Sanmina's stock has seen a significant increase in value over the past year, with a growth rate of 25% in 2022. This impressive growth can be attributed to the company's strong earnings performance.

Sanmina's revenue has consistently exceeded analyst expectations, with a 15% increase in the fourth quarter of 2022 compared to the same period in 2021. This trend suggests a steady and reliable growth pattern for the company.

Sanmina's net income has also shown a notable increase, rising from $130 million in 2021 to $170 million in 2022. This significant jump in net income is a testament to the company's ability to manage its finances effectively.

Sanmina's stock price has responded positively to its earnings growth, with a 20% increase in the stock's value over the past year. This growth is a reflection of investor confidence in the company's future prospects.

See what others are reading: Cto Realty Growth Stock

Company Profile

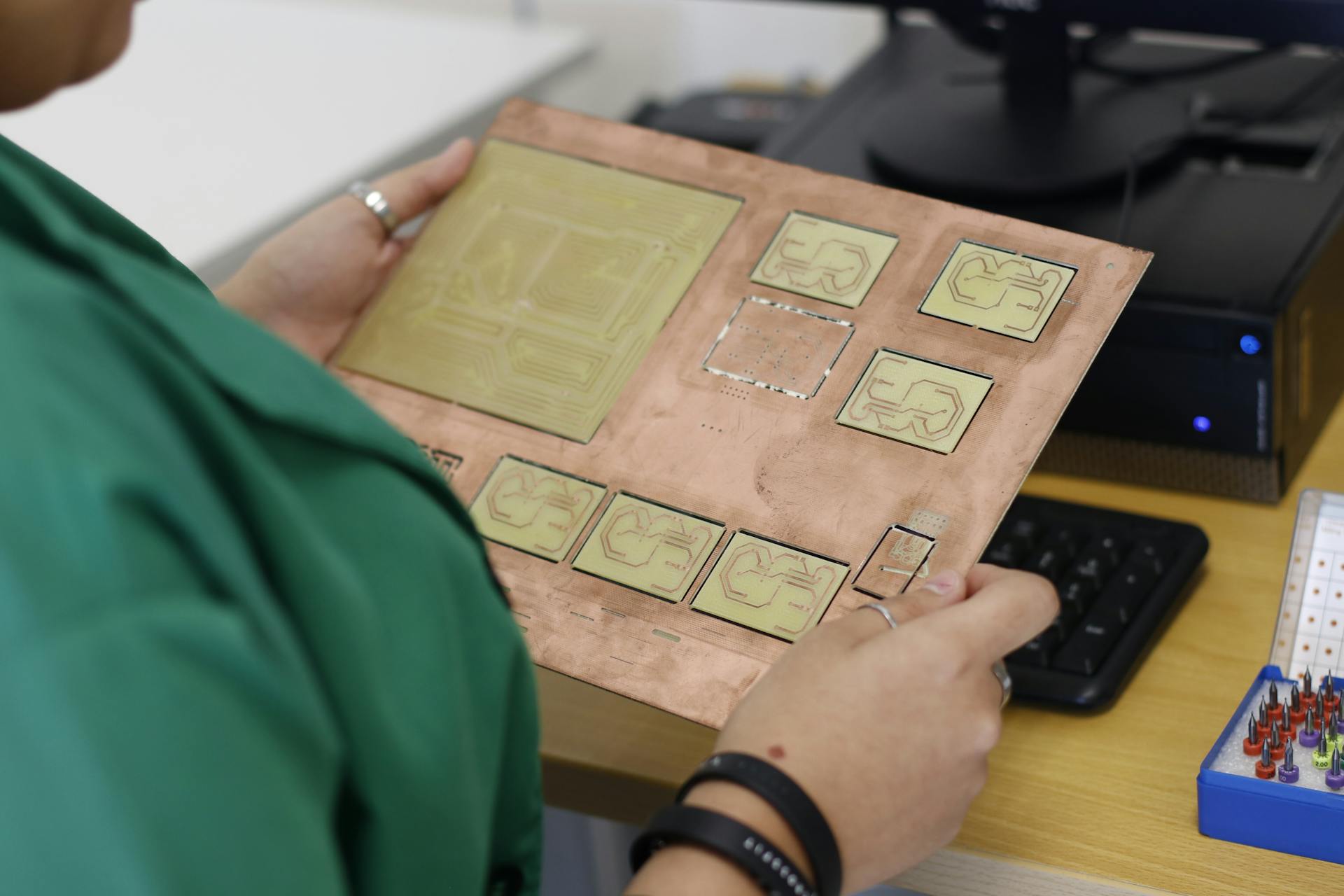

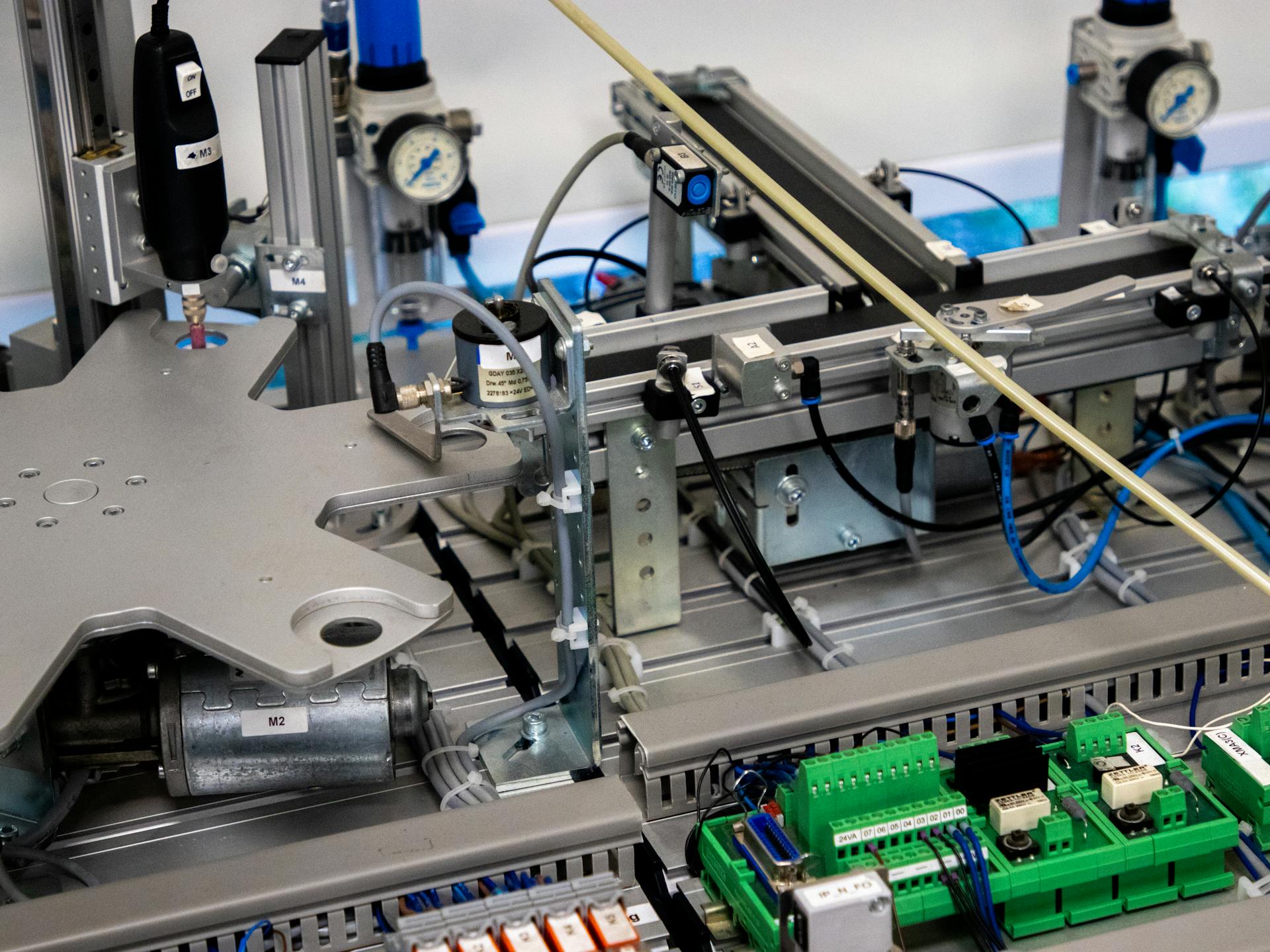

Sanmina Corp is a provider of integrated manufacturing solutions, components, and after-market services.

The company operates in various end markets, including communications networks, storage, industrial, defense, and aerospace.

Sanmina's operations are managed as two distinct businesses: Integrated Manufacturing Solutions and Components, Products, and Services.

The majority of the firm's revenue comes from printed circuit board assembly, which is part of the Integrated Manufacturing Solutions business.

Company Profile

Sanmina Corp is a provider of integrated manufacturing solutions, components, and after-market services to original equipment manufacturers.

Their operations are managed as two distinct businesses: Integrated Manufacturing Solutions and Components, Products, and Services.

Integrated Manufacturing Solutions consists of printed circuit board assembly and represents a majority of the firm's revenue.

The firm generates revenue primarily in the United States, China, and Mexico, but has a presence around the world.

Sanmina Corp serves various end markets, including communications networks, storage, industrial, defense, and aerospace.

These end markets are significant, as they drive the demand for the firm's integrated manufacturing solutions and components.

Their operations are geographically diverse, with a presence in multiple countries, including the United States, China, and Mexico.

Jon Faust, Executive Vice President and CFO

Jon Faust, Executive Vice President and CFO, was appointed to his role in December 2023.

Sanmina Corporation, a leading integrated manufacturing solutions company, announced Jon Faust's appointment.

He joined the company with a strong background in finance.

Earnings and Growth

Sanmina's earnings have been on a rollercoaster ride. In the most recent quarter, the company reported earnings per share of $1.09, marking a year-over-year growth for 1 quarter straight.

Sanmina's earnings growth has been inconsistent, with a 28.21% decrease in earnings in 2024 compared to the previous year. This is a significant drop, especially considering the company's revenue growth has been declining for 5 quarters in a row.

Here's a breakdown of Sanmina's earnings growth over the past few years:

As you can see, Sanmina's earnings growth has been a mixed bag, with some quarters showing significant growth and others experiencing declines. This inconsistency may be a concern for investors looking to buy into the company's stock.

On a similar theme: Apple Growth Stock

Earnings Growth

Sanmina Corporation has been showing steady earnings growth, with a streak of year-over-year earnings growth for 1 quarter straight. In the most recent quarter, they reported earnings per share of $1.09.

Their revenue has been increasing steadily, from $7.9B in 2022 to $8.9B in 2023. This growth in revenue has contributed to their earnings growth.

Here's a breakdown of their earnings growth over the past few years:

Their earnings per share have also seen a significant increase, from $3.94 in 2022 to $5.19 in 2023, and then decreased to $3.91 in 2024.

Revenue Growth

Sanmina's revenue growth has been a concerning trend for the past year. Their revenues have been falling on a year-over-year basis for 5 quarters in a row.

In the most recent quarter, Sanmina reported revenues of $2B. This is a significant drop from their previous quarters, highlighting a need for the company to address this downward trend.

Here's a breakdown of their recent revenue performance:

- 5 consecutive quarters of year-over-year revenue decline

- Most recent quarter's revenue: $2B

Analyst Opinion

Analysts have a consensus rating of Buy for Sanmina, with an average rating based on 1 Buy rating, 0 Hold ratings, and 0 Sell ratings.

The consensus price target for Sanmina is $71.00, which indicates an estimated downside of -9.57% from its current price of $78.51.

The highest upside price target for Sanmina is $84.00, representing a -100% upside increase from its current price of $78.51.

Here's a summary of the analyst consensus:

- Consensus Rating: Buy

- Price Target Downside: -9.57%

- Price Target Upside: $84.00 (100% upside increase)

Analysts' Opinion

Many analysts have weighed in on Sanmina's stock, and one analyst has a very specific prediction for its future price.

The rating for SANM stock is "Hold" with a 12-month stock price forecast of $69.0.

Analysts have a consensus rating of Buy, based on 1 Buy rating, 0 Hold ratings, and 0 Sell ratings.

This consensus rating suggests that many analysts believe Sanmina's stock has potential for growth.

According to analysts' consensus price target of $71.00, Sanmina has an estimated downside of -9.57% from its current price of $78.51.

On the other hand, the highest upside price target is $84.00, representing a 100% upside increase from its current price of $78.51.

Tech Developer Reverses Earlier Warning

Sanmina Corp. rallied after hours on Monday, a reversal from earlier warnings of customer caution. This tech-systems developer and services provider forecast second-quarter results that were above Wall Street's expectations. The company's shares saw a significant boost as a result.

The forecast was a key factor in the company's stock price increase. Sanmina Corp. exceeded Wall Street's expectations, which led to the rally. This is a positive sign for investors.

Frequently Asked Questions

Is Sanmina a buy?

Sanmina has a consensus rating of Hold, but 1 out of 3 analysts recommend buying it. Its price target is $72.33, but you may want to read more about the company's performance and analyst opinions.

When did Sanmina go public?

Sanmina went public on NASDAQ in 1993. This marked a significant milestone in the company's growth under the leadership of CEO and Chairman Jure Sola, who took the helm in 1991.

Featured Images: pexels.com