Silver ETFs 3x options and choices are numerous, but let's break it down. There are several popular silver ETFs that offer 3x leverage, including the ProShares UltraSilver ETF (AGQ) and the ProShares UltraShort Silver ETF (ZSL).

These ETFs use a variety of investment strategies, including futures contracts and options on futures contracts. They're designed to provide a high degree of leverage, but keep in mind that this also means they can be highly volatile.

Investors can choose from different types of 3x silver ETFs, including leveraged and inverse ETFs. The ProShares UltraSilver ETF (AGQ) is a leveraged ETF that seeks to provide 3x the daily performance of silver prices.

Discover more: Options on Etfs

Silver ETF Options

Silver ETF options are a popular way to gain exposure to the price of silver, with many investors using them to hedge against inflation or market volatility.

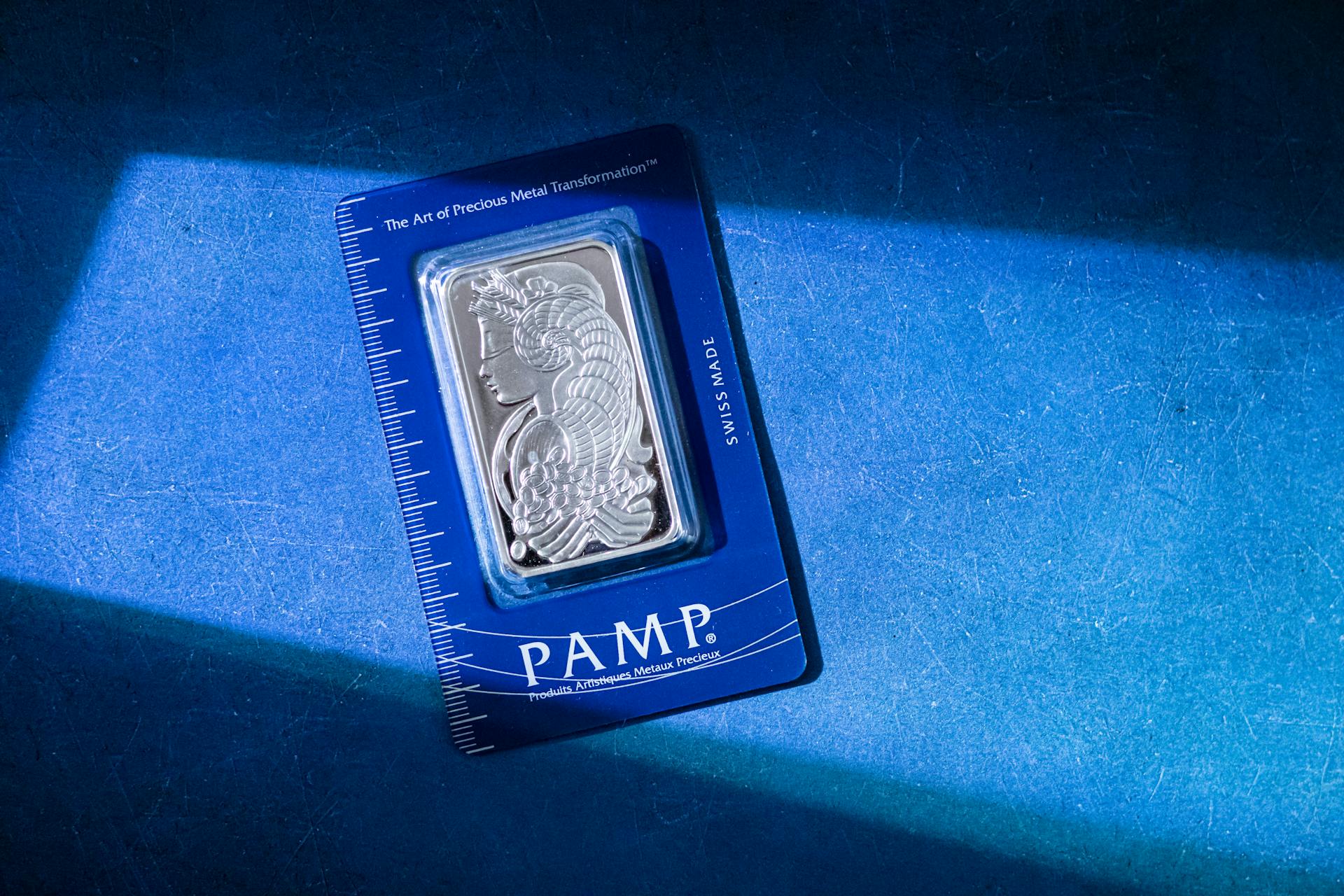

There are several silver ETF options available, including the iShares Silver Trust and the Sprott Physical Silver Trust, which hold physical silver bars in their vaults.

