The silver spot price CAD market can be a complex and dynamic space, but understanding its basics is key to making informed investment decisions.

Silver spot prices are determined by supply and demand in the global market, with the Canadian dollar playing a significant role in the pricing of silver in CAD terms.

The CAD silver spot price is influenced by the price of silver in US dollars, with a fluctuating exchange rate between the two currencies impacting the final price in CAD.

In a typical day, the CAD silver spot price can fluctuate by a significant margin, making it essential to stay up-to-date with market trends and news.

Intriguing read: Spot Price vs Market Price

Understanding Prices

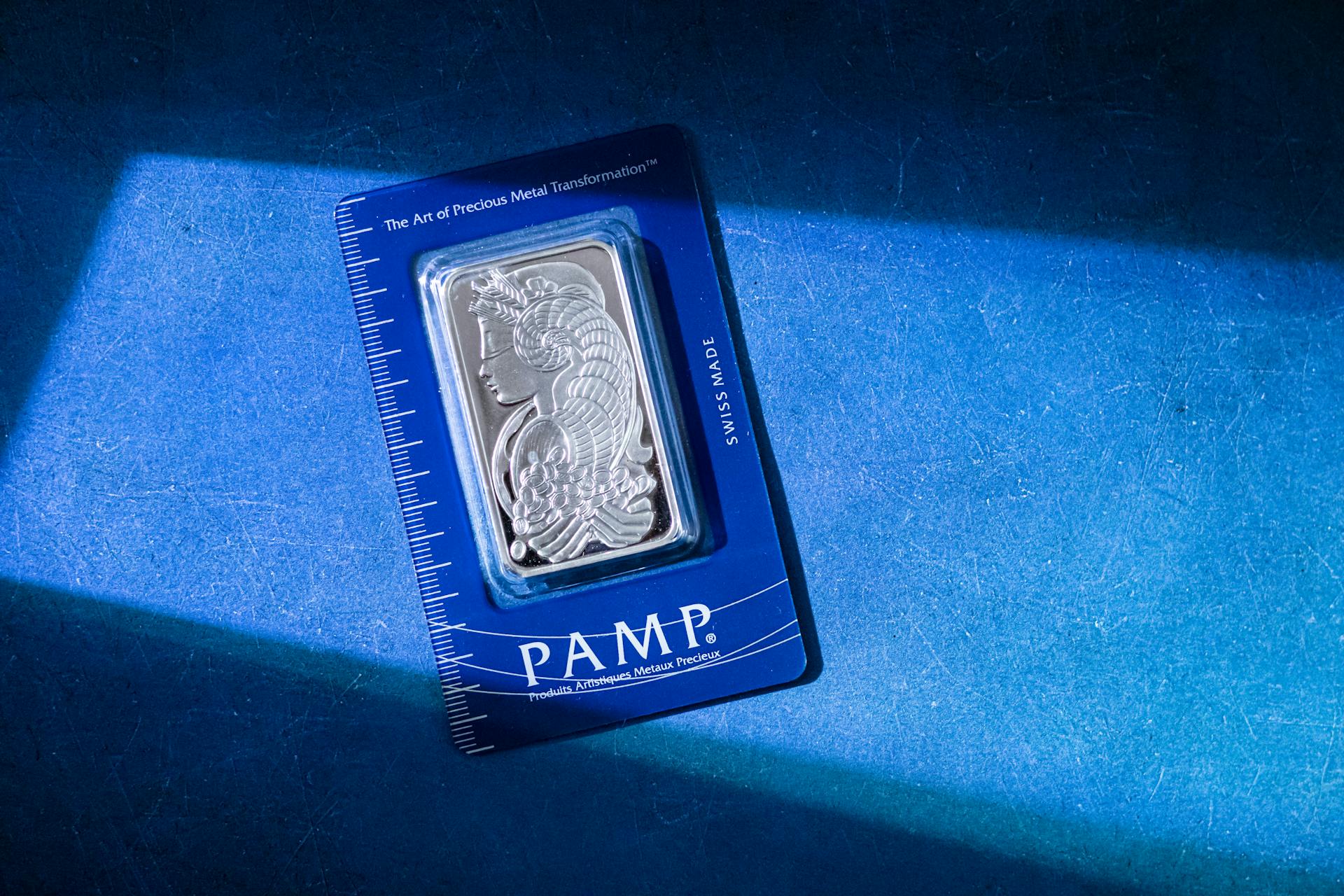

The silver spot price CAD can be a bit confusing, but it's actually quite straightforward once you understand the basics. The spot price is the current market rate for a troy ounce of raw silver.

To get a good deal on your investment or sale of silver, you should look at the spot price of the metal. The spot price is what the current marketplace rate will be if your transaction in the commodity or currency were to be immediately delivered.

Intriguing read: Gold Rate in Dirhams

The spot price of silver is determined by a number of factors, including the cost of mining silver, which is relatively low compared to mining gold. Silver is also used in a variety of industries due to its strong makeup, malleability, and conductivity, which continues to increase demand and drive up the price.

The spot price of silver has had a volatile history, showing its spectacularity in certain instances and falling in others. Unlike gold, silver's prices have a stronger relationship to economic activities, making silver investing more speculative than gold.

The spot price of silver is set according to futures contracts scheduled for the next month, and the volume of these contracts is factored into the spot value. This means that the spot price can fluctuate depending on the time and location of the exchange.

Silver's trading denomination is mainly XAG USD, but in Canada, many use XAG CAD. You can take a look at our live metal prices page to see what silver is being traded at in CAD.

Price Determination

The price of silver is determined by several key factors.

