planning, and energy consumption needs.

Technological innovation is disrupting the residential real estate sector, with investors and companies seeking to improve the homebuying experience for both agents and consumers. This is a major change from traditional practices.

Auto dealers are racing to digitize their businesses, with a focus on driving efficiency and increasing customer satisfaction. This is a critical step in adapting to changing consumer expectations.

Here are some key industry trends to keep in mind:

- Cutting-edge AI solutions are now available in the insurance ecosystem.

- Facility and asset management software is gaining traction in the built-world.

- Technological innovation is transforming the residential real estate sector.

- Auto dealers are prioritizing digital transformation to boost efficiency and customer satisfaction.

Leading Companies, Investors and Individuals Transforming the Ecosystem

Private middle market software companies are our clients, including both emerging leaders and established incumbents.

Our clients are investor owners, executives, and board members who devise and implement value creation strategies, often focusing on operational excellence, organic growth, profitability, and market consolidation.

Large publicly held companies that define their market segments and drive consolidation activity are also our clients.

These companies are significant players in the software ecosystem, and we've had the privilege of working with leading operating companies, investors, and strategic buyers who are driving transformation in the industry.

Our clients are often involved in mutual selection, where they choose to partner with or acquire other companies to drive growth and innovation.

Strategic Acquirers and Partners

As a software investment banker, you're likely to work with strategic acquirers who are looking to expand their reach through targeted deals. Large diversified consolidators are a type of strategic acquirer that DueDash supports with tools and expertise.

These consolidators are often looking to acquire high-growth software leaders to strengthen their portfolio.

Some examples of strategic acquirers include large diversified consolidators, high-growth software leaders, and mature incumbents.

Strategic Acquirers

Strategic Acquirers are often large diversified consolidators, high-growth software leaders, and mature incumbents. They have the resources and expertise to make strategic acquisitions that drive growth and innovation.

These types of acquirers are typically large companies with a diverse portfolio of businesses, looking to expand their offerings and gain market share. They often have a strong track record of success and a clear vision for the future.

Large diversified consolidators, for example, are known for their ability to integrate acquired companies into their existing operations. They have the resources and expertise to handle complex acquisitions and make them a success.

High-growth software leaders, on the other hand, are often acquiring companies to enhance their product offerings and expand their market reach. They're looking for innovative solutions and technologies that will help them stay ahead of the competition.

Mature incumbents are also making strategic acquisitions, often to refresh their product lines and stay relevant in a rapidly changing market. They're looking for ways to stay competitive and maintain their market share.

Here are some examples of Strategic Acquirers:

- Large diversified consolidators

- High-growth software leaders

- Mature incumbents

Peak Partners LLC

Peak Partners LLC is a notable example of a strategic partner that's making waves in the industry. They've successfully closed 4 deals via Axial, a platform that facilitates partnerships and acquisitions.

Their total closed deals number stands at 15, a testament to their ability to identify and capitalize on opportunities.

Frequently Asked Questions

What do tech investment bankers do?

Tech investment bankers advise companies in the tech industry on strategic transactions, such as mergers, acquisitions, and financing options. They help clients navigate complex deals and make informed decisions to drive growth and success.

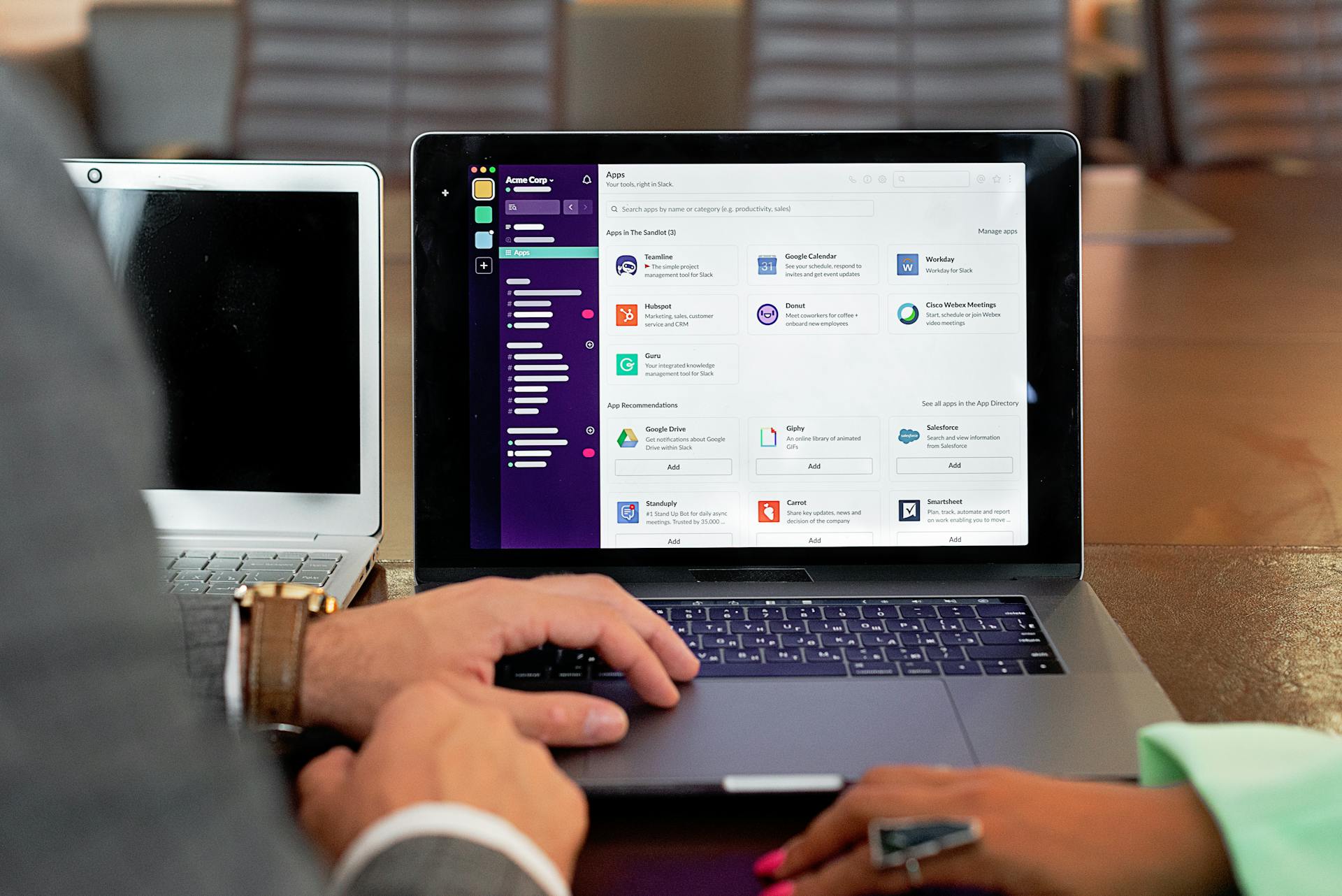

What software does investment banking use?

Investment banking commonly uses Excel, a spreadsheet application from Microsoft, to format, organize, and calculate data. Learning its basic functions is a crucial skill for those interested in finance.

Do investment bankers make 500K a year?

Investment bankers can earn up to $500k a year, typically at higher levels and in major financial centers. Salary potential varies widely depending on experience and location.

Do investment bankers make 7 figures?

Yes, investment bankers can earn 7 figures, with total compensation ranging from high six figures to low seven figures per year. Typically, a Managing Director can earn between $1 and $3 million annually.

Featured Images: pexels.com