These ETFs offer a convenient and cost-effective way to invest in silver, with fees ranging from 0.30% to 0.50% per annum.

Suggestion: Etfs with Weekly Options

ProShares Ultra Silver ETF

The ProShares Ultra Silver ETF (AGQ) is an interesting option for traders. It attempts to provide two times the daily performance of the Bloomberg Silver Subindex.

AGQ invests in financial instruments such as swap agreements, futures contracts, and forward contracts, which helps to achieve its goal. A tight 0.07% spread and average share volume of over 150,000 make this fund a trader's favorite.

The ETF's expense ratio of 0.95% is higher than some other options, but it shouldn't overly affect short-term holds. AGQ has assets under management (AUM) of $211.34 million.

After breaking out from a double bottom pattern in late December, AGQ's share price has traded sideways for most of 2019. The recent pullback into key support between $24 and $25 provides an attractive entry point for swing traders.

A nearly oversold relative strength index (RSI) reading gives further conviction of an upside reversal in the coming trading sessions. Consider setting a take-profit order in the vicinity of last month's high at $28.59.

3x Long USLV ETN VelocityShares

The VelocityShares 3x Long Silver ETN, or USLV, is a fund that's been around since 2011. It aims to provide returns three times the daily return of the S&P GSCI Silver index ER.

This fund is suited for traders who want a high-risk, short-term bet on rising silver prices. Its daily reset can cause longer-term returns to deviate from its advertised leverage due to compounding.

More than 180,000 shares change hands per day, making it easy to enter and exit positions. As of March 6, 2019, USLV had net assets of $271.31 million and a YTD loss of 10.73%.

The fund has recently retraced back into a buy zone created from last year's price action. A golden cross signal on its chart has caught the attention of bulls.

Take a look at this: Direxion Daily 20+ Year Treasury Bull 3x Shares

VelocityShares 3x Inverse S&P GSCI Silver Index ER

The VelocityShares 3x Inverse S&P GSCI Silver Index ER, also known as DSLVF, is an ETN that's linked to the S&P GSCI Silver Index ER. This means it tracks the inverse performance of silver.

For another approach, see: Global X Artificial Intelligence & Technology Etf

Credit Suisse, the issuer of DSLVF, has been trying to reduce its legal exposure by delisting some of its ETNs, including the highly volatile TVIX and ZIV. This move is likely a response to the XIV termination debacle in 2018.

Silver has been struggling, with prices sliding due to declining haven demand and plentiful supplies. This has made it the outcast among precious metals, unlike gold, platinum, and palladium, which have seen gains.

If you're considering investing in silver, you might want to take a closer look at DSLVF. However, keep in mind that it's a highly inverse product, which means it's designed to perform well when silver prices fall.

Here's a quick summary of some key points about DSLVF:

Please note that the above table only shows some examples of stocks with recent price movements.

Returns and Charts

The returns on silver ETFs 3x have been quite impressive over the years. The YTD return is a whopping +44.02%.

In the past year, the fund has seen a significant increase, with a 1-year return of +87.65%. This is a testament to the fund's ability to grow your investments over time.

The 3-year return, however, has been a bit of a mixed bag, with a -8.31% return. This might be a concern for some investors, but it's essential to consider the overall performance of the fund.

Here's a breakdown of the fund's returns over different time periods:

Frequently Asked Questions

Is there an inverse silver ETF?

Yes, there are inverse silver ETFs that provide the opposite daily or monthly return on silver prices through futures contracts, offering a synthetic short position. These leveraged ETFs can be a useful tool for investors looking to profit from declining silver prices.

What is the largest silver ETF?

The largest silver ETF is the iShares Silver Trust, offering a convenient and cost-effective way to invest in physical silver. It holds physical silver bars stored in secure vaults in New York and London.

Sources

- https://www.investopedia.com/in-the-zone-3-silver-etfs-to-watch-4588677

- https://www.investing.com/etfs/velocityshares-3x-inverse-silver

- https://www.barchart.com/etfs-funds/quotes/USLV/opinion/20-200-Day-MA/strategy-charts

- https://www.justetf.com/en/etf-profile.html

- https://www.justetf.com/en/etf-profile.html

Featured Images: pexels.com