The cost of mining silver is a major determining factor in the price of silver. This cost is relatively low compared to mining gold.

Silver is relatively easy to find, with many silver mines in operation today, supplying silver for various industries. This abundance of supply contributes to the growth of the silver market.

The jewelry industry also plays a significant role in determining the price of silver. As demand for jewelry increases in countries like India and China, so does the cost of silver globally.

The spot price of silver is set according to futures contracts scheduled for the next month, and the volume of these contracts is factored into the spot value. This provides a clear benchmark for the current market rate of silver.

You might enjoy: Silver Gold Spot Prices

Canadian Dollar Price

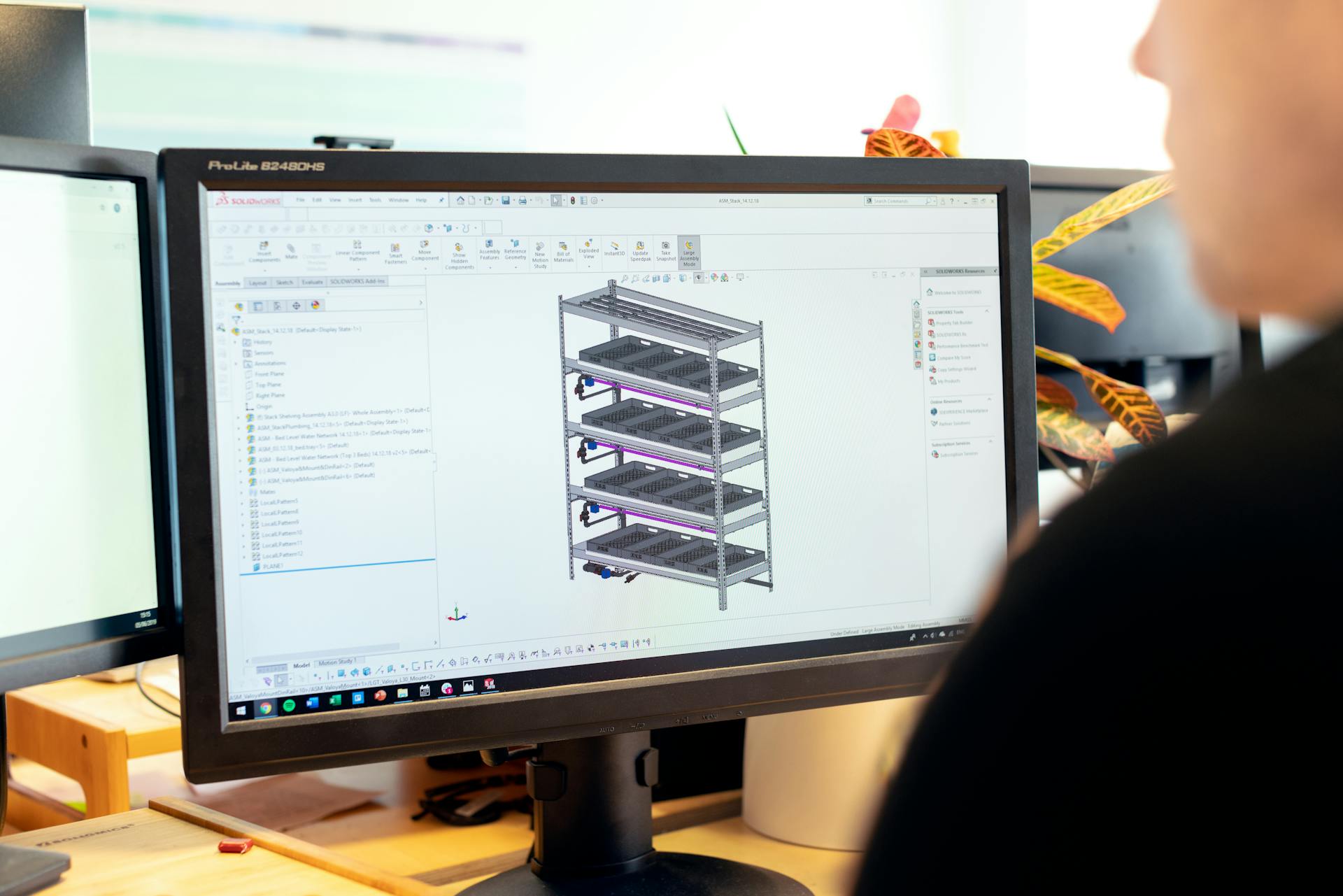

The Canadian Dollar Price is a crucial aspect to consider when investing in silver in Canada. The Royal Canadian Mint is headquartered in Ottawa and is responsible for producing a wide variety of products, including bullion bars and coins.

Silver prices in Canada are typically quoted in Canadian Dollars. The Canadian Silver Maple Leaf coin, one of the most popular silver coins in the world, features the iconic maple leaf design and carries a face value of $5 CAD.

You can find the current silver spot price in Canadian Dollars on our live metal prices page. Silver's trading denomination is mainly XAG USD, but in Canada, many use XAG CAD.

The spot price of silver has had a volatile history, showing its spectacularity in certain instances and falling in others. Silver's prices have a stronger relationship to economic activities, making Silver investing more speculative than Gold.

The XAG USD pair is more traded than the XAG CAD pair, but you can still find the current silver spot price in CAD on our website.

For more insights, see: What Is Cad Dollars

Frequently Asked Questions

Is silver about to skyrocket?

Silver is expected to experience significant growth, potentially outpacing gold with a 25-30% increase in 2025, according to industry expert Jose Gomez. This could propel silver's price to $38, making it a potentially lucrative investment opportunity.

Featured Images: pexels